How Can I Avoid Paying Property Taxes In Nj

In other words the inherited home must be your primary residence. The first is to simply sell the property as soon as you inherit it.

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property.

How can i avoid paying property taxes in nj. There can be significant tax implications for trusts. When you sell a house in New Jersey you are required to pay income taxes on the taxable gain said Bernie Kiely a certified financial planner and certified public accountant with Kiely Capital Management in Morristown. By offering 99999999 on a property that costs 1 million you can save 10000 and one penny by avoiding the tax.

Make sure you review your tax card and look at comparable homes. First if my only home is in New Jersey and I. Nonresidents who sold property in New Jersey are required to file the NJ-1040-NR for the year in which the property was GITREP-1 Nonresident Sellers Tax Declaration Sellers Tax Prepayment.

The implications for these trusts vary depending upon the type of trust. For instance a brokerage fee of 70000 could be. Can you explain how the exit tax would work.

If you stand to inherit property and you want to avoid paying taxes on it there are three possible options for minimizing or eliminating capital gains tax altogether. Delaying your move from New Jersey wont necessarily help you avoid the exit tax. Since you do not owe this tax you will entitled to a tax refund when you file your 2015 tax return.

Since you lived in this house as your principal residence for two of the last five years then there is a 250000 exclusion of any gain on the sale of this home Rosen said. Be sure to include copies for both tax years if completing Form PTR-1. When Must New Jersey Death and Inheritance Taxes Be Paid When Administering a New Jersey Trust.

By selling it right away you arent leaving any room for the property to appreciate in value any further. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. Form 1098 from your mortgage company.

Rosen said its important thing to file your New Jersey non-resident or part-time tax return for 2015. In lieu of sending a completed homeowners verification form you may send in copies of the following proof of taxes due and paid. Look on the postcard for the Assessment Total.

Wait One Year Before Selling Inherited Property. In New Jersey once a tax lien is on your home the collector on behalf of the municipality can then sell that lien at a public auction. The average property tax bill in the country depending on whether you add in taxes such as the vehicle property tax which 27 states charge including Rhode Island 1133 per year.

Cancelled checks or receipts showing the amount of property taxes paid. I paid 200000 for the house and sold for 275000. The Section 121 Exclusion allows a taxpayer to exclude up to 250000 500000 for joint returns of the capital gain from the sale if they live in the property for at least two of the five years before the sale.

If you can prove to your municipality that the assessed value of your home is too high they will lower the assessed value and this lowers your property taxes. Another way to avoid the tax is by cleverly using fees related to the purchase in the contract. The Income Tax Implications of Trusts in New Jersey.

When homeowners dont pay their property taxes the overdue amount becomes a lien on the property. Every January or February homeowners in New Jersey get a postcard from their tax assessor with the assessed value of their home. Since there may be no other reason for a nonresident to file a New Jersey tax return and pay tax we require the tax due be estimated and paid upfront.

This is so regardless of whether its your principal residence second home or investment property. As with all things financial taxes are an issue. Google Translate is an online service for which the user pays nothing to obtain a.

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Nj Senior Freeze Property Tax Reimbursement Access Wealth

Nj Senior Freeze Property Tax Reimbursement Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Mortgage Help During Covid 19 Crisis But What About Property Taxes Nj Spotlight News

Mortgage Help During Covid 19 Crisis But What About Property Taxes Nj Spotlight News

106 Year Old Gets Help Paying Nj Property Taxes Avoids Eviction Very Old Woman Old Women Year Old

106 Year Old Gets Help Paying Nj Property Taxes Avoids Eviction Very Old Woman Old Women Year Old

Important 2020 Nj Property Tax Appeal Deadlines New Jersey Business Magazine

Important 2020 Nj Property Tax Appeal Deadlines New Jersey Business Magazine

N J S Nonprofit Hospitals Will Avoid Property Taxes But Must Make Community Service Payments Under New Law Nj Com

N J S Nonprofit Hospitals Will Avoid Property Taxes But Must Make Community Service Payments Under New Law Nj Com

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Map 30 Year Mortgage Northern California

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Map 30 Year Mortgage Northern California

Will I Get A Check Or Property Tax Credit For The Senior Freeze Property Tax Tax Credits Seniors

Will I Get A Check Or Property Tax Credit For The Senior Freeze Property Tax Tax Credits Seniors

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

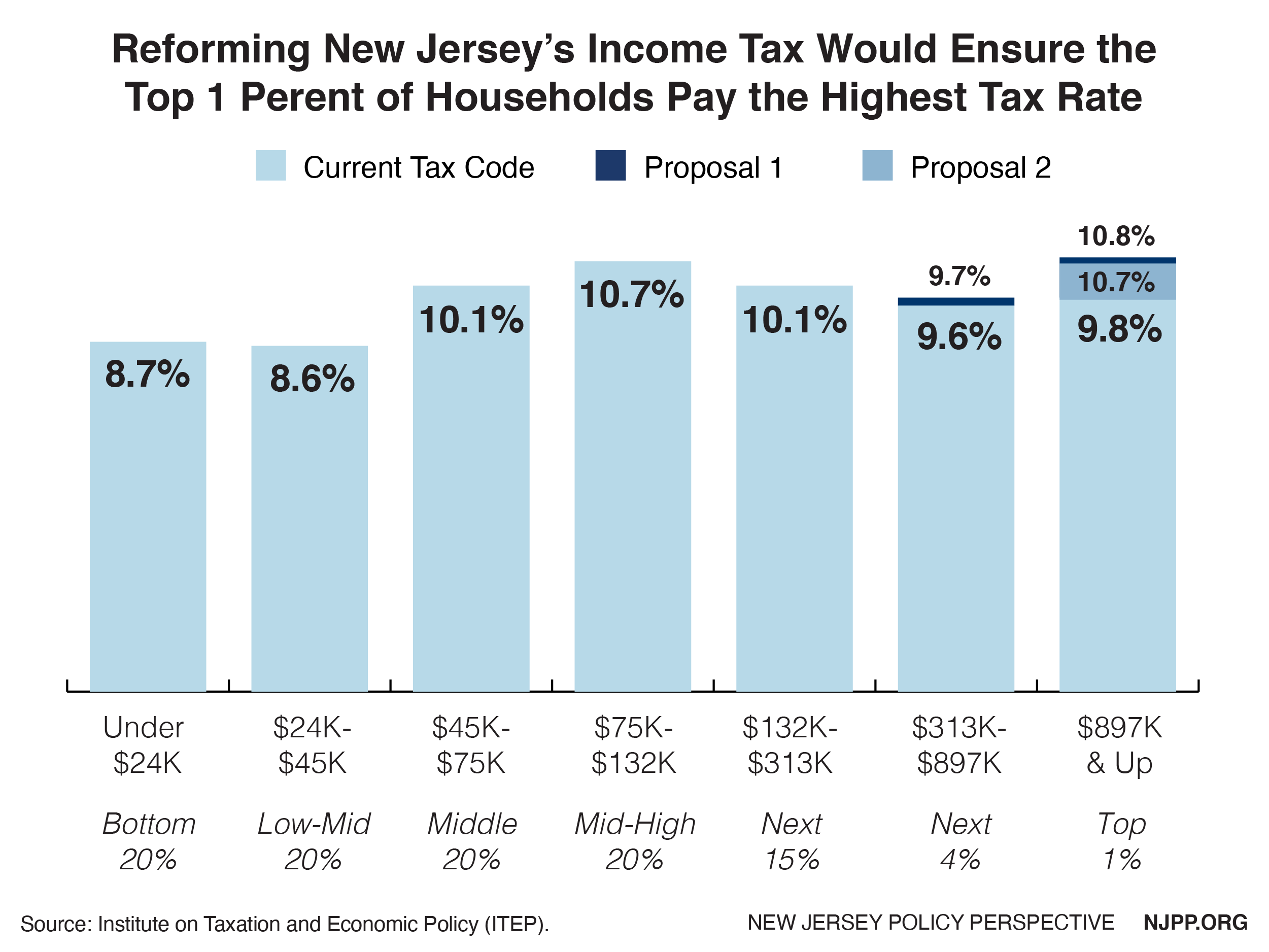

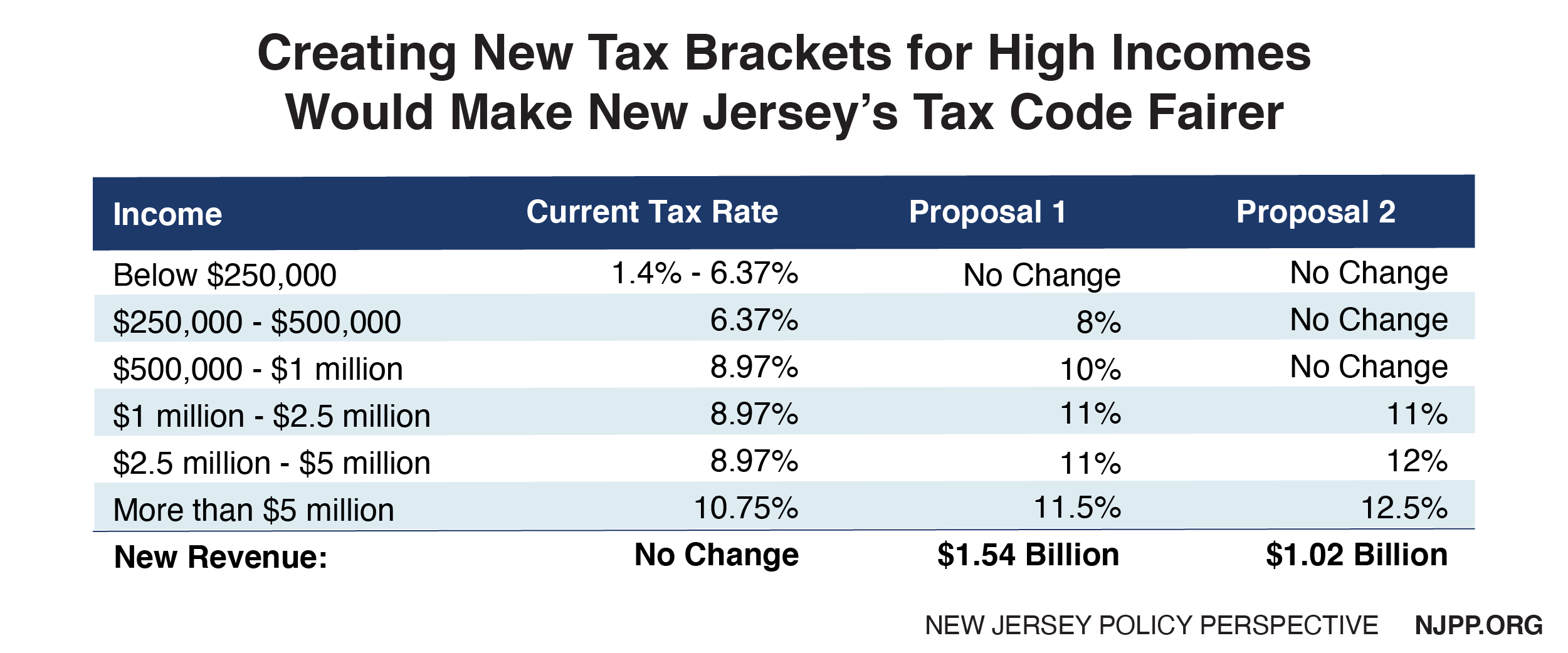

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

28 Of All Business Owners In New Jersey Were Foreign Born Ct Repatriation Section965 Nj Gilti Repatriation Legal Marketing Local Marketing Tax Lawyer

28 Of All Business Owners In New Jersey Were Foreign Born Ct Repatriation Section965 Nj Gilti Repatriation Legal Marketing Local Marketing Tax Lawyer

New Brunswick Nj Accounting Firm Business Tax Accounting Firms Tax Prep

New Brunswick Nj Accounting Firm Business Tax Accounting Firms Tax Prep

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

New Jersey Exit Tax Moving Out Of State Tax Considerations

New Jersey Exit Tax Moving Out Of State Tax Considerations

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home