Property Tax Homestead Exemption Tennessee

Use the Tennessee Trustee website to find your County Trustee contact information. The homestead exemption amounts in Tennessee for.

Alabama Homestead Exemption And Property Tax Rates Tax Rate Homesteading Property Tax

Alabama Homestead Exemption And Property Tax Rates Tax Rate Homesteading Property Tax

Tennessees homestead exemption allows homeowners to deduct up to 5000 off their upcoming tax return for their principal place of residence.

Property tax homestead exemption tennessee. However there is a property tax relief program for the elderly disabled and veterans. You still receive your tax bill s and are responsible for paying your property taxes each year. An application will become available November 1 by contacting our office at 386736-5938.

If you are interested in receiving a property tax exemption for your personal residence please call the office of Erica S. Your property tax bill would equal 2000. You must still pay your property tax each year.

The exemption will attach to the property until the property is sold or bequeathed upon which time the new owner will have to apply for a homestead tax exemption. According to Tennessee statute the homestead exemption shall not be subject to execution attachment or sale under legal proceedings during the life of the individual. 66 rows A homestead generally refers to the primary residence owned and occupied by a person or.

Tennessee Property Tax Exemptions That Include Homestead. Must be entitled to claim homestead tax exemption. Tax Relief is not an exemption.

Tennessee has the lowest homestead exemption of the states that do not allow the use of the federal homestead exemption and has the third lowest combined dollar value of all property exemptions after Missouri and Alabama. Tennessee does not have a homestead exemption. For more information on the changes to the Property Tax Relief Program read Public Chapter No.

Eligibility Requirements for the Homestead Tax Deferral Program. The Tennessee Homestead Exemption Amount. Exemption from property tax is available to religious charitable scientific or nonprofit educational institutions who apply while the property currently is used exclusively to carry out one or more of the purposes for which the organization was created.

The assessed valuation of a property is based on 25 of its fair market value. You may qualify for the following exemptions. Joint owners of property such as married couples may claim up to 7500 on property used as their principal place of residence.

The person claiming the exemption must reside at the property on January 1 and cannot claim a homestead exemption on any other property. You may qualify for the following. To apply for this benefit please contact the County Trustees office in your county.

To keep things simple lets say the assessed value of your home is 200000 and your property tax rate is 1. Gilmore Metro Trustee at 615-862-6330. Tax relief is payment by the State of Tennessee to reimburse homeowners meeting certain eligibility requirements for a part or all of paid property taxes.

Low-income homeowners who are senior citizens. Under the Tennessee exemption system homeowners may exempt up to 5000 of their home or other property covered by the homestead exemption which is a principal place of residence. The maximum market value on which tax relief is calculated is 175000.

In addition to the homestead tax. Tennessee Property Tax Exemptions That Include Homestead Tennessee offers various property tax relief programs that would either exempt pay or reimburse a portion of property taxes on your primary residence homestead. Tennessee offers various property tax relief programs that would either exempt pay or reimburse a portion of property taxes on your primary residence homestead.

General Residential Homestead Exemption To qualify the property must be designed or adapted for human residence and the homeowner must own the property on January 1 of the year application is made. With limited exception no organization is automatically exempt from the payment of property taxes but rather must apply to and be approved by the Tennessee State Board. Acting on constitutional authority the Tennessee General Assembly authorized certain property tax exemptions for Tennessees religious charitable scientific literary and nonprofit educational organizations.

To qualify for the homestead tax exemption contact the Volusia County Property Appraisers office. Generally Tennessee property owners may designate up to 5000 worth of their property as a homestead or 7500 if it involves more than one debtor. The maximum market value on which the tax relief is calculated will be the first 23500 of your primary residence in 2016 for elderly and disabled homeowners or 100000 for disabled veterans or their widow ers.

But if you were eligible for a homestead tax exemption of 50000 the taxable value of your home would drop to 150000 meaning your tax bill would drop to 1500. The homestead exemption can be found in the Tennessee Code Annotated 26-2-301. Function of the Homestead Exemption The primary purpose of the homestead exemption is to protect your home from creditors who may seek to place a lien on your property in order to recover a debt.

Relocating To Florida Check Out These Relocation Tips And Resources Real Estate Buying Florida Relocation

Relocating To Florida Check Out These Relocation Tips And Resources Real Estate Buying Florida Relocation

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Northern Saskatchewan Wilderness Home For Sale Off Grid Homestead Wilderness Wild Fire

Northern Saskatchewan Wilderness Home For Sale Off Grid Homestead Wilderness Wild Fire

Https Secure Tennesseetrustee Org Index Php Entity Sevier State Tn Page 32

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

Https Www Grundyco Org Wp Content Uploads 2019 01 Property Tax Exemptions Pdf

The Tennessee Property Tax Homestead Exemption Top Guide

The Tennessee Property Tax Homestead Exemption Top Guide

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

Tennessee Property Assessment Glossary

Tennessee Property Assessment Glossary

Zillow Has 260 Homes For Sale In Berea Ky View Listing Photos Review Sales History And Use Our Detailed Real Estate Filters To Fi Zillow Berea Perfect Place

Zillow Has 260 Homes For Sale In Berea Ky View Listing Photos Review Sales History And Use Our Detailed Real Estate Filters To Fi Zillow Berea Perfect Place

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Do You Qualify For A Property Tax Exemption Find Out Here

Do You Qualify For A Property Tax Exemption Find Out Here

The Georgia Coalition Of Black Women Held Their Luncheon Honoring The Legacies Of Dr Rita Jackson Samuels And Mlk On Fri March 29 Atlanta Black Women Women

The Georgia Coalition Of Black Women Held Their Luncheon Honoring The Legacies Of Dr Rita Jackson Samuels And Mlk On Fri March 29 Atlanta Black Women Women

.jpeg?width=600&height=424) Programs Offer Property Tax Relief For Elderly Disabled And Veterans

Programs Offer Property Tax Relief For Elderly Disabled And Veterans

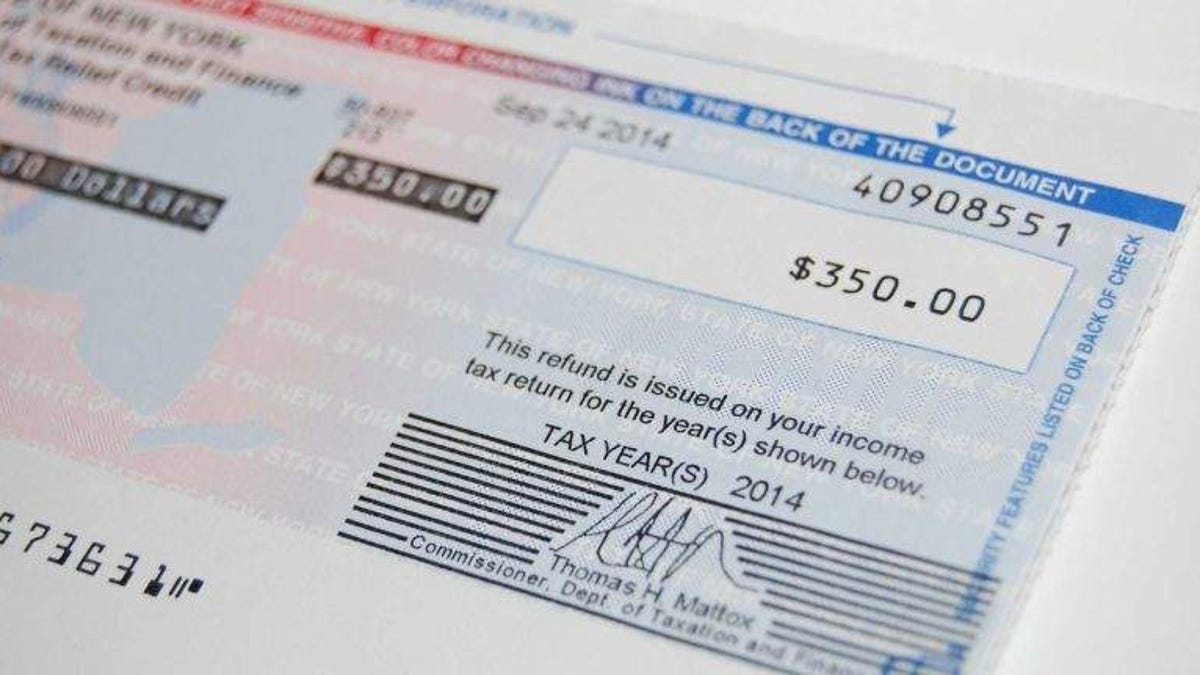

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Reality Check Applying For Property Tax Break Wlos

Reality Check Applying For Property Tax Break Wlos

What Is A Homestead Tax Exemption

What Is A Homestead Tax Exemption

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home