Property Tax Percentage In California

Typically a mill levy as well as the assessed property value are used to calculate the property tax rate for a home in San Diego. Heres who must pay California state tax whats taxable.

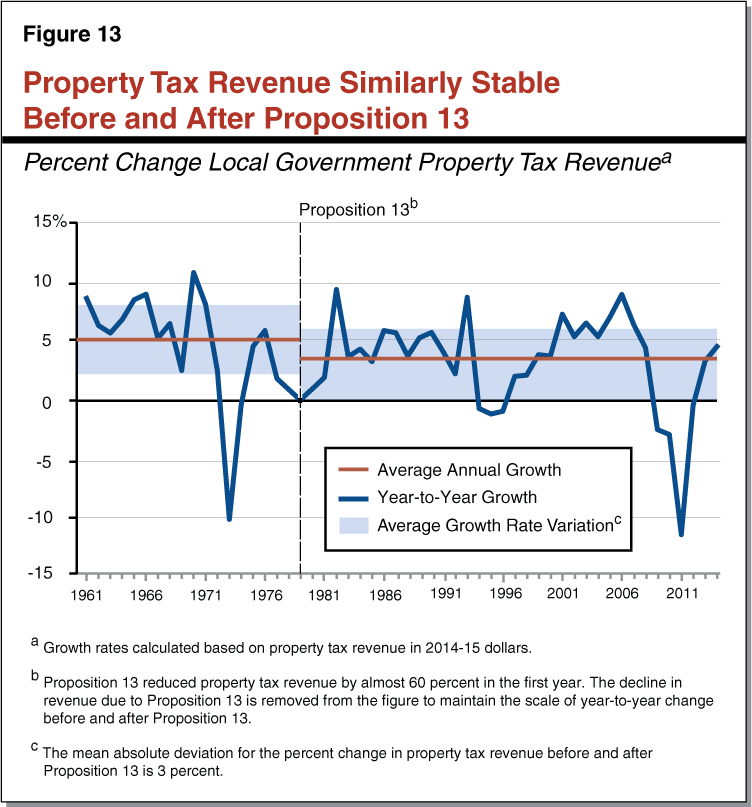

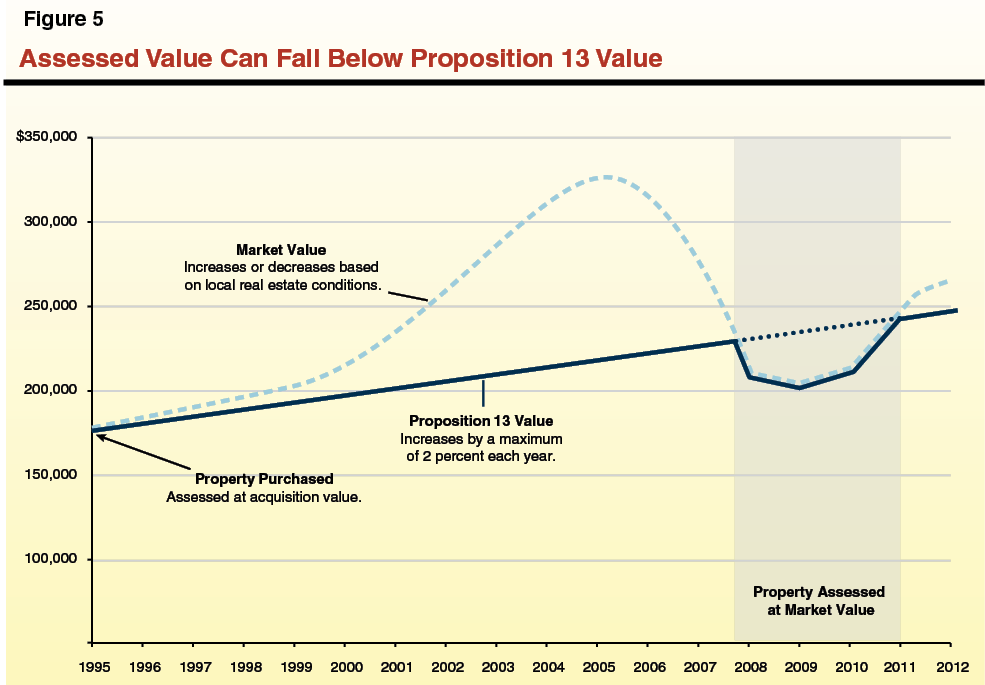

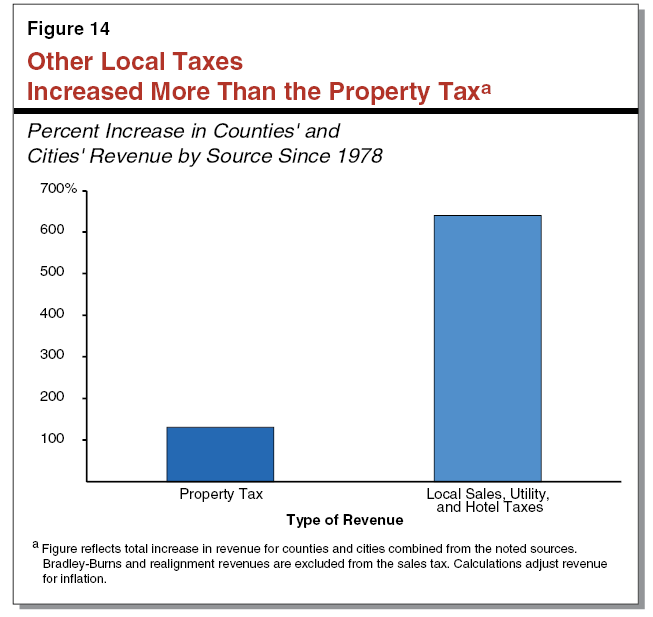

Common Claims About Proposition 13

Common Claims About Proposition 13

And of course taxes.

Property tax percentage in california. When you sell a home in California you are involved in a transaction that exchanges hundreds of thousands of dollars sometimes millions. California property taxes are based on the purchase price of the property. The national average sits at 108.

A California property tax bill includes a variety of different taxes and charges. Arleta Los Angeles 9500. It also limits increases in assessed value to 2 every year except if the home has changed ownership or undergone construction.

In 2017 Investopedia reported the average. The average effective property tax rate in California is 073. Proposition 13 passed by Californias voters in 1978 sets the maximum allowable property tax rate at 1 of a homes assessed value.

As shown on the sample property tax bill in Figure 1 these levies commonly include. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. The tax brackets in California range from a low of just 1 to a high of 123.

Property Tax Division Mission Statement. Property tax rates in California generally fall within the range of 11 percent to 16 percent of assessed value with an average close to 111 percent. Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land.

The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. Property taxes provide a major source of income for the state of California as such they are carefully calculated into a percentage. Additional tax rates to pay for local voterapproved debt.

The property tax raised more than 621 billion for local government during 2016-17. Today it is Californias counties cities schools and special districts that depend on the property tax as a primary source of revenue. Calculating Property Taxes in California.

Some information relating to property taxes is provided below. Taxes are not an area where you want to. To administer accurately and efficiently the billing collection and reporting of property tax revenues levied as directed by California State Law and County Ordinances and assist the public with understanding property tax information in.

California state tax rates are 1 2 4 6 8 93 103 113 123. The average effective property tax rate in California is 077. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor.

These funds were allocated as follows. California property tax rates typically fall between 11 percent to 16 percent of its assessed value. Of course the average tax rate in California varies by county.

Lets talk in numbers. Being a progressive state with a progressive income tax system there. 2020 rates included for use while preparing your income tax deduction.

California Property Tax Calculator. This rate includes any state county city and local sales taxes. 1788 rows Humboldt.

This compares well to the national average which currently sits at 107. It is understandable then that a lot of paperwork is involved in this transaction. Tax Rate The annual tax rate used to compute your property taxes Annual Increase If the assessed value is automatically increased and taxed on the increased value then enter that percentage here.

For example California increases the assessed value each year at the rate of inflation up to 2 maximum. Counties 15 percent cities 12 percent schools school districts and community. An extra 1 may apply.

How Property Taxes in California Work. Californias overall property taxes are below the national average. If a property has an assessed home value of 300000 the annual property tax for it would be 3440 based on the national average.

So when you buy. The 1 percent rate established by Proposition 13 1978. The exact property tax levied depends on the county in California the property is located in.

The latest sales tax rate for Placentia CA. The average effective after exemptions property tax rate in California is 079 compared with a national average of 119. Marin County collects the highest property tax in California levying an average of 550000 063 of median home value yearly in property taxes while Modoc County has the lowest property tax in the state collecting an average tax of 95300 06 of median home value per year.

California Property Taxes Explained Big Block Realty

California Property Taxes Explained Big Block Realty

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

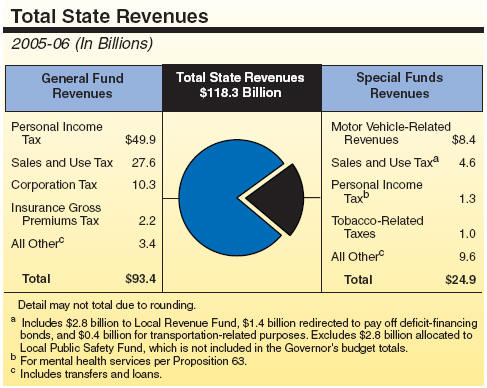

California S Tax System A Primer

California S Tax System A Primer

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

California Taxes A Guide To The California State Tax Rates

California Taxes A Guide To The California State Tax Rates

Understanding California S Property Taxes

Understanding California S Property Taxes

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Common Claims About Proposition 13

Common Claims About Proposition 13

Understanding California S Property Taxes

Understanding California S Property Taxes

California S Tax System A Primer

California S Tax System A Primer

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Labels: percentage, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home