Property Tax Laws Washington State

Additionally states levy extra taxes on items such as liquor tobacco products and gasoline. To qualify for the Exemption Program you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability.

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Attorney Generals Office The Washington State Attorney Generals Office has some helpful information if you are facing foreclosure on your property.

Property tax laws washington state. Direct appeals to board of tax appeals. EHB 2242 changed the state school levy from a budget based system limited by the one percent growth to a 270 per 1000 market value rate based property tax for the 2018 2021 tax years. The tax deed so made by the county treasurer under the official seal of the treasurers office must be recorded in the same manner as other conveyances of real property and vests in the grantee his or her heirs and assigns the title to the property therein described without further acknowledgment or evidence of the conveyance.

Once real estate has been delinquent in property taxes for at least three years the county treasurer may initiate foreclosure proceedings RCW 8464050. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. Where does your property tax go.

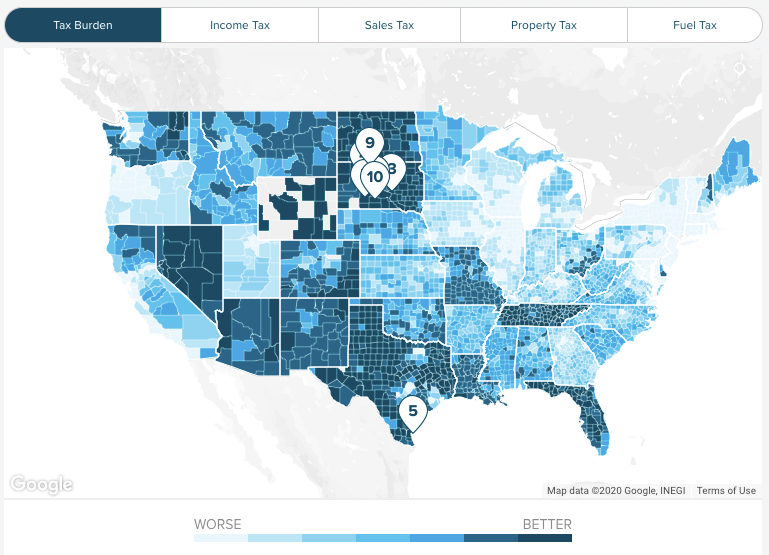

Instead they offer Washington tax deeds. Federal agencies and instrumentalities taxation. Washington Tax Laws Federal state and local governments all collect taxes in a variety of ways.

7 1 3. State funding for certain school districts. None of the 39 counties in Washington State offer Washington tax lien certificates.

In 2018 the Legislature made additional changes to lower the levy rate for taxes in 2019. Board of Tax Appeals. In Washington o nce a tax year is three years late the county can start a foreclosure.

What are the eligibility requirements for the Property Tax Exemption Program. Voter-approved property taxes imposed by school districts. Washington State law requires businesses and other organizations to review their records each year to determine whether they hold any property that has been unclaimed for a set period of time.

ESSB 6614 changed the rate based levy from 270 per 1000 market value. Property taxes imposed by the state. Flood control district property.

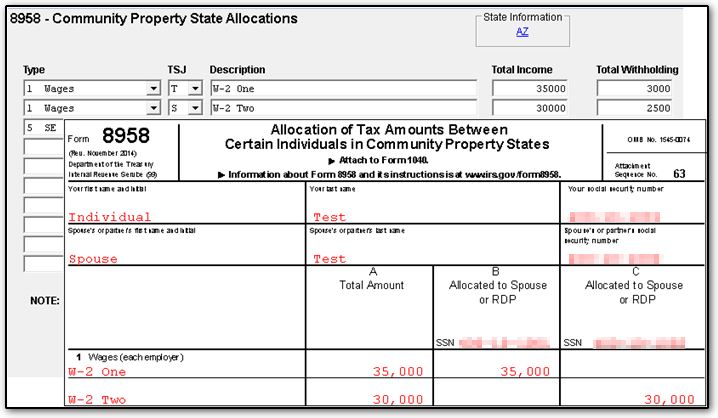

Lease of tax acquired property for underground storage of natural gas. 2 Neither person shall give community property without the express or implied consent of the other. Businesses must file an annual report and deliver the property to the state.

Appeal to board from denial of petition or notice of determination as to reduction or refund Procedure Notice. RCW 8440038 3 Direct appeal to state board of tax appeals. Property taxes make up at least 94 percent of the states General Fund which supports public services for Washington residents.

Deferral of property taxes Depending on your income you can defer property tax payments. What Happens if You Dont Pay Property Taxes in Washington All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. 1 Neither person shall devise or bequeath by will more than one-half of the community property.

Tax amount varies by county The median property tax in Washington is 263100 per year for a home worth the median value of 28720000. See property tax exemptions and deferrals for more information. For 2018 residents dont have to file a state estate tax return if the value of their estate is less than the tax exempt amount of 2193000 according to Washington inheritance laws.

State revenues are comprised of property taxes sales tax and certain taxes on businesses. You must also own and occupy your residence and your combined disposable income must be 40000 or less. Counties in Washington collect an average of 092 of a propertys assesed fair market value as property tax per year.

21 rows Impact of Local Zoning Ordinances on Property Tax Exemptions Granted Under Chapter 8436 RCW 1422009 Transfer or Removal of Land Owned by a Federally Recognized Indian Tribe Classified Under Chapter 8433 or 8434 RCW. The same applies to non-residents with property in Washington though.

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Washington Paycheck Calculator Smartasset

Washington Paycheck Calculator Smartasset

How School Funding S Reliance On Property Taxes Fails Children Npr

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

About Washington Department Of Revenue

About Washington Department Of Revenue

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Statistics Reports Washington Department Of Revenue

Statistics Reports Washington Department Of Revenue

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Idaho Income Tax Calculator Smartasset

Idaho Income Tax Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Black Families Pay Significantly Higher Property Taxes The Washington Post

Black Families Pay Significantly Higher Property Taxes The Washington Post

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

1040 Splitting A Community Property Return

1040 Splitting A Community Property Return

Black Families Pay Significantly Higher Property Taxes The Washington Post

Black Families Pay Significantly Higher Property Taxes The Washington Post

Labels: property, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home