How Much Is Personal Property Tax In Missouri On A Car

Missouri Sales Tax - A One-Time Tax Sales Tax is paid to the State usually at the Department of Motor Vehicles when the vehicle is first purchased. To enter your Personal Property Taxes go to Federal Taxes then click on Deductions and Credits.

Can I deduct this.

How much is personal property tax in missouri on a car. 15000 market value 3 5000 assessed value Taxes are imposed on the assessed value. 24 - 35 HP. If you live in a state with personal property tax consider the long-term cost when you buy a vehicle.

The average effective property tax rate in Missouri is 093. Missouri refers to the fees you pay at the time of purchasing a car as registration fees but then requires that we pay personal property taxes yearly based on the value of our cars. Boat and outboard motor titling and.

Personal Property Tax - A Yearly Tax Personal property tax is paid to Jackson County by December 31 of every year on every vehicle you owned on January 1. Vehicle values are based on the average trade-in value as published by the National Automobile Dealers Association RSMo 1371159 wwwmogamogov. That comes in a bit lower than the national average which currently stands at 107.

The Median Missouri property tax is 126500 with exact property tax rates varying by location and county. Motor vehicle titling and registration. In the state of MO we pay Personal Property tax for each car we own this is not a registration fee.

12 - 23 HP. The states median annual property tax payment is 1563. Personal property tax paid on equipment used in a trade or business can be deducted as a business expense.

61115 Your family has to pay more than 600 each year in personal property taxes for your vehicles. Personal property is assessed at 33 and one-third percent one third of its value. Who owes personal property tax.

Calculate personal property tax vehicle missouri. Taxable Horsepower 1-Year Fee 1-Year Processing Fee 2-Year Fee 2-Year Processing Fee. Calculate Personal Property Tax - Vehicle - Missouri.

Motor vehicle title penalties. The business portion is deducted as a business expense and the remainder as a personal deduction when property is used partly for business and partly for personal reasons. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

Your vehicles taxable horsepower is recorded on your title or on your Application for Missouri Title and Registration. The good news is that tax can be claimed when you file. Sole proprietors can deduct these taxes on Schedule C.

Overview of Missouri Taxes. For additional information click on the links below. Total Personal Property Tax.

Louis County Revenue Department collects taxes on both real estate and personal property such as cars and recreational vehicles. 2019 Withholding Tax and MO W-4 Changes. Missouris effective vehicle tax rate according to the study is 272 percent which means the owner of a new Toyota Camry LE four-door sedan 2018s highest-selling car valued at.

Yes you can deduct those personal property taxes if they were paid in 2016. Every person owning or holding taxable personal property in Missouri on the first day of January including all such property purchased on that day shall be liable for taxes thereon during the same calendar year. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

Is there a calculator that anyone is aware of. I am looking for a way to calculate what my personal property tax will be on my car for the state of Missouri.

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

Paid Personal Property Tax Receipt Missouri Property Walls

Paid Personal Property Tax Receipt Missouri Property Walls

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Online No Tax Due System Information

Online No Tax Due System Information

Online No Tax Due System Information

Online No Tax Due System Information

Pay Your Bill Online Clay County Missouri Tax

Pay Your Bill Online Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

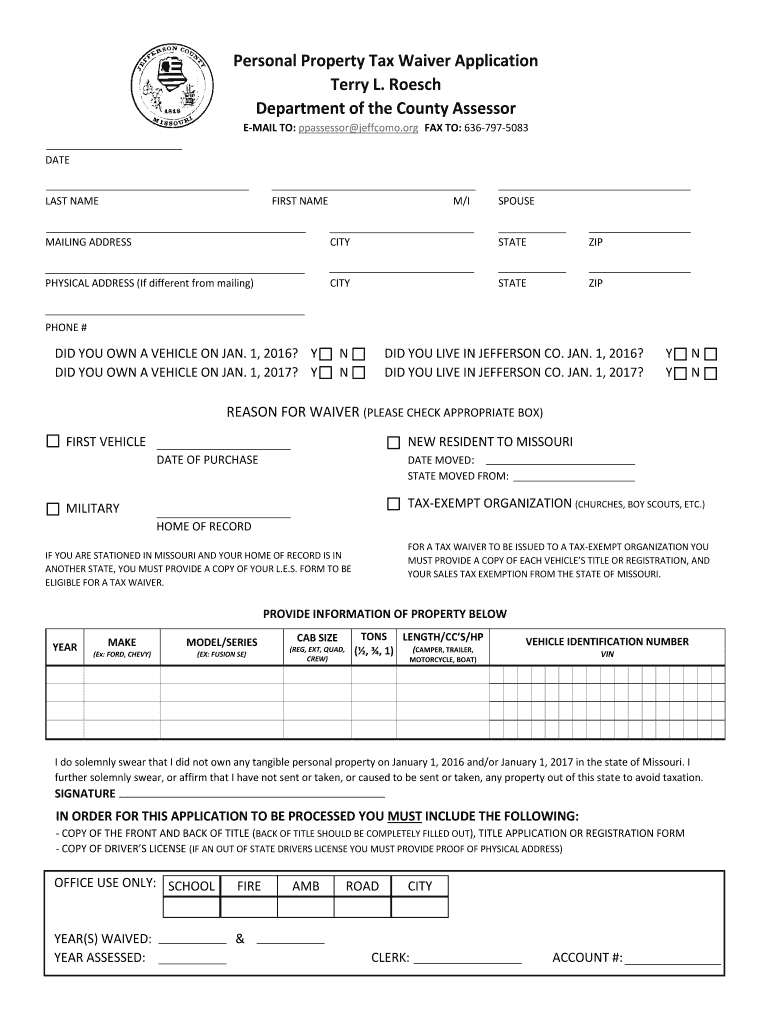

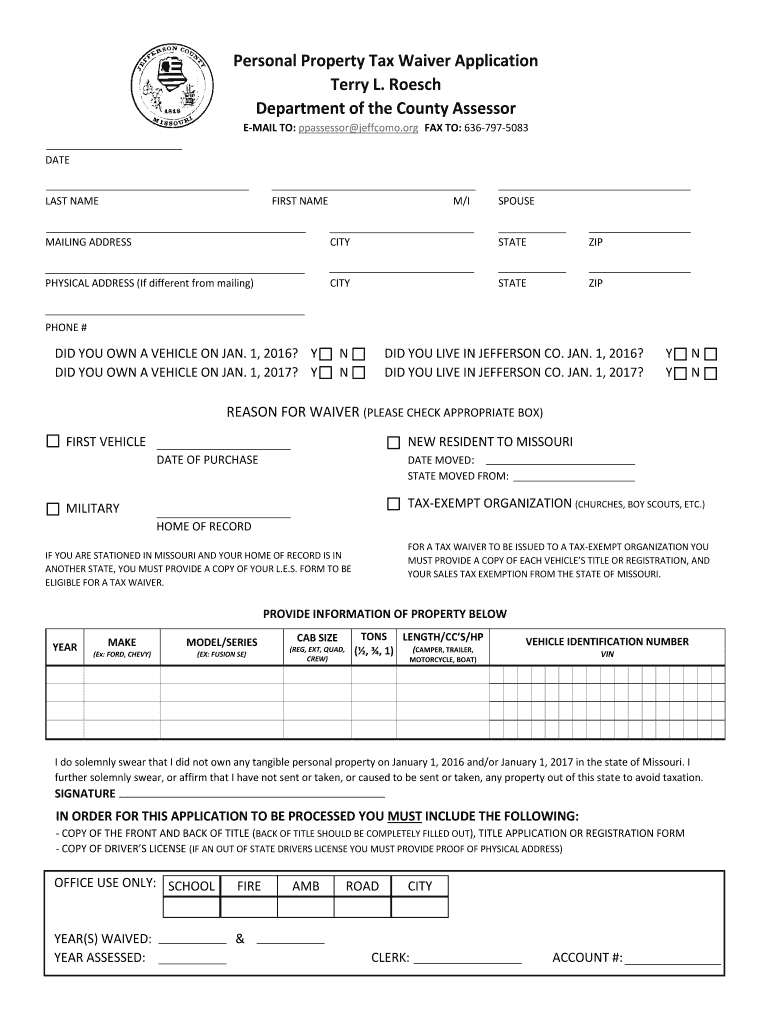

Missouri Personal Property Tax Waiver Online Property Walls

Missouri Personal Property Tax Waiver Online Property Walls

Missouri Car Registration Everything You Need To Know

Missouri Car Registration Everything You Need To Know

Https Dor Mo Gov Forms 426 Pdf

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Missouri Car Sales Tax Calculator

Missouri Car Sales Tax Calculator

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home