Property Tax On Car In Ri

The Tax Collectors Office collects Real Estate Tax Personal Property Tax Motor Vehicle Tax Water and Sewer payments. So for example a rate of 2000 is equal to 20 in tax for every 1000 in assessed value.

Http Economicprogressri Org Wp Content Uploads 2017 04 Car Tax Fact Sheet Final Pdf

A resident of Pawtucket with a high 5330 tax rate and a minimum 500 exemption who owns a 40000 vehicle would pay a 2105 car tax.

Property tax on car in ri. Welcome to the Town of Westerlys Tax Collection webpage. Welcome to the City of Providences Tax Payment System. Currently motor vehicle tax rates per thousand dollars of assessed value range by municipality from a low of 975 per thousand in New Shoreham to a high of 6000 per thousand in Providence.

Division of Municipal Finance One Capitol Hill 1st Floor Providence RI 02908 Phone. Vehicles registered in Providence RI are taxed for the previous calendar yearThe car tax is not a real time tax. For example the 2017 tax bill is for vehicles registered during the 2016 calendar year.

We also process Municipal Lien Certificates and sell town beach passes seasonally May - September for more information on Beach Passes Click Here. For example if your bill of sale is dated July 26 2020 sales tax is due on or before August 20 2020. Cities and towns in Rhode Island set tax rates to pay for things like schools parks and law enforcement.

Taxes are considered delinquent if not paid within 7 days of the due date. Office of the Governor. By law you are required to physically return your plates to the Rhode Island DMV.

You are taxed on how many days out of 365 days of the year your vehicle is registered. 40 rows In all other RI municipalities motor vehicles are assessed at 100 before any adjustments. Section 44-18-20 imposes a tax on the storage use or other consumption in this state of tangible personal property purchased from any retailer at the current rate on the sale price of the property.

Each year real estate taxes are due May 31 August 31 November 30 and February 28. Do not constitute the proper way of cancelling your registration. 401 462-4368 Contact Us Customer Service Agreement DMV Feedback Form.

Payments accepted include real estate tangible property and motor vehicle excise taxes. Payments made will update to your account in real-time. No that does not.

Google names Warwick as Rhode Islands eCity. Sales tax on vehicle sales is due on the 20th day of the month following the month in which the sale took place. Business Relief Programs Including RI on Pause Application Information Learn More Now.

Moving selling gifting junking your vehicle throwing away your plates registering your vehicle in a new State etc. Select the type of payment you would like to make from the Select Tax Payment Type menu aboveYou can also view your current and previous year tax statements by selecting the Tax Statements menu abovePlease be advised payments made by CreditDebit cards will be charged a convenience fee of 285 of the amount being paid. RIDE Funding.

Article 11 caps the maximum tax rate at 60 in FY2018 and then lowers in steps down to 20 in FY2023. Real Estate 1432 per 1000. In FY2024 the tax is eliminated.

Important Information Regarding Sales Tax Customers are required to remit sales tax to the State in a timely manner. Property Tax Cap. A resident of Block Island with a 975 rate and 1000 exemption would only pay 380 for the same car.

Motor Vehicle Tax Personal Property Tax Real Estate Property Taxes Utility Bills. You are taxed on the amount of days you have an active registration. RI Office Auditor.

Please be advised payments made by CreditDebit cards will be charged a convenience fee of 285 of the amount being paid. Motor vehicle bills must be current in order to receive clearance to Register with the RI Department of Motor Vehicles. Rhode Island Property Tax Rates.

Real estate motor vehicle tangible and sewer taxes can be paid on-line in person at the Town Hall or by mail sent to Cumberland Town Hall PO Box 7 Cumberland RI 02864. Tax rates are expressed in dollars per 1000 of assessed value. State of Rhode Island - Division of Taxation Sales and Use Tax Regulation SU 87-65.

For more information on tangible tax bills please visit the Assessors Division. The motor vehicle bills and tangible tax bills are for the prior calendar year. Warwick City Hall 3275 Post Road Warwick RI 02886 401 738-2000.

401 574-9912 Directions Staff Directory. Division of Motor Vehicles 600 New London Avenue Cranston RI 02920-3024 Phone. Motor Vehicles - Gifts of.

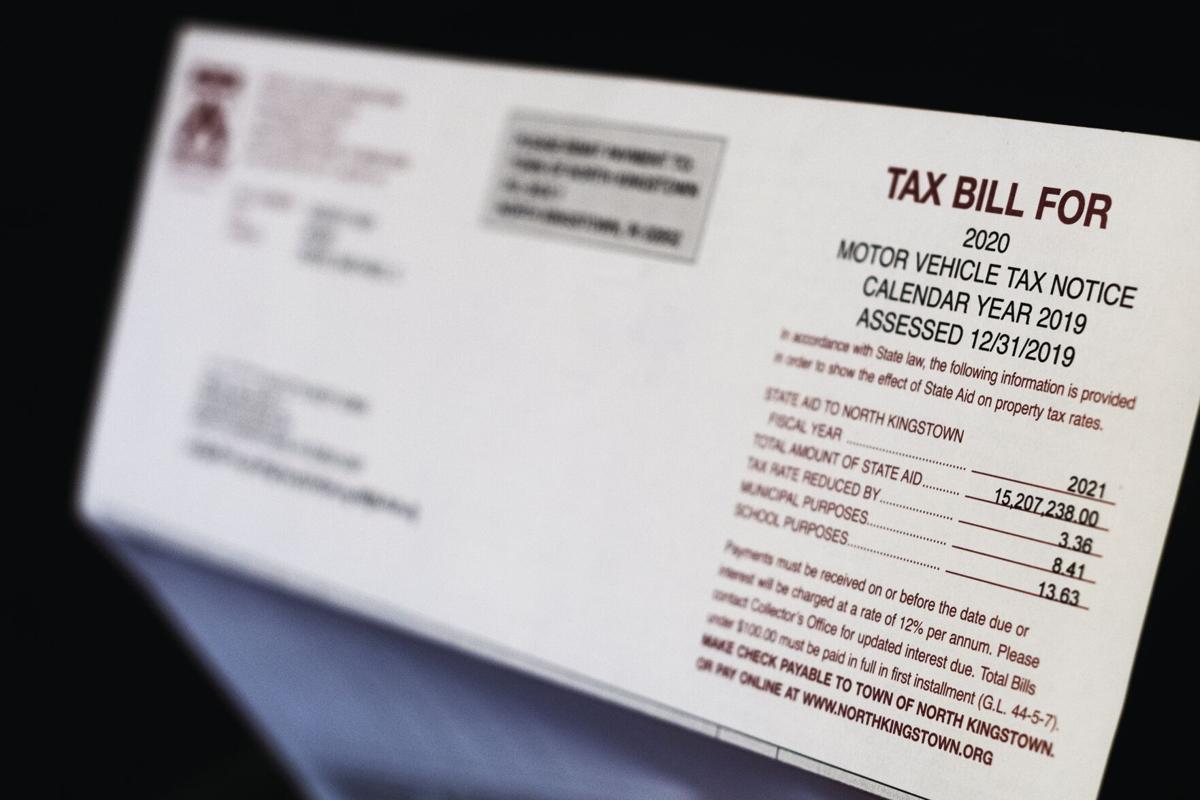

The Tax Rates for the Tax Roll Year 2020. PROVIDENCE Property-tax bills have gone out across Rhode Island but in most cities and towns they do not include car taxes.

Understanding Rhode Island S Motor Vehicle Tax

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Http Economicprogressri Org Wp Content Uploads 2017 04 Car Tax Fact Sheet Final Pdf

A List Of Some Of The Taxes We Pay Federal Income Tax Indirect Tax Capital Gains Tax

A List Of Some Of The Taxes We Pay Federal Income Tax Indirect Tax Capital Gains Tax

Ri Gov Town Of Bristol Tax Payments

Ri Gov Town Of Bristol Tax Payments

Portsmouth Home Portsmouth Zillow My House

Portsmouth Home Portsmouth Zillow My House

Comments By Seller Excellent Condition Everything Is In Genuine Condition As Good As A Brand New Car After Market Alloy Ri Toyota Corolla Toyota Corolla Car

Comments By Seller Excellent Condition Everything Is In Genuine Condition As Good As A Brand New Car After Market Alloy Ri Toyota Corolla Toyota Corolla Car

12 Tax Tips To Consider When Buying A Shore Or Vacation Property This Summer Rhode Island Beaches Beach Cottages Beach Cottage Decor

12 Tax Tips To Consider When Buying A Shore Or Vacation Property This Summer Rhode Island Beaches Beach Cottages Beach Cottage Decor

Http Economicprogressri Org Wp Content Uploads 2017 04 Car Tax Fact Sheet Final Pdf

Pay Progressive Car Insurance With Credit Card Authorization To Repair Form Bonner Body Shop Progressive Car Insurance Cash Flow Statement Car Insurance

Pay Progressive Car Insurance With Credit Card Authorization To Repair Form Bonner Body Shop Progressive Car Insurance Cash Flow Statement Car Insurance

Rhode Island Map Rhode Island History Rhode Island Island County

Rhode Island Map Rhode Island History Rhode Island Island County

Http Economicprogressri Org Wp Content Uploads 2017 04 Car Tax Fact Sheet Final Pdf

Http Economicprogressri Org Wp Content Uploads 2017 04 Car Tax Fact Sheet Final Pdf

Http Economicprogressri Org Wp Content Uploads 2017 04 Car Tax Fact Sheet Final Pdf

The Official Web Site Of The Town Of Tiverton Rhode Island Vehicles

The Official Web Site Of The Town Of Tiverton Rhode Island Vehicles

Portsmouth Home Portsmouth Zillow My House

Portsmouth Home Portsmouth Zillow My House

Officials Your Car Tax Bill Is Still Coming News Independentri Com

Officials Your Car Tax Bill Is Still Coming News Independentri Com

Car Donations Ri Car Car Sit Donate

Car Donations Ri Car Car Sit Donate

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home