Do Senior Citizens Have To Pay Property Taxes In Mississippi

For instance all homeowners age 65 or older are exempt from state property taxes. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence.

Tax Assessor Collector Lamar County Mississippi

Tax Assessor Collector Lamar County Mississippi

There is also an additional bonus exemption on property taxes upon reaching age 65.

Do senior citizens have to pay property taxes in mississippi. Seniors with net taxable income of 12000 or less on their combined taxpayer and spouse federal income tax return are exempt from all property taxes on their principal residence. Erty taxes are determined and utilized in Mississippi. Income Tax - Qualified retirement income is exempt from state income tax.

Mississippi residents benefit from the lowest per capita tax burden in the nation. This does not apply to or affect county municipal or school district taxes. When it comes to taxing real estate you have to look at the local level such as counties cities.

TITLE 27 - TAXATION AND FINANCE. Persons who are 65 years of age and older or who are disabled upon application and proof of eligibility are exempt from all ad valorem taxes up to 750000 of assessed value. In Mississippi all property is subject to a property tax unless it is exempt by law.

27-33-67 - Exemptions for persons over 65 years of age and disabled. Seniors who are 65 or older receive a full exemption on the first 7500 of their propertys assessed value. Personal Property Business Business personal property refers to furniture fixtures machinery equipment and inventory located within businesses.

The application for exemption must be filed with the individual county on or before April 1. Property tax or ad valorem tax is a tax imposed on the ownership or possession of property and is generally based on the value of the property. Property taxes in Mississippi are very low.

The IRS requires you to file a tax return when your gross income exceeds the sum of the standard deduction for your filing status plus one exemption amount. Mississippi is tax-friendly when it comes to retirees. You may be surprised but no state government collects property taxes directly tied to property values.

It is a limit on the amount of taxes you must pay on your residence. Non-military retirees in South Carolina will enjoy a homestead exemption for homeowners over 65. 1 Each qualified homeowner under sixty-five 65 years of age on January 1 of the year for which the exemption is claimed and who is not totally disabled as herein defined shall be exempt from ad valorem taxes.

They also gain an additional bonus exemption on property taxes upon reaching the age of 65. If you are a senior however you dont count your Social Security income as gross income. Where do my property taxes go.

In this way how long do you have to pay property taxes in Mississippi. If you qualify your residence homestead for an age 65 or older or disabled person homestead exemption for school district taxes the school district taxes on that homestead cannot increase as long as you own and live in that home. The vast majority of seniors living in this part of Texas do not have to pay property taxes but you must be at least 65 years old and your Harris County home must be your primary residence.

Property tax revenues are used to support county and city governments and. Chapter 33 - Ad Valorem Taxes - Homestead Exemptions. Exemptions for persons over 65 years of age and disabled.

For seniors however housing costs may be even lower than that. In addition to low tax rates in general retirees living in Mississippi do not have to pay any state income tax on qualified retirement income. The following discussion of the different classes of property the formulation of a tax bill and the distribution of property tax revenues should provide a better understanding of Mississippis property tax system ulti-mately leading to a better educated and more engaged citizenry.

This exempts the first 7500 in assessed value from taxation up to a maximum of 300 off your tax bill. The median annual property tax paid in the state is just 1009 which ranks as the sixth-lowest amount in the country. In addition to low tax rates in general retirees living in Mississippi dont have to pay any state income tax on qualified retirement income.

Find out how taxes are calculated how to pay them and what other fees are involved. The effective property tax rate in Mississippi is one of the 10 lowest in the nation. Homeowners may also be eligible for the Mississippi homestead exemption.

Property taxes are hard to avoid even for senior citizens. These filing rules still apply to senior citizens who are living on Social Security benefits. And anyone over the age of 65 can enjoy a homestead exemption on the first 75000 of the homes value.

If Social Security is your sole source of income then. One reason why could be that the median home value in the state is nearly half the amount of the national median. Honolulu comes close with an exemption of 120000.

You must meet the minimum age for a senior property tax exemption The person claiming the exemption must live in the home as their primary residence The minimum age requirement for senior property.

The 10 Best States For Retirees When It Comes To Taxes Retirement Locations Retirement Advice State Tax

The 10 Best States For Retirees When It Comes To Taxes Retirement Locations Retirement Advice State Tax

Mississippi Property Tax Calculator Smartasset

Mississippi Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

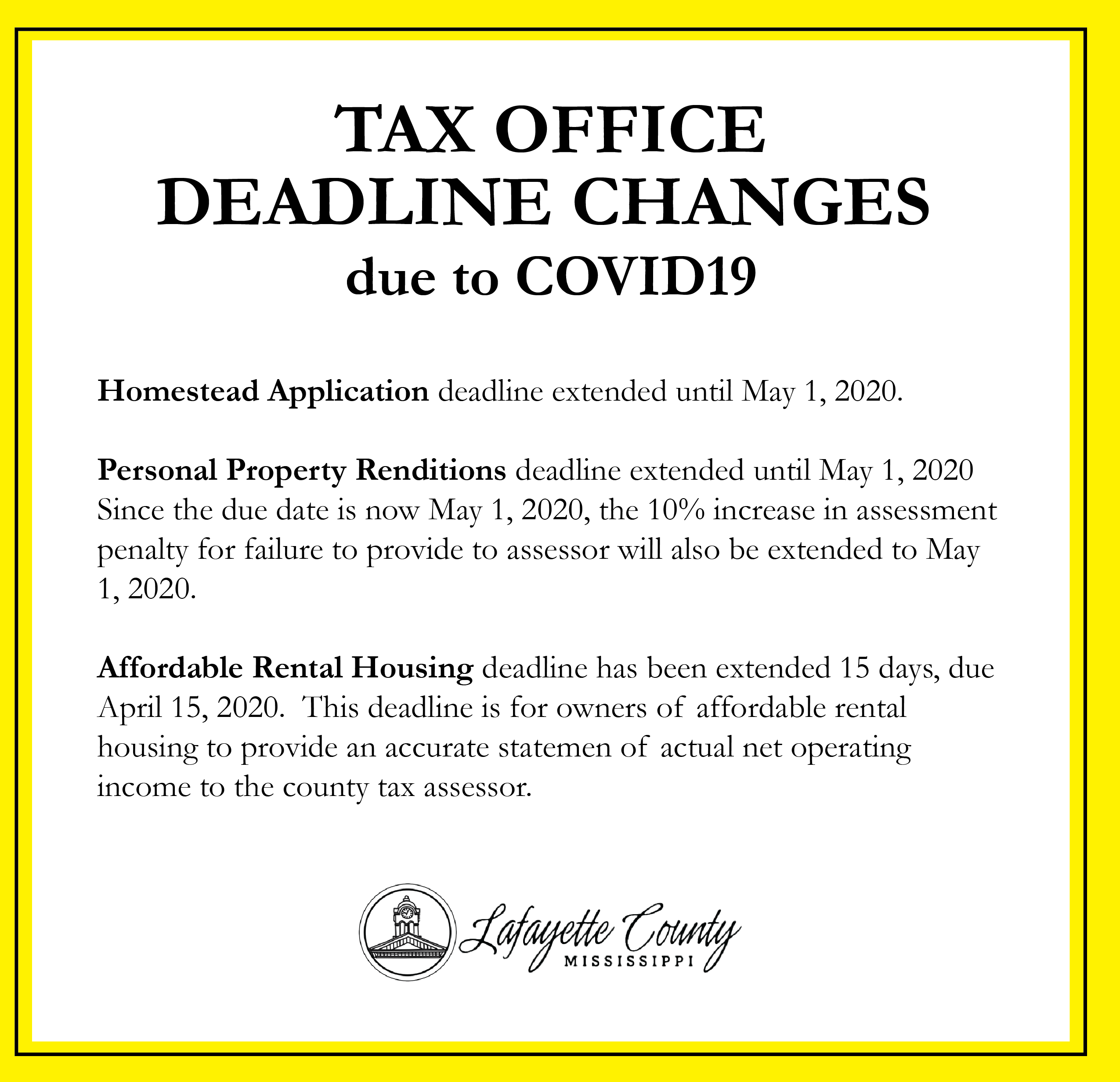

Tax Assessor Collector Lafayette County

Tax Assessor Collector Lafayette County

Mississippi Property Tax Calculator Smartasset

Mississippi Property Tax Calculator Smartasset

Mississippi S 5 Safest Cities Of 2021 Safewise

Mississippi S 5 Safest Cities Of 2021 Safewise

Massachusetts Tops Lgbtq Business Index Mississippi Last Mississippi Lgbtq Business

Massachusetts Tops Lgbtq Business Index Mississippi Last Mississippi Lgbtq Business

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch Retirement Retirement Advice States

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch Retirement Retirement Advice States

Mississippi Retirement Taxes And Economic Factors To Consider

Retirees Moving To These States Can Get Some Great Tax Breaks

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

Ahrq Logo Comparison Of The 50 States And The District Of Columbia Across All Health Care Quality Measu Healthcare Education Health Care American Healthcare

Ahrq Logo Comparison Of The 50 States And The District Of Columbia Across All Health Care Quality Measu Healthcare Education Health Care American Healthcare

State By State Guide To Taxes On Retirees Retirement Strategies Retirement Advice Retirement

State By State Guide To Taxes On Retirees Retirement Strategies Retirement Advice Retirement

Where To Retire Early Health Insurance Early Retirement Life Insurance For Seniors

Where To Retire Early Health Insurance Early Retirement Life Insurance For Seniors

Mississippi Living Taxes Retirement Gulf Coast Heritage Realty Mississippi Gulf Coast Area

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home