How Do I Know If There Is A Tax Lien On My Property

If the property has environmental concerns such as leaky storage tanks or a chemical spill such things can drop the property value to near zero or even to the negative. Once the Tax Commission has filed its notice with the Secretary of State information from the lien is available to the public.

5 17 2 Federal Tax Liens Internal Revenue Service

5 17 2 Federal Tax Liens Internal Revenue Service

Puts your balance due on the books assesses your liability.

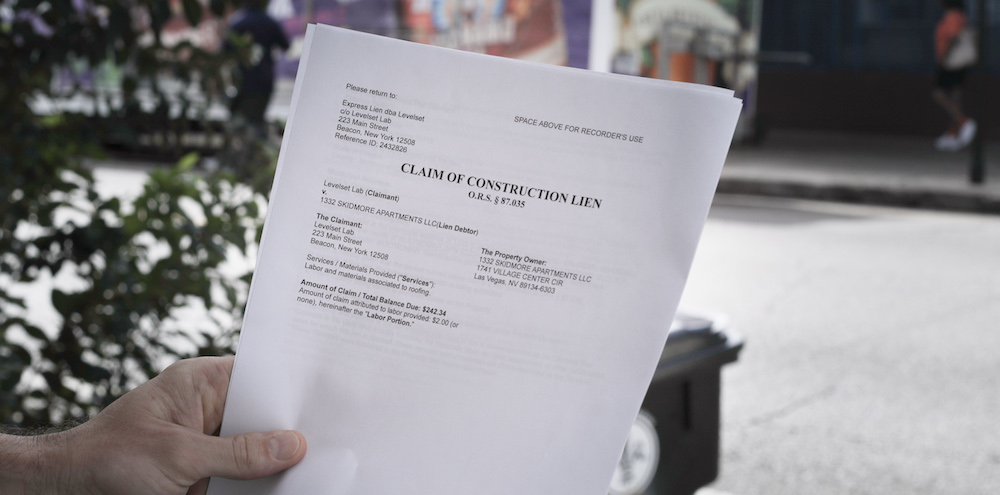

How do i know if there is a tax lien on my property. Liens come in different varieties including tax liens and mechanics liens. A lien secures our interest in your property when you dont pay your tax debt. A federal tax lien exists after.

A tax lien will typically show up on your credit report which can make it very hard to buy property get a credit card or handle basic needs like getting a car. The IRS eliminates the lien within 30 days after youve paid your debt in full. Is effective for at least 10 years may be extended May impact your credit.

First you can search your local county assessors website. A lien attaching to a property such as a home. Sends you a bill that explains how much you.

A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Joe Crump shows you how to find out if there is a lien on a property and what to do about it if there is. The lien is the amount owed and must be.

A lien is a claim by a creditor upon the real property of a debtor. You may also have a harder time getting employed by a company that runs a background and credit check since a person with a tax lien levied against they may be a financial risk. The lien protects the governments interest in all your property including real estate personal property and financial assets.

A property may have been destroyed and where there was once a building securing the lien there is now a vacant lot. Once a Notice of State Tax Lien is recorded or filed against you the lien. These liens attach to your property and your rights to property.

If theres an unknown lien listed on your credit report it may not have been filed by the Tax. Unlike tax returns tax liens are a public notice of debt. With the property address go to the county recorders office and request a title deed search.

You can find out if there is a bank lien on a house by contacting County Recorders Office in the relevant county. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. The title deed is the abstract that shows the entire history of ownership liens rights of way and.

Tax lien certificates can be a relatively passive real estate investment but there are risks. You can typically find out if there is a bank lien on a house and who the home title holder is by searching by name or address. The IRS files a Notice of Federal Tax Lien which notifies creditors that the government has a legal right to your property if you dont pay the debt in time.

This lien is a public claim for the outstanding delinquent tax meaning the property. Third you can hire a title company to conduct a lien search on your property. Attaches to any California real or personal property you currently own or may acquire in the future.

Learn the different kinds of liens - involuntary vs. If there are any liens on your property the first thing to do is check what they are and for what reason theyve been enacted. You have a right to appeal a federal tax lien.

When a lien appears on your credit report. The simplest way to find them is to search your property address or PIN on your county recorders website. There are a few ways to find tax liens on your property.

In certain municipalities the treasurers office will eventually place a property tax lien on the property. Heres what you need to know before attending a tax lien auction. Liens are public information.

If the home is being sold for less than the lien amount the taxpayer can request the IRS discharge the lien to allow for the completion of the sale. Normally if you have equity in your property the tax lien is paid in part or in whole depending on the equity out of the sales proceeds at the time of closing. Next you can visit your local county assessors office.

Federal Tax Lien Statute Of Limitations 101 Credit Com

Federal Tax Lien Statute Of Limitations 101 Credit Com

5 12 3 Lien Release And Related Topics Internal Revenue Service

5 12 3 Lien Release And Related Topics Internal Revenue Service

Tax Liens An Overview Checkbook Ira Llc

Tax Liens An Overview Checkbook Ira Llc

Property Liens Search By Address Takes Less Than 5 Minutes

What Is A Lien Types Of Property Liens Explained

What Is A Lien Types Of Property Liens Explained

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

What Is A Tax Lien What You Need To Know Credit Com

What Is A Tax Lien What You Need To Know Credit Com

What Is A Tax Lien And How Does It Affect Your Financing Options

What Is A Tax Lien And How Does It Affect Your Financing Options

What Is A Tax Lien Credit Karma Tax

What Is A Tax Lien Credit Karma Tax

What Is A Property Lien An Unpaid Debt That Could Trip Up Your Home Sale Perfect Agent

What Is A Property Lien An Unpaid Debt That Could Trip Up Your Home Sale Perfect Agent

How To Remove Tax Liens From Your Credit Report Updated For 2021

How To Remove Tax Liens From Your Credit Report Updated For 2021

5 12 3 Lien Release And Related Topics Internal Revenue Service

5 12 3 Lien Release And Related Topics Internal Revenue Service

What Is A Tax Lien Credit Karma Tax

What Is A Tax Lien Credit Karma Tax

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

Can You Wholesale Houses That Have Liens Reflipper Net

Can You Wholesale Houses That Have Liens Reflipper Net

Property Liens Search By Address Takes Less Than 5 Minutes

Labels: property

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home