Knoxville Tn Property Tax Due Dates

Typically if a homeowner fails to pay for even just two years they will be notified by a local agency. All unpaid property taxes become delinquent on December 1.

2506 Harvey St Knoxville Tn 37917 Realtor Com

2506 Harvey St Knoxville Tn 37917 Realtor Com

In Tennessee only businesses pay personal property taxes not individuals or private citizens.

Knoxville tn property tax due dates. Its obviously important to keep the property tax account up to date. City tax statements are mailed between mid September and mid October each year after approval is received from the state. Be answered by calling 865-215-2084 or email at citytaxofficeknoxvilletngov.

Taxes are due October 1 of each tax year and are delinquent the following March 1. This bid will NOT include the 2013 2014 or the 2015 taxes due to the City of. For example if your fiscal year coincides with the calendar year then your return will be due on April 15.

Property Assessor City County Building Suite 204 400 Main Street Knoxville TN 37902. According to State law 15 interest is added to delinquent Property Tax each month until paid. State Tax - The use tax rate on food is 4.

A tax relief program is available to eligible elderly andor disabled homeowners who meet certain income limits. City and county taxes in Knoxville are due every October with a grace period lasting until February. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee.

Public Service provides the majority of services to City residents. If you have questions or concerns about your Knox County property tax please contact me or my staff. Safety services and resources for Knoxville citizens and visitors.

They become delinquent on March 1. Box 70 Knoxville TN 37901 Phone. Mailing Address Knox County Trustee PO.

Real Estate tax is assessed on all l. Tennessee has one of the lowest median property tax rates in the United States with only nine states collecting a lower median property tax than Tennessee. Tax Notices are typically mailed in late September each year and are payable through the end of February.

For County tax information contact Knox County. Property taxes are due by November 30 each year. Streets Traffic Transit.

400 Main Street Knoxville TN 37902. Due Dates Annual 15th day of the 4th month following the close of your books and records. All other tangible personal property unless specifically exempted is 7.

Questions regarding information provided here can. Counties in Tennessee collect an average of 068 of a propertys assesed fair market value as property tax per year. It is a tax on land and any improvements on it.

You have my assurance that honesty and integrity will be at the core of everything we do in the Trustees Office. This website provides tax information for the City of Knoxville ONLY. VmHomeInit vmHomeerrorMessage.

The State of Tennessee passed legislation that permits counties to freeze property tax amounts for homeowners who are 65 or older on or before December 31 2020 and your combined 2019 annual income for you your spouse and all other owners of the property cannot exceed 41240. Real Estate Property taxes are levied against the value of the property involved. The median property tax in Knox County Tennessee is 1091 per year for a home worth the median value of 152300.

Tennessee is ranked 1348th of the 3143 counties in the United States in order of the median amount of property taxes collected. The discounted amount to pay is indicated on tax bills the City mails annually. Knox County collects on average 072 of a propertys assessed fair market value as property tax.

State Single Article Rates - 275 on any single item sold in excess of 1600 but not more than 3200 - see local tax on single articles. Search and pay for your Property Tax Real Estate Tangible Personal Property records online using this service. The use tax rate is the same as the sales tax rate.

You may take a 1 discount calculated for you on your bill if you pay before October 31. Airports bus trolleys streets traffic concerns impound lot maps parking tickets. The median property tax in Tennessee is 93300 per year for a home worth the median value of 13730000.

As the account becomes more delinquent the notices become more aggressive. For business with a 11-1231 calendar year this tax is due on April 15th of the following year. The business tax rates vary depending on your classification and whether you are a retailer or a wholesaler.

Your business tax return is due on the 15th day of the fourth month following the end of your fiscal year. Your home and up to five 5 acres can be frozen.

![]() Trustee Knox County Tennessee Government

Trustee Knox County Tennessee Government

5800 Central Avenue Pike Knoxville Tn 37912 Realtor Com

5800 Central Avenue Pike Knoxville Tn 37912 Realtor Com

416 Sundown Rd Knoxville Tn 37934 Realtor Com

416 Sundown Rd Knoxville Tn 37934 Realtor Com

1945 Oakleigh Way Knoxville Tn 37919 Zillow

1945 Oakleigh Way Knoxville Tn 37919 Zillow

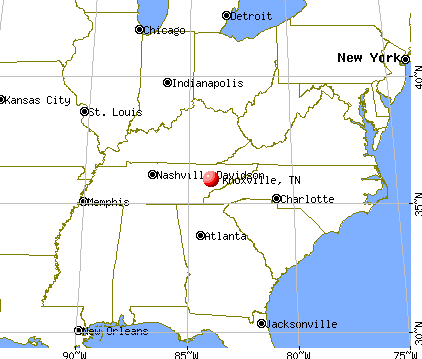

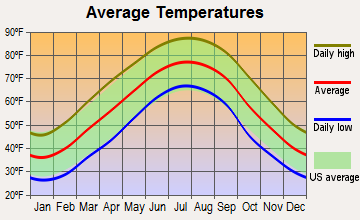

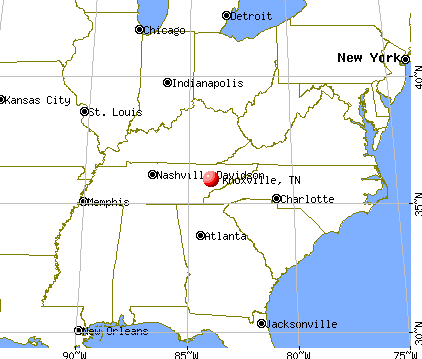

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1926 Whitman Dr Knoxville Tn 37909 Realtor Com

1926 Whitman Dr Knoxville Tn 37909 Realtor Com

East Knoxville Locations County Clerk Knox County Tennessee Government

East Knoxville Locations County Clerk Knox County Tennessee Government

221 Brakebill Rd Knoxville Tn 37924 Realtor Com

221 Brakebill Rd Knoxville Tn 37924 Realtor Com

5804 Shelley Dr Knoxville Tn 37909 Realtor Com

5804 Shelley Dr Knoxville Tn 37909 Realtor Com

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Best Electrical Service In Knoxville Tennessee Electricity Tennessee Knoxville

Best Electrical Service In Knoxville Tennessee Electricity Tennessee Knoxville

9635 Westland Cove Way Knoxville Tn 37922 Realtor Com

9635 Westland Cove Way Knoxville Tn 37922 Realtor Com

2541 Lakefront Dr Knoxville Tn 37922 Realtor Com

2541 Lakefront Dr Knoxville Tn 37922 Realtor Com

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Trustee Knox County Tennessee Government

Trustee Knox County Tennessee Government

5913 Nature Ln Knoxville Tn 37912 Realtor Com

5913 Nature Ln Knoxville Tn 37912 Realtor Com

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1928 Rudder Ln Knoxville Tn 37919 Realtor Com

1928 Rudder Ln Knoxville Tn 37919 Realtor Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home