How Do I Find My Maryland Property Tax Bill Online

To view your property assessment information search the States property assessment database State Search. Box 17535 Baltimore MD 21297-1535.

Differences Between D C Virginia And Maryland Washington Dc Coldwell Banker Blue Matter Maryland Real Estate Virginia Maryland

Differences Between D C Virginia And Maryland Washington Dc Coldwell Banker Blue Matter Maryland Real Estate Virginia Maryland

Go to our Real Property Data Search at httpsdatdatmarylandgovRealPropertyPagesdefaultaspx Select the appropriate county from the drop down menu.

How do i find my maryland property tax bill online. Real property tax bills are due when rendered and are considered delinquent on October 1. To pay by phone call 240-777-8898. Interest starts to accrue at the rate of one percent per month until the bill is paid.

Easy online tool to enable Maryland residents and businesses to pay taxes online. Easy online tool to enable Maryland residents and businesses to pay taxes online. Real property tax annual bills and the first installment of semiannual bills are due on or before September 30 and become delinquent on October 1.

Select 2020 Income Tax Forms from the Forms drop down menu or link from the RELIEF Act Page The EITC Assistant is also available to help you determine eligibility for this important tax credit Click on the RELIEF Act tab from the landing page or from the COVID menu on mobile devices for more information BREAKING NEWS. Contact Information Manager of Billing and Collections. However information may not be available during times of system maintenance.

This system may be used to make bill payments on business taxes using electronic funds withdrawal direct debit from a US. Contact SDAT or visit one of their local assessment offices. State law provides that all real property is subject to the property tax.

Pay your Real Estate Tax Bill Online. For any taxable year the taxes billed are based on personal property located in Maryland as of January 1 of that same year. Begin by entering your account number or bill number or street address for the bill you want to pay in the box below.

Revised Individual forms for Tax Year 2020 are available now. System Availability - The Online Service center is available 24 hours a day 7 days a week from any home office or public access point. You will receive an email confirmation of your payment.

Then click on the payment type. Logon To the Individual Taxpayer. Online Bill Pay is an easy convenient and secure way to pay your Maryland tax liabilities online for free.

You can search the online database by either the address street name account identifier or map reference. You can not search by owners name town neighborhood subdivision or zip code. Metered Water Real Property Miscellaneous Bills Part Year Bills Personal Property and Alley Footway and Street Scape Bills.

Search and pay for real or personal property tax information online. Your payment has been received by the Comptroller of Maryland. Your assessment and tax rate are shown on the front of your tax bill.

Get help if you need it. For any of the Following. City of Baltimore Bureau of Revenue Collections PO.

The following online payment services are available. A property owner will receive a property tax bill each year. Foreign facilities will not be accepted.

You can also view Local Tax Billing Collection Offices information. The second semiannual installment is due on or before December 31 and becomes delinquent on January 1. Many types of Property Tax Credits are offered to.

To calculate your bill multiply the assessment by the tax rate divide by 100 add any charges - the result should equal the amount due. Bank or financial institution. File personal income taxes.

To update the permanent mailing address for your property tax bill contact the State Department of Assessments and Taxation through their website or by calling 410-512-4900. Real Property Taxes are billed by Howard County on an annual basis on July 1 although many taxpayers have the option of semi-annual payments. Online or phone payments can be made from your home.

Most likely payment of your real property tax is handled through your mortgage lender but you can view local property tax rates on SDATs Web site. For any of the Following. Personal property tax bills are mailed throughout the taxable year July - June depending on when the personal property tax returns were filed by a business.

For assistance users may contact the Taxpayer Services Division Monday through Friday from 830 am until 430 pm via email at taxhelpmarylandtaxesgov or via phone 410-260-7980 from central Maryland or at 1-800-MDTAXES 1-800-638-2937 from elsewhere. You will need a parcel ID account number or property address which you will find on your tax bill. Constant Yield PDF FY21Tax Rates PDF Credits The Maryland Department of.

Or property owned by federal state or local governments are exempt from property tax. Call the 24-hour self-service system at 410-887-2403 and follow the prompts. Delinquent real and personal property taxes are subject to interest and penalty.

Ambulance Bills Civil Citation Environmental. Claim for Refund of Tax Erroneously Paid. Upon qualification properties that are owned and used by religious charitable or educational organizations.

Logon To the Individual TaxpayerOnline Service Center. Links to our online property tax information can be found by clicking on Search for Tax Records on the left side of this page. Real Estate Tax Bill Inquiry.

Stumped How To Form A Maryland Llc The Easy Way

Smoke Alarm Laws In Maryland Changed On Jan 1 2018 Smoke Alarms Alarm Smoke

Smoke Alarm Laws In Maryland Changed On Jan 1 2018 Smoke Alarms Alarm Smoke

Can I Claim The Mortgage Interest Deduction Tax Deductions Tax Software Tax Refund Calculator

Can I Claim The Mortgage Interest Deduction Tax Deductions Tax Software Tax Refund Calculator

Maryland Property Tax Calculator Smartasset

Maryland Property Tax Calculator Smartasset

Re Brokerage Commission Invoice Invoic Commission Invoice Template Invoice Template Real Estate Commission

Re Brokerage Commission Invoice Invoic Commission Invoice Template Invoice Template Real Estate Commission

I Pinimg Com Originals A1 D1 E2 A1d1e267f6a9fd9

I Pinimg Com Originals A1 D1 E2 A1d1e267f6a9fd9

Understanding Your Property Assessment Notice City Of Takoma Park

Understanding Your Property Assessment Notice City Of Takoma Park

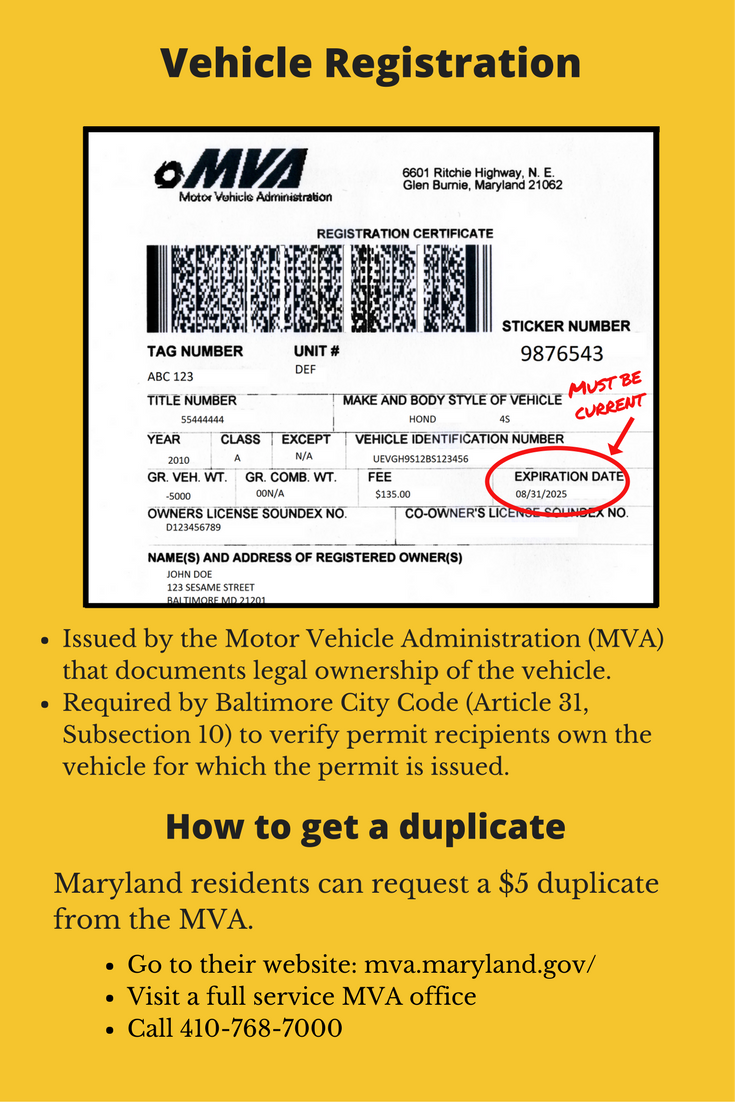

Required Customer Documents Parking Authority

Required Customer Documents Parking Authority

Free African Americans Of Virginia North Carolina South Carolina Maryland And Delaware African American Genealogy African American Family African American

Free African Americans Of Virginia North Carolina South Carolina Maryland And Delaware African American Genealogy African American Family African American

Fy2021 Tax Information For Anne Arundel County Anne Arundel County Md

Fy2021 Tax Information For Anne Arundel County Anne Arundel County Md

Montgomery County Md Property Tax Calculator Smartasset

Montgomery County Md Property Tax Calculator Smartasset

Pay Business Taxes Maryland Business Express Mbe

Pay Business Taxes Maryland Business Express Mbe

Late Rent Notice Real Estate Forms Late Rent Notice Real Estate Forms Templates

Late Rent Notice Real Estate Forms Late Rent Notice Real Estate Forms Templates

Understanding Your Property Assessment Notice City Of Takoma Park

Understanding Your Property Assessment Notice City Of Takoma Park

How To Find A Good Property Management Company Management Company Management Property Management

How To Find A Good Property Management Company Management Company Management Property Management

Pay Or Search Real Property And Personal Property Taxes Baltimore County

How To Form An Llc In Maryland Startingyourbusiness Com

How To Form An Llc In Maryland Startingyourbusiness Com

The Differences Between Va Md And Dc Taxation Lipsey Associates Of Vienna Virginia

The Differences Between Va Md And Dc Taxation Lipsey Associates Of Vienna Virginia

Free Maryland 14 Day Notice To Quit Threat To Others Pdf Word Template Eviction Notice Threat Being A Landlord

Free Maryland 14 Day Notice To Quit Threat To Others Pdf Word Template Eviction Notice Threat Being A Landlord

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home