Capital Gains Tax Uk Property Disposals Service

From 6 th April 2020 UK taxpayers are required to report and pay CGT on the sale of UK residential property. UK residential property capital gains tax What is the issue.

Uk Residential Property New Capital Gains Tax Rules Lexology

The report must be made online via the UK Property Reporting Service.

Capital gains tax uk property disposals service. For all other capital gains nothing has changed. As above if you are already required to submit a self-assessment tax return the gain would also need to be reported on the tax return in the usual way. Property gains accruing on disposal of the property are chargeable to CGT ATED-related CGT irrespective of where the non-natural person or company making the disposal is resident.

From 6 April 2020 you need to report and pay your non-resident Capital Gains Tax using the Capital Gains Tax on UK property service if youve sold ordisposed of. The changes affect UK resident individuals and trustees disposing of UK residential properties. Currently you have to use HMRCs online services to report and pay CGT due on property disposals.

Where such a tax return is required the submission deadline will be 30 days from the date of completion. Individuals can make tax-free gains each year. Such a return is not required if the 30-day deadline falls after having already disclosed the disposal on a Self Assessment tax return.

Since April 2020 any UK resident disposing of a UK residential property who has CGT to pay has to calculate report and pay the tax within 30 days of completion. Gains on UK residential property disposals must now be declared on HMRCs online CGT disposal return and the tax paid using the Capital Gains Tax UK property disposal service within 30 days of completion. If your client disposed of more than one property from 6 April 2020 with the same.

Where such a tax return is required the submission deadline will be 30 days from the date of completion. Report and Pay CGT if youre non-resident. Report and Pay CGT if youre UK resident.

The annual exemption currently stands at. However for such disposals or for non-residential UK disposals HMRC offers a real time capital gains tax service which allows individuals to pay the CGT on such disposals early if preferred. If you sold property in the UK on or after 6 April 2020 You must report and pay any tax due on UK residential property using a Capital Gains Tax on UK property account within 30 days of selling it.

Instead companies simply declare the disposal in their accounts and UK corporation tax return in the usual way and pay any tax due as normal. You should report and pay Capital Gains Tax online within 30 days of a propertys disposal completion date. The new service for taxpayers to report their own gain is available on Report and pay Capital Gains Tax on UK property.

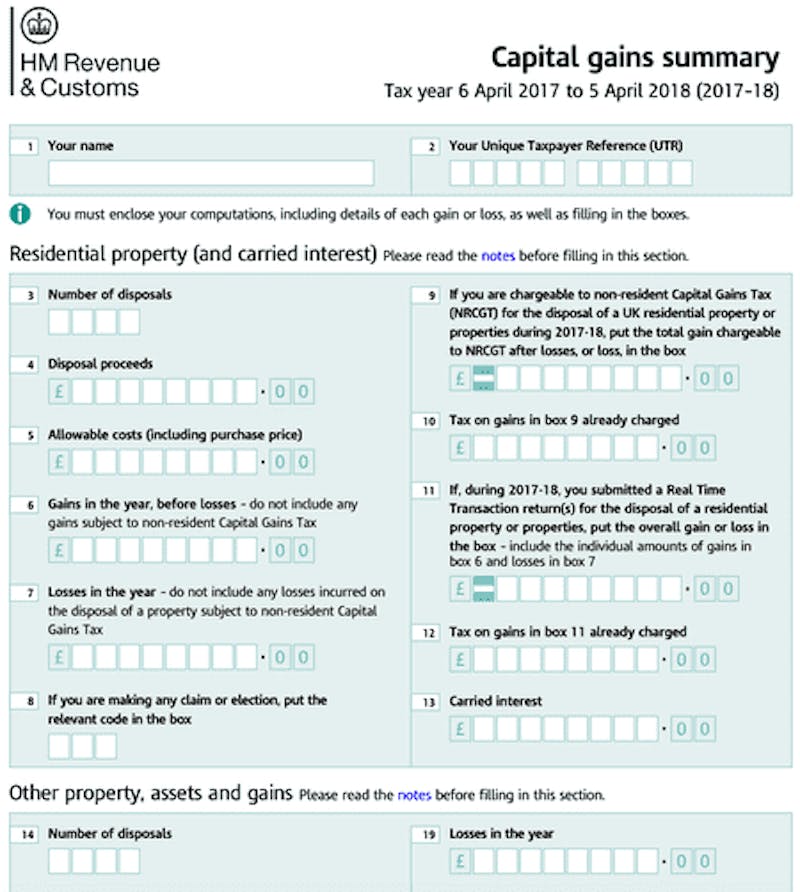

From 6 April 2020 UK residents who make a chargeable gain on the sale of UK residential property will need to disclose the sale and pay any Capital Gains Tax CGT to HMRC within 30 days of completion. The report and payment are both due 30 days from the date of completion. When filling in the capital gains summary pages on form SA108 you include details about your non-resident capital gains on disposals of UK property or land from box 521 onwards.

1 hour agoIt could be achieved relatively simply with a deed of trust and no capital gains costs should arise. If you make a disposal of UK land and property you may also need to report the disposal of the property to HMRC on a separate return and pay capital gains tax within 30 days of the date of completion. Non-UK residents already had a requirement to report the disposal of such property.

What about non-UK companies that sell UK residential property. The new service for agents to report on behalf of their clients is available on Manage your clients Capital Gains Tax on UK property account. Further to the commencement of the new tax year last week it is now necessary for an online capital gains tax CGT return to be submitted in certain cases where a building is disposed of.

Service availability and issues Updated 8 September 2020. Report and pay Capital Gains Tax on UK property. Changes in relation to reporting a taxable disposal of UK residential properties as well as capital gains tax CGT arising from such a disposal came into effect from 6 April 2020.

The disposal itself takes place on date of exchange. UK companies do not have to declare the gain to HMRC through the Capital Gains Tax Service within 30 days of the sale or pay any tax that is due. If youre an agent youll need to use your clients Capital Gains Tax on UK Property account after requesting authorisation via your Agent Services Account.

The relevant legislation can be found in schedule 2 of Finance Act 2019. Online capital gains tax CGT for property disposals Further to the commencement of the new tax year last week it is now necessary for an online capital gains tax CGT return to be submitted in certain cases where a building is disposed of.

11 Strategies To Minimise Your Capital Gains Tax

11 Strategies To Minimise Your Capital Gains Tax

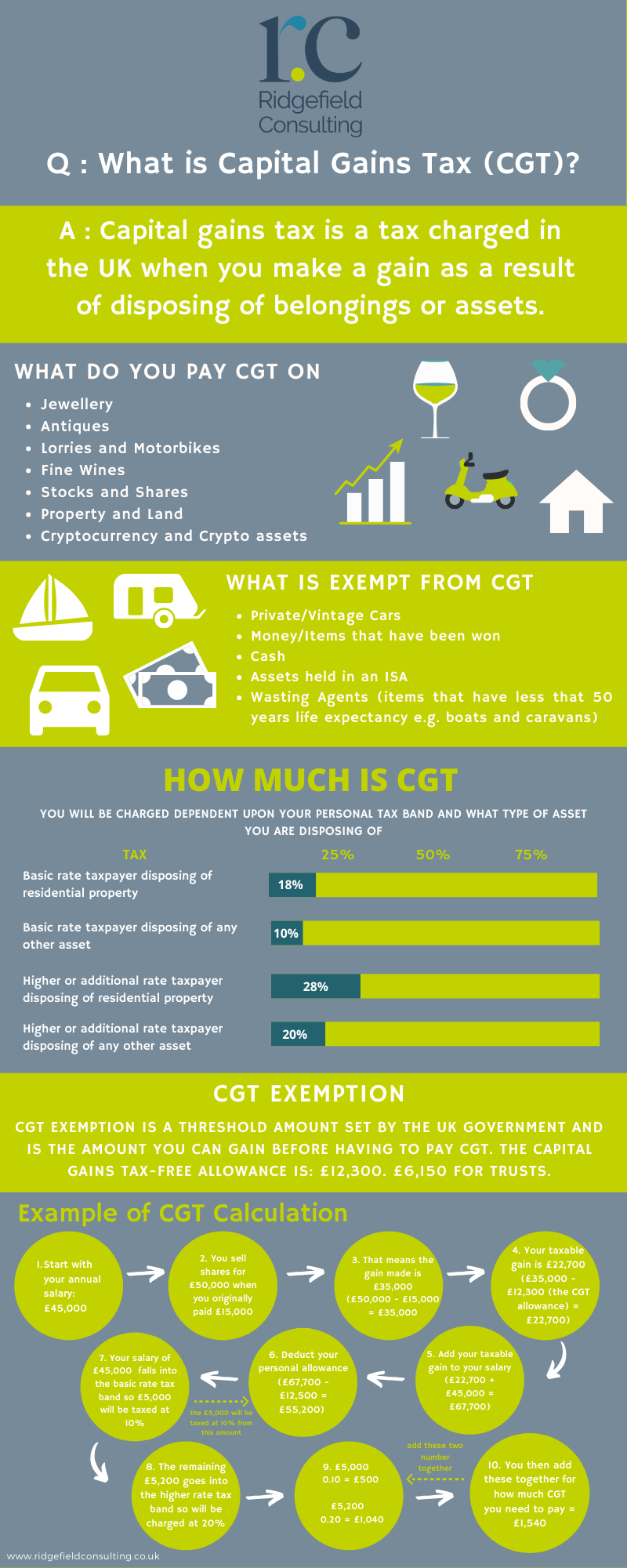

What Is Capital Gains Tax Cgt Ridgefield Consulting

What Is Capital Gains Tax Cgt Ridgefield Consulting

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Should I Pay Capital Gains Tax Or Exit Tax On My Investment

Should I Pay Capital Gains Tax Or Exit Tax On My Investment

Main Residence Property Sale New Capital Gains Tax Implications Kirk Rice

Main Residence Property Sale New Capital Gains Tax Implications Kirk Rice

Capital Gains Tax Cgt For British Expats Selling Uk Property Iexpats

Capital Gains Tax Cgt For British Expats Selling Uk Property Iexpats

Guide To Capital Gains Tax Times Money Mentor

Guide To Capital Gains Tax Times Money Mentor

![]() Capital Gains Tax Cgt For British Expats Selling Uk Property Iexpats

Capital Gains Tax Cgt For British Expats Selling Uk Property Iexpats

Report And Pay Capital Gains Tax On Uk Property Non Residents Who Cannot Set Up A Government Gateway Account Chartered Institute Of Taxation

Report And Pay Capital Gains Tax On Uk Property Non Residents Who Cannot Set Up A Government Gateway Account Chartered Institute Of Taxation

A Guide To Capital Gains Tax On Uk Property For Us Expats

A Guide To Capital Gains Tax On Uk Property For Us Expats

Capital Gains Tax Clear House Accountants

Capital Gains Tax Clear House Accountants

What Are Capital Gains Tax Rates In Uk Taxscouts

What Are Capital Gains Tax Rates In Uk Taxscouts

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Cryptocurrency Taxes In The Uk The 2020 Guide Koinly

Cryptocurrency Taxes In The Uk The 2020 Guide Koinly

Capital Gains Tax For Expats Experts For Expats

Capital Gains Tax For Expats Experts For Expats

Capital Gains Tax On Sale Of Rental Property Mcl

Capital Gains Tax On Sale Of Rental Property Mcl

Capital Gains Tax Spreadsheet Shares

Capital Gains Tax Spreadsheet Shares

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home