Washington State Veterans Property Tax Exemption

Washington State Disabled Veteran Property Tax Exemption. This program freezes the value of your residence exempts all excess levies and may exempt a portion of regular levies.

Pin On Military Veteran Benefits

Pin On Military Veteran Benefits

The total value of the exemption varies by municipality so be sure to contact your local tax authority for more details.

Washington state veterans property tax exemption. The exemption amount is based on income as determined by the Washington State Department of Veterans Affairs. Discover why properties owned by taxing districts are exempt from property taxes. Obtain information about properties owned by cemeteries and non-profit organizations that may apply for property tax exemption.

Contact For questions about the. Army Navy Air Force Marines and Coast Guard. 34 rows A disabled veteran in Washington may receive a property tax exemption on hisher primary.

To find out if you qualify contact your County Assessor. Disabled veterans in the State of Washington may qualify for need-based property tax exemptions on a primary residence provided there is a 100 service-connected disability rating. Veteran must prove financial need according to the criteria established by the State Veterans Commission if their annual income exceeds 95279 effective Jan.

Veterans exemption There are three different property tax exemptions available to veterans who have served in the U. Armed Forces including veterans who have served in the US. Applicants with an annual income of 95279 or less are given a rebuttable presumption to have a need for the exemption.

The qualifying applicant receives a reduction in the amount of property taxes. WAC 458-16A-100 458-16A-150. Veterans Can Buy a Home with 0 Down.

The Senior Citizens and Disabled Persons Property Tax Exemption Program helps eligible individuals on a limited income to pay property taxes. The Washington State Department of Veterans Affairs WDVA including the State Veterans Homes does not discriminate against any person on the basis of race color national origin gender sexual orientation disability or age in admission treatment or participation in its programs services and activities or in employment. This property tax exemption isnt automatic and doesnt transfer from one property to another property.

The filing period is between January 1st and April 1st of the assessment year. A property tax exemption is available to disabled Veterans. Disabled Veterans only have to file for the abatement one time.

Veterans Property Tax Exemption. Forms and information may be obtained from the following. Veterans with a disability status of 50 or above are eligible for a veteran property tax exemption with a state-mandated minimum of 10000.

Senior Citizens Or People with Disabilities. Applicants with less than a 100 VA disability rating may qualify for a partial exemption. To qualify for the Exemption Program you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability.

Our state leaders have created programs to support different needs in our communities. However a recent change allows an exemption to that rule to qualified widows and orphans. All property must be on record as of 1 January of the year you file.

See all Washington Veterans Benefits. Have combined disposable income of 40000 or less. After which it will automatically renew each year.

The dis-abled veteran or surviving spousepartner must file an exemption claim by the due date with the county asses-sor where the property is located. What are the eligibility requirements for the Property Tax Exemption Program. A disabled veteran in Washington may receive a property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of service.

Washington Veteran Financial Benefits Disabled Veteran Property Tax Exemption Veterans with a 100 service-connected disability or over the age of 61 and income below certain levels varies by. A 40-or-more disabled veteran or the surviving spouse of a veteran may be entitled to a Veterans Exemption on property taxes. Completion of Property Tax Assistance Claim Form for WidowsWidowers of Veterans.

Own and occupy a primary residence in the State of Washington. Washington Property Tax Exemption. Find out if you qualify for a property tax deferral.

Veterans who reside in Washington and retired because of a disability veterans with a 100 percent service-connected disability and widows of 100 percent disabled veterans may qualify for income-based property tax exemptions and deferrals. Property tax exemption for senior citizens and people with disabilities. You dont have to file a claim every year unless a licensed physician certified the.

You must also own and occupy your residence and your combined disposable income must be 40000 or less. RCW 8436379 8436389.

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Pin On Military Veteran Benefits

Pin On Military Veteran Benefits

Purple Heart Honorees Mack Payne Vietnalm Veteran News Purple Heart Korean Wars American Veterans Historically Black Colleges

Purple Heart Honorees Mack Payne Vietnalm Veteran News Purple Heart Korean Wars American Veterans Historically Black Colleges

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Court Disabled Veteran Owned Small Business Beats Va Disabled Veterans Veteran Small Business

Court Disabled Veteran Owned Small Business Beats Va Disabled Veterans Veteran Small Business

Is Tax Return Filing Required With Solo 401 K Plan Irs Form 5500 Ez Internal Revenue Service Irs Irs Forms

Is Tax Return Filing Required With Solo 401 K Plan Irs Form 5500 Ez Internal Revenue Service Irs Irs Forms

Washington Veteran S Benefits Military Benefits

Washington Veteran S Benefits Military Benefits

Purple Heart Recipients Korean Wars American Veterans Historically Black Colleges

Purple Heart Recipients Korean Wars American Veterans Historically Black Colleges

Washington State Veterans Benefits The Insider S Guide Va Claims Insider

Washington State Veterans Benefits The Insider S Guide Va Claims Insider

Of All The Military Benefits The Va Home Loan Is One Of The Most Popular And Important For Those Interested In Becoming A Home Home Loans Loan Home Ownership

Of All The Military Benefits The Va Home Loan Is One Of The Most Popular And Important For Those Interested In Becoming A Home Home Loans Loan Home Ownership

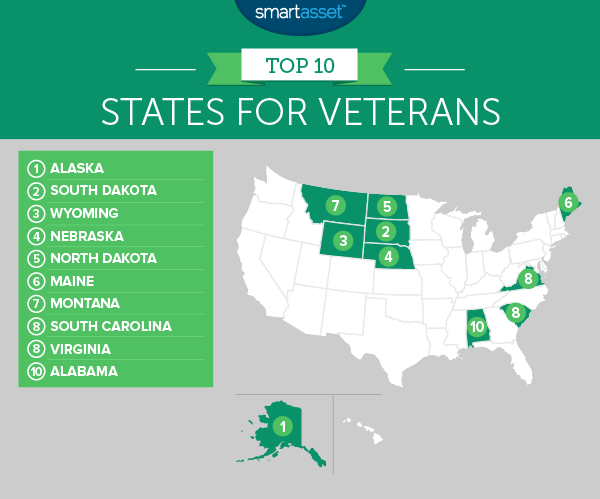

The Best States For Veterans Smartasset

The Best States For Veterans Smartasset

Pin On Us Army Veteran Proud To Be

Pin On Us Army Veteran Proud To Be

John D Dingell Va Medical Center Detroit Michigan

John D Dingell Va Medical Center Detroit Michigan

Military Retirees Retirement Military Retirement Military

Military Retirees Retirement Military Retirement Military

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Local Military Veterans Discounts Military Benefits

Local Military Veterans Discounts Military Benefits

Dependency And Indemnity Compensation Explained Cck Law

Dependency And Indemnity Compensation Explained Cck Law

Washington The Official Army Benefits Website

Washington The Official Army Benefits Website

Labels: exemption, property, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home