Property Tax Pay Online Kolkata

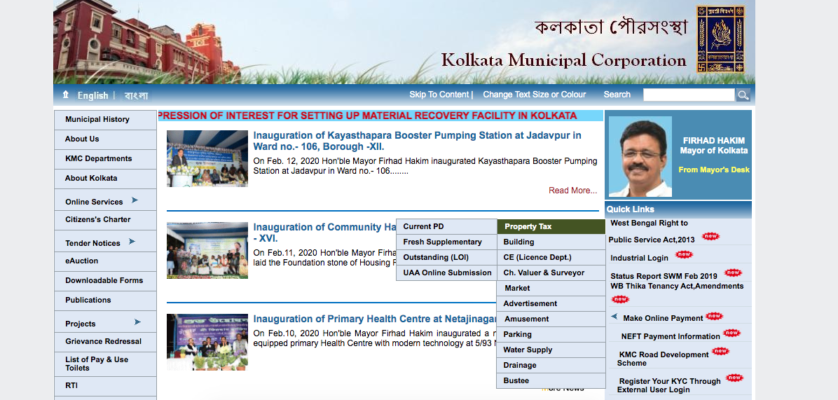

Click Make Online Payment Upon clicking on make an online payment three options will appear. Online Payment Procedure Of KMC Property Tax.

Fresh bills are also issued after the first assessment of a property LOI.

Property tax pay online kolkata. Apply for Mailing Address Change. Schedule of PresentationRebate Dates of Property Tax PD Bils for the Year 2018-2019. View the E-Prop-Tax page for more information.

The Kolkata Municipal Corporation allows taxpayers to pay property tax online without any hassles. We accept major credit card and debit card payments over the telephone. Periodic Demand bills which are issued annually based on the last decided valuation of the property FS Bill.

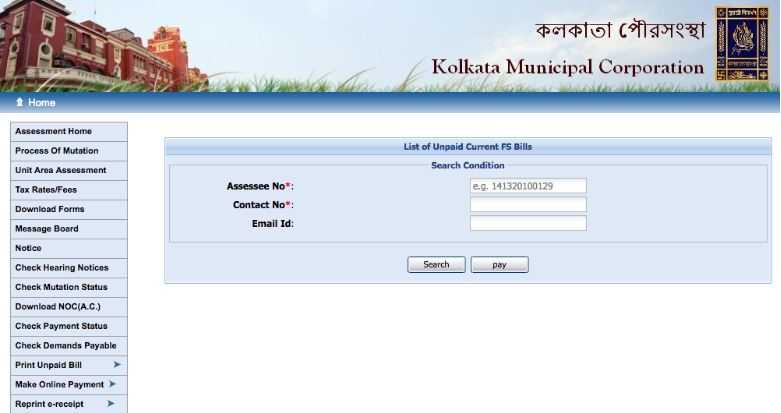

How to pay property tax online. Unpaid Property Tax - Current PD Bill Print Please Note. Kolkata Municipal CorporationFast Track Settlement Committee Regulations 2015.

How to Pay Online. You can find your assessee number through your ward number and street name here. Users can pay their Property Tax in Kolkata.

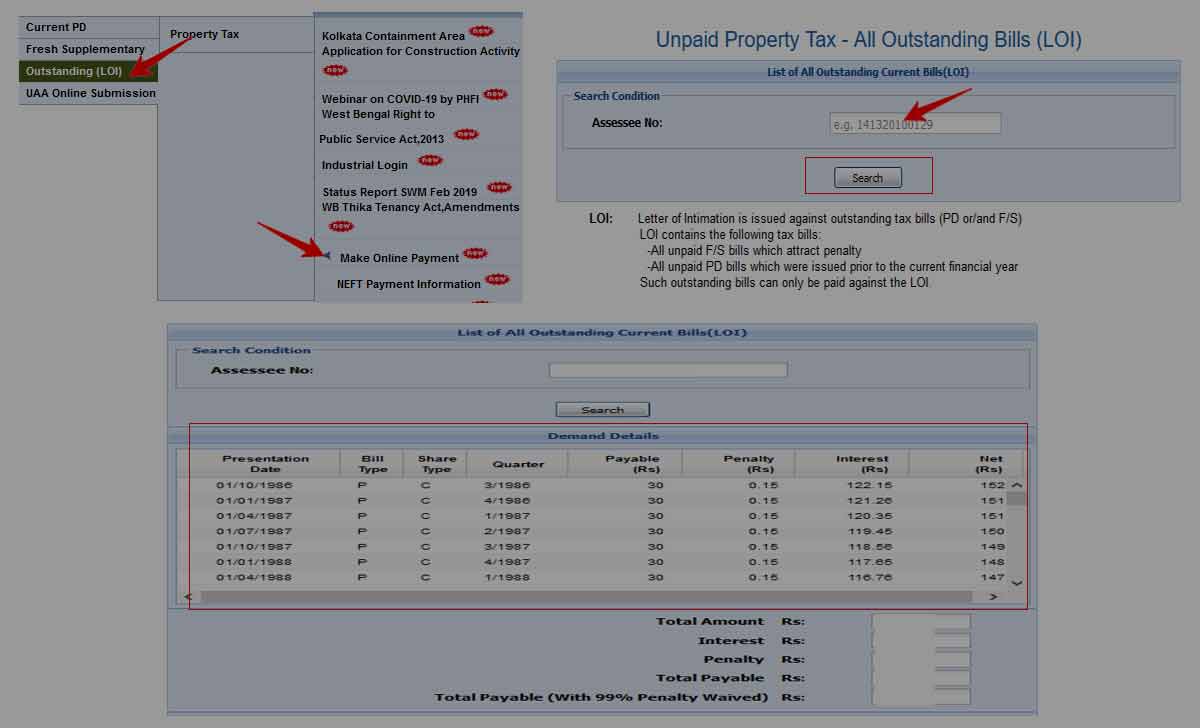

FreshSupplementary bills which are issued immediately after a hearing to reflect any changes to the earlier issued bills. -All unpaid FS bills which attract penalty -All unpaid PD bills which were issued prior to the current financial year. Schedule of PresentationRebate Dates of Property Tax PD Bils for the Year 2017-2018.

Letter of Intimation is issued against outstanding tax bills PD orand FS. D ear citizens payment of property tax both through online and offline mode will remain suspended from 6 pm of 08042021 till further notice for generation of demand notice for the fy-. Click Online Services on the left menu bar.

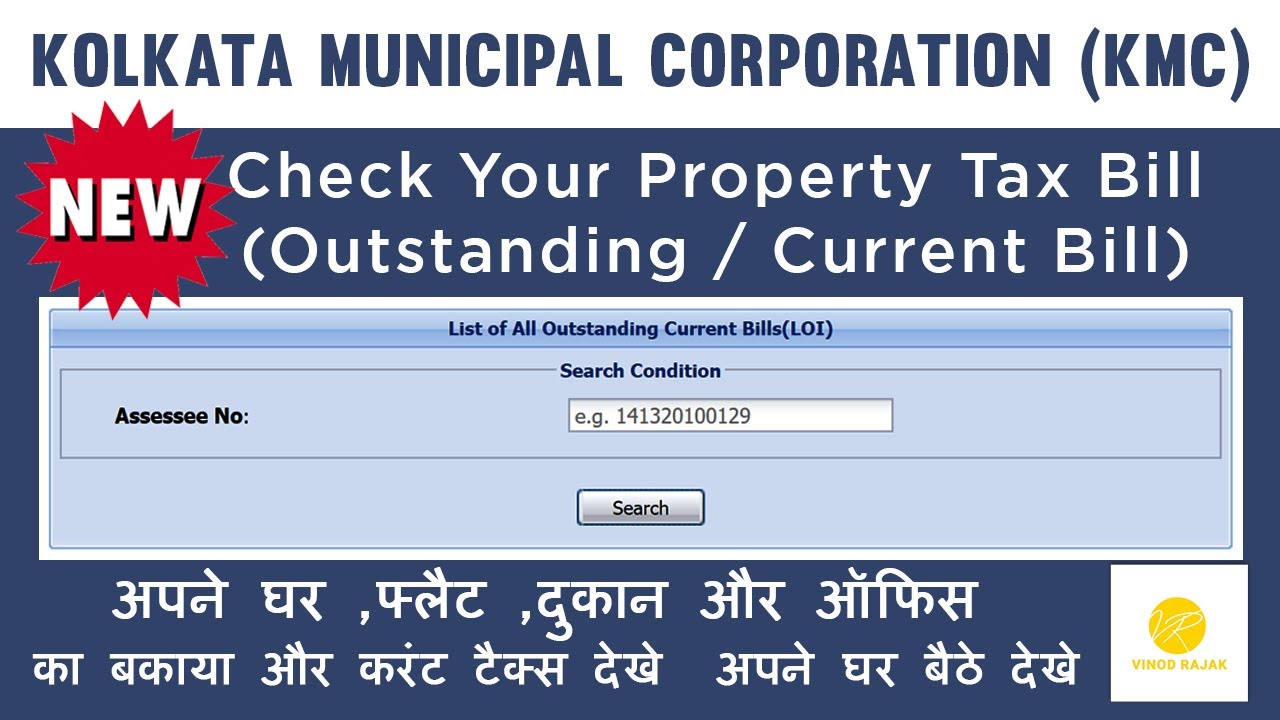

Make full or partial payment by entering the specific amount to pay. Current PD This periodic demand is for bills. What is the procedure for online payment of property tax in Kolkata.

Steps to guide first time online users. This payment can be done through the official website of the Kolkata Municipal Corporation. Make Online Payment.

17 hours agoKolkata Municipal Corporation Property Tax KMC House Tax Water Bill Online Payment April 18 2021 Leave a reply KMC Property Tax Payment Guide Owners of residential properties in Kolkata are liable to pay House Tax to the Kolkata Municipal Corporation KMC every year. User can Get online list of unit offices for trade licensing in Kolkata. Visit the KMC website and click on the assessment-collection option under online services.

The launched website provides all the details to the tax payers from which they will be able to deposit the KMC property tax. With the announcement of being able to pay your property tax online in Kolkata it has offered the convenience of paying your property tax which is just one click away. Pay multiple accounts in a single transaction using the Add Additional Accounts button.

You can check this link for further assistance regarding this matter. Print Unpaid Bill. Letter of Intimation is issued against outstanding tax bills PD orand FS LOI contains the following tax bills.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail. Upon clicking on make an online payment three options will appear. To pay by telephone call toll-free 18884730835Your Secured Property Tax Bill contains your Assessors Identification Number AIN Year and Sequence which you will need to complete the transaction.

Visit KMC website ie. The Kolkata Municipal Corporations web portal with e-payment facility was launched in 2010 in Kolkata. Choose assessment-collection from the drop-down menu.

However you taxpayers should know their assessee number and registered mobile number with them to make use of this service. Choose assessment-collection from the drop-down menu. Click Online Services on left menu bar.

To make an online payment you must access your tax statement from the Statement Search and Payment screen. Kolkata Municipal CorporationPreservation and Maintenance of Water Body Regulations 2016. This printout can be produced at any common collection centers to make the paymentPlease contact the.

Click Make Online Payment which will offer three options Current PD Fresh-Supplementary Outstanding LOI. Then click the Pay Online button to. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

Now irrespective of which state you live in you can pay your taxes through KMC property tax online payment method. You can take a printout of the unpaid PD bills which are issued in the current financial year. Go to the assessment homepage and click on Make Online Payment tab.

Nkda NKDApropertyTax NKDA_property_tax_paymentHow to Pay NKDA Property Tax OnlineIn this video Ive described the steps to pay NKDA Property Tax online.

How To Pay Kmc Property Tax Bill Online Property Walls

How To Pay Kmc Property Tax Bill Online Property Walls

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

How To Pay Kmc Property Tax Bill Online Property Walls

How To Pay Kmc Property Tax Bill Online Property Walls

Online Kolkata Municipal Corporation Property Tax Kolkata Property Tax Kolkata Real Estate Kolkata Commonfloor Articles

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

How To Pay Property Tax In Kolkata Online Step By Step Guide For Kmc

How To Pay Property Tax In Kolkata Online Step By Step Guide For Kmc

How To Pay Kmc Property Tax Bill Online Property Walls

How To Pay Kmc Property Tax Bill Online Property Walls

How To Pay Kmc Property Tax Bill Online Property Walls

How To Pay Kmc Property Tax Bill Online Property Walls

Filling Mcd Property Tax Online

Online Kolkata Municipal Corporation Property Tax Kolkata Property Tax Kolkata Real Estate Kolkata Commonfloor Articles

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Trade License Renewal Kmc Trade License Renewal Kolkata Municipal Corporation Trade License Youtube

Trade License Renewal Kmc Trade License Renewal Kolkata Municipal Corporation Trade License Youtube

How To Pay Property Tax Online In Kolkata

How To Pay Kmc Property Tax Bill Online Property Walls

How To Pay Kmc Property Tax Bill Online Property Walls

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

How To Pay Property Tax In Kolkata Online Step By Step Guide For Kmc

How To Pay Property Tax In Kolkata Online Step By Step Guide For Kmc

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Find Kolkata Unpaid Property Tax Dues Or Outstanding Bills

Find Kolkata Unpaid Property Tax Dues Or Outstanding Bills

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

Kmc Property Tax Online Payment Procedure Calculation Payment Centers And Latest News

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home