Property Tax In Westerville Ohio

City of Westerville OH. Thanks for visiting our site.

Box 130 Westerville Ohio 43086-0130.

Property tax in westerville ohio. Find columbus properties for sale at the best price. If you want to view Westerville OH property tax records you can use our real estate record website to find them. Mailing Address City of Westerville Income Tax Division PO.

I owe city taxes but I am unable to pay my full liability at the time my return is due. We also have information about road documents and how taxable value is determined. Year Total MAGI Federal tax return line 4 1040EZ.

Compare the best Property Tax lawyers near Westerville OH today. Year Total FAGI line 37 1040. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its.

Year Total FAGI orksheet attached. We have 20 properties for sale listed as westerville oh columbus taxes from just 110000. Phone Number 614 901-6420.

The countys average effective property tax rate is 218 which ranks as the second-highest out of Ohios 88 counties. Year Total FAGI line 21 1040A. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax practitioners in Ohio.

Property Record Research Locations Listings. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Estimated MAGIW Granted Denied County auditor.

Income Tax Department 64 E. The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected.

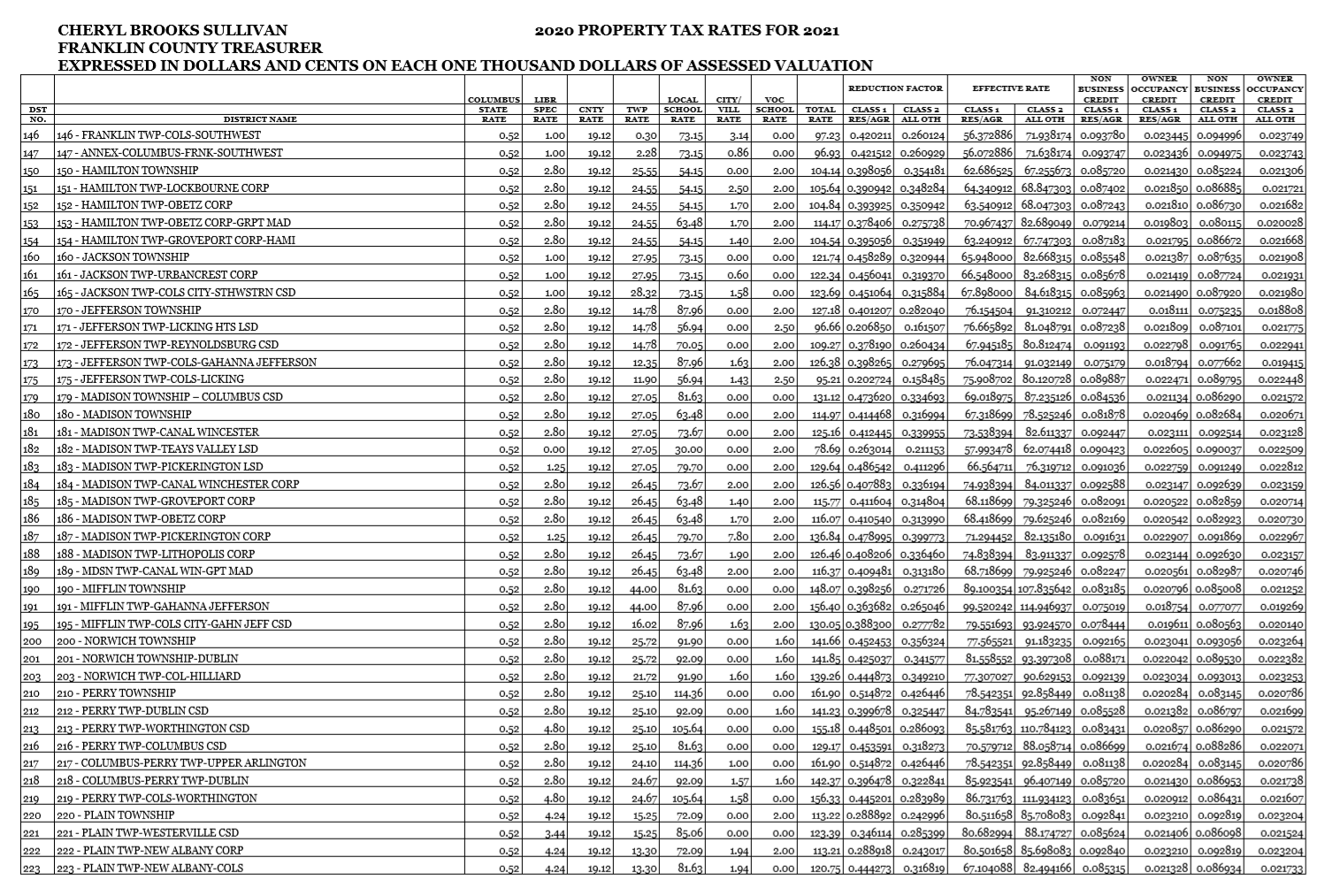

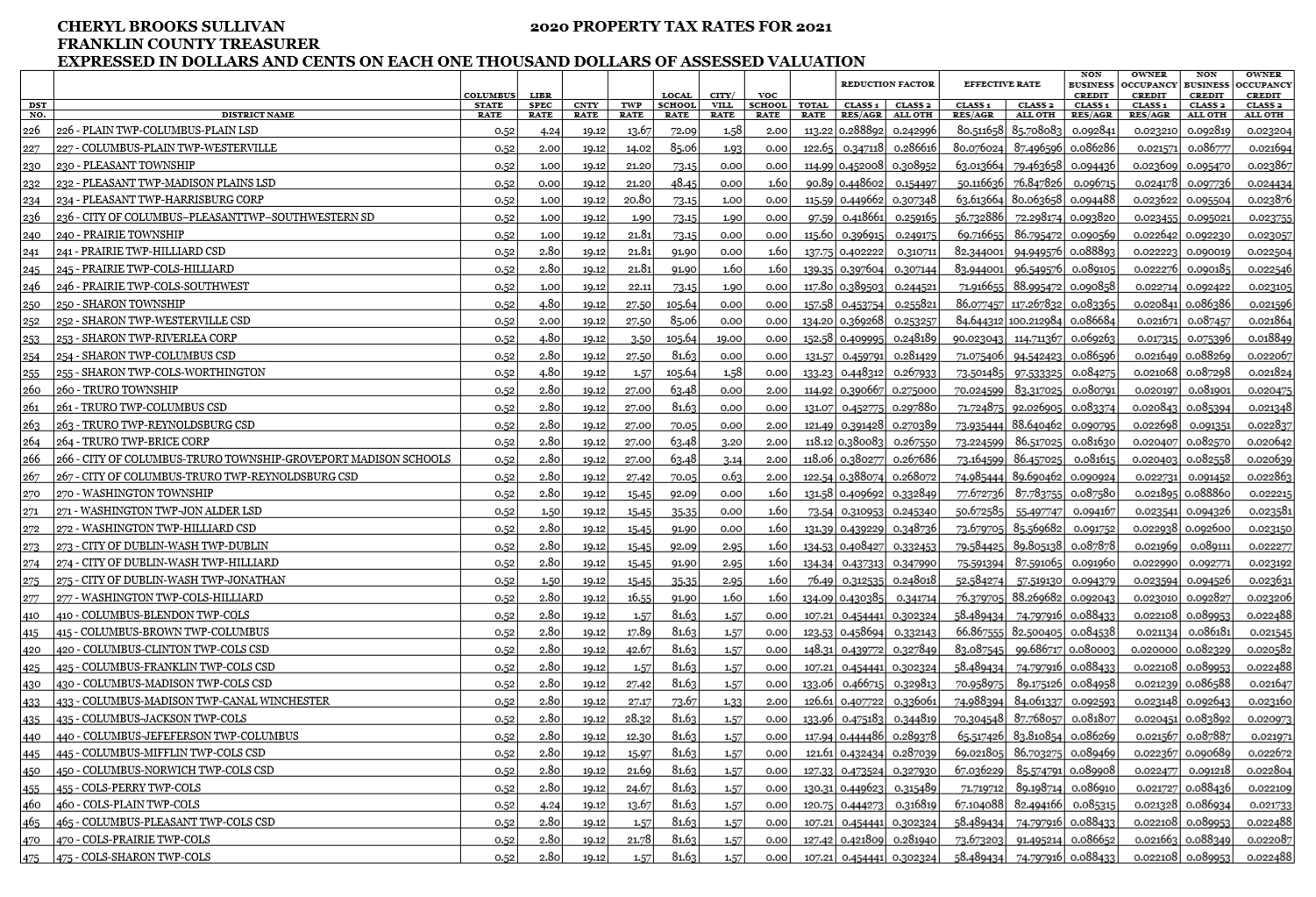

2020 Property Tax Rates for 2021 As provided by the Franklin County Auditor expressed in dollars and cents on each one thousand dollars of assessed valuation. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Century 21 Joe Walker and Associates.

Use our free directory to instantly connect with verified Property Tax attorneys. Property Tax Rates Real Estate Property Tax Rates. Should I still file my return.

Delinquent tax refers to a tax that is unpaid after the payment due date. City of Westerville OH. Walk-in Assistance 8 am.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. Our goal is to help make your every experience with our team and Ohios tax system a success.

Website Design by Granicus - Connecting People and Government. A Westerville Ohio Rental Property Tax can only be obtained through an authorized government agency. Office Hours Monday through Friday 8 am.

This western Ohio County has among the highest property tax rates in the state. Monday through Friday 800 am. Ohio tax return line 3 plus line 11 of Ohio Schedule A.

1455 The property tax rate shown here is the rate per 1000 of home value. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Westerville Ohio Rental Property Tax. The Westerville Income Tax Division offers assistance from 8 am.

Walnut Street Westerville Ohio 43081 Phone. Website Design by Granicus - Connecting People and Government. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year.

If the tax rate is 1400 and the home value is 250000 the property tax would be 1400.

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

The Property Tax On My Eaton Ohio Home Is Increasing 14 Percent In 2018 I Knew The Rate Was Abnormal It S Roughly Twi Property Tax Preble County How To Plan

The Property Tax On My Eaton Ohio Home Is Increasing 14 Percent In 2018 I Knew The Rate Was Abnormal It S Roughly Twi Property Tax Preble County How To Plan

1089 S Champion Columbus Ohio Foreclosure 23 000 6 Bed 2 Bath Straight Up In The Hood Estate Finds Foreclosures Real Estate

1089 S Champion Columbus Ohio Foreclosure 23 000 6 Bed 2 Bath Straight Up In The Hood Estate Finds Foreclosures Real Estate

Hicks Elite Realty Professionals Her Realtors Columbus Cincinnati Dayton Ohio Real Estate Ohio Real Estate Selling House Dayton Ohio

Hicks Elite Realty Professionals Her Realtors Columbus Cincinnati Dayton Ohio Real Estate Ohio Real Estate Selling House Dayton Ohio

Tables Charts Chart Design Chart Logo Graphic

Tables Charts Chart Design Chart Logo Graphic

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

1895 Sells Mansion In Columbus Ohio Captivating Houses Mansions Ohio Real Estate Mansions For Sale

1895 Sells Mansion In Columbus Ohio Captivating Houses Mansions Ohio Real Estate Mansions For Sale

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Commercial Building With 4800 Sf At Minimum Bid 200 000 Online Auction Real Estate Auction Concrete Floors Commercial Real Estate

Commercial Building With 4800 Sf At Minimum Bid 200 000 Online Auction Real Estate Auction Concrete Floors Commercial Real Estate

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

New Year New Property Tax Bills Is It Time To Appeal

New Year New Property Tax Bills Is It Time To Appeal

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Delena Ciamacco Real Estate Expert Home Ownership Tax Time Benefits Re Max Real Estate Central Ohio Real Estate Ta Home Ownership Ohio Real Estate Home

Delena Ciamacco Real Estate Expert Home Ownership Tax Time Benefits Re Max Real Estate Central Ohio Real Estate Ta Home Ownership Ohio Real Estate Home

Labels: ohio, property, westerville

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home