Property Transfer Tax In Vermont

191731100 191731100 TRANSFEREE 1 From Form PTT-172 Section B Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Phone. 2 Transfers of property to the United States of America the State of Vermont or any of their instrumentalities agencies or subdivisions.

Internal Application Form Best Of 9 Job Application Rejection Letters Templates For The Application Form Lettering Job Application

Internal Application Form Best Of 9 Job Application Rejection Letters Templates For The Application Form Lettering Job Application

Thu 03252021 - 1200.

Property transfer tax in vermont. Tax on transfer of title to property. This booklet includes forms and instructions for. Forms Acceptable to File with Vermont Towns This fact sheet provides a table with a list of the Property Transfer Tax Returns PTTRs depending on the date of closing.

How Much Are Transfer Taxes in Vermont. If the home youre buying is not your primary residence you will pay 145 on the full value of the property. 2020 Income Tax Booklet.

802 828-6851 VT Form PTT-173 PROPERTY TRANSFER TAX PAYMENT VOUCHER 1. 6306 b Homestead Declaration and Property Tax Credit. The property transfer tax is a tax on the transfer of title to real property based on the purchase price paid by the buyer.

Town CY2019 Full screen Close. Tax Year 2020 Form PTT-172 Vermont Property Transfer Tax Return. If the home youre buying is your.

WHEN IS A PROPERTY TRANSFER TAX RETURN REQUIRED TO BE FILED. Author Angela Métraux Description This report holds information of property sales by town and property category. Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 If you would like assistance or have questions please call 802-828-6851.

State of Vermont Property Transfer Tax System. Form for each transfer. When real estate is sold in Vermont state income tax is due on the gain from the sale whether the seller is a resident part-year resident or nonresident.

A Property Transfer Tax Return must be filed with a town clerk whenever a deed transferring title to real property is delivered to a town clerk for recording. 00145 of property value. 0005 on the first 100000.

2020 Vermont Income Tax Return Booklet. If the seller is a nonresident the buyer is required to withhold 25 of the sale price and remit it to the Vermont Department of Taxes. When a home purchase closes the home buyer is required to pay among other closing costs the Vermont Property Transfer Tax.

Furthermore details for total sales average and median selling prices of properties for valid sales are reported. Property Transfer Tax Exemptions in Vermont The buyer can use an exemption for the property transfer tax on the first 110000 in value of the property transferred when they obtain a mortgage loan. The following transfers are exempt from the tax imposed by this chapter.

Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the municipality with a single service. PTTRs must be submitted online via myVTax or on the acceptable paper form version to be valid. Department of Agriculture and Rural Development made the loan.

This is possible if. The amount of the tax equals one and one-quarter percent of the value of the property transferred or 100 whichever is greater except as follows. Valid sales represent true market.

The property transfer tax is a tax on the transfer by deed of title to real property in Vermont. The typical homeowner in Vermont can expect to spend 4340 annually in property taxes. 1 Transfers recorded prior to the effective date of this act.

9603 9603. IN-111 IN-112 IN-113 IN-116 HS-122 PR-141 HI-144. A tax is hereby imposed upon the transfer by deed of title to property located in this State or a transfer or acquisition of a controlling interest in any person with title to property in this State.

If the home youre buying is your primary residence you will only pay 05 on the first 100000 of value. The buyer is taxed is at a rate of 05 of the first 100000 of the homes value and 145 of the remaining portion of the value. The average effective property tax rate in Vermont is 186 which ranks as the fifth-highest rate in the US.

DEPARTMENT OF TAXES Property Transfer Tax Return Form PTT-172. Application for Assessment of Parcel under 10 VSA.

Vermont Real Estate Transfer Taxes An In Depth Guide For 2021 Clever Real Estate

Vermont Real Estate Transfer Taxes An In Depth Guide For 2021 Clever Real Estate

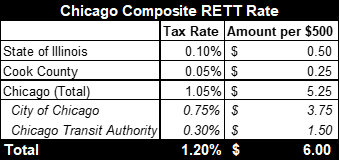

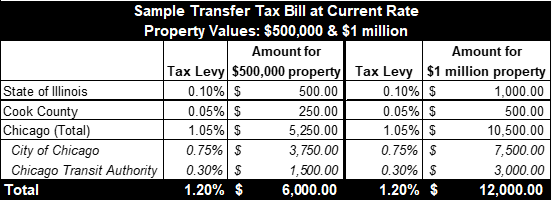

What Is A Real Estate Transfer Tax The Civic Federation

What Is A Real Estate Transfer Tax The Civic Federation

Free Corporate Bylaws Template Northwest Registered Agent Corporate Professional Writing Business Template

Free Corporate Bylaws Template Northwest Registered Agent Corporate Professional Writing Business Template

What You Should Know About Contra Costa County Transfer Tax

What You Should Know About Contra Costa County Transfer Tax

What Is A Real Estate Transfer Tax The Civic Federation

What Is A Real Estate Transfer Tax The Civic Federation

Free Quit Claim Deed Free Quit Claim Deed Forms Pdf Word Eforms Free Fillable Forms By Efor Quitclaim Deed Letter Templates Doctors Note Template

Free Quit Claim Deed Free Quit Claim Deed Forms Pdf Word Eforms Free Fillable Forms By Efor Quitclaim Deed Letter Templates Doctors Note Template

Transfer Tax Who Pays What In Alameda County

Transfer Tax Who Pays What In Alameda County

The Income Tax Implications Of Divorce Where You Own A Home And A Cottage Real Estate Buying Selling Real Estate Estate Tax

The Income Tax Implications Of Divorce Where You Own A Home And A Cottage Real Estate Buying Selling Real Estate Estate Tax

A Breakdown Of Transfer Tax In Real Estate Upnest

A Breakdown Of Transfer Tax In Real Estate Upnest

Real Estate Transfer Taxes Deeds Com

Real Estate Transfer Taxes Deeds Com

What Are Transfer Taxes Clever Real Estate

What Are Transfer Taxes Clever Real Estate

Closing Costs Who Pays What When Buying Or Selling A Home Tilo Team Real Estate Closing Costs Selling House Home Repairs

Closing Costs Who Pays What When Buying Or Selling A Home Tilo Team Real Estate Closing Costs Selling House Home Repairs

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency

Transfer Tax Who Pays What In Monterey County California

Transfer Tax Who Pays What In Monterey County California

10 No 42 Vermont Best Places To Travel Amazing Travel Destinations Places To Travel

10 No 42 Vermont Best Places To Travel Amazing Travel Destinations Places To Travel

Transfer Tax Vermont What I Wish Everyone Knew About Transfer Tax Vermont Business Letter Template Everyone Knows Grade 1 Lesson Plan

Transfer Tax Vermont What I Wish Everyone Knew About Transfer Tax Vermont Business Letter Template Everyone Knows Grade 1 Lesson Plan

Https Inequality Org Wp Content Uploads 2019 09 Luxury Real Estate Transfer Taxation Pdf

Https Tax Vermont Gov Sites Tax Files Documents Fs 1275 Pdf

Transfer Tax Vermont What I Wish Everyone Knew About Transfer Tax Vermont Business Letter Template Everyone Knows Grade 1 Lesson Plan

Transfer Tax Vermont What I Wish Everyone Knew About Transfer Tax Vermont Business Letter Template Everyone Knows Grade 1 Lesson Plan

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home