Can't Pay Property Taxes Due To Covid 19

Due to the financial hardships caused by the Covid-19 pandemic King Countyhas extended the first-half 2020 property tax deadline to June 1 according to a statement released by Dow. The Vigo County Treasurers Office has a new website.

Homeowners have several options to choose from.

Can't pay property taxes due to covid 19. This state pays taxes early in the year usually March 31 but this year they gave a two week extension to April 15th. Officials say the due date has not been extended this year. Property tax amounts are established on the lien date of January 1 of each year.

Drop offs are from 8 am. -- With many people out of work due to the coronavirus COVID-19 pandemic the City Department of Finance DOF is offering several programs to assist property owners who are. Tax bills are likely still due Beyond making mortgage payments landlords may have other expenses to cover too.

Falling behind on your property taxes could under normal circumstances land you in foreclosure but because of the COVID-19 crisis you may have some protection in that. Normally you only have until April 15 to file your previous years tax return and pay the IRS any money it indicates that you owe. Thats a lot of detail but its important for taxpayers experiencing COVID-19-related financial difficulties to know about these available options and how to get the help they need.

Heres the bottom line. VIGO COUNTY Ind. Property taxes which cost a national average of 3500 a year.

Property tax amounts are established on the lien date of January 1 of each year. Property tax assessments are established on the lien date of January 1 of each year. STATEN ISLAND NY.

Monday - Wednesday beginning June 1 2020. Ryan is exploring potential property tax relief as a result of harm caused by COVID-19 to real and business personal property in Texas. Will property tax amounts be reduced due to economic impact of COVID-19.

If youre struggling with your tax bill reach out to us. Will property tax amounts be reduced due to economic impact of COVID-19. WTHI - Vigo County property tax bills are in the mail and they are due Monday May 10.

Will property tax amounts be reduced due to economic impact of COVID-19. Since the financial impact of Covid will extend into next year it is. Once you go to this link.

Under newly enacted Texas Tax Code 1135 taxpayers suffering damage to their property caused by a governor-declared disaster may receive a temporary exemption from a portion of their property tax liability. The property tax amounts currently due for the 2019-2020 Annual Secured Property Taxes have a lien date of January 1 2019 and therefore no reduction based on the economic impact of COVID-19 will be made to the current bill. The property tax amounts currently due for the 2019-2020 Annual Secured Property Taxes have a lien date of January 1 2019 and therefore no reduction will be made to the current bill.

Can I request a penalty waiver if I am unable to make a timely payment due to COVID-19. The majority 61 are concerned they may end up in tax debt due to COVID-19. Our people can help you walk through it.

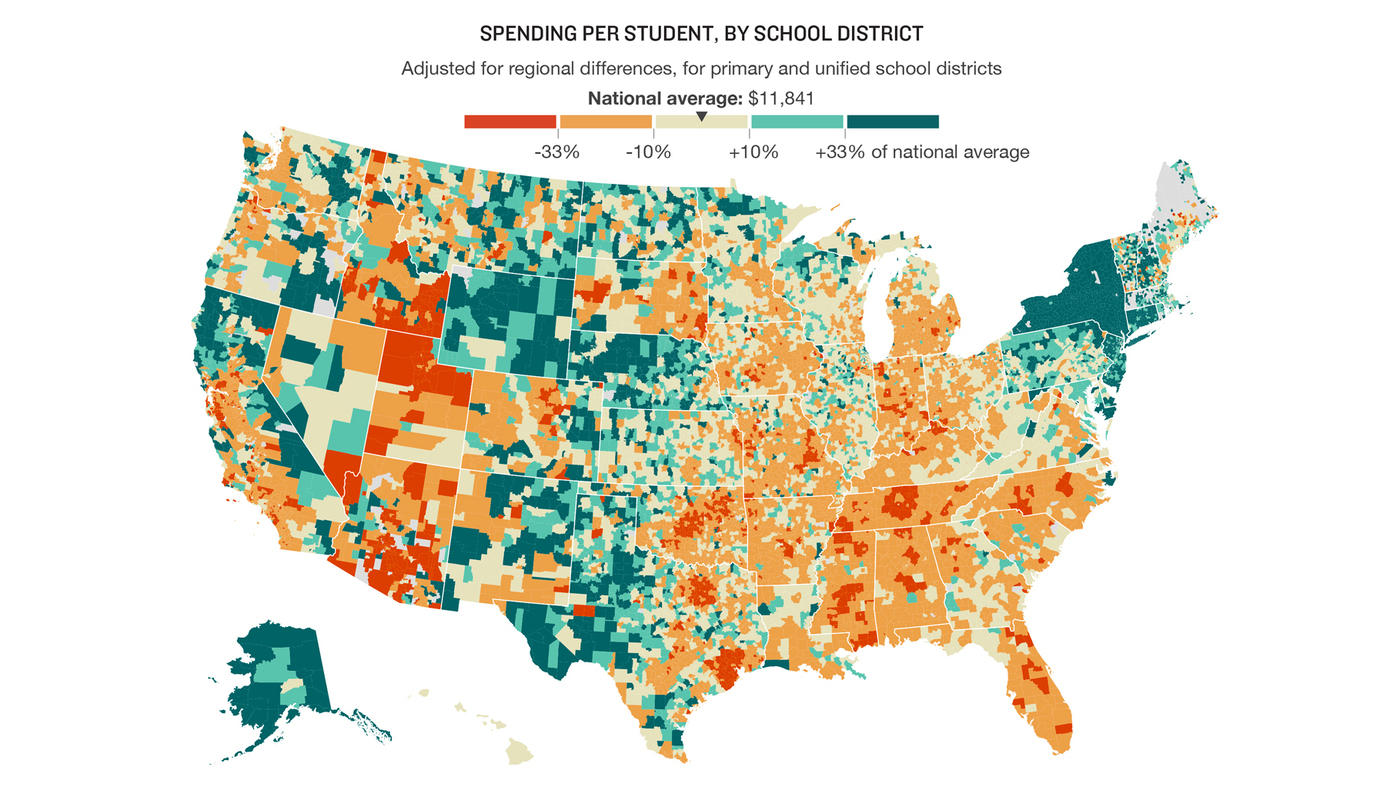

This year however because. Was 3498 in 2018 according to property database ATTOM Data Solutions but in some parts of the country youll pay a lot more. Pennsylvania created a COVID-19 property tax relief program which extends through July 15.

Property Taxes Are Probably Still Due Despite Coronavirus Local governments rely on them to pay for services like trash pickup and the public schools. The average property tax bill in the US. The property tax amounts currently due for the 2019-2020 Annual Secured Property Taxes have a lien date of January 1 2019 and therefore no reduction will be.

Yes you can file a COVID -19 Application for Penalty Waiver with the ACTTC for any installment of property taxes that first became delinquent on or after March 4 2020. Only a handful of states have directed municipalities to issue property tax delays according to the Tax Foundations tracking of state responses to the COVID-19 pandemic. More than a quarter 27 of those on a payment plan with the IRS for old tax debt are concerned about making payments.

How to Manage your Property Tax Accounts during COVID-19 Cómo Manejar sus Cuentas de Impuestos de Propiedad durante COVID19 Drop-off services resumed for FranchisedIndependent Dealerships and Title Services at all Harris County Tax Office locations except for the Kyle Chapman Tax Office location.

Property Taxes Department Of Tax And Collections County Of Santa Clara

How School Funding S Reliance On Property Taxes Fails Children Npr

How School Funding S Reliance On Property Taxes Fails Children Npr

New Property Fraud Warning System Unvieled By Passaic County Clerk S Office Tapinto Passaic County House Deeds County

New Property Fraud Warning System Unvieled By Passaic County Clerk S Office Tapinto Passaic County House Deeds County

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

What Is Your Taxpayer Filing Status Emil Estafanous Cpa Cff Cgma Married Filing Separately Status Mortgage Interest

What Is Your Taxpayer Filing Status Emil Estafanous Cpa Cff Cgma Married Filing Separately Status Mortgage Interest

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

9 States With The Lowest Property Tax Rates In 2021

9 States With The Lowest Property Tax Rates In 2021

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home