Property Tax On Cars In Nebraska

In 1997 legislation changed the method of taxation of motor vehicles to a uniform statewide tax and fee system. States that assess a personal property tax on vehicles include.

General Information Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No.

Property tax on cars in nebraska. For information about obtaining a registration for a leased vehicle refer to Vehicle Registration. History - The motor vehicle tax replaced the property tax levied on. A 100 fee is charged for each successful Nebraska Title Lien and Registration Record Search.

- Click start next to Car Registration Fees and follow the prompts. Nebraska use tax is due when a lessee who lives in Nebraska takes possession of a motor vehicle under a lease agreement outside Nebraska from an unlicensed lessor and then brings the motor vehicle into Nebraska and registers it for operation on the highways of Nebraska. The Lessees individuals leasing the vehicle is provided with a copy of the title designated Registration Copy for registration purposes.

If you are registering a motorboat contact the Nebraska Game and Parks Commission. For vehicles that are being rented or leased see see taxation of leases and rentals. To enter it in-Federal Taxes- Deductions and Credits - Scroll to Cars and Other Things You Own.

AL AZ AR CA CO GA IN IO KY LA MI MN MS MO MT NE NV NH SC WA WY. Registering a recently-purchased vehicle will involve paying state and local sales tax in addition to registration and possible plate fees. Deducting Personal Property Tax.

A convenience fee of 235 100 minimum is included on all payments. Questions regarding titles for Leased Vehicles can be addressed by email or by phone at 402 471. Manley will start a 05 rate and Humphrey will increase its rate from 15 to 2.

Your purchase will be charged to your Nebraskagov subscriber account. The motor vehicle tax is the only deductible item for Nebraska. The Department of Motor Vehicles DMV is the oversight state agency not DOR.

Landfill gas is exempt from property tax if the depreciable tangible personal property was installed on or after January 1 2016 and has a nameplate capacity of 100 kilowatts or more. Welcome to Nebraska Taxes Online. The MSRP on a vehicle is set by the manufacturer and can never be changed.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. The business portion is deducted as a business expense and the remainder as a personal deduction when property is used partly for business and partly for personal reasons. Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed.

To make their tax information available online. The car or motor vehicle tax in Nebraska can be overwhelming since they are actually several taxes rolled together to pay for one very expensive little sticker on your license plate. This tax information is being made available for viewing and for payments via credit card.

DO NOT mail personal property returns to the Department of Revenue. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918. Use tax is due on the total dollar amount paid by the lessee to the lessor.

Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent. Personal property tax paid on equipment used in a trade or business can be deducted as a business expense. Personal Property Assessment Information Guide September 11 2020 Page 3.

This service is intended for qualified business professional use only to view vehicle title lien and registration information. If you live in one of the states that base a portion of the registration fee on the vehicles value you deduct the business-related portion of the fee on Schedule C. The percentage of the Base Tax applied is reduced as the vehicle ages.

The counties on our site have made an agreement with MIPS Inc. County Assessor address and contact information. Please enter either Address info or a Parcel Number.

This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

Nebraska Personal Property Return must be filed with the County Assessor on or before May 1. Sole proprietors can deduct these taxes on Schedule C. 20-17 Personal Property Changes Guidance Bulletin Personal.

Real Property Tax Search. If you are not a Nebraskagov subscriber sign up. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

In Nebraska motor vehicle tax is no longer a property tax according to value. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2021 updated 03032021 Effective July 1 2021 the following changes were made for local sales and use tax rates. This is less than 1 of the value of the motor vehicle.

The Nebraska state sales and use tax rate is 55 055. 60 rows Motor Vehicle Tax.

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

Nebraska Online Vehicle Tax Estimator Gives Citizens Tax And Fee Estimates

Nebraska Online Vehicle Tax Estimator Gives Citizens Tax And Fee Estimates

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

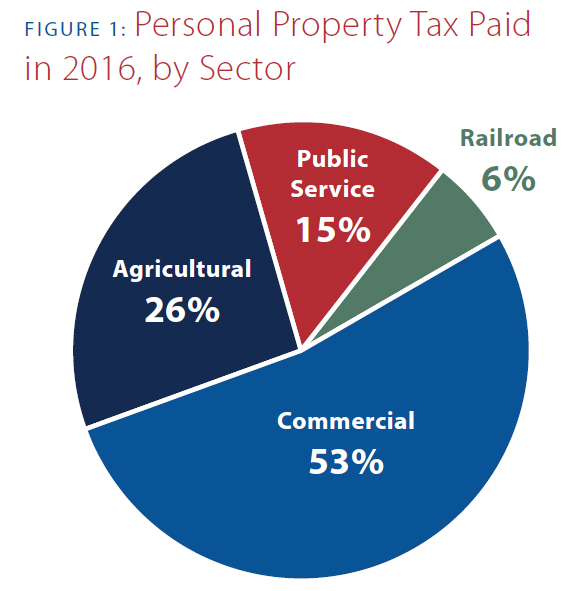

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

The States With The Lowest Car Tax The Motley Fool

The States With The Lowest Car Tax The Motley Fool

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Nebraska Sales Tax Small Business Guide How To Start An Llc

Nebraska Sales Tax Small Business Guide How To Start An Llc

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Americans Are Migrating To Low Tax States United States Map Native American Map Low Taxes

Americans Are Migrating To Low Tax States United States Map Native American Map Low Taxes

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Minnesota Property Tax Calculator Smartasset

Minnesota Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home