Do Disabled Veterans Pay Property Taxes In Louisiana

In Louisiana tax sales occur annually typically in May or June. Louisiana Property Tax Exemptions Thanks to legislature known as Amendment 7 VA-rated 100 service-connected disabled veterans living in Louisiana may receive a property tax exemption of up to the first 150000 of the assessed value of a primary residence.

Additional Benefits For 100 Disabled Veterans Youtube

Additional Benefits For 100 Disabled Veterans Youtube

Compensation or retired pay received from the United States by any Veteran of the military or naval forces of the United States.

Do disabled veterans pay property taxes in louisiana. Qualifying Veterans can receive additional tax benefits on their homestead exemption. Additional eligibility requirements apply. A disabled veteran in Louisiana may receive a property tax exemption of up to the first 150000 of the assessed value of hisher primary residence if the veteran is 100 percent disabled as a result of.

According to the Louisiana Department of Veterans Affairs in parishes in which the voters have elected to adopt the policy the amount of the homestead exemption is doubled to 15000 of a homes assessed value 150000 of market value for property owned by a military veteran having a service-related disability rating of 100 as determined by the US. Must provide proof of disability through written certification from the VA as of January 1st each year. But not all veterans who think they should qualify actually get the tax break.

Learn about your options to avoid a tax sale if you cant keep up with the property taxes How Louisiana Tax Sales Work. Qualifying Veterans can receive additional tax benefits on their homestead exemption. Louisiana homeowners are exempt.

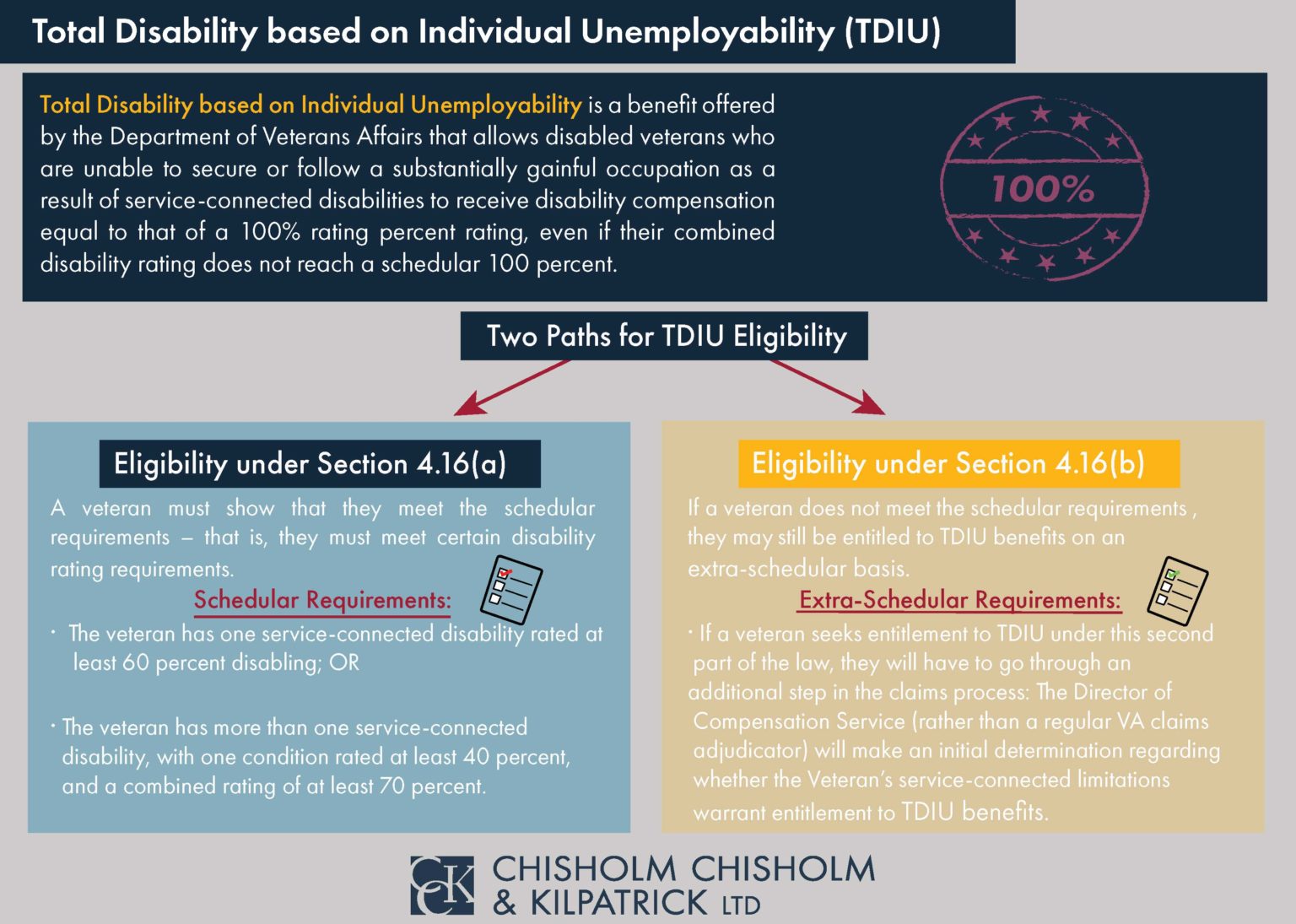

The same exemption applies to those deemed as 100 unemployable. Territory of Puerto Rico Disabled Veteran Property Tax Exemption. Additional special property tax exemptions are also assessed for some disabled veterans or active duty servicemembers killed in action.

Retired pay and SBP payments are tax-free. Additional special property tax exemptions are also assessed for some disabled veterans or active duty servicemembers killed in action. Louisiana like all other states has a process that allows the taxing authority to sell a property to collect delinquent taxes.

Department of Veterans Affairs. In 2010 the Louisiana Legislature passed a law to double the homestead exemption for veterans who are 100 percent disabled. Louisiana State Taxes on World War II Veterans Retired Military Pay.

Veterans rated with 100 disability are exempt from ad valorem tax on their homes. Please visit your local Parish Assessors Office to learn more. 65 rows The amendment passed with 74 percent of the vote.

Veterans who receive disability compensation of 50 or more from the VA are exempt from property tax on the first 50000 of appraised taxable value. Please visit your local Parish Assessors Office to learn more. The property tax for Veterans rated with 50 or greater disability is frozen at the current rate this also applies to spouses of deceased disabled Veterans.

Most states exempt disabled vets from paying state income tax but youll also get an exemption on property tax based on your degree of disability and. A disabled veteran in Louisiana may receive a property tax exemption of up to the first 15000 of the assessed value of hisher primary residence if the veteran is 100 percent disabled as a result of. Additional eligibility requirements apply.

In Louisiana homeowners do not have to pay parish property taxes on.

Louisiana Military And Veterans Benefits The Official Army Benefits Website

Louisiana Military And Veterans Benefits The Official Army Benefits Website

Ssdi Benefits For Veterans With Disabilities Military Benefits

Ssdi Benefits For Veterans With Disabilities Military Benefits

60 Va Disability Benefits Explained Va Claims Insider

60 Va Disability Benefits Explained Va Claims Insider

80 Percent Va Disability How To Increase Or Appeal To 100

80 Percent Va Disability How To Increase Or Appeal To 100

Disabled Veterans Can Fly Space Available Flights For Free Gold Coast Veterans Foundation

Disabled Veterans Can Fly Space Available Flights For Free Gold Coast Veterans Foundation

How Much Is 100 Percent Va Disability Disabled Vets

How Much Is 100 Percent Va Disability Disabled Vets

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Service Disabled Veteran Owned Small Business 1 Day Event Disabled Veterans Veteran Owned Business Veteran

Service Disabled Veteran Owned Small Business 1 Day Event Disabled Veterans Veteran Owned Business Veteran

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

2021 Va Service Connected Disability Compensation Rate Charts

2021 Va Service Connected Disability Compensation Rate Charts

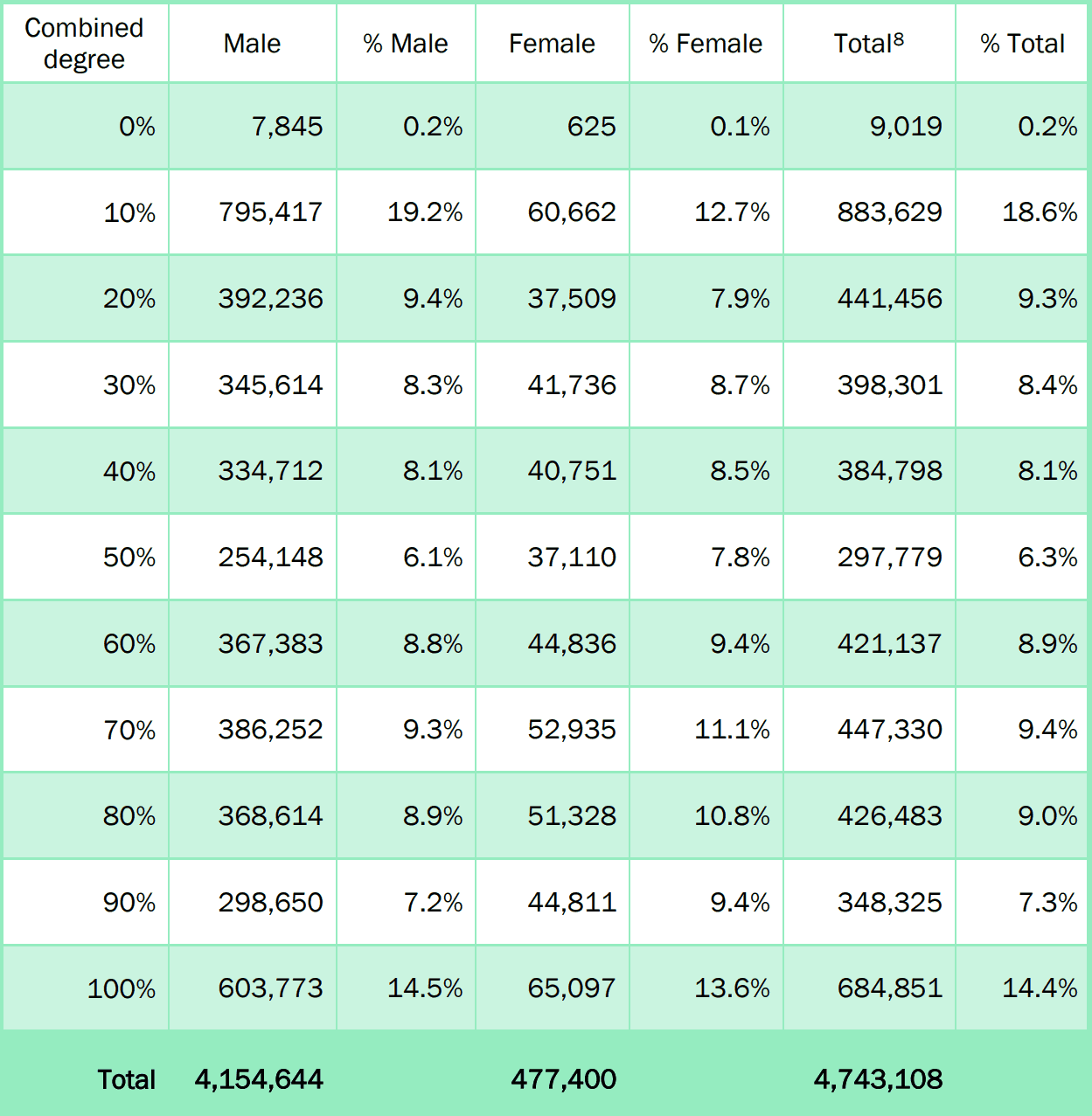

Veteran Disability Exemptions By State Va Hlc

Veteran Disability Exemptions By State Va Hlc

Louisiana Military And Veterans Benefits The Official Army Benefits Website

Louisiana Military And Veterans Benefits The Official Army Benefits Website

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

80 Percent Va Disability How To Increase Or Appeal To 100

80 Percent Va Disability How To Increase Or Appeal To 100

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home