Property Tax Calculator With Mill Rate

Class 4 - 10694. 100000 30000.

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

Class 2 - 12267.

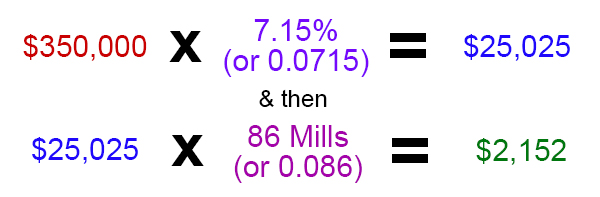

Property tax calculator with mill rate. So if the millage rate for a property is 7 mills this implies that. In this example multiply 001 by 418000 to get 4180 in county property tax. Mil Rate x Assessed Value 1000.

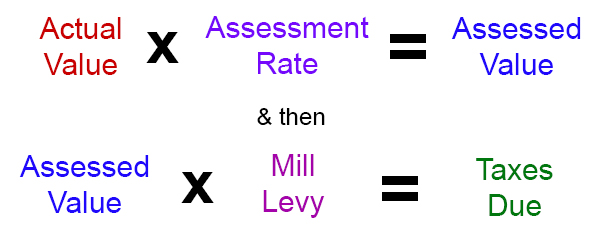

Millage rates are mathematically expressed as 0. This is an ESTIMATED tax calculation based on the latest mill rate set by state and local governments. To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000.

Real estate tax rates in New York are given in mills or millage rates. Your property tax rate is based on your tax class. TAX RATE MILLS ASSESSMENT PROPERTY TAX.

For Class 2 Properties with 11 Units or More and Class 4 Properties Step 2B. 4 for a primary residence 6 for a non-primary residence or other real property or a motor vehicle 105 for personal property. Learn how to Calculate Your Annual Property Tax.

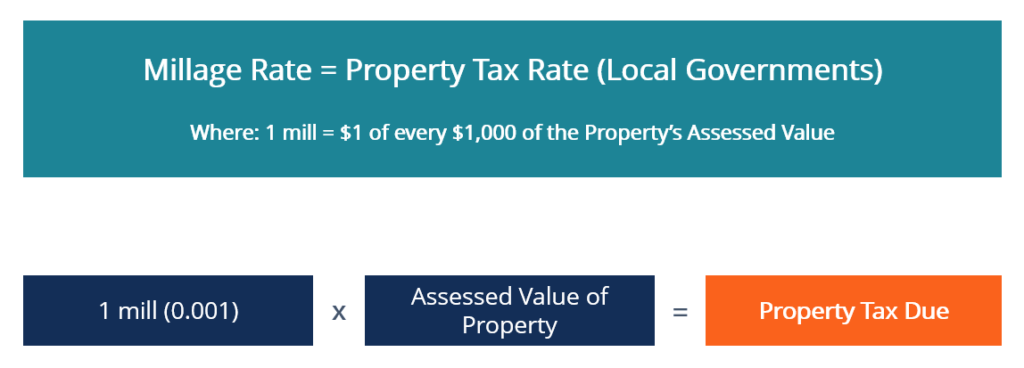

By definition one mill is equivalent to 1 owed per 1000 one-thousandth of a dollar. Property Tax Calculator - Estimate Any Homes Property Tax. Start filing your tax return now.

Since these can be a little confusing it is also useful to look at effective tax rates. For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900. 2020 Millage Rates - A Complete List.

Property Tax Rates for Tax Year 2020. Property Tax Calculation he amount of municipal tax payable by a property owner is calculated by multiplying the mil rate by the assessed value of a property and dividing by 1000. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan.

The estimated tax calculation does not take into consideration any exemptions ie. Millage rates are expressed in tenths of a penny meaning one mill is 0001. Entered the Appraisal value of the property in the Appraisal Value field.

It means that 10 represents one part per thousandth and can also be expressed as 01. 2019 Millage Rates - A Complete List. 100000 60000.

100000 300000. Try our FREE income tax calculator. 29 mills therefore is equal to 29 for every 1000 of assessed value or 29.

A mill is one one-thousandth of a dollar and in property tax terms is equal to 100 of tax for each 1000 of assessment. For example a property with an assessed value of 50000 located in a municipality with a mill rate of 20 mills would have a property tax bill of 1000 per year. The tax liability can also be calculated by multiplying the taxable value of the property by the mill rate and then dividing by 1000.

If the property has exemptions for example STAR SCHE or J-51 subtract the total exempt valueThe resulting amount is the taxable valueThe exempt value does not include abatements which are subtracted from the annual property tax amount. TAX DAY NOW MAY 17th - There are 30 days left until taxes are due. Begin Estimating Property Taxes.

Select the correct assessment ratio from the Assessment Ratio drop down. AV changes are phased in over five years. A mill is equal to 1 of tax for every 1000 in property value.

Millage rates are typically expressed in mills with each mil acting as 11000 of 1000 of property value or 1 total. There are four tax classes. Class 1 - 21167.

Urban Tax Rate no Enhanced waste Urban Tax Rate with Enhanced waste ResidentialFarm. Property Tax Rates for Tax Year 2021. Class 1 - 21045.

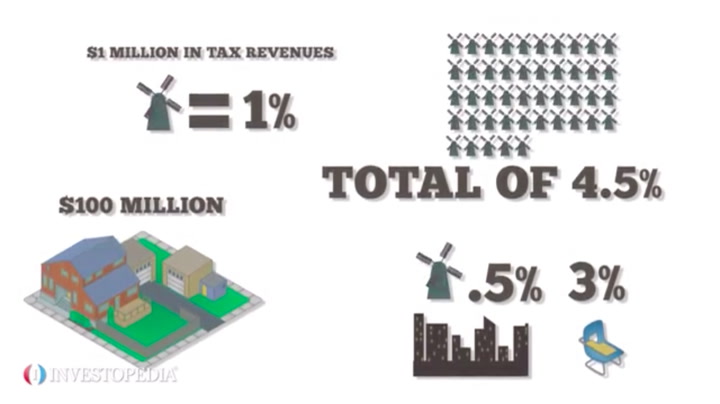

The ESTIMATE tax calculator allows what if scenarios so you can estimate what your property taxes might be if you purchased or acquired a piece of property in Bernalillo County. Divide 5 mills by 1000 to get 0005. Thus 45 mills are equal to.

The tax rates are listed below. The millage rate is the amount per 1000 of assessed value thats levied in taxes. Mill Rates A mill is equal to 100 of tax for each 1000 of assessment.

2017 Millage Rates - A Complete List. Then multiply each result by your propertys taxable value. Class 3 - 12826.

2018 Millage Rates - A Complete List.

How Property Taxes Are Calculated

How Property Taxes Are Calculated

Tax Rates Gordon County Government

Tax Rates Gordon County Government

Millage Rate Overview Sources How To Calculate

Millage Rate Overview Sources How To Calculate

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Washington County Property Tax Calculator

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

Millage Rate Overview Sources How To Calculate

Millage Rate Overview Sources How To Calculate

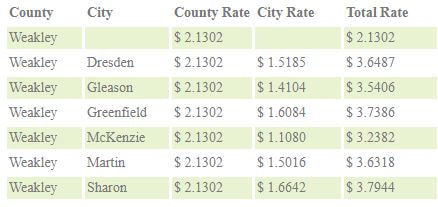

Weakley County Assessor Of Property Tax Rates

Weakley County Assessor Of Property Tax Rates

Welcome To Gaines Charter Township

Welcome To Gaines Charter Township

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home