New York Property Tax Credit Lookup

Find Property Borough Block and Lot BBL. Assessed Value History by Email.

What Is The Basic Star Property Tax Credit In Nyc Hauseit

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Owners of cooperative units and condominiums who meet the requirements for the Cooperative and Condominium Property Tax Abatement can have their property taxes reduced.

New york property tax credit lookup. Apply for the STAR Exemption. The City of Newburgh is accepting credit cardsdebit cards VISA Mastercard Discover for property taxes. Available information includes property classification number and type of rooms year built recent sales lot size square footage and property tax.

Some credits are treated differently. Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Exemptions.

Property Tax Bills. The New York City Council recently passed legislation that reduces the late payment interest rate for property taxes due on July 1 2020 for eligible property owners who have been impacted by COVID-19 and who apply to DOF by September 30 2020. Beginning August 19 2016 taxpayers may be eligible to claim a full or partial Real Property Transfer Tax exemption for transfers of real property or economic interests therein to or from Housing Development Fund Companies or entities in which a Housing Development Fund Company owns a controlling interest collectively known as an HDFC Transfer under Section 11-2106b9 of the Administrative Code of the City of New York.

Property Records ACRIS Deed Fraud Alert. Year Credits Allocated New ConstRehab. If you do nothing it will be automatically applied to your next tax bill.

Property assessment information may change during the year but does not become final for taxing purposes until the official filing of the town Final Assessment Roll on or about July 1. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents. Creditdebit payments can be made either in person at the Tax Collectors office Monday through Friday 830AM-400PM or online.

You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form. Any overpaid property tax will be credited to your account. Our property records tool can return a variety of information about your property that affect your property tax.

Property Taxes Due July 1 2020. Data and Lot Information. The amount of the abatement is based on the average assessed value of the residential units in the development.

NYC is a trademark and service mark of the City of New York. NOTICE-Credit and Debit Card Payments Now Accepted. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

It will close February 16 2021. A fee of 265 of the total bill amount plus 025 per transaction will be charged. A New York Property Records Search locates real estate documents related to property in NY.

Bills are generally mailed and posted on our website about a month before your taxes are due. See Property tax and assessment administration for important updates and access to New York State resources for assessors county real property tax directors and their staff. To apply for the STAR exemption please contact New York State directly at 518-457-2036.

The amount of any unpaid tax represents delinquent County Town taxes which could include unpaid school village taxes from prior years and are owed to. The filing period for tax year 2021-2022 is now open. Or log in to Online Assessment Community.

Code Financial Characteristics Codes For-profitnon-profit Sponsor DDAQCT Increased Basis Tax-Exempt Bond FmHARHS 515 Loan 7030 Credit Subsidy Targeting Information Primarily available for projects placed in service since 2003 HUD Subsidies in addition to LIHTC Dollar Amount of HUD Subsidies. Homeowners who do not receive a check and who believe they are entitled to the credit or who believe their credit was incorrectly calculated will be able to contact the Tax Department to have their case reviewed. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance.

Local assessment officials.

The Ultimate Revelation Of Real Estate Tax Attorney Real Estate Tax Attorney In 2020 Tax Attorney Estate Tax Attorneys

The Ultimate Revelation Of Real Estate Tax Attorney Real Estate Tax Attorney In 2020 Tax Attorney Estate Tax Attorneys

Hcr Program Notices Covid 19 Homes And Community Renewal

Hcr Program Notices Covid 19 Homes And Community Renewal

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Assessment City Of Mount Vernon Ny

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

What Is The Basic Star Property Tax Credit In Nyc Hauseit

What Is The Basic Star Property Tax Credit In Nyc Hauseit

What Is The Basic Star Property Tax Credit In Nyc Hauseit

What Is The Basic Star Property Tax Credit In Nyc Hauseit

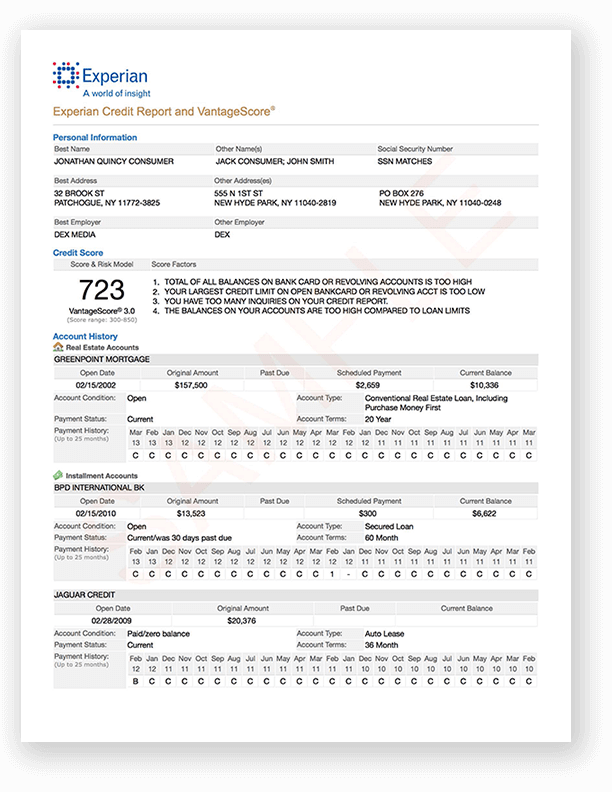

How To Run A Credit Check On Your Customer With Experian Connect

How To Run A Credit Check On Your Customer With Experian Connect

Will I Get A Check Or Property Tax Credit For The Senior Freeze Property Tax Tax Credits Seniors

Will I Get A Check Or Property Tax Credit For The Senior Freeze Property Tax Tax Credits Seniors

Real Property Tax Service Agency Fulton County

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

The School Tax Relief Star Program Faq Ny State Senate

The School Tax Relief Star Program Faq Ny State Senate

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Property Tax Exemption Who Is Exempt From Paying Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home