Property Tax Rate San Diego

The individual bonds are listed out on your property tax bill. Avoid Penalties and Save Money.

Understanding California S Property Taxes

Understanding California S Property Taxes

1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov INTERNATIONAL.

Property tax rate san diego. If you do not know the Tax Rate Area for which you want a tax rate the following table lists a typical Tax Rate Area for each city in the county. After the end of the fiscal year June 30 a 3300 redemption fee and a 1-½ per month 18 per annum penalty is added on the unpaid tax amount. A 10 penalty and 1000 cost added after 5PM on April 10th.

The TAX RATE consists of the 1 tax rate and voter approved bonded debt rate. 858 694-2922 MS O-53. For example if you purchase a 500000 property the taxes will be around 520 per month.

Please contact the Treasurer-Tax Collector for more information on defaulted tax bills. A property listed on the defaulted roll may have gone through a segregation process which may have caused the taxes to become defaulted. You may call the Tax Collectors Office at 877 829-4732 or email taxmansdcountycagov for information.

Percent 1 tax rate applies to all taxable property values including land improvements and personal property. Specific tax statutes determine the taxable base value for the various debt service rates. SEARCH SELECT PAY ITS THE BEST WAY.

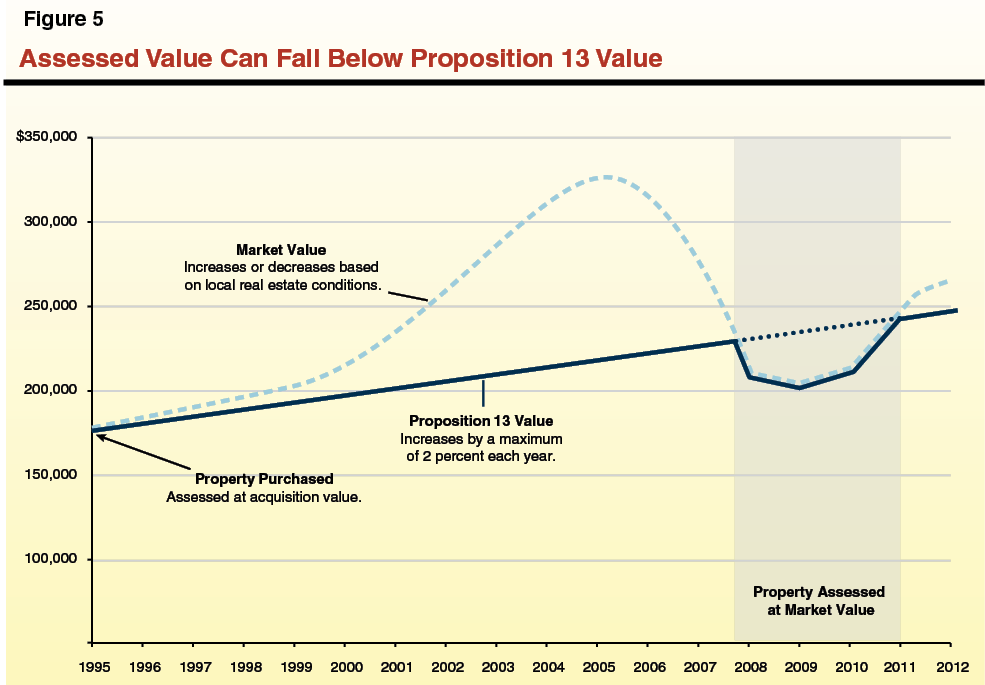

The median property tax on a 48600000 house is 359640 in California. Proposition 13 limits the tax rate to 1 of a propertys current assessed value plus any voter-approved bonds and assessments. Debt service tax rates may apply to all property values land only or land and improvements only.

City of Chula Vista. The best way to pay property taxes is online. However because assessed values rise to the purchase price when a home is sold new homeowners can expect to pay higher rates than that.

City of Del Mar. Debt service tax rates may apply to all property values land only or. The median property tax in San Diego County California is 2955 per year for a home worth the median value of 486000.

The use of 125 reflects the maximum tax rate for San Diego County. The property tax rate is 1 plus any bonds fees or special charges. The median property tax on a 48600000 house is 296460 in San Diego County.

Generally your tax amount is 1 of the net value of your property but thats not all. City of El Cajon. San Diego County collects on average 061 of a propertys assessed fair market value as property tax.

858 694-2901 Fax. This page allows you to search for San Diego County secured unsecured and defaulted properties. This is because in San Diego the taxes are calculated through the assessed value of a home.

A 10 penalty added after 5PM on December 10th. This amounts to about 125 of the purchase price. The proposition also states that property values cant increase more than 2 annually based on the California Consumer Price Index.

The average effective property tax rate in San Diego County is 073 significantly lower than the national average. The one percent 1 tax rate applies to all taxable property values including land improvements and personal property. The Auditor Controller issues an annual report on Property Valuations Tax Rates and Useful Information for Taxpayers where historical tax rate data is available.

San Diego County Treasurer-Tax Collector Dan McAllister reminds taxpayers that they have just 12 days left to pay the second installment of their 2020-2021 property taxes before they face a 10. The San Diego County Assessor is responsible for determining the value for all homes which is crucial as far as property taxes go. San Diego County has one of the highest median property taxes in the United States and is ranked 168th of the 3143 counties in order of median property taxes.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the San Diego County Tax Appraisers office. San Diego County CA Property Taxes. You can also find this information online.

Where can I obtain a copy of my tax bill. Center 1600 Pacific Hwy Room 162 San Diego. Search for your bill using parcelbill number mailing address or unsecured bill number.

Jon Baker - Manager Auditor Controller 5530 Overland Avenue Suite 410 San Diego CA 92123 Phone. San Diego County Admin. Combined with the 1 base rate most property tax rates in San Diego County are somewhere between 102 and 119.

As a general rule you can calculate your monthly tax payment by multiply the purchase price by0125 and dividing by 12. Heres how it works.

Understanding California S Property Taxes

Understanding California S Property Taxes

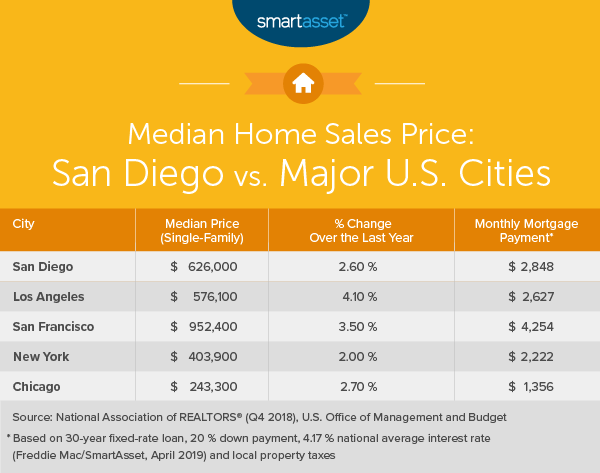

The Cost Of Living In San Diego Smartasset

The Cost Of Living In San Diego Smartasset

Sinking Tax Revenue During Pandemic Creating Budget Crisis For San Diego The San Diego Union Tribune

Sinking Tax Revenue During Pandemic Creating Budget Crisis For San Diego The San Diego Union Tribune

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

San Diego County Ca Property Tax Rates In 2021

San Diego County Ca Property Tax Rates In 2021

San Diego County Ca Property Tax Faq S In 2021

San Diego County Ca Property Tax Faq S In 2021

Understanding California S Property Taxes

Understanding California S Property Taxes

San Diego Property Tax Rate San Diego Real Estate Taxes Welcome To San Diego

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

Understanding California S Property Taxes

Understanding California S Property Taxes

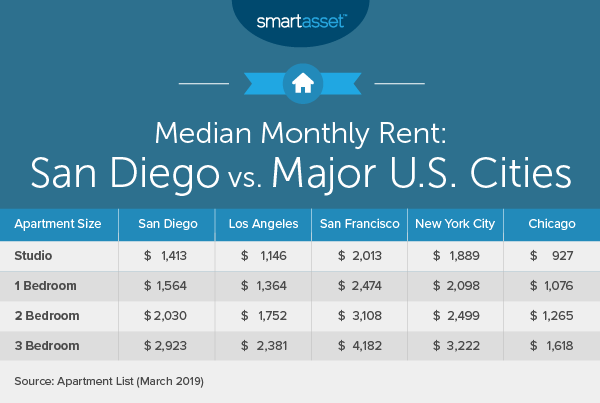

The Cost Of Living In San Diego Smartasset

The Cost Of Living In San Diego Smartasset

Understanding California S Property Taxes

Understanding California S Property Taxes

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Ca Property Tax Rates In 2021

San Diego County Ca Property Tax Rates In 2021

Understanding California S Property Taxes

Understanding California S Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home