How To Get Ag Property Tax Exemption In Texas

Texas Tax Code Section 1113 1126. In some cases all you need is a piece of land thats not currently being used.

The City And County Orders Violate Gov Austin Stcn Southtexascommunitynews Ag Paxton Sues City Of Austin For Impo Capitol Building Texas State Capitol City

The City And County Orders Violate Gov Austin Stcn Southtexascommunitynews Ag Paxton Sues City Of Austin For Impo Capitol Building Texas State Capitol City

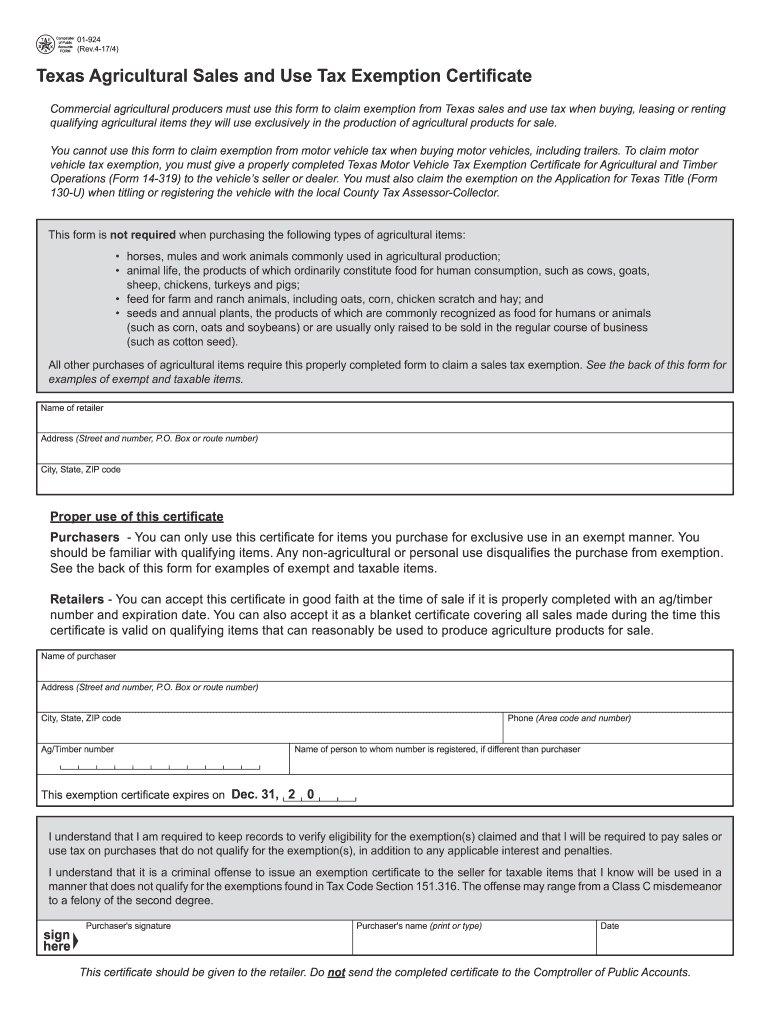

Your business type must be listed below to qualify for tax exemption on certain items or for an AgTimber Number.

How to get ag property tax exemption in texas. If you do not have a valid AgTimber Number you must pay tax to retailers on your purchases. But you dont have to be a full-time farmer to take advantage of agricultural tax breaks that will help you with your property taxes. 01-339 Texas Sales and Use Tax Resale Certificate Exemption Certification PDF 12-302 Texas Hotel Occupancy Tax Exemption Certification PDF 50-299 Primarily Charitable Organization Property Tax Exemption PDF.

The property must have had an ag exemption in the previous tax year and must be at least 10 acres. Agricultural use or open-space land Theyre covered in tax code sections 2341 - 2347 and 2351 - 2359 respectively. Blake Bennett Extension Economist Dallas Ag Exemption o Common term used to explain the Central Appraisal Districts CAD appraised value of the land o Is not an exemption Is a special use appraisal based on the productivity value of the land not market value.

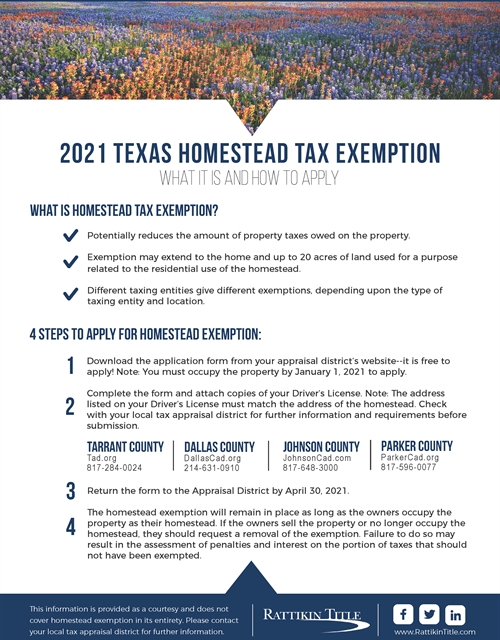

Any taxing unit including a city county school or special district may offer an exemption of up to 20 percent of a. You can apply for property-tax exemptions under two different sections of the Texas tax code. The general deadline for filing an exemption application is before May 1.

Own land that qualifies for 1-d 1-d-1 or qualified timberland appraisal in the appraisal district. AAAB members must have lived in the appraisal district at least five years. Sales and use tax exemptions Farmers and ranchers are exempt from state and local sales taxes for most agricultural inputs they buy and for the products they sell.

Reasonable increase notice is guaranteed. Provides that veterans with disabilities may qualify for property tax exemption home or other property ranging from 5000 to 12000 depending on the severity of the disability. DoNotPay can help you with lowering your property tax in Texas or elsewhere.

The new property owner s must apply for the Ag Exemption and must have owned the property on January 1 of the tax year. If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption for disabled homeowners the owner must choose one or the other for school district taxes. Non-Texas corporations must also include a copy of the corporations formation documents and a current Certificate of Existence issued by their state of incorporation.

All purchasers including non-Texas residents must have a valid agricultural and timber registration number AgTimber Number issued by the Comptroller to claim exemption from Texas tax. Download Agricultural and Timber Exemption Registration Number form. Appraisal district chief appraisers are responsible for determining whether or not property qualifies for an exemption.

And not be an appraisal district officer or employee to serve on the AAAB. Property can not be converted from a residential or commercial tax valuation directly to at wildlife tax valuation. Your county appraiser determines whether your farm or ranch qualifies for either.

The owner cannot receive both exemptions. Texas Tax Code Section 1126m. You may file for a homestead exemption for up to one year after the taxes are due.

For information on the open space provision of the Texas property tax law including how to apply for an exemption contact the local county Central Appraisal District office. Exemptions from property tax require applications in most circumstances. After maintaining your 1-d-1 ag exemption status for one calendar year then you have the option of converting to the wildlife tax valuation commonly referred to as the wildlife exemption.

To qualify a home must meet the definition of a residence homestead. A Texas landowner interested in obtaining a wildlife exemption must currently be approved for an agricultural property tax exemption. The homeowner must be an individual and use the home as his or her principal residence as of January 1 of the tax year.

Next the landowner must complete form Application for 1-D-1 Open Space Agricultural Appraisal provide the wildlife management information required and attach form Wildlife Management Plan for agricultural tax valuation PWD-885. Download Form The form used to apply for a Texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. You have the right to receive notice of any increases in the appraised value of your property.

If you can prove that you farm as a business and not just for recreation you can get both property tax breaks and income tax breaks. All or only a part of your propertys values can be exempt from property taxes. AAAB members serve for two-year staggered terms.

Applications for property tax exemptions are filed with appraisal districts. Texas Ag Exemption What is it and What You Should Know Dr. To apply for exemption complete AP-204 and reference the statutory citation that establishes the exemption.

Texas Tax Code Section 1142 c School Tax Ceiling. Plus the owner pays 7 percent interest for each year from the date the taxes would have been due.

Landmark Wildlife Management Wildlife Exemption

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Ag Exemption Explanation Denton

Wildlife Exemption Requirements In Texas

Wildlife Exemption Requirements In Texas

Ag Exemption Explanation Denton

2017 2021 Form Tx Comptroller 01 924 Fill Online Printable Fillable Blank Pdffiller

2017 2021 Form Tx Comptroller 01 924 Fill Online Printable Fillable Blank Pdffiller

Ag Exemptions And Why They Are Important

Ag Exemptions And Why They Are Important

Landmark Wildlife Management Wildlife Exemption

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Horse Property For Sale In Fort Bend County Texas Rare Ag Exempt Unrestricted 5 Acre Horse Ranch In Fort Bend Count Horse Ranch Horse Facility Horse Property

Horse Property For Sale In Fort Bend County Texas Rare Ag Exempt Unrestricted 5 Acre Horse Ranch In Fort Bend Count Horse Ranch Horse Facility Horse Property

2017 2021 Form Tx Comptroller 01 924 Fill Online Printable Fillable Blank Pdffiller

2017 2021 Form Tx Comptroller 01 924 Fill Online Printable Fillable Blank Pdffiller

Beware Of Designation Of Homestead Offers Texas Ag Warns

Beware Of Designation Of Homestead Offers Texas Ag Warns

Equestrian Estate For Sale In Harris County Texas The Acreage Is Setup As Ag Exempt Main House Is Spacious 4 Equestrian Estate Horse Facility Maine House

Equestrian Estate For Sale In Harris County Texas The Acreage Is Setup As Ag Exempt Main House Is Spacious 4 Equestrian Estate Horse Facility Maine House

How To Become Ag Exempt In Texas Rustic Wood Signs Texas Photography How To Become

How To Become Ag Exempt In Texas Rustic Wood Signs Texas Photography How To Become

2021 Texas Homestead Tax Exemption

2021 Texas Homestead Tax Exemption

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Ag Exemption Explanation Denton

Equestrian Estate For Sale Jn Denton County Texas Fantastic Opportunity 20 263 Plus Minus Acres Ag Equestrian Estate Horse Property Build Your Dream Home

Equestrian Estate For Sale Jn Denton County Texas Fantastic Opportunity 20 263 Plus Minus Acres Ag Equestrian Estate Horse Property Build Your Dream Home

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home