How Do I Lookup My Property Tax Bill Online

1 if paid in February. Review the tax balance chart to find the amount owed.

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

To get a copy of your bill before 2018 contact Customer Service via phone email or chat.

How do i lookup my property tax bill online. Make an Online Property Tax Payment Part 3. When the discount period ends on a weekend or holiday. Show instructions for searching.

To search a range of assessments you may enter any of the following. You can view copies of your bill back through 2018. The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes.

To locate the amount of your Secured Property Taxes click the following link How much are my property taxes. Click on the year of the bill that you wish to view. Enter Debit or Credit Card Details.

Create an Online Profile. Read the following if making payments online or by phone. For inquiries regarding real property tax for 2020 and prior please contact the Tax Collector at 864-596-2597.

3 if paid in December. If you have further questions please contact our office at 951955-3900 or e-mail your. All tax payments are due before April 1 at which time the taxes become delinquent and additional charges will apply.

For best search results enter a partial street name and partial owner name ie. Florida Statute 197162 offers taxpayers a discount paying their taxes early. Tax Bill Search The information provided in these databases is public record and available through public information requests.

If a receipt is requested the receipt date will show the Treasurers posting date and not the online payment date. Make an Online Property Tax Payment Part 2. Click on Bills tab.

2 if paid in January. The tax statement provided by this website has been prepared from Tax Office data current as of the date printed on the statement and is subject to changes or corrections. Online payments will be received and posted by the Treasurers office on the first business day excluding weekends and holidays after the online payment was made.

The Board of Tax Assessors is responsible for property. Property Tax Search Dashes must be used. Current year is available between October 1 and June 30 only.

The list below has links to county websites where property records can be searched online or property tax payments can be made online. You do not need to request a duplicate bill. Welcome to the online Property Tax Lookup.

In the Value field at the right enter your assessment number ie. You must pre-pay for the years requested by cash personal check or money order. If you do not know your Parcel Number you may look it up here.

Ways to pay your taxes. Pay Property Tax Online. You can see property value and tax information back through 2008.

To view andor pay your SecuredUnsecured Property Tax Bills enter the ParcelAccount Number below and click the submit button. The Property Tax Lookup is a convenient way to review your City of Toronto property tax account anytime anywhere from your computer or mobile device. Owner Name Last Name First Name Property Control Number.

However there is still a 100 fee for walk-in or mail requests. To find and pay property taxes. If you encounter a problem accessing a website on this list you will need to contact the office of the Board of Tax Assessors or the Tax Commissioner in the county.

Search by address Search by parcel number. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. Make an Online Property Tax Payment Part 1.

Please allow 2-3 business days for the payment to show as posted. This is a summary of your. You can always download and print a copy of your Property Tax Bill on this web site.

And enter your Assessors Identification Number. See property taxes paid in previous years. You can view and print property tax payment history for prior years online for free.

For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at 8888072111 or 2139742111 press 1 2 and then press 9 to reach an agent Monday Friday 800am. An email reminder will be sent approximately two weeks prior to each delinquent. When the results are returned click the Property Control Number to view andor pay.

To view or pay your property taxes please have your tax bill s ready and available to enter all of the required information. Property Address Address must be entered as it appears on the tax bill Click Search. 4 if paid in November.

124 Main rather than 124 Main Street or Doe rather than John Doe. Register your email address here to receive property tax bill reminders. Choose options to pay find out about payment agreements or print a payment coupon.

If you have trouble searching by Name please use your Property Tax Account Number or your Property Address. If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment. This website provides current year and delinquent secured tax information.

You can access this new web site by clicking the link below or by directing your browser to. To look up your property tax billstatement. If delinquent taxes are owed current bills cannot be accepted online or by phone.

Details provided include account balance current and previous billing amounts payment details due dates and more. Enter the address or 9-digit OPA property number.

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Information Lake County Il

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Tax

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Tax

San Diego County Public Records Public Records San Diego Records

San Diego County Public Records Public Records San Diego Records

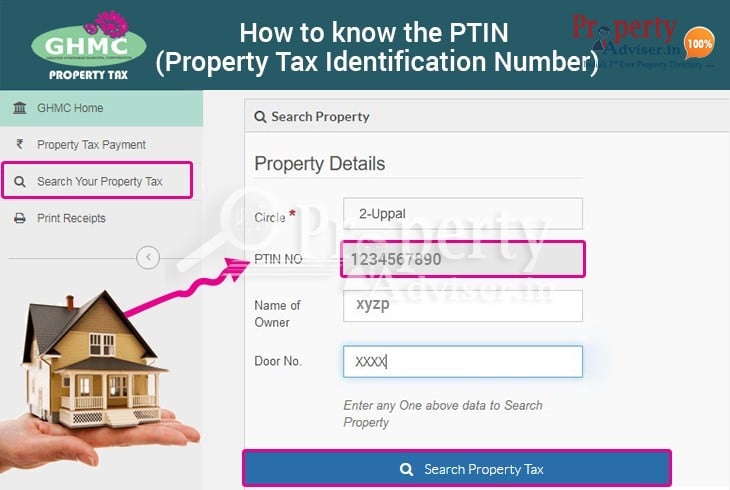

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Current Payment Status Lake County Il

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Info About The Property Tax Bill For San Diego County Property Tax San Diego County Informative

Info About The Property Tax Bill For San Diego County Property Tax San Diego County Informative

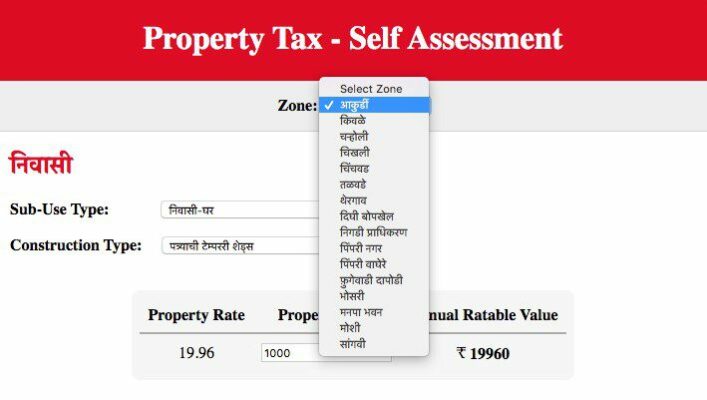

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Labels: bill

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home