What Is Uc Penalty In Property Tax

The property tax department had an annual property tax collection target of Rs 492 crore for 2014-15. We will bill you for penalties and interest.

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

On May 6 2020 the Governor of the State of California issued Executive Order N-61-20.

What is uc penalty in property tax. Interest on unpaid tax from the day after the original due date of your return through the date you pay the tax. Levy Bond Telephone Numbers. This Executive Order mandated that tax collectors cancel late penalties on delinquent property taxes if the delinquency is due to the impacts of COVID-19 and if the property meets certain criteria.

Generally you must include in taxable income any unemployment compensation from a state government. Military Tax Penalty Relief. The minimum penalty is 35 and the maximum is 200.

When a claimant serves a penalty week heshe will be ineligible for benefits for that week ie no monies are paid to the claimant even though heshe otherwise is eligible for them. Utah law allows Utah residents fi ve types of property tax relief. Tax Administration lists appraises and assesses all real and personal property in Union County according to state law.

Blind Exemption UC 59-2. State or local income tax refunds you received that year. The penalty is 10 percent of the total contributions payable for the quarter with a minimum of 25 and a maximum of 250.

Active or Reserve Duty Armed Forces Exemption see UC 59-2-1902 4. 1 a Acquisition cost means any cost required to put an item of tangible personal property into. 174 Shares Under the Biden Stimulus ARP package which funded another round of unemployment benefit extensions there was a late provision added that provided a tax break on unemployment insurance UI benefits.

Interest on unpaid taxes accrues at 1 of the taxes due per each month or portion of a month that the payment is late. This chapter is known as the Property Tax Act Enacted by Chapter 4 1987 General Session 59-2-102 Definitions. The taxpayer must owe less than 50000 on May 17 in taxes for all properties owned.

No penalties for taxes paid by June 15. For more information about penalties and interest see Publication 103 Penalties and Interest for Illinois taxes. For more information go to the Tennessee State Tax Guide for Middle-Class Families.

Veterans with a Disability Exemption UC 59-2-1903 1904 3. Property Tax Act Part 1 General Provisions 59-2-101 Short title. Below is a link to the Kern County COVID-19 Penalty Waiver Request Form with instructions.

Box 1 of the 1099-G Form shows your total unemployment compensation payments for the year. This was added as a compromise to appease factions of the. Circuit Breaker Renter Refund Utah Code 59-2-1209 Homeowner Low Income Abatement UC 59-2-1208 2.

Due Date E-Mail Reminder. The median property tax rate for Tennessee homeowners is 636 per 100000 of assessed home value. As used in this chapter.

The mission of the Treasurer-Tax Collectors Office is to perform the duties and responsibilities of each function in accordance with highest standards possible. Taxes must not be escrowed with your mortgage payment. Any property not assessed may be valued and taxed as far back as fi ve years prior to the time the property is discovered see UC 59-2.

Penalty Abatements for COVID-19. To offer courteous responsive and efficient customer service with timely payment processing and collection of taxes and revenues. According to state law partial payments made by June 15 will accrue penalties back to May 17 on the unpaid portion.

Gavin Newsom did not delay the property tax deadline for the states homeowners to pay their property taxes without a penalty. A claimant is assessed penalty weeks when heshe knowingly makes a false statement or fails to provide material information to obtain federal or state UC benefits. Property intentionally concealed removed transferred or mis-represented in order to avoid taxation is subject to a penalty of 100 percent of the tax due.

A penalty is assessed against any employer who fails to submit a quarterly tax report when it is due. Copy of Tax Bill. About Union County Taxes.

But till January it could collect only Rs 250 crore of which Rs 2125 crore was from penalty. The penalty for a late report is 01 of total wages paid in the quarter. You can avoid the late report penalty charge by filing your reports on time even if you are unable to pay the tax at the time of filing.

To invest revenues received by the County Special Districts and Schools with the primary objective. The Washington County Board acted on April 13 2021 to provide penalty relief to property taxpayers by abating penalty for certain taxpayers who make the May 17 2021 property tax payments on or before June 15 2021. Each year as of January 1 the Assessor must compile a tax roll of property subject to ad valorem according to value taxation.

Berks County Treasurer S Office

Berks County Treasurer S Office

Https Leg Mt Gov Content Committees Interim 2019 2020 Revenue Minutes June 2019 Ric June27 2019 Ex19 Pdf

Https Www Ucop Edu Financial Accounting Files Taxation W4nr State Pdf

Https Www Kenoshacounty Org Agendacenter Viewfile Item 17041 Fileid 17262

Https Www Boe Ca Gov Meetings Pdf 2018 082118 G1 Rules302 Etal Pubcom Prang Laco Pdf

100 Property Tax Penalty On Illegal Buildings The Hindu

Https Tax Utah Gov Forms Pubs Pub 36 Pdf

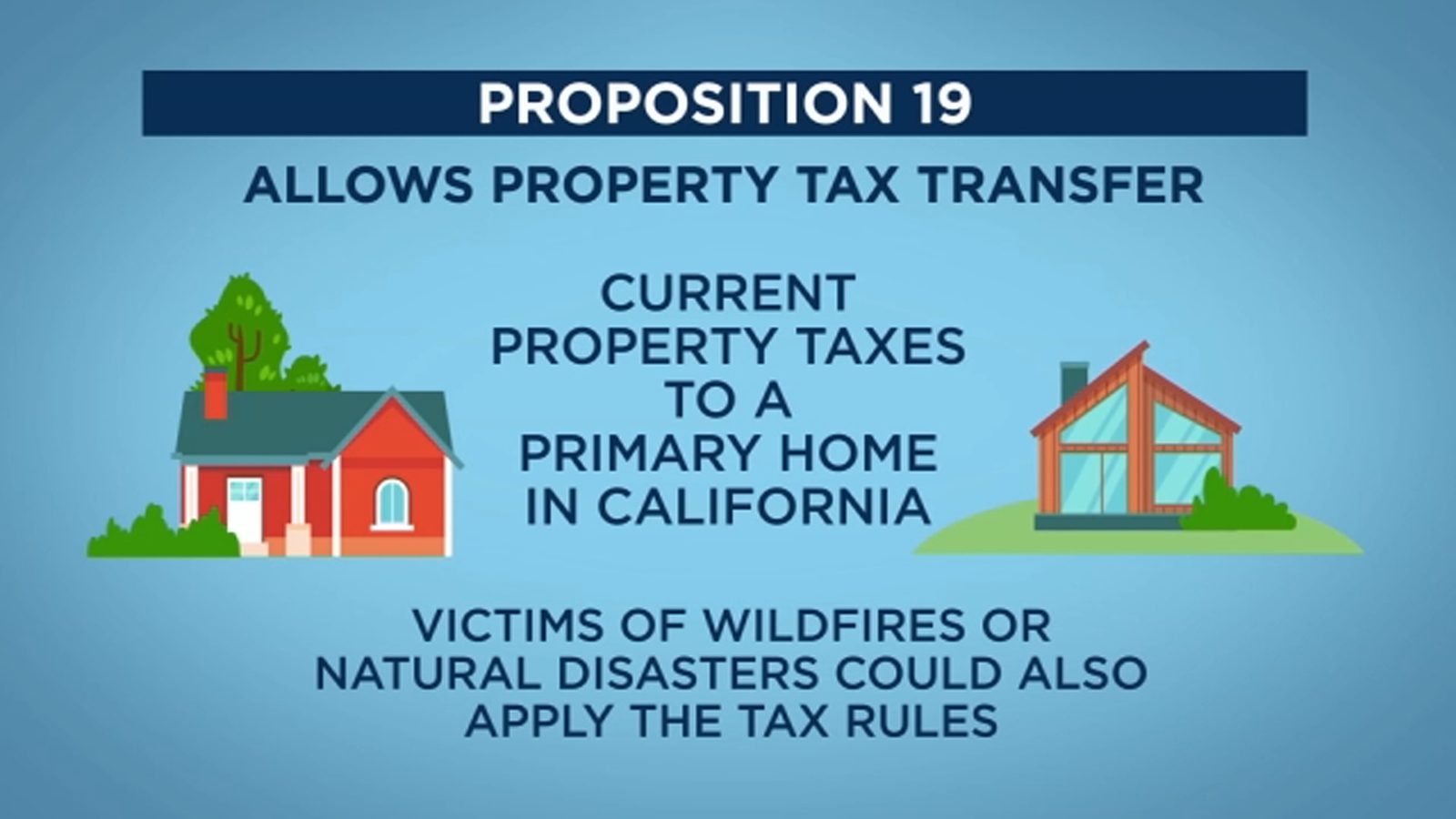

California Prop 19 Explained Measure Would Change Several Facets Of Property Tax Rules In California Abc7 San Francisco

California Prop 19 Explained Measure Would Change Several Facets Of Property Tax Rules In California Abc7 San Francisco

Https Www Boe Ca Gov Meetings Pdf 2018 082118 G1 Rules302 Etal Pubcom Prang Laco Pdf

Armanino Covid 19 State Relief Matrix

Armanino Covid 19 State Relief Matrix

Https Www Boe Ca Gov Meetings Pdf 2018 082118 G1 Rules302 Etal Pubcom Prang Laco Pdf

Property Tax Won T Be Delayed In Yolo County Because Of Coronavirus Daily Democrat

Property Tax Won T Be Delayed In Yolo County Because Of Coronavirus Daily Democrat

Https Www Boe Ca Gov Meetings Pdf 2018 082118 G1 Rules302 Etal Pubcom Prang Laco Pdf

Property Taxes Due Friday Causing Hardship Amid Covid 19 Pandemic

Property Taxes Due Friday Causing Hardship Amid Covid 19 Pandemic

100 Property Tax Penalty On Illegal Buildings The Hindu

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

100 Property Tax Penalty On Illegal Buildings The Hindu

Https Leg Mt Gov Content Committees Interim 2019 2020 Revenue Minutes June 2019 Ric June27 2019 Ex19 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home