Property Tax Exemption San Diego

Homeowners should be wary of such solicitations and consider filing for property tax themselves. Proof of residency may include voter or vehicle registration bank accounts or income tax records.

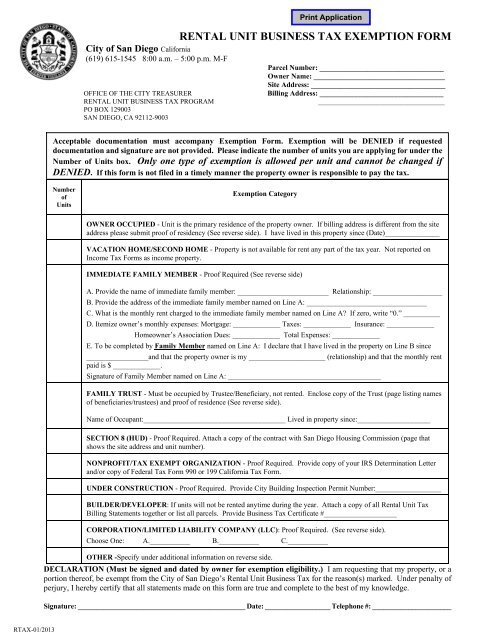

Fillable Online Sandiego Rental Unit Business Tax Exemption Form City Of San Diego Sandiego Fax Email Print Pdffiller

Fillable Online Sandiego Rental Unit Business Tax Exemption Form City Of San Diego Sandiego Fax Email Print Pdffiller

The California Constitution provides for the exemption of 7000 maximum in assessed value from the property tax assessment of any property owned and occupied as the owners principal place of residence.

Property tax exemption san diego. A qualified applicant must file by the end of the calendar year for the tax year in which they wish to seek relief. The Takeaway There is a special tax exemption that is easy to get in San Diego and it is known as the Homeowners Property Tax Exemption. For Veterans in SD exemption eligibility can differ based on your personal wealth and disability status.

If you own and occupy your home as your principal place of residence you may be eligible for an exemption of up to 7000 off the propertys assessed value resulting in a property tax savings of approximately 70 to 80 annually. For more information contact the San Diego County AssessorRecorderCounty Clerk at 858 505-6262. 1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov.

The dwelling may be any place of residence subject to property tax. Of approved units exempted from the tax. Who is eligible to participate.

The procedure is explained on the website of the County AssessorRecorderCounty Clerk at arcccosan-diegocaus. Property Tax Exclusion for Solar. Click on ReassessmentOwnership under Assessor Services then on Proposition 13 and then on Application.

The Disabled Veterans Property Tax Exemption provides for the cancellation or refund of taxes paid 1 when property becomes eligible after the. Center 1600 Pacific Hwy Room 162 San Diego CA 92101. Dan McAllister Treasurer-Tax Collector San Diego County Admin.

There is no cost for this. The exemption reduces the annual property tax bill for a qualified homeowner by up to 70. The Police and Fire-Rescue departments work together within our communities to provide the highest level of quality service and protection.

In order to qualify you must be a property owner co-owner or a purchaser named in a contract of sale. 126380 2015 basic exemption amount 365 days 34625 exemptionday. Property is occupied by immediate family member and the annual rent is less than the owners total annual expenses.

Claims received after that date are still eligible for exemption but will only receive 85 of the. Additionally there are State sponsored property tax relief programs available to help senior citizens on limited income legally blind and disabled. The assessed value of your property will not increase as a result of adding most solar systems with the exception of swimming pool and hot tub heaters.

San Diego County Property Tax Exemption Options. From neighborhood watch to 9-1-1 services our team is here for you 24 hours a day seven days a week. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own.

Within two years of the purchase or new construction of the replacement dwelling. Number of approved units exempted from the tax. If you did not have the homeowners exemption on your property you may need to provide documents to the assessor that prove it was your principal place of residence.

Property taxes are quite possibly the most widely unpopular taxes in the US. It offers you a 7000 rebate on your houses assessment each year that you qualify. Most non-disabled Veterans will use the California Homeowners Exemption to reduce the taxable value of their home by 7000.

State law provides property tax savings for those 55 years or older who sell their home and purchase another one of equal or lesser value. SAN DIEGO CA 92101 TELEPHONE. Fortunately there are several options for property tax exemption in San Diego.

To receive the full value of the exemption 7000 off your assessed value for an annual savings of approximately 70 on your property taxes please sign and return this form to the Assessors Office. Exemption Allowed represents exemptions for an owner occupied unit andor exemptions requested and approved by the Office of the City Treasurer. A single-family residence a structure.

For example an applicant acquiring property in March 2009 must file an exemption claim by December 31 2009 in order to be considered timely. Exemption Allowed represents exemptions for an owner occupied unit andor exemptions requested and approved by the Office of the City Treasurer. Your property tax reduction will be prorated from the date the property became eligible for the exemption.

Your 2015-2016 prorated exemption and taxes would be calculated as follows. This equals about 70 a year. Property is occupied by immediate family member and the annual rent is less than the owners total annual expenses.

To obtain the exemption the claimant must be an owner or co-owner a veteran spouse of an owner a purchaser named in a contract of sale or a shareholder in a corporation where the rights of shareholding entitle the claimant to possession of a home owned by the corporation.

Rental Unit Business Tax Exemption Form City Of San Diego

Rental Unit Business Tax Exemption Form City Of San Diego

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

Https Www Sandiegocounty Gov Content Dam Sdc Auditor Trb1819 Trbcomplete Pdf

Homeowners Exemption Homeowner Property Tax San Diego County

Homeowners Exemption Homeowner Property Tax San Diego County

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Property Tax Re Assessment Bubbleinfo Com

Property Tax Re Assessment Bubbleinfo Com

Https Www Sandiegocounty Gov Content Dam Sdc Auditor Trb1718 Trbcomplete Pdf

Property Tax San Diego Page 1 Line 17qq Com

Property Tax San Diego Page 1 Line 17qq Com

Understanding California S Property Taxes

Understanding California S Property Taxes

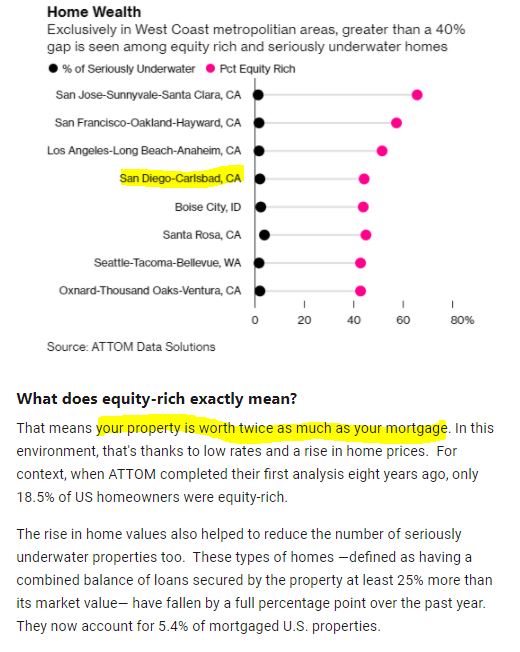

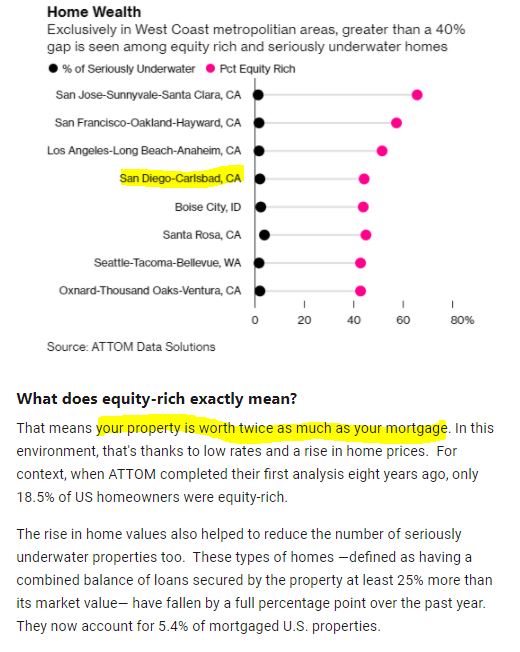

San Diego County Ca Property Taxes 2020 2021 Update By Scott Taylor Medium

San Diego County Ca Property Taxes 2020 2021 Update By Scott Taylor Medium

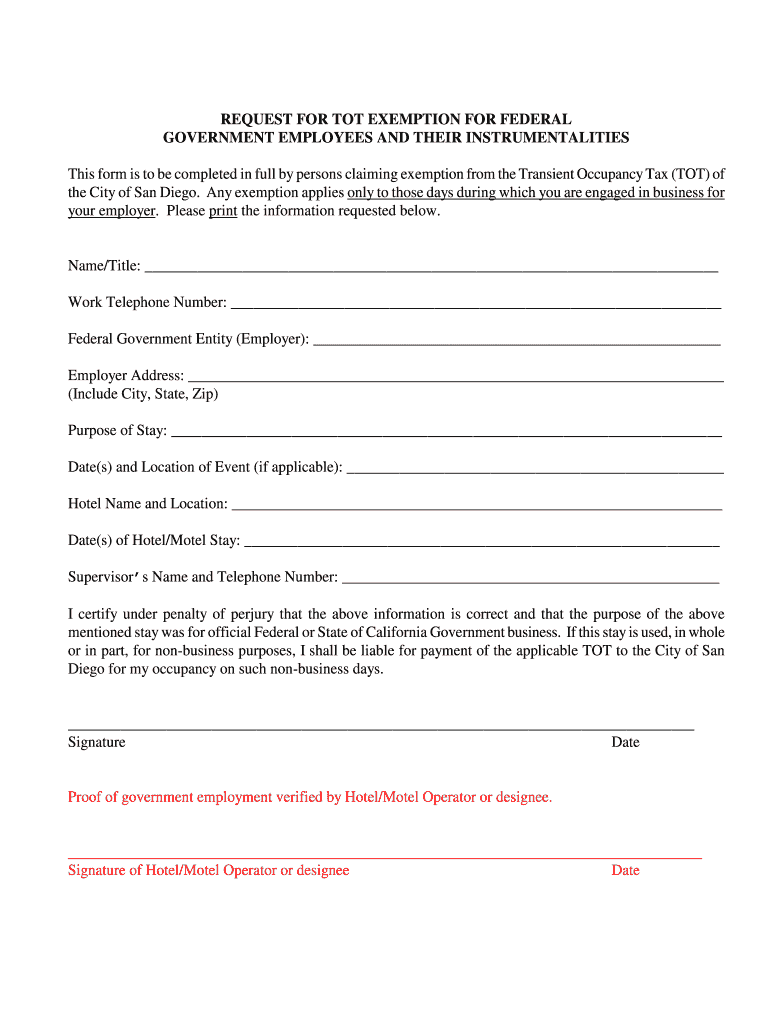

San Diego Exemption Tax Form Fill Online Printable Fillable Blank Pdffiller

San Diego Exemption Tax Form Fill Online Printable Fillable Blank Pdffiller

San Diego County Ca Property Tax Faq S In 2021

San Diego County Ca Property Tax Faq S In 2021

Showusyourmailers Dueling Ads Over Tax Breaks In San Diego Assessor Race Kpbs

Showusyourmailers Dueling Ads Over Tax Breaks In San Diego Assessor Race Kpbs

Showusyourmailers Dueling Ads Over Tax Breaks In San Diego Assessor Race Kpbs

Showusyourmailers Dueling Ads Over Tax Breaks In San Diego Assessor Race Kpbs

Https Www Sandiego Gov Sites Default Files Tr Rtax Exemption Form Pdf

Texas Homestead Tax Disabled Veteran Home Exemption Information

Texas Homestead Tax Disabled Veteran Home Exemption Information

Important For Owners Of Real Property In San Diego Case Escrow

Important For Owners Of Real Property In San Diego Case Escrow

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home