How To Lower My Property Taxes In California

For Supplemental Adjusted Supplemental or Adjusted Property Tax Bills a formal appeal may be filed within 60 days of either 1 the. If you disagree with the assessed value of your property you should contact the Assessors Office to request a review of the valueTo protect your right to appeal the value of your property you may file a formal appeal with the Assessment Appeals Board.

Understanding California S Property Taxes

Understanding California S Property Taxes

Failure To File Appeal Of Supplemental Or Escape Assessment Within 60 Days Of Mailing.

How to lower my property taxes in california. Despite property tax breaks that no other state has California could use expanded tax breaks from Proposition 19 to help homeowners establish an even lower property tax base saving residents even more during a crisis like the pandemic were in right now. Appeal the Taxable Value of Your Home. 10 Commonly Overlooked Ways To Reduce California Real Property Taxes.

This video covers how property tax is calculated and how you can pay a lower overall property tax. If you live in a county with high property taxes you may be able to buy a house in. Steps to Appeal Your California Property Tax.

Option 1 Appeal The Taxable Value. By the time you are already paying a certain amount its. Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year.

There are however a few ways homeowners can reduce their California property taxes. Move to a Less Expensive Area 6 12 Property tax rates vary widely from state to state and from county to county. Although this law may have similar counterparts in other states were only discussing the benefits to those living in the Golden State.

In California the State Board of Equalization BOE oversees the local county assessors offices which determine the property taxes in their area. Failure To Seek Correction of Erroneous Change of Ownership. County authorities known as assessors compute a homeowners property tax by multiplying the homes taxable value by the applicable tax rate.

Familiarize yourself with the appeal procedures and your rights and. For married couples only one spouse must be 55 or older. In order to come up with your tax bill your tax office multiplies the tax rate by the.

California homeowners 55 and older can get a one-time opportunity to sell their primary residence and transfer the property tax assessment to a new home under Proposition 60. Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county clerk or online. California Prop 60 is an excellent property tax break that directly and exclusively benefits homeowners 55 or older living in the state of California.

Lower My Property Taxes. Decline In Value Prop 8 Calamity Property Destroyed. February 18 2015 at 722 pm.

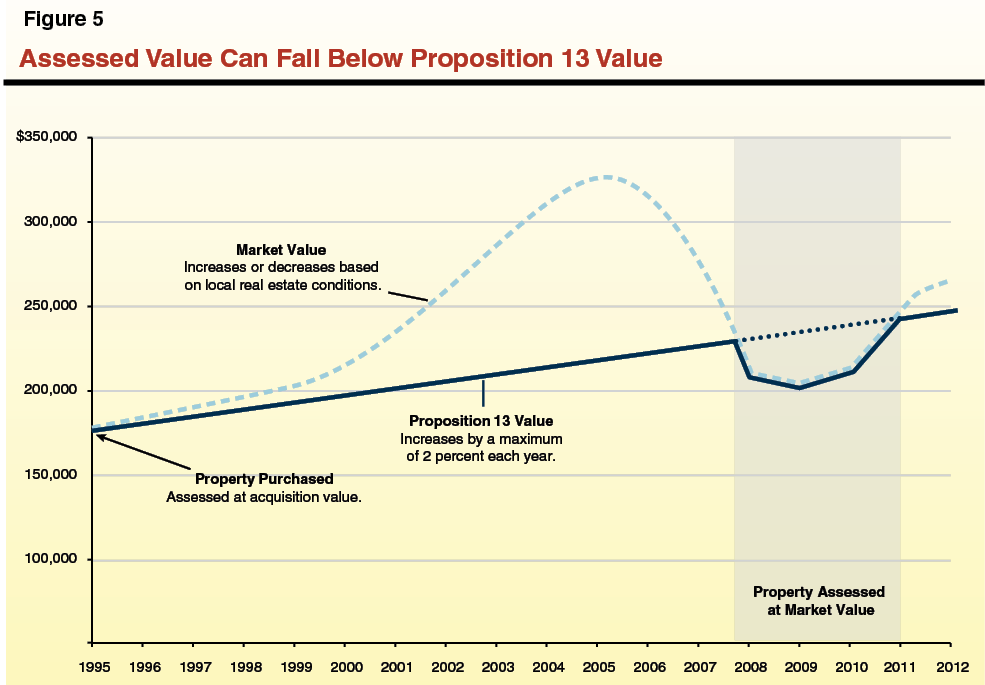

Can I lower my Property Taxes. Your local tax collectors office sends you your property tax bill which is based on this assessment. Decline in Property Value Proposition 8 Since property taxes are calculated from the overall property value you should always try to have your property taxes lowered if the value of your property has declined.

When you see an error in official records we can help expedite the process of lowering your property taxes. The caveat here is the market value of the new house generally must be lower or equal to the home being sold. California has 58 counties and some variation in policies and procedures for calculating and assessing property taxes.

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

California Property Taxes Explained Big Block Realty

California Property Taxes Explained Big Block Realty

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Understanding California S Property Taxes

Understanding California S Property Taxes

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

California Prop 15 Results Proposition Fails Leaving 1978 S Prop 13 Untouched Not Raising Property Taxes Abc7 San Francisco

California Prop 15 Results Proposition Fails Leaving 1978 S Prop 13 Untouched Not Raising Property Taxes Abc7 San Francisco

How To Lower Your Property Taxes In California Youtube

How To Lower Your Property Taxes In California Youtube

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

California Property Tax Appeal How To Lower Property Taxes In California Property Tax Mortgage Payoff Pay Off Mortgage Early

California Property Tax Appeal How To Lower Property Taxes In California Property Tax Mortgage Payoff Pay Off Mortgage Early

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home