Property Tax Bill Suffolk County New York

It gives the Suffolk County Clerks Office great pride and pleasure to offer you for the first time online access to land records. You may obtain copies or certified copies of documents by visiting Public Access or by requesting them by mail.

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

In addition if the Liber and Page numbers for deeds and mortgages.

Property tax bill suffolk county new york. Requests by mail require the property tax map identification number located on the property tax bill include a photocopy with your request or you may contact the Town Assessors office in which the property is located to obtain the property tax map identification number. The Tax Map Division has the responsibility and is the sole authority responsible for creating and maintaining the tax maps of Suffolk County. Bills are generally mailed and posted on our website about a month before your taxes are due.

Assessors assign a code to each property on an assessment roll. NYC is a trademark and service mark of the City of New York. Suffolk County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Suffolk County New York.

Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due. Equalization rates are necessary to calculate tax rates for counties. To provide targeted relief on late property taxes to Suffolk County property owners suffering.

We do not determine the tax rates we only collect the taxes. Suffolk County has one of the highest median property taxes in the United States and is ranked 12th of the 3143 counties in order of median. New York State developed property class codes to provide a statewide uniform classification system for assessment administration.

Begining March 13 2020 there will be only limited access to the services of the Suffolk County Real Property Tax Service Agency until further notice. Verification is a procedure that helps to maintain the most current information on each tax map parcel and is required by law prior to recording of many documents. The median property tax in Suffolk County New York is 7192 per year for a home worth the median value of 424200.

The County occupies the easternmost portion of Long Island in the southeastern portion of New York. These records can include Suffolk County property tax assessments and assessment challenges appraisals and income taxes. Town County and School Taxes in Suffolk County cover the period from December 1st through November 30th of the following year.

Property tax bill for 12012020 to 11302021. Taxes become a lien on December 1st of each year. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance.

Documents may be mailed to the agency at 300 Center Drive Riverhead New York 11901 or they may be delivered to the county center at the same address and left for processing. Suffolk County collects on average 17 of a propertys assessed fair market value as property tax. State of New York.

The County Comptroller is also authorized to accept partial payments of a minimum of 200 towards any outstanding property tax. If a bank or mortgage company pays your property taxes they will receive your property tax bill. Town County and School taxes in Suffolk County cover the period from December 1st through November 30th of the following year.

For additional information please contact the Suffolk County Comptrollers Office at 631-852-3000 or go to our website at wwwsuffolkcountynygov. Taxes are collected in accordance with New York State Real Property Tax laws and the Suffolk County Tax Act. Public Hearings are set for school county and town budgets.

Tax rate 50 per 1000 of taxable assessed value. SEE Detailed property tax report for 48 Caroline Ave Suffolk County NY. Yearly median tax in Suffolk County.

Taxes are collected in accordance with New York State Real Property Tax Laws and the Suffolk County Tax Act. The property class code should not directly impact the amount of your assessment. Tax bill for property with a taxable assessment of 150000 7500.

Requests by mail require the property tax map identification number located on the property tax bill include a photocopy with your request or you may contact the Town Assessors office in which the property is located to obtain the property tax map identification number. We do not determine the tax rates we merely collect and distribute the taxes. Numerous resources for starting financing or relocating a business in Suffolk County including licensing taxes zoning compliance and more.

See sample report. However if you disagree with the code assigned to your property you. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report.

An act to amend the real property tax law in relation to waiving any interest penalties or other charges for late payment of property taxes due to the COVID-19 pandemic in Suffolk county PURPOSE OR GENERAL IDEA OF BILL. Below is a description of how your taxes are divided up. BOYLE TITLE OF BILL.

NYC is a trademark and service mark of the City of New York. This site contains information on land records recorded and imaged into the Suffolk County Clerks Office Imaging System from 1987 to present. Because they include multiple municipalities and for school.

We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Suffolk County is a located in the US.

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

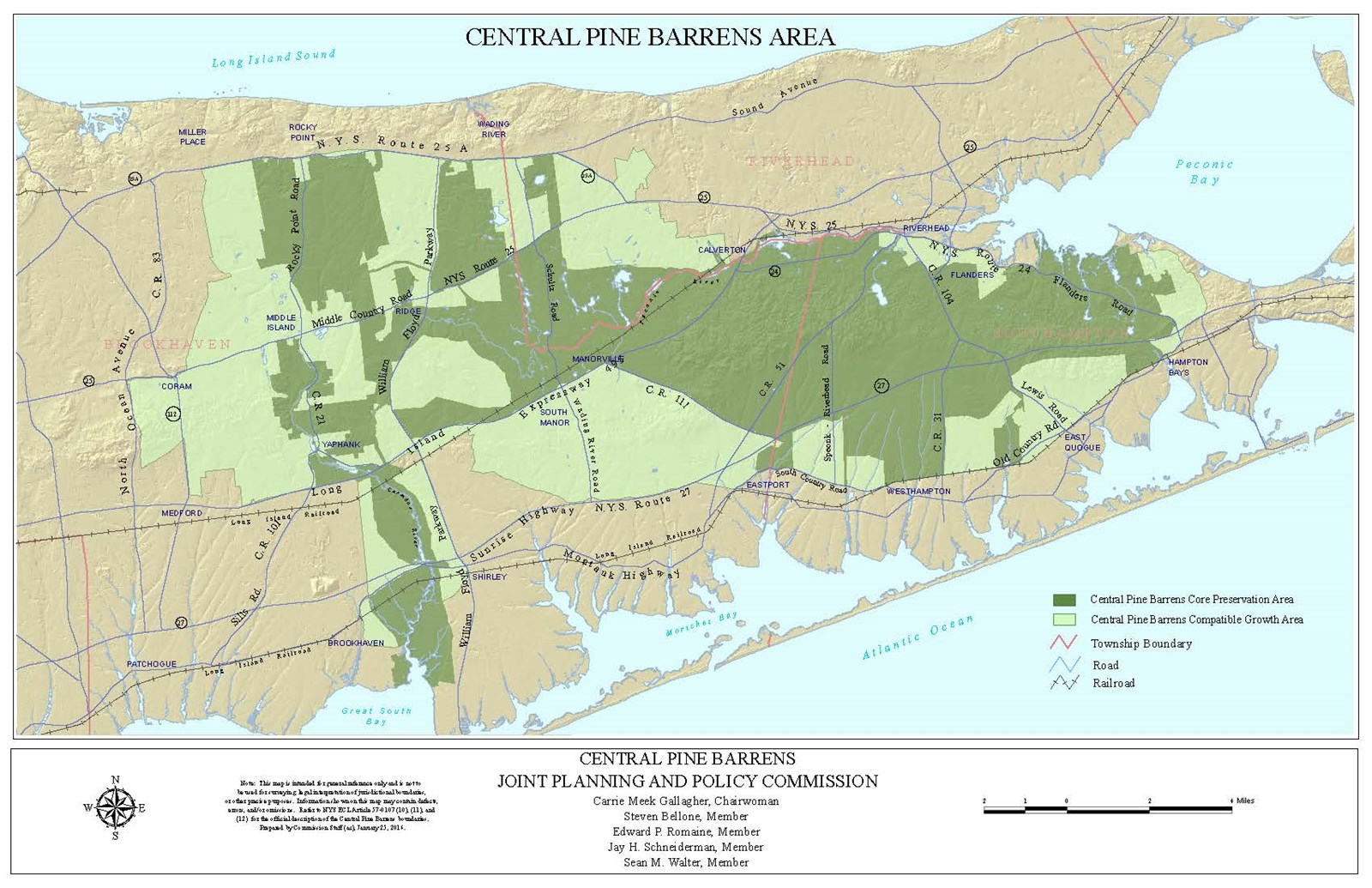

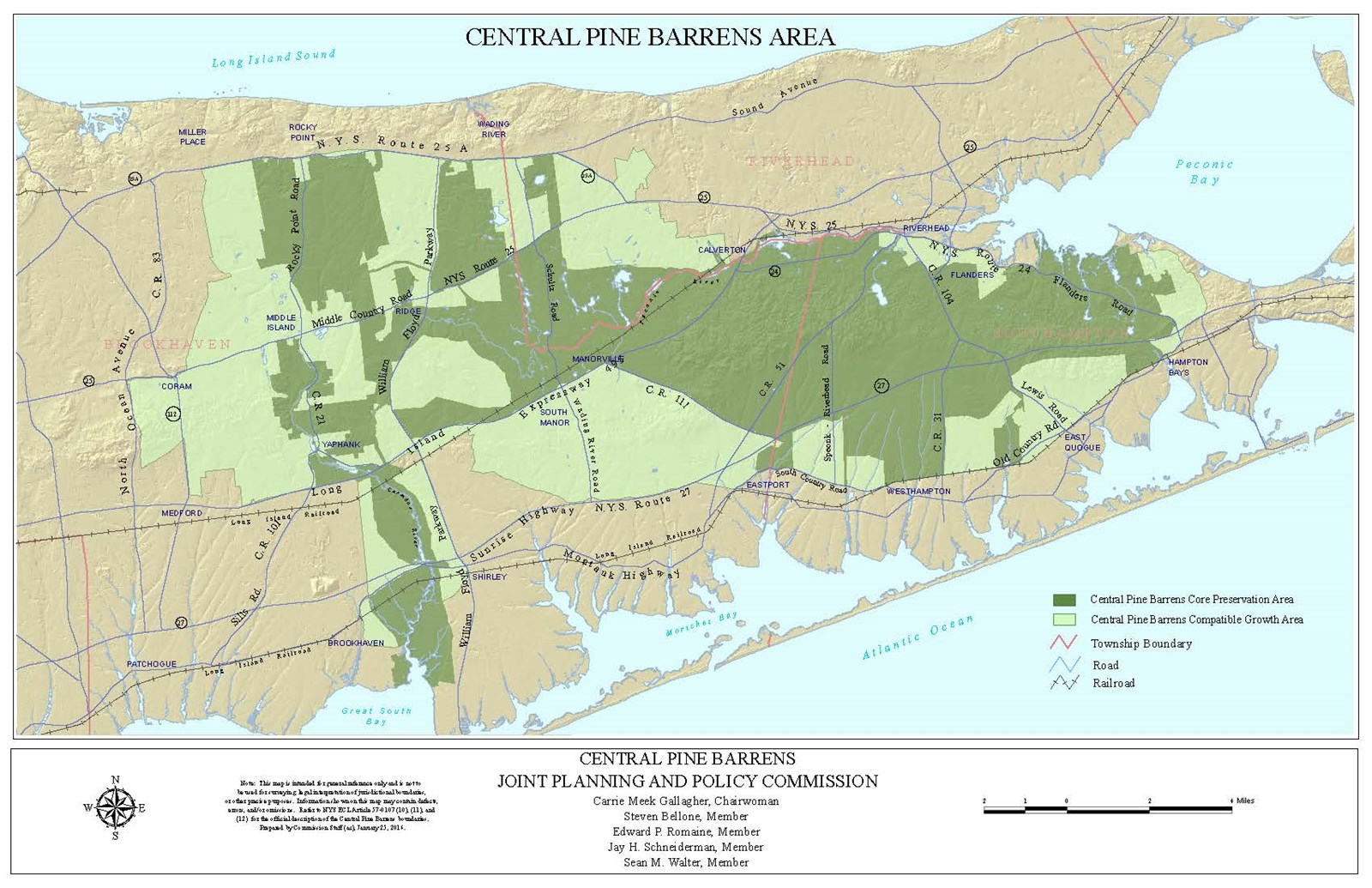

Parcel Location Central Pine Barrens Joint Planning And Policy Commission

Parcel Location Central Pine Barrens Joint Planning And Policy Commission

Https Www Suffolkcountyny Gov Portals 0 Formsdocs Planning Envplanning Aquaculture Alpacunderwater022008 Pdf

Compare Your Property Taxes Empire Center For Public Policy

Compare Your Property Taxes Empire Center For Public Policy

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Https Www Scnylegislature Us Documentcenter View 67791 10112019 Review Of The 2020 Recommended Operating Budget Pdf

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Http Www Osc State Ny Us Files Local Government Documents Pdf 2020 05 Property Taxes In Nys 2019 Pdf

Geographic Information Systems

Geographic Information Systems

Property Tax Map Reforming Government

Property Tax Map Reforming Government

Star Registration Letters In Mail To Suffolk County Homeowners Riverheadlocal

Star Registration Letters In Mail To Suffolk County Homeowners Riverheadlocal

Https Www Dos Ny Gov Lg Countywide Services County Plans Suffolk 20plan Pdf

Https Www Osc State Ny Us Files Local Government Documents Pdf 2020 07 Property Tax Exemptions Pdf

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home