Columbus Ohio Property Tax Records

Available information includes property classification number and type of rooms year built recent sales lot size square footage and property tax. All tax bills are mailed 28 to 30 days before the due date.

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors.

Columbus ohio property tax records. Pataskala Office 312 Township Rd Pataskala OH 43062 Telephone Newark Office Number. Ohio real and personal property tax records are managed by the Auditors Office in each county. Delinquent tax refers to a tax that is unpaid after the payment due date.

Land and land improvements are considered real property while mobile property is classified as personal property. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the. Monday through Friday 900 am.

Your property tax bill. Before beginning your search please review the detailed instructions below on how to search and apply for properties. 740 670-5040 Pataskala Office Number.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. It has been an ad valorem tax meaning based on value since 1825. Unclaimed Funds Search Daily Conveyances Historical Parcel Sheets Housing Affordability Info Parcel Archive.

373 South High Street 26th FloorThe Franklin County Assessors Office is located in Columbus Ohio. Rd Ave Blvd St Pl etc. Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio.

The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. To have a better chance of finding the desired parcel enter as complete an address as possible. Housing Advocates Franklin County Auditor Show Support for property Tax Relief proposal.

Office Hours Monday to Friday 830 AM to 430 PM Closed on Holidays. The Franklin County Auditors Office located in Columbus Ohio determines the value of all taxable property in Franklin County OH. Columbus is the county seat of Franklin.

Use an when unsure of spelling or to return all results on particular street. Find Ohio Tax Records Ohio Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in OH. City of Columbus Income Tax Division 77 N.

Use our free Ohio property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Our goal is to help make your every experience with our team and Ohios tax system a success. For accurate search results do not add suffix to street name ie.

Columbus OH 43215-9030 614 6458664 614 6456675 FAX Property Search. Our property records tool can return a variety of information about your property that affect your property tax. Thanks for visiting our site.

Click on the OnTrac logo above to go to the new website. Applications may be submitted electronically through the website or a hard copy may be mailed or dropped off at our office. Real Estate Property Tax Rates Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property.

Front Street 2nd Floor. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax practitioners in Ohio. Please examine your tax bill and notify the Clark County Treasurers Office at 937-521-1832 of any error or questions your may have regarding your tax bill.

If an exact match is not found up to 500 search results may be returned. Checking the Franklin County property tax due date. Tax Records include property tax assessments property appraisals and income tax records.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Front Street building to drop. Real Estate Taxes The real estate tax collection begins with the assessment of the real estate parcels in Franklin County.

Appealing your property tax appraisal. Columbus Ohio 43215 Get Directions. The real property tax is Ohios oldest tax.

Due to the COVID-19 pandemic the Division is currently closed to the public. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site. Taxpayers may use the secure drop box located in the lobby of the 77 N.

614 645-7193 Customer Service Hours.

Https Tax Ohio Gov Portals 0 Tax Analysis Tax Data Series Real Property He1 He1ty15 Pdf

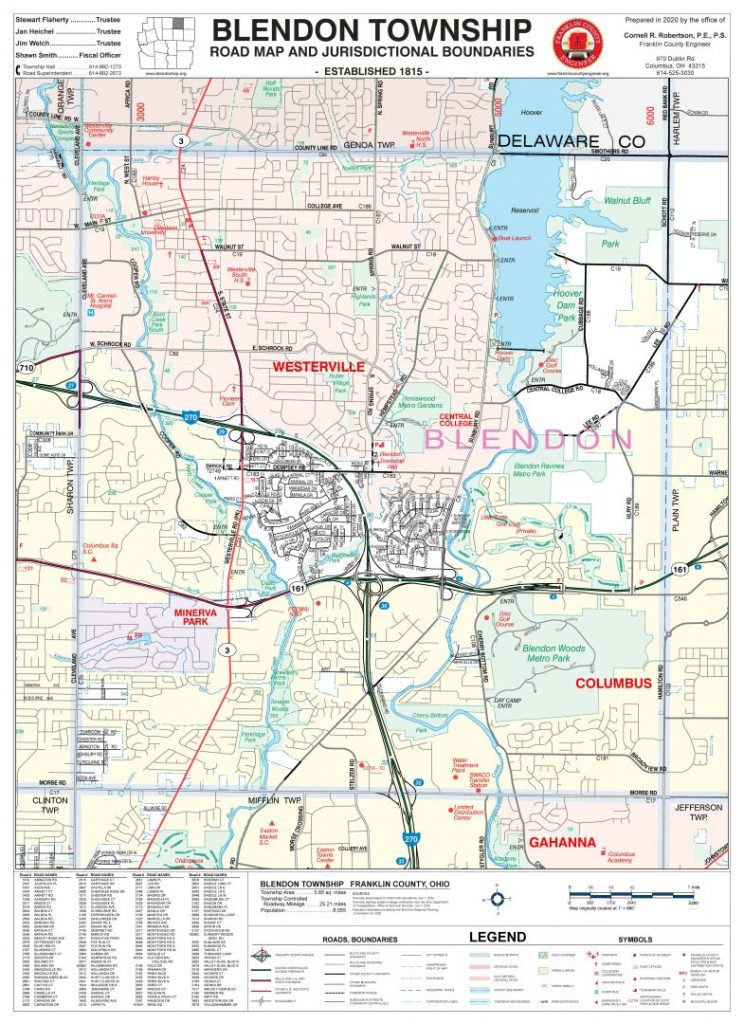

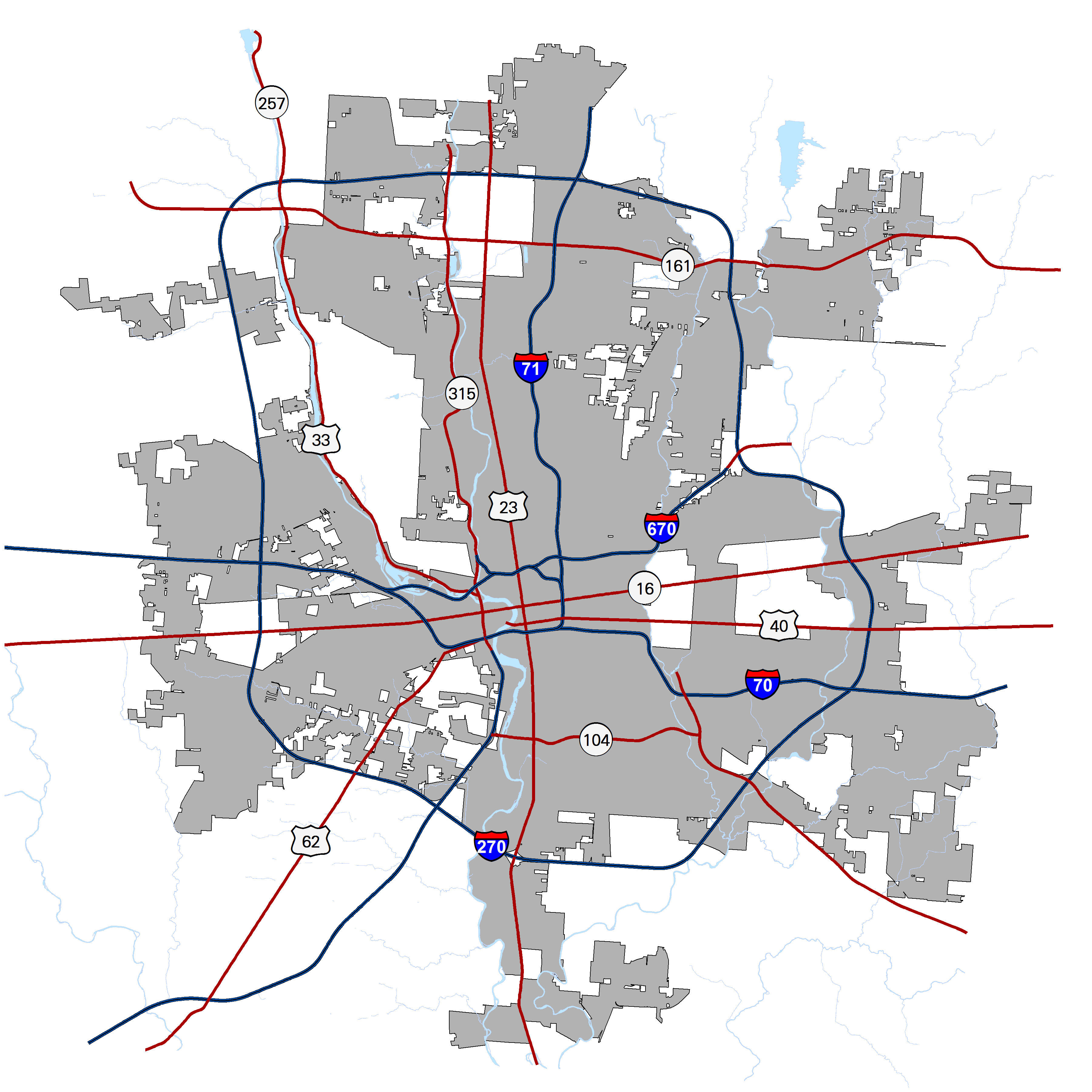

Historical Maps And Information Franklin County Engineer S Office

Historical Maps And Information Franklin County Engineer S Office

Search Ohio Public Property Records Online Courthousedirect Com

Search Ohio Public Property Records Online Courthousedirect Com

Https Tax Ohio Gov Portals 0 Research Vta Nov2017 Session3 Pdf

Franklin County Auditor Appraisal

Franklin County Auditor Appraisal

Franklin County Treasurer Property Search

Franklin County Treasurer Property Search

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Https Tax Ohio Gov Portals 0 Tax Analysis Tax Data Series Tangible Personal Property P49 P49cy09 Pdf

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Franklin County Auditor Real Estate

Franklin County Auditor Real Estate

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home