National Property Tax Uk Proposal

This is an effective tax rate of 1. Proposals to replace council tax and stamp duty with a new proportional property tax would leave more than three quarters of households better off it has been claimed.

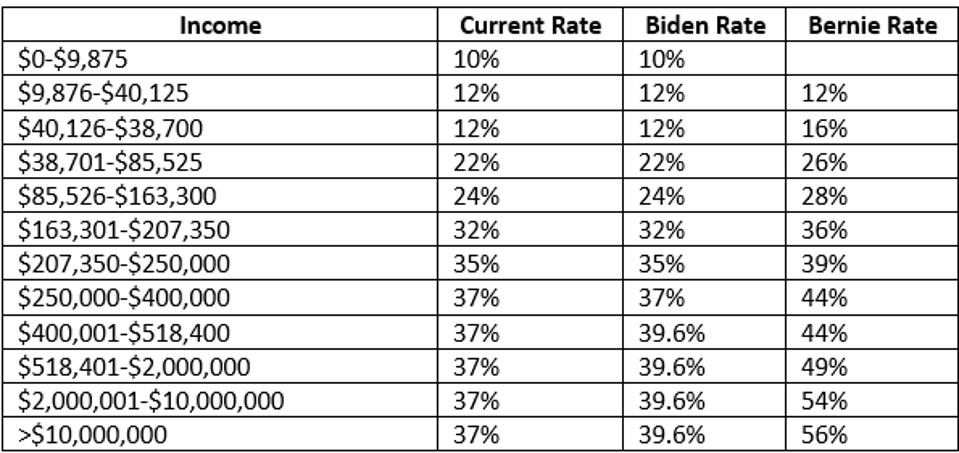

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

The proposal which is reported to have attracted interest from the Treasury would see revenues split between local and central government with councils retaining the ability to set the rate.

National property tax uk proposal. The charity has instead proposed a proportional property tax consisting of a simple rate of 048 percent on the current value of the property. This means for example that should you buy a house for 625000 in April 2021 0 per cent stamp duty will be charged on the first 500000 with 5 per cent or 6250 charged on the remaining 125000 giving a total stamp duty payment of 6250. To be revenue neutral for the Treasury campaigners estimate it needs to be set at 048 per cent of the value of the property per year so that.

For residential property you pay no tax if its worth under 125000 and then theres a sliding scale of 2 for prices of 125001 to 250000 reaching a maximum of. 03 February 2021 By Sarah Calkin. If you bought a British property for 245000 you would pay 0 tax on the value of the property up to 125000 and 2 tax on the value between 125001 and 245000.

Buy to letsecond home higher stamp duty rates and thresholds. Rishi Sunak is planning to begin raising taxes in Marchs budget to plug the black hole in the national finances as officials model a long-term plan to replace both council tax and stamp duty with a. This tax may be imposed on real estate or personal propertyThe tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate and is generally an obligation of the owner of the property.

The Wealth Tax Commission proposed the 5 per cent levy on housing pension business equity and savings wealth last month and forecasted that it. Some Conservative MPs have also argued for. Joe Biden if elected president would enact a national 3 property tax.

Most local governments in the United States impose a property tax also known as a millage rate as a principal source of revenue. No 11 rejected proposals last week for an emergency wealth tax of 5 per cent on assets including homes of more than 500000 per person. WEALTH tax rules have been proposed as a measure which could potentially be announced at the upcoming Spring Budget.

The government - which received the report yesterday from its own Office for Tax Simplification - is keen to stress no decision has yet been taken about whether to implement the proposal. In this example your total liability for stamp duty would be 2400. Biden has not proposed a federal property tax as part of his tax.

About 14 billion could be raised by cutting exemptions and doubling rates according to the review which was set up by Chancellor Rishi Sunak. Ahead of Chancellor of the Exchequer Rishi Sunak delivering his statement on. Property taxes On property taxation another already-announced proposal to introduce a 3 stamp duty land tax SDLT surcharge on non-UK.

Our progressive tax system means the top 1 of income taxpayers are projected to pay over 29 of all income tax and the top 5 over 50 of all income tax in 2019-20.

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

12 Eu States Reject Move To Expose Companies Tax Avoidance Tax Avoidance The Guardian

12 Eu States Reject Move To Expose Companies Tax Avoidance Tax Avoidance The Guardian

Https Www Jstor Org Stable 2130888

Biden S Tax Plan For His First 100 Days Forbes Advisor

Biden S Tax Plan For His First 100 Days Forbes Advisor

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Us Offers New Plan In Global Corporate Tax Talks Financial Times

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Doing Business In The United States Federal Tax Issues Pwc

Doing Business In The United States Federal Tax Issues Pwc

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

What Does A Biden Presidency Mean For Your Tax Bill

What Does A Biden Presidency Mean For Your Tax Bill

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home