What Can I Claim Working From Home Covid 19

The working-from-home tax relief is an individual benefit. Working from Home.

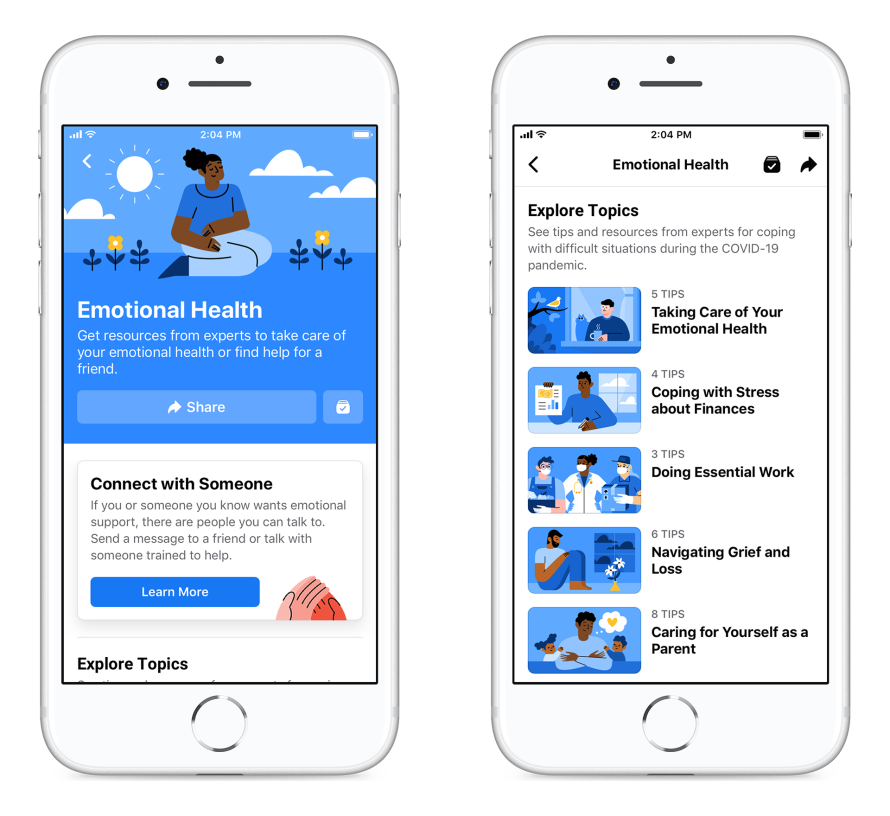

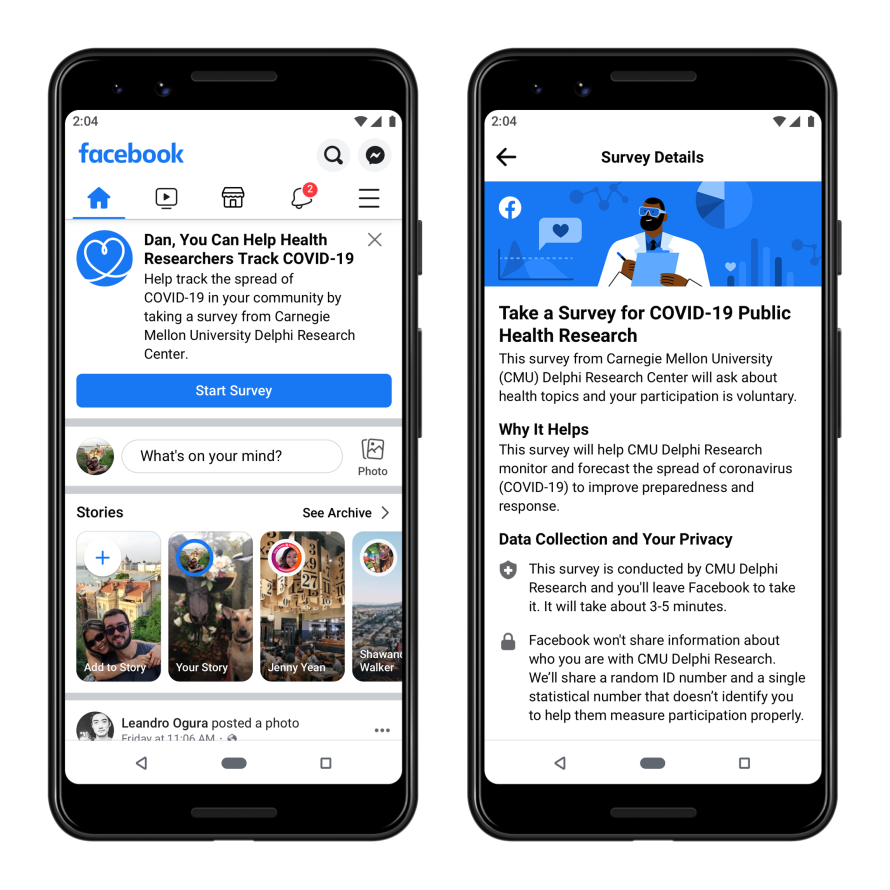

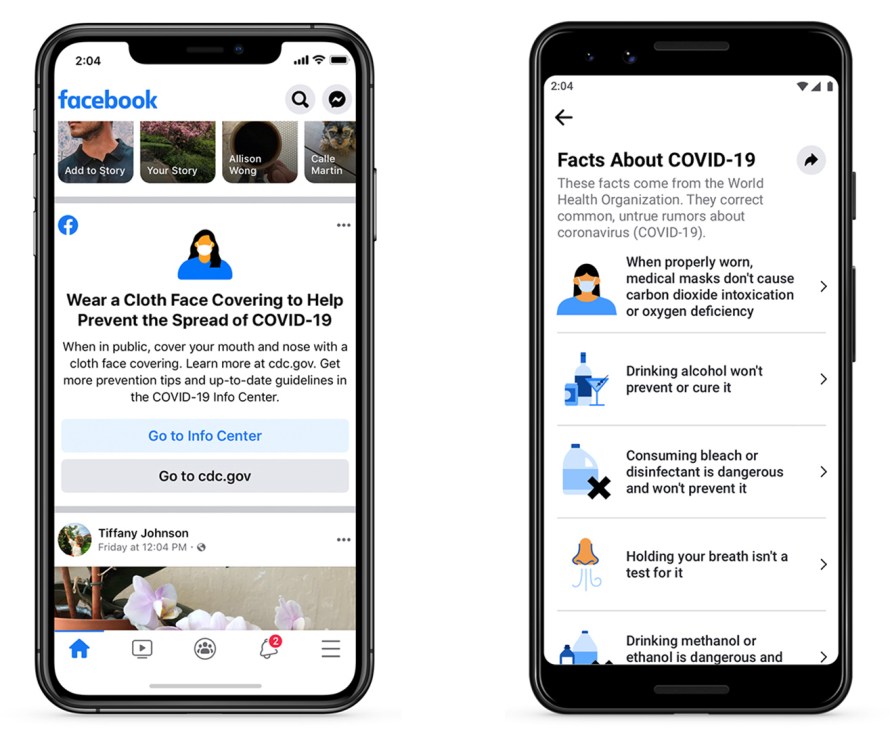

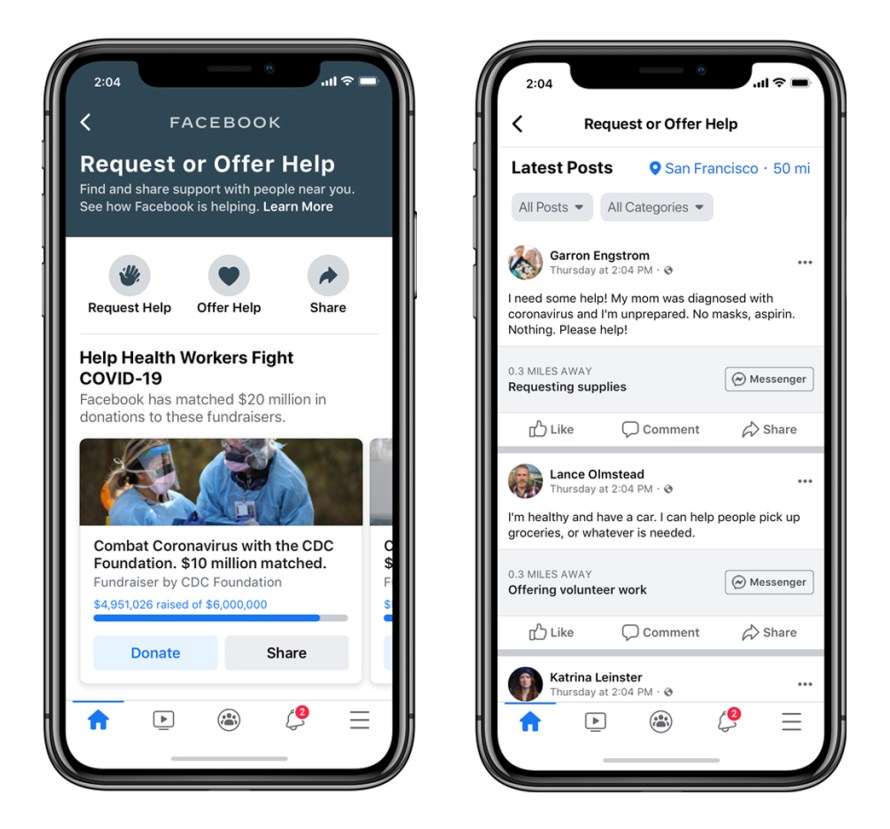

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

As COVID-19 cases continue to hit record highs across the country having the right health insurance policy and knowing about its coverage is essential as one never knows when it can come handy in treatment As COVID-19 cases continue to hit record highs across the country having the right health.

What can i claim working from home covid 19. The maximum amount that can be claimed is 400 per individual. Now that tax filing season is underway some might ask whether theyll get. If two or more of you live in the same property youre all required to work from home and its fair to say that costs have increased specifically from each individual working from home you can all claim it.

This amount is a tax deduction and not a credit which means you deduct it from your income to. This method can only be. But unfortunately your new arrangement may not render you eligible for any.

If you worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic you can claim 2 for each day you worked from home during that period. Phone and internet expenses. 2 days agoCan salaried workers now also claim home office tax relief.

If youre a resident of Québec who needed to work from home due to COVID-19 you can claim your expenses using the temporary flat rate or detailed method on the new TP-59S-V. Cleaning costs for a dedicated work area. Will I be able to claim home office expenses on my 2020 federal tax return.

As with any work-injury claim there must be evidence that the virus was contracted arising out of and in the course of employment. COVID-19 has changed everything this year for American workers. For example if you worked from home for 8 weeks and you worked 40 hours each week that would be 320 hours.

The maximum you can claim using the new temporary flat rate method is 400 200 working days per individual. People working from home because of the pandemic are wondering if they can get a tax deduction out of it. Due to Covid-19 the work environment was forced to make certain changes more rapidly.

Expenses you can claim. By Elizabete Da Silva 17 Apr 2021 0052. 2 days agoPeople working from home during the coronavirus lockdown could each be owed 280.

Expenses Related to Working Remotely Because of the COVID-19 Pandemic form. For example if you multiply 320 hours by 080 per hour you get 256. Electricity expenses associated with heating cooling and lighting the area from which you are working and running items you are using for work.

CRA allows all employees who worked from home during the COVID-19 pandemic in 2020 to claim up to 400 in employment expenses as a flat rate. Out of a total of 68 million vaccinations with the JJ Covid-19 shot. Can You Claim the Home Office Deduction on Your 2020 Tax Return.

You can then also claim any additional days you worked at home in 2020 due to the COVID-19 pandemic. This means you could claim a deduction of 256 when you lodge your tax return. The COVID-19 pandemic has changed the way a lot of people work.

Certified financial planner Paul Roelofse explains how you can claim tax back from working from home. When you have worked out the total hours you multiply it by 080. If you work from home you can claim a deduction for the additional expenses you incur.

So if youve had an increase in costs because youre required to work from home you can claim it. Unfortunately if you are working from home as a W-2 employee that is your wages are paid through payroll and your employer withholds taxes theres not much you can claim on your tax return according to Christina Taylor head of operations at Credit Karma Tax. Did you make a claim before October 2020.

When the COVID-19 pandemic shut down the economy last March about half of US. During the pandemic the government launched a new microservice which let people claim a whole years tax relief. You can claim 2 for each day you worked from home during that period plus any additional days you worked at home in 2020 due to the COVID-19 pandemic.

Some changes have been good on the pocketbook such as reduced expenses on commuting lower auto insurance premiums and less money. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. This includes if you have to.

I am currently working from home as a result of COVID-19 as directed by my employer. Workers suddenly shifted to remote work. However it is extremely difficult to determine the precise.

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

What Happens To Unemployment Benefits If You Re Called Back To Work

What Happens To Unemployment Benefits If You Re Called Back To Work

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

![]() Coronavirus 2019 Covid 19 Resources For Employers And Workers Lwda

Coronavirus 2019 Covid 19 Resources For Employers And Workers Lwda

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

This Is What Happens To All Those Vacation Days That Never Got Used

This Is What Happens To All Those Vacation Days That Never Got Used

Is Remote Working Here To Stay After The Covid 19 Crisis Is Over

Is Remote Working Here To Stay After The Covid 19 Crisis Is Over

Key Economic Findings About Covid 19 Bfi

Key Economic Findings About Covid 19 Bfi

You Can Claim 400 In Expenses If You Worked From Home Due To Covid 19 2021 Turbotax Canada Tips

This Is What Happens To All Those Vacation Days That Never Got Used

This Is What Happens To All Those Vacation Days That Never Got Used

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Is Remote Working Here To Stay After The Covid 19 Crisis Is Over

Is Remote Working Here To Stay After The Covid 19 Crisis Is Over

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

Keeping People Safe And Informed About The Coronavirus About Facebook

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

Grey And Green Work From Home Instagram Workplace Safety Tips Work From Home Tips Workplace Safety

Grey And Green Work From Home Instagram Workplace Safety Tips Work From Home Tips Workplace Safety

Best Air Purifiers Of 2020 According To Experts

Best Air Purifiers Of 2020 According To Experts

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home