What Is Property Code 1245

Section 1245 Property is any new or used tangible or intangible personal property that has been or could have been subject to depreciation or amortization. Section 1245 property defined.

Su9 2 Business Property 1245 And 1250 Flashcards Quizlet

Su9 2 Business Property 1245 And 1250 Flashcards Quizlet

For purposes of this section the term section 1245 property means any property which is or has been property of a character subject to the allowance for depreciation provided in section 167 or subject to the allowance of amortization provided in and is either.

What is property code 1245. Section 1245 A section of the IRS tax code indicating that any depreciable property that is sold for more than the depreciated value qualifies for capital gains taxation rather than income taxation. Cost segregation is the act of identifying IRS Code Sec. Gain Treated as Ordinary Income.

Part III- Section 1245 - Property which includes tangible personal property such as furniture and equipment that is subject to depreciation. Buildings and structural components are not included. 1231 1245 and 1250.

Prior to amendment introductory provisions read as follows. According to the instructions for Form 4797 Section 1245 property is. 1245 property includes any property that is of a character subject to the allowance for depreciation and is either personal property or certain other property described within Code 1245 a 3 B through F.

Section 1245 Property Defined. Depreciation allowed or allowable. Section 1245 property.

Also included is intangible personal property such as patents and licenses that are subject to amortization. According to the Internal Revenue Service IRS Section 1245 property is defined as intangible or tangible personal property that could be or is subject to depreciation or amortization excluding. Examples of tangible personal property are machinery vehicles equipment grain storage bins and silos blast furnaces and brick kilns.

Section 1245 property does not include buildings and structural components. 103-66 and is one of the following. Section 1245 Property is any new or used tangible or intangible personal property that has been or could have been subject to depreciation or amortization.

1245 a 3 provides that IRS Code Sec. What is a 1245 property. Depreciation taken on other property or taken by other taxpayers.

1245 tangible property assets are depreciated over shorter depreciable lives mandated by the Internal Revenue Service IRS. Learn about 1231 1245 1250 property and its treatment for gains and losses. Section 1245 property.

The answer appears to be YES. Examples of property that is not personal. Depreciation on other tangible property.

This type of property includes tangible personal property such as furniture and equipment that is subject to depreciation or intangible personal property such as a patent or license that is subject to amortization. Property Used in a Trade or Business The Internal Revenue Code includes multiple classifications for property. According to the Internal Revenue Service Code Section 1245 a Section 1245 property is any property defined as an intangible or tangible personal property and subject to depreciation or amortization.

Facility for bulk storage of fungible commodities. Property that is depreciable or amortizable under section 185 repealed 197 or 1253 d 2 or 3 as in effect before the enactment of PL. This type of property includes tangible personal property such as furniture and equipment that is subject to depreciation or intangible personal property such as a patent or license that is subject to amortization.

Generally 1245 property is known as tangible or personal property. Buildings and structural components. If the sale of section 1245 property is less than the depreciation or amortization on the property or if the gains on the disposition of the property are less than the original cost gains are.

Section 1245 a 3 provides that section 1245 property is any property which is or has been subject to depreciation under 167 and which is either personal property or other tangible property used as an integral part of certain activities. Section 1250 property - depreciable real property including leaseholds if they are subject to depreciation.

What Is 1245 Property And How Is It Taxed Millionacres

What Is 1245 Property And How Is It Taxed Millionacres

Order Cell Phones With Checking Account Usbccellphones Code 3204682013 Sprintcellphonede Best Cell Phone Coverage Sprint Cell Phone Deals Mobile Phone Shops

Order Cell Phones With Checking Account Usbccellphones Code 3204682013 Sprintcellphonede Best Cell Phone Coverage Sprint Cell Phone Deals Mobile Phone Shops

Mortgage Flyers Easy Money Postcard Flyer Or Print Contest Design Postcard Flyer Koto Mortgage Refinance Mortgage Mortgage Loans

Mortgage Flyers Easy Money Postcard Flyer Or Print Contest Design Postcard Flyer Koto Mortgage Refinance Mortgage Mortgage Loans

Section 1245 Depreciation Recapture Income Tax Course Cpa Exam Regulation Tax Cuts And Jobs Act Youtube

Section 1245 Depreciation Recapture Income Tax Course Cpa Exam Regulation Tax Cuts And Jobs Act Youtube

Http Media Straffordpub Com Products Calculating Depreciation Recapture Under Irc 1245 And 1250 Minimizing Tax Through Transaction Planning 2017 08 15 Presentation Pdf

Calculate Cash On Cash Return On Your Investment Never Lose Money Again Video Included Investing Personal Financial Planning Investing In Shares

Calculate Cash On Cash Return On Your Investment Never Lose Money Again Video Included Investing Personal Financial Planning Investing In Shares

Section 1245 Depreciation Recapture Income Tax Course Cpa Exam Regulation Tax Cuts And Jobs Act Youtube

Section 1245 Depreciation Recapture Income Tax Course Cpa Exam Regulation Tax Cuts And Jobs Act Youtube

Refer A Friend And Reward Yourself Told You So Rewards Referrals

Refer A Friend And Reward Yourself Told You So Rewards Referrals

Http Media Straffordpub Com Products Calculating Depreciation Recapture Under Irc 1245 And 1250 Minimizing Tax Through Transaction Planning 2017 08 15 Presentation Pdf

Sample Cover Letters Cover Letter For Resume Resume Cover Letter Template Cover Letter Example

Sample Cover Letters Cover Letter For Resume Resume Cover Letter Template Cover Letter Example

1245 June Dr Decatur Ga 30035 Renting A House House Rental House Styles

1245 June Dr Decatur Ga 30035 Renting A House House Rental House Styles

Export Hive Table Into Csv Format Using Beeline Client Hive Table Hives Apache Hive

Export Hive Table Into Csv Format Using Beeline Client Hive Table Hives Apache Hive

What Is 1245 Property And How Is It Taxed Millionacres

What Is 1245 Property And How Is It Taxed Millionacres

Facebook Signs Up To German Privacy Code About Facebook Facebook Features Facebook Help

Facebook Signs Up To German Privacy Code About Facebook Facebook Features Facebook Help

Http Media Straffordpub Com Products Calculating Depreciation Recapture Under Irc 1245 And 1250 Minimizing Tax Through Transaction Planning 2017 08 15 Presentation Pdf

Section 1231 1245 1250 Gains Losses Income Taxes 2018 2019 Youtube

Section 1231 1245 1250 Gains Losses Income Taxes 2018 2019 Youtube

Http Media Straffordpub Com Products Calculating Depreciation Recapture Under Irc 1245 And 1250 Minimizing Tax Through Transaction Planning 2017 08 15 Presentation Pdf

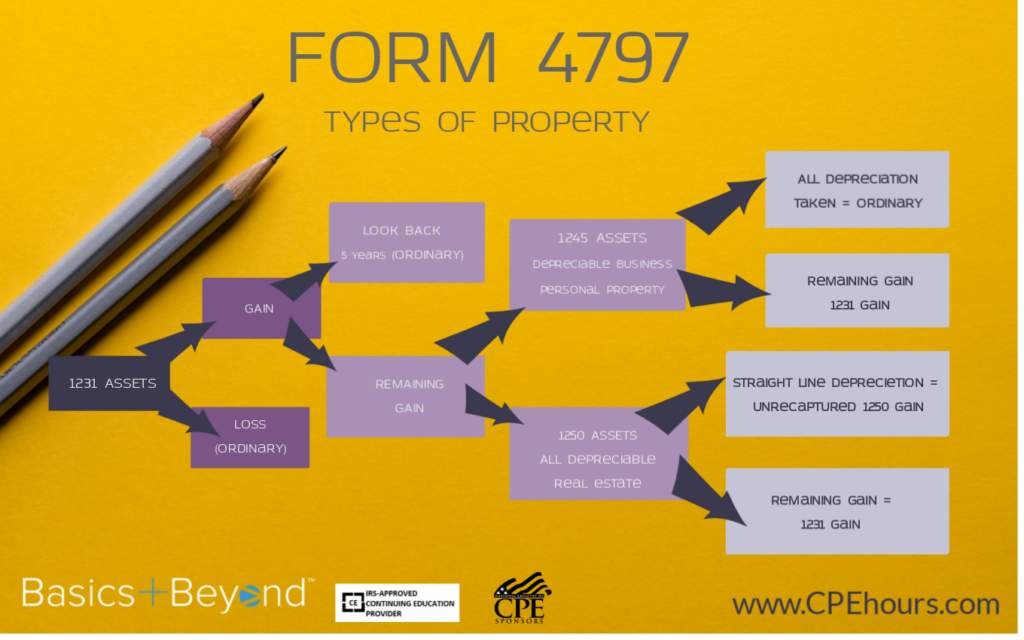

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

1231 1245 And 1250 Property Used In A Trade Or Business Investing Infographic Investment Quotes Investing

1231 1245 And 1250 Property Used In A Trade Or Business Investing Infographic Investment Quotes Investing

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home