Property Tax Exemption For Seniors Alabama

Heres an excerpt taken directly from the State of Alabama web site. Only one spouse must typically be 65 or over if youre married and you own your property jointly.

Seniors Still Miss Out On Tax Exemptions Daily Mountain Eagle

Seniors Still Miss Out On Tax Exemptions Daily Mountain Eagle

Of course there are qualifying rules for all these tax breaks and the first of these is your age.

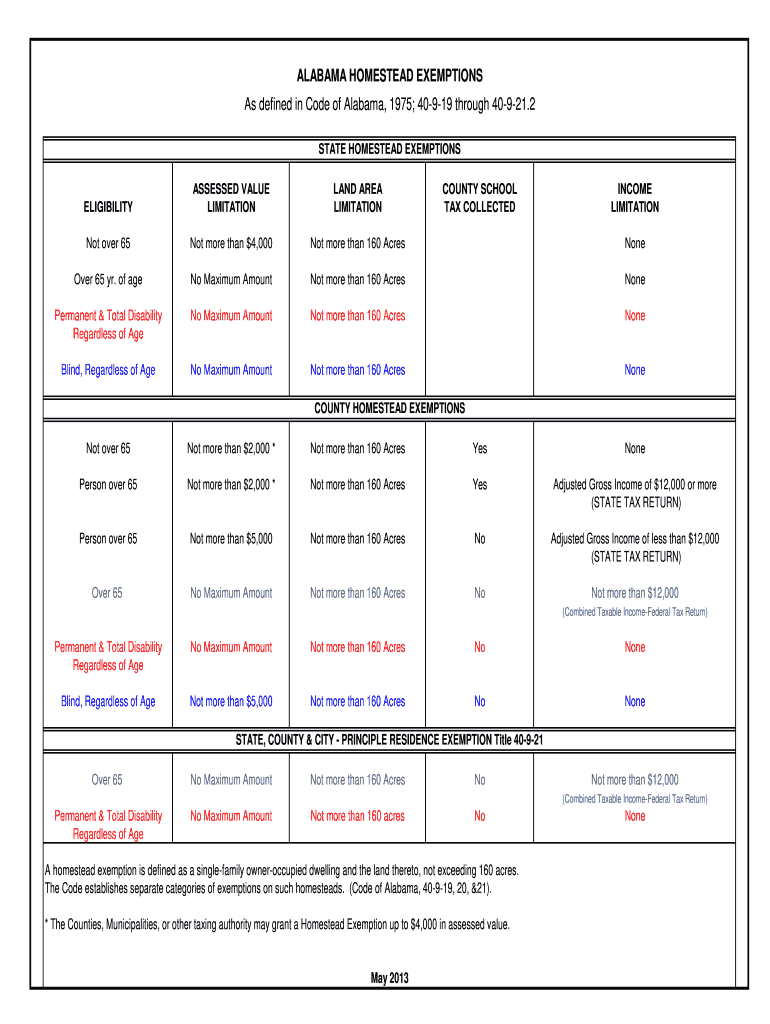

Property tax exemption for seniors alabama. You must be at least 62 years or older on January 1st of the year in which you are applying you must apply by April 1st and you must meet certain income requirements. All low-income property owners age 65 or older may be eligible to claim Homestead Exemption 3 under Act 48. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified.

Homestead Exemption 4 is available if the homeowners are ages 65 or older with 12000 or more in combined taxable income on their latest Federal Income Tax Return and 12000 or higher annual adjusted gross income as reflected on their most recent State Income Tax Return. Code of Alabama 1975 40-9-19 through 40-9-211 A homestead exemption is a tax break a property owner may be entitled to if he or she owns a single-family residence and occupies it as hisher primary residence on October 1 of the tax year for which the property owner is applying. The qualifying applicant receives a substantial reduction in property taxes.

If you are over 65 years of age or permanent and totally disabled regardless of age or blind regardless of age you are exempt from the state portion of property tax. If the property owner earned less than 12000 his exemption increases to 5000 and he is not responsible for. Please contact your local taxing official to claim your homestead exemption.

If you are over 65 years of age or permanent and totally disabled regardless of age or blind regardless of age you are exempt from the state portion of property tax. You must meet the minimum age for a senior property tax exemption The person claiming the exemption must live in the home as their primary residence The. Property owners in this bracket are still responsible for county school taxes.

A homestead exemption must be claimed exemptions are not automatic. County taxes may still be due. The current tax bill will still need to be paid.

Are seniors exempt from property taxes in Alabama. Property owners are sent a renewal form each year in October in lieu of a property tax bill. The good news is that if you are age sixty-five or older you are exempt from paying state property taxes.

County property taxes may also be subject to the homestead exemption in Alabama. OVER 65 YEARS OLD EXEMPTION Code of Alabama 1975 40-9-21 If you are sixty-five years old or older you are entitled to an exemption from the. 2 The qualifying senior must be the property owner of.

Person claiming exemption or someone with. To apply for senior citizens or disability exemption you must bring proof of age birth certificate or drivers license and most recent Federal and State income tax returns to the Tax Assessors office between October 1 and December 31 to be eligible for exemption on the next years tax. In Alabama seniors who own a single-family home and occupy it as their primary residence can claim an exemption on a portion of their property taxes.

This exemption must be renewed annually. Under Homestead Exemption 3 Act 48 Total Tax Exemption the property owner pays no taxes. You must own and occupy the single family residence.

I AM OVER 65. 1 The qualifying senior must be at least 65 years old on January 1 of the year in which he or she applies. As of publication if a homeowner over 65 has an adjusted gross income of greater than 12000 on his most recent state tax return then up to 2000 of his propertys assessed value is exempt from county property taxes.

Currently there are three basic requirements. Taxpayers Age 65 and older with an annual adjusted gross income of less than 12000 as reflected on the most recent state income tax return or some other appropriate evidence OR who are retired due to permanent and total disability regardless of ageexempt from all of the state portion of the property taxes and 5000 of assessed value on the county portion of the ad valorem taxes including school. County taxes may still be due.

If you are over 65 years of age or permanent and totally disabled regardless of age or blind regardless of age you are exempt from the state portion of property tax. As noted these exemptions are generally reserved for those who are age 65 or older. Anyone age 65 or older can claim the exemption on 100 of their state property taxes.

County taxes may still be due. This exemption must be claimed in advance. Anyone over 65 years of age will be entitled to exemption on the States portion of property tax.

There are three basic requirements to qualify. Please contact your local taxing official to claim your homestead exemption. Please contact your local taxing official to claim your homestead exemption.

6 Best States To Retire Based On State Taxes Taxes Are One Of The Most Important Considerations When Choosing Among The State Tax Tax Free States Retirement

6 Best States To Retire Based On State Taxes Taxes Are One Of The Most Important Considerations When Choosing Among The State Tax Tax Free States Retirement

Who Pays The Highest Property Taxes In Alabama Al Com

Who Pays The Highest Property Taxes In Alabama Al Com

Disabled Veterans Property Tax Exemptions By State Veterans Affairs And Veterans News From Hadit Com Disabled Veterans Disability Property Tax

Disabled Veterans Property Tax Exemptions By State Veterans Affairs And Veterans News From Hadit Com Disabled Veterans Disability Property Tax

What Is The Alabama Homestead Exemption Davis Bingham Hudson Buckner P C

What Is The Alabama Homestead Exemption Davis Bingham Hudson Buckner P C

Property Tax Alabama Department Of Revenue

Property Tax Alabama Department Of Revenue

Https Revenue Alabama Gov Wp Content Uploads 2017 07 Plan For Equalization Revised 04 27 18 Pdf

A Note From The Legal Helpdesk Property Taxes In Alabama

A Note From The Legal Helpdesk Property Taxes In Alabama

Alabama Business Personal Property Tax A Breakdown

Alabama Business Personal Property Tax A Breakdown

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1 Fill Online Printable Fillable Blank Pdffiller

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1 Fill Online Printable Fillable Blank Pdffiller

Alabama Property Tax Exemption Do You Qualify Al Com

Alabama Property Tax Exemption Do You Qualify Al Com

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Alabama Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Alabama Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Alabama School Connection Local School Tax Millage And The 10 Mill Local Match Chargeback Thing Explained

Alabama School Connection Local School Tax Millage And The 10 Mill Local Match Chargeback Thing Explained

Homestead Exemption Rules Changing

Homestead Exemption Rules Changing

Http Baldwincountyal Gov Docs Default Source Revenue Documents Forms And Downloads Senior Prop Tax Appraisal Pdf Sfvrsn 4

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax South Dakota States

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax South Dakota States

Https Revenue Alabama Gov Wp Content Uploads 2017 05 4 13 Pdf

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home