How To Find Comparable Properties For Tax Appeal

Preparing a Building Equity Analysis. Similar to your property.

Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High The Neighbourhood Statement Assessment

Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High The Neighbourhood Statement Assessment

Submit your appeal before the townships deadline and only once.

How to find comparable properties for tax appeal. If you want to find the sale price of a specific comparable the county usually keeps those records. Only submitted filings will be received by the CCAO. In some counties you can search online but in others you may have to go to the courthouse.

You may review the classifications of other properties used in the same way as yours. To attach comparable properties with your appeal requires some specific steps. On the Block and Lot line enter your propertys identification numbers under subject and the numbers of the first three comparable properties under.

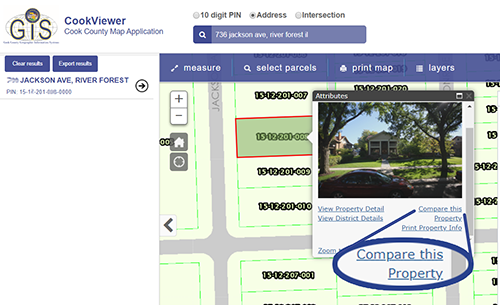

If youre willing to shell out between 350 and 600 you can hire an appraiser to give you a professional opinion of. Click on Compare properties Find properties that are comparable to yours. Request a list of recently sold properties in your area from a real estate agent.

One thing to note is that county records dont show seller concessions. Research the sales of comparable properties. Then enter your propertys address or PIN.

Dont expect to run some simple mathcomp A comp B comp C divided by three to get your list price. To find properties that are comparable to yours. Median AVPSF for similar properties is 050 100000 sq.

Ask the assessor to explain the criteria used to classify your property. Local brokers or appraisers in the area may also share data regarding sales listings or lease information. This online mapping tool is a useful way to compare properties and their assessed values.

Your tax bill should list the assessed value of your home which is the basis for your tax bill. Wondering how to find comparables for property tax appeals. You have two options.

Values of similar properties in your neighborhood. Ask a REALTOR to find three to five comparable properties -- comps in real estate jargon -- that have sold recently. While you no longer have to be an agent or home appraiser to find comparable sales aka comps for your own house its still a tricky business.

Base Your Appeal on the Market Appeals can raise or lower your tax bill. See what price homes in a similar area and similar square footage are selling for. It may take a little digging but a visit to the Board of Tax Assessors will reveal whats on file.

To support an appeal based on overvaluation you are encouraged to submit supporting documentation such as recent closing statements or purchase. To support an appeal based on uniformity either you or our analysts can look at comparable properties properties similar to yours and determine whether the assessed value of your property is in line with the assessed values of other comparable properties. Duplicate appeal filings are not recommended.

The list of steps is broadly previewed below but you can also read step-by-step instructions with images. The Board of Review has a comprehensive online appeal filing application available for the filing of assessment appeals. The Lake County Comparable Property Grid is available in the application and can be uploaded to the Board of Review.

Ft x 050 50000 recommended assessment based on equity. The Texas Property Tax Code as revised in 2003 Section 4143 b for appeals. Comparable sales and assessments can be researched through this application.

Review sales data to see what similar properties in your area are selling for. If you are using Cook Viewer to do research for an appeal of your propertys assessed value please read our guide on how to supply comparable properties with an appeal. Before you mount a challenge make sure your homes market value is lower than its assessed value.

If your property has not been inspected recently. See our 4-step guide for how to find and attach comparable properties in the Attachments section. For a fee the agent can find comparable homes in terms of size age number of rooms and location.

Ask a real estate agent to find comps which are the recent sale prices of properties similar to your own in terms of size facilities condition and location.

Find Comparable Properties Cook County Assessor S Office

Find Comparable Properties Cook County Assessor S Office

Commercial Assessment Reporting System Writing Software Report Writing Commercial Real Estate

Commercial Assessment Reporting System Writing Software Report Writing Commercial Real Estate

Cool Property Tax Appeals To Lower Property Taxes Find Your Reason To Appeal Property Tax Homeowners Guide Homeowner

Cool Property Tax Appeals To Lower Property Taxes Find Your Reason To Appeal Property Tax Homeowners Guide Homeowner

How To Challenge A Low Appraisal And Tips For Agents And Appraisers Appraisal Sample Resume What Is Property

How To Challenge A Low Appraisal And Tips For Agents And Appraisers Appraisal Sample Resume What Is Property

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

Homes For Sale Real Estate Listings In Usa Property Tax Real Estate Buying Investment Property

Homes For Sale Real Estate Listings In Usa Property Tax Real Estate Buying Investment Property

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

Enriched Realestate Commercial Property For Sale Commercial Property For Sale Commercial Property Commercial Real Estate

Enriched Realestate Commercial Property For Sale Commercial Property For Sale Commercial Property Commercial Real Estate

San Diego County Public Records Public Records San Diego Records

San Diego County Public Records Public Records San Diego Records

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeal Consulting Business Course An Evergreen Consulting Business That Needs C Consulting Business Business Courses Tax Consulting

Property Tax Appeal Consulting Business Course An Evergreen Consulting Business That Needs C Consulting Business Business Courses Tax Consulting

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

/Comparative-Market-Analysis.Folger-656a8b7e5889401c94eacd9b0eccf8d2.jpg) Comparative Market Analysis Cma Definition

Comparative Market Analysis Cma Definition

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Checklist Real Estate Forms Real Estate Investing

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Checklist Real Estate Forms Real Estate Investing

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Inoii Com G Learn Affiliate Marketing Marketing Checklist Email Marketing Examples

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Inoii Com G Learn Affiliate Marketing Marketing Checklist Email Marketing Examples

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Find Comparable Properties Cook County Assessor S Office

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Labels: appeal, comparable

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home