How Much Is My Personal Property Tax Missouri

61115 Your family has to pay more than 600 each year in personal property taxes for your vehicles. Personal property is assessed valued each year by the Assessors Office.

The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or E-Check Electronic Bank Draft.

How much is my personal property tax missouri. Your assessment list is due by March 1st of that year. An acknowledgment is issued when your return is received and accepted. How to fill out personal property tax.

Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity. 137075 Every person owning or holding taxable personal property in Missouri on the first day of January including all such property purchased on that day shall be liable for taxes thereon during the same calendar year. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. 116 rows Once market value has been determined the Missouri assessment rate of 19 is applied. Personal property tax is collected by the Collector of Revenue each year on tangible property eg.

Who owes personal property tax. Missouri has one of the lowest median property tax rates in the United States with only fifteen states collecting a lower median property tax than Missouri. Share This Post With Your Neighbors.

The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. Total Personal Property Tax. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

After the assessed value is calculated the tax levy is applied. E-Check is an easy and secure method allows you to pay your individual income taxes by bank draft. All Personal Property tax bills have now been mailed.

An automobile with a market value of 10000 would be assessed at 33 13 or 3333. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year.

Calculate Personal Property Tax - Vehicle - Missouri. Counties in Missouri collect an average of 091 of a propertys assesed fair market value as property tax per year. Facebook Twitter LinkedIn Pinterest Email.

Information and online services regarding your taxes. The median property tax on a. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor.

If you need to change a vehicle listed on your bill do not see a bill for a certain tax year when you search on this website change your address or ask about the value assigned to your property or vehicles which affects the amount of your bill - you need to contact the Assessors office their office maintains that type of data and. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. Property Assessment Appeals Information on how to appeal your Property Assessment from the Assessors Office.

All Personal Property Taxes are due by December 31st of each year. I am looking for a way to calculate what my personal property tax will be on my car for the state of Missouri. Motorized vehicles boats recreational vehicles owned on January 1st of that year.

Taxes not paid in full on or before December 31 will accrue interest penalties and fees. Tax Waiver Statement of Non-Assessment How to obtain a Statement of Non-Assessment Tax Waiver. Tax amount varies by county.

Is there a calculator that anyone is aware of. You pay tax on the sale price of the unit less any trade-in or rebate. If you live in a state with personal property tax consider the long-term cost when you buy a vehicle.

As an example a residence with a market value of 50000 would be assessed at 19 which would place its assessed value at 9500. Only the Assessors Office can change the vehicles or addresses on a personal property tax bill. The median property tax on a 13970000 house is 127127 in Missouri.

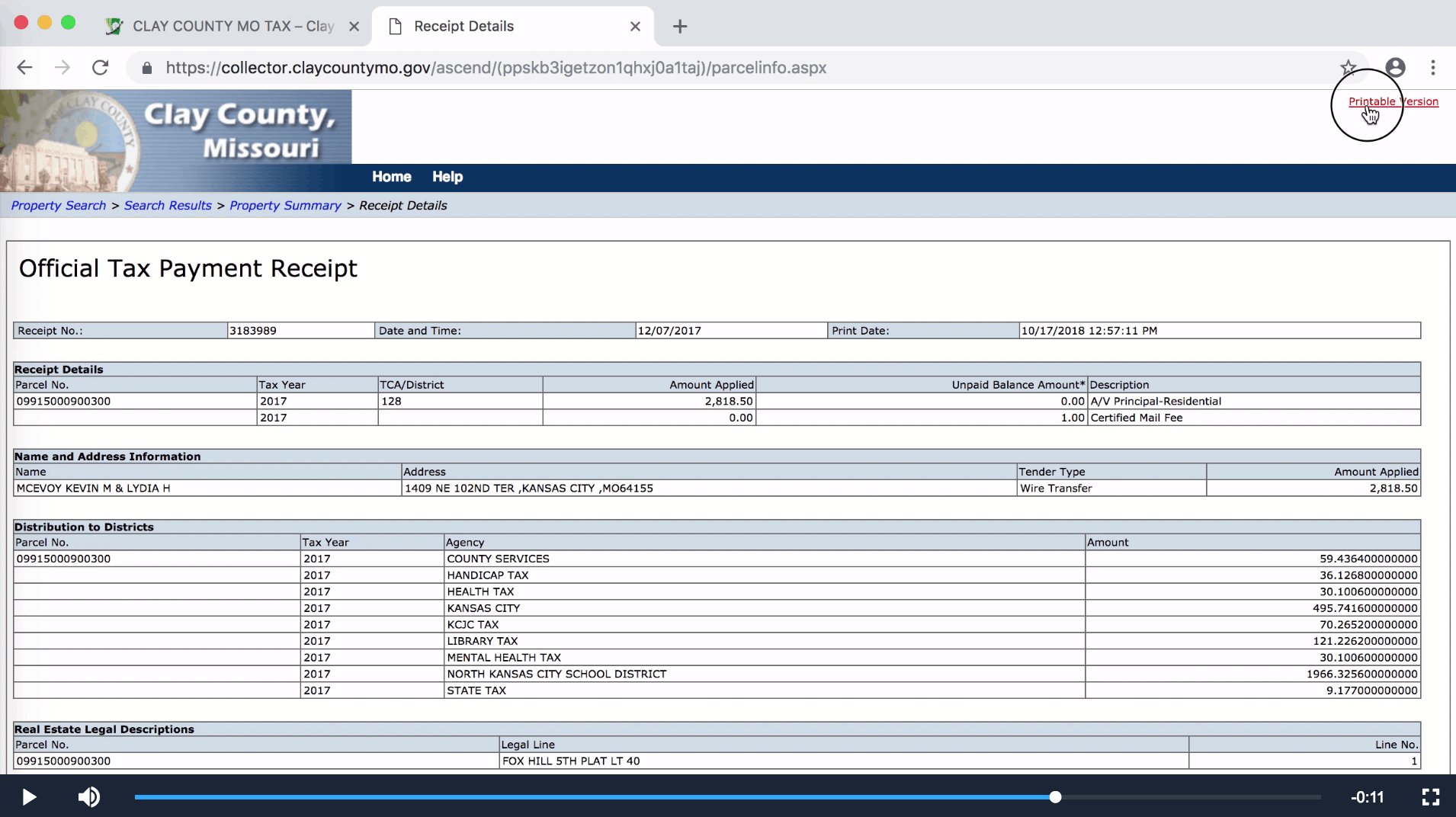

PERSONAL PROPERTY TAXES Clay County Missouri Tax 2017-06-14T125229-0500.

Missouri Department Of Revenue Mo Gov

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home