How To Do Taxes In Quebec

Then multiply this number by 45 percent and write the result on line 438. In Quebec the federal and provincial tax returns must be filed separately.

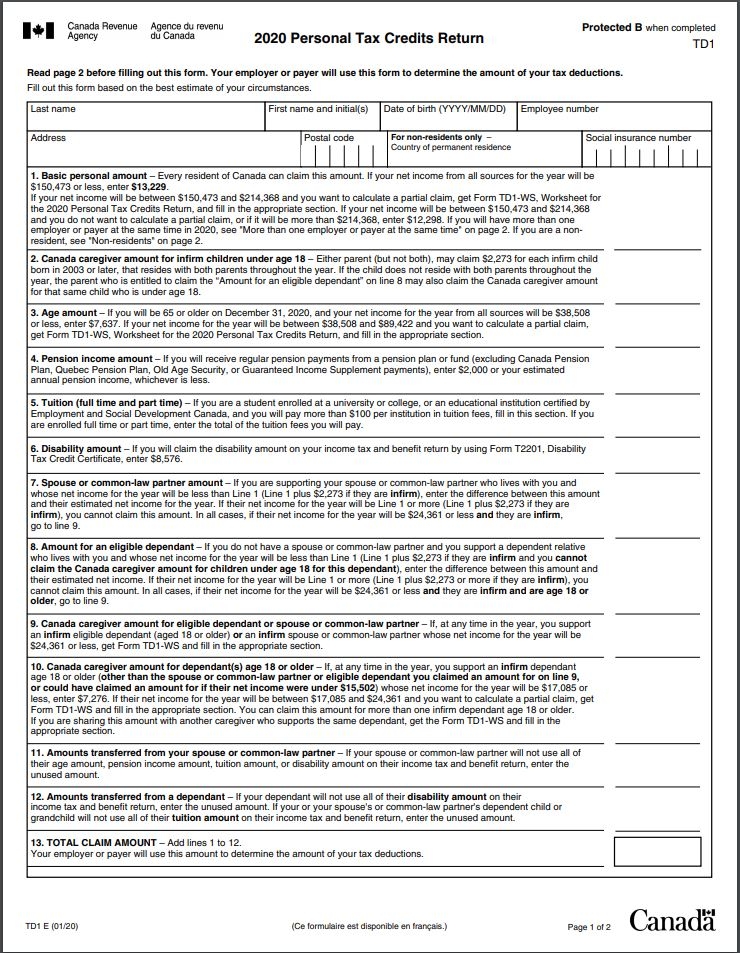

Canada S Federal Personal Income Tax Rates 2021 Turbotax Canada Tips

Filing Your Income Tax Return.

How to do taxes in quebec. For more information visit Revenu Quebec. The goods and services tax GST which is calculated at a rate of 5 on the selling price. The GST and QST are collected on the supply of most goods and services.

Calculate the GST 5 QST 9975 amount in Quebec by putting either the after tax or before tax amount. This marginal tax rate means that your immediate additional income will be taxed at this rate. The most common consumption taxes for Québec residents are.

Go to the Invoice Settings section. The Liberals extended the tax-filing deadline last year from April 30 to June 1 during the first wave of Covid-19 and put off payment of any balances owing until September to ease cash-flow concerns for households. Steps to get ready for 2020 taxes Find out whats new.

Quebec Sales Tax GST QST Calculator 2021 WOWAca. There are different types of free tax clinics. Note this amount on line 437 of your federal return.

File online - There are a variety of software products to meet your needs some of which are free. When you file your income tax return online do not send us any paper copies of the return. You can file your income tax return either online through NetFile Québec or by mail.

Use our Income tax calculator to quickly estimate your. Filing online is fast easy and secure. The filing relief applies to the Quebec return only.

To start grab your T4 slip and find the amount of income tax deducted. Add your information in the field for GSTHST registration number. Claiming this credit involves both your federal and TP1 Québec tax returns.

That means that your net pay will be 40512 per year or 3376 per month. Your federal information slips except those for income earned outside Québec your receipts and other supporting documents unless otherwise indicated. 7 rows Income Tax Calculator Quebec 2020.

Your average tax rate is 221 and your marginal tax rate is 349. You can use commercial software authorized by Revenu Québec to complete your income tax return and file it online using the integrated NetFile Québec feature. Any QPP contributions that you paid should be treated on your tax return as if you contributed them to CPP.

If you work in Quebec the RL-1 will contain important information most notably income tax that has been deducted from your Quebec pay. As a rule employers withhold taxes contributions and premiums from salaries and wages they pay to employees. Find out whats new for 2020 and your filing and payment due dates gather your documents to report income and claim deductions and choose how you want to file and send your completed tax return to the CRA.

These tax clinics are hosted by community organizations across Canada through the Community Volunteer Income Tax Program CVITP and the Income Tax Assistance - Volunteer Program in Quebec. Let us help you through it. If you live in the province of Quebec you may need to file a separate provincial income tax return.

Revenu Québec has a form called the Relevé 1 Revenus demploi et revenus divers the RL-1 form. If you have employment income and deductions from Quebec but reside in another province you will include your Quebec provincial income tax on line 43700 line 437 prior to 2019 of your tax return as part of total income tax deducted. While you may also have a T4 the Quebec information is not on your T4.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. The Québec taxation system is similar to that of Canada and many other countries. Click the checkbox under Disclaimer.

Understand your rights as a taxpayer and who should file a tax return. For more information about online filing go to Get ready to file your 2020 income tax return. The Québec sales tax QST which is calculated at a rate of 9975 on the selling price excluding the GST.

Quebec tax The Government of Quebec develops and administers its own tax laws and policies. Show up during advertised hours and a volunteer will do your tax return for you on a first-come first-served basis. Hit Save at the bottom of the page Register now Instructions to register.

Click for more information PAYING A BALANCE DUE OR RECEIVING A REFUND There are several ways to pay a balance of income tax due or receive an income tax refund whether it is further to receiving a notice of assessment or at any other time. Quebec - 2020 Income Tax Package. Filing your own return.

How To Claim The Solidarity Tax Credit Revenu Quebec Youtube

How To Claim The Solidarity Tax Credit Revenu Quebec Youtube

Delphi Variety Katalogos Ca Greek Pages Plus Montreal Quebec Canada Quebec Canada Montreal Create Website

Delphi Variety Katalogos Ca Greek Pages Plus Montreal Quebec Canada Quebec Canada Montreal Create Website

Taxes In Quebec City Workingholidayincanada Com

Taxes In Quebec City Workingholidayincanada Com

Musee Du Fort Quebec Quebec City Quebec House Styles

Musee Du Fort Quebec Quebec City Quebec House Styles

Pin Su Canada Travels Quebec City

Pin Su Canada Travels Quebec City

Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips

Excel Invoice Template Quebec Invoice Template Online Invoicing Invoicing

Excel Invoice Template Quebec Invoice Template Online Invoicing Invoicing

Winter Sunset On Cap D Espoir Lighthouse Phare En Gaspesie Canada Canada Landscape Canada Quebec Canada

Winter Sunset On Cap D Espoir Lighthouse Phare En Gaspesie Canada Canada Landscape Canada Quebec Canada

Bookkeeping Services In Quebec Bookkeeping Services Accounting Services Accounting

Bookkeeping Services In Quebec Bookkeeping Services Accounting Services Accounting

Where Is Provincial Tax Deducted H R Block Canada

Where Is Provincial Tax Deducted H R Block Canada

Top 10 Best Places To Live In Quebec Canada Quebec Canada Best Places To Live

Top 10 Best Places To Live In Quebec Canada Quebec Canada Best Places To Live

Handyman Bill Sample No Tax Invoice Template Word Invoice Template Invoice Sample

Handyman Bill Sample No Tax Invoice Template Word Invoice Template Invoice Sample

150 Reasons Canada Is Great In Honor Of Its 150th Anniversary Canada Frontenac Trip

150 Reasons Canada Is Great In Honor Of Its 150th Anniversary Canada Frontenac Trip

Check Out The Top 5 Best Places To Live In Canada Best Places To Live Median Household Income Canada

Check Out The Top 5 Best Places To Live In Canada Best Places To Live Median Household Income Canada

Quebec Canada Bell Fun Shaw Ctf

Quebec Canada Bell Fun Shaw Ctf

Resume Templates Quebec Quebec Resume Resumetemplates Templates Resume Examples Good Resume Examples Resume Skills

Resume Templates Quebec Quebec Resume Resumetemplates Templates Resume Examples Good Resume Examples Resume Skills

Taxes In Quebec City Workingholidayincanada Com

Taxes In Quebec City Workingholidayincanada Com

Where Is Provincial Tax Deducted H R Block Canada

Where Is Provincial Tax Deducted H R Block Canada

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home