Franklin County Maine Property Tax Search

Maine Property Tax Institute - April 13-14 2021 Maine Property Tax School August 2-6 2021 IAAO Course - Fall 2021. Name Phone Online Report.

Franklin County Contact Info.

Franklin county maine property tax search. Vickie Braley Deputy County Treasurer Finance Mgr. Property Tax Educational Programs. In-depth Property Tax Information.

At this site the public has full access to the same records available to anyone using the computer search screens at the Registry of Deeds office. See what the tax bill is for any Franklin County ME property by simply typing its address into a search bar. 2020 Personal Property Commitment Book.

140 Main Street Suite 3 FarmingtonMaine 04938 The Treasurers office is located on the first floor of the Franklin County Superior Courthouse building at 140 Main Street in downtown Farmington at the corner of Main and Anson Streets. For more details about taxes in Franklin County or to compare property tax rates across Maine see the Franklin County property tax page. To use this Web Portal enter complete Owner Address or Parcel ID information and click Search for Parcels or hit Enter and you will be directed to that property tax.

Franklin County ME Property Tax Search by Address. The Franklin County Tax Office is responsible for listing appraising and assessing all real estate personal property and registered motor vehicles within Franklin County. For current year assessment information go to the Assessor Department page.

UCC Information Official State Website. Certified Maine Assessor CMA Exams. Our town tax commitments and tax lists are available in PDF format.

John Smith Street Address Ex. See Franklin County ME tax rates tax exemptions for any property the tax assessment history for the past years and more. Franklin County collects on average 099 of a propertys assessed fair market value as property tax.

Franklin County Tax Records Search Maine Perform a free Franklin County ME public tax records search including assessor treasurer tax office and collector records tax lookups tax departments property and real estate taxes. Find property records vital records inmate and court records professional and business licenses contractor licenses and much more. The County assumes no responsibility for errors in the information and does not guarantee that the.

NETR Online Franklin Franklin Public Records Search Franklin Records Franklin Property Tax Maine Property Search Maine Assessor. Search for a Property Search by. Median Property Taxes No Mortgage 1525.

A guide to property tax and what your money is used for is now available in PDF format below. 099 of home value. Franklin Registry of Deeds 207 778 - 5889.

The Pine Tree State. Pamela Prodan County Treasurer. Personal Property Tax Commitments.

Tax District Property Type -Any- BRASSFIELD BUNN BUNN FIRE CENTERVILLE CENTRAL FIRE EPSOM FRANKLINTON FRANKLINTON FIRE GOLD SAND HOPKINS JUSTICE LOUISBURG MITCHINERS FIRE PILOT WAKE FOREST WHITE LEVEL YOUNGSVILLE YOUNGSVILLE FIRE. The Tax Office is charged with collecting all current and delinquent taxes on this property. Scanned Documents and Indexes from 1984 forward and continues to expand to include earlier records.

Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site. Yearly median tax in Franklin County. Franklin County Public Records.

AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. Maine is ranked 1050th of the 3143 counties in the United States in order of the median amount of property taxes. The Property Tax Division is responsible for annually assessing and collecting property taxes in the UT.

Indexes from 1838 to 1983 have been scanned into the database in their original form. Franklin County Maine Public Records Directory - Quickly find public record sources in the largest human edited public record directory. Our office is also staffed to administer and oversee the property tax administration in the unorganized territory.

The median property tax in Franklin County Maine is 1278 per year for a home worth the median value of 128700. 2020 Real Estate by MapLot Commitment Book. Homeowners Guide to Property Tax in Maine.

Property Tax Web Portal. The Citys Property Tax Web Portal has information available for review AFTER property tax bills have been produced and is updated after property tax payments are processed. There are 23769 real estate tax accounts and 814 personal property tax accounts maintained by the.

The AcreValue Franklin County ME plat map sourced from the Franklin County ME tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. Median Property Taxes Mortgage 1798. 123 Main Parcel ID Ex.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Available to you are the following. Much like a municipal assessors office the division maintains records of all property ownership in the UT and has over 700 UT tax maps.

The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. Franklin County Property Tax Exemptions httpswwwmainegovrevenuepropertytaxsidebarexemptionshtm View Franklin County Maine property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions. 207 778 3346 Phone Get directions to the county offices.

Franklin County Property Tax Payments Annual Median Property Taxes.

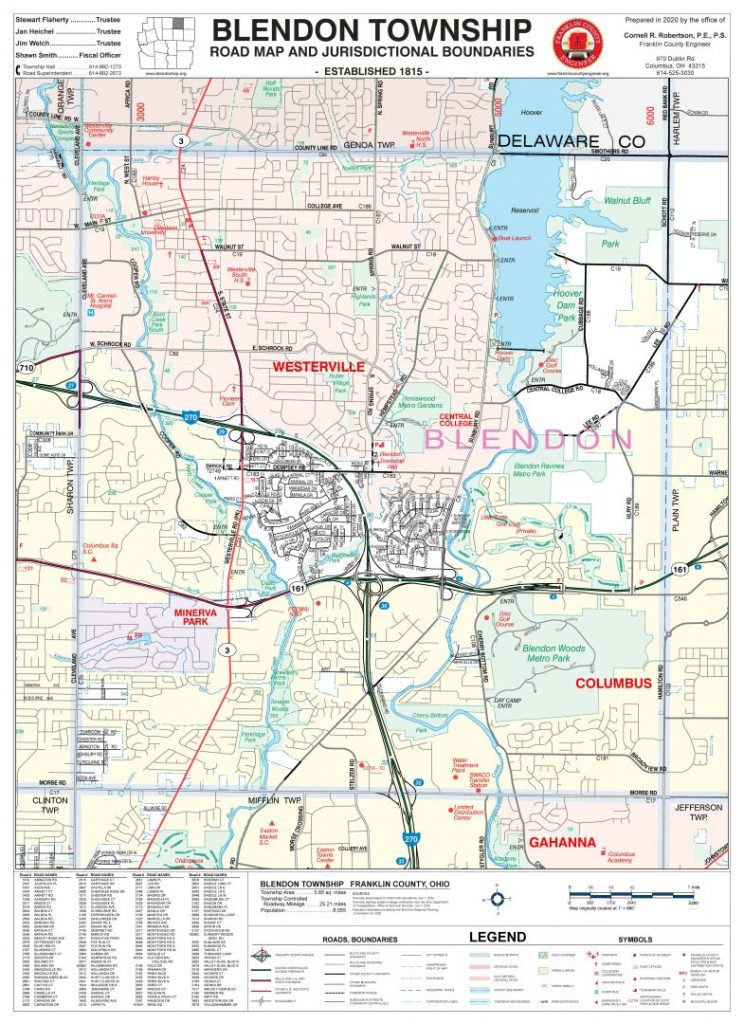

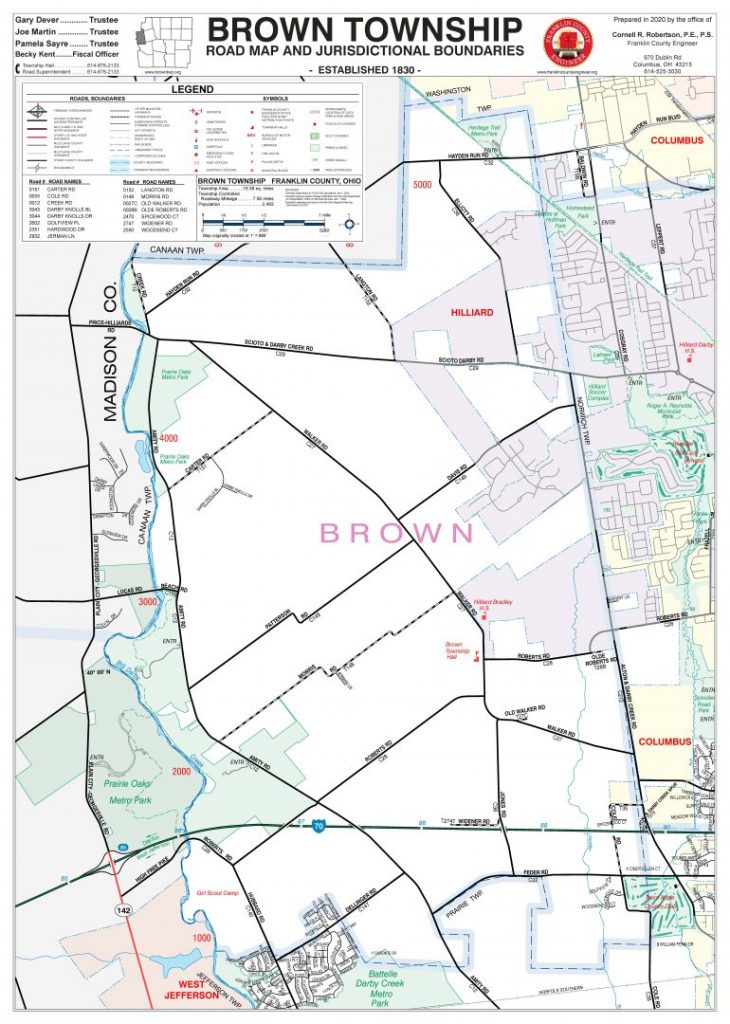

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

County Clerk Recorder Property Tax Information Franklin County

Franklin County Virginia Map 1911 Rand Mcnally Rocky Mount Neva Gogginsville Taylors Store Stanopher Redwood S Franklin County Virginia Map Virginia

Franklin County Virginia Map 1911 Rand Mcnally Rocky Mount Neva Gogginsville Taylors Store Stanopher Redwood S Franklin County Virginia Map Virginia

Franklin County Maine United States Britannica

Franklin County Maine United States Britannica

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home