Greenville County Sc Vehicle Property Tax Rate

Payment of the taxes on the real property. Citizens can pay property taxes through the mail the internet or by using the convenient dropbox located outside the Tax Office.

The countys average effective rate is 069.

Greenville county sc vehicle property tax rate. Greenville County encourages those needing to pay taxes to avoid coming inside County Square. Greenville County collects on average 066 of a propertys assessed fair market value as property tax. Beaufort County collects the highest property tax in South Carolina levying an average of 131900 045 of median home value yearly in property taxes while Chesterfield County has the lowest property tax in the state collecting an average.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Berkeley County residents should be aware of an upcoming permanent change of location to their local South Carolina Department of Motor Vehicles SCDMV office. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100.

See Clarendon County ex rel. In Greenville primary residences are taxed at 4 percent of their assessed values vehicles and secondary residences are taxed at 6 percent of. Citizens can pay property taxes through the mail the internet or by using the convenient dropbox located outside the Tax Office.

1919 Thurmond Mall Columbia SC 29201. 803-252-7255 800-922-6081 Fax 803-252-0379. Tip If you believe your vehicle value assessment is too high your county auditor may have an appeal procedure.

Some say mileage matters but in all the time I lived in Greenville County South Carolina over 20 years I was never asked for mileage just proof of insurance. SC Code 12 -37-610 and 12-49-20. The annual South Carolina Property Tax Rates Report by County details millage rates for every jurisdiction that levies property taxes in the state.

The largest tax in Greenville County is the school district tax. Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average. We appreciate the contributions of county auditors from each of the 46 counties.

My 2004 Toyota Camry when I left in 2015 was exactly 9107 and that included road tax. Box 8207 Columbia SC 29202-8207. After you pay your taxes the plate or registration decal is mailed to the customer from the SCDMV the next working day.

Greenville County Tax Collector SC 301 University Ridge Greenville SC 29601 864-467-7050. You can pay both the vehicle property taxes and renewal fees at the county treasurers office. In-depth Greenville County SC Property Tax Information.

Please Enter Only Numbers. The exact property tax levied depends on the county in South Carolina the property is located in. The information provided for each county is listed below in the order that it is.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Greenville County Tax Appraisers office. Multiply the value that was received in step two by the millage rate for your area of Spartanburg. In this state you must pay your personal vehicle property taxes before a license plate can be renewed and a new decal issued.

The median property tax on a 14810000 house is 74050 in South Carolina. The millage rate is the amount per 1000 that is used to calculate a tax rate and varies depending on the area where the vehicle was purchased. A leasehold interest will be subject to ad valorem tax if real property that is subject to a property tax exemption is leased for a definite term and the lessee does not qualify for an exemption.

For instance if your vehicles value is assessed at 10000 and the property tax rate is 5 simply multiply 10000 by 5 to get 500 which is what you owe. South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median amount of property taxes collected. Citizens can pay property taxes through the mail the internet or by using the convenient dropbox located outside the Tax Office.

Greenville County encourages those needing to pay taxes to avoid coming inside County Square. The median property tax on a 14810000 house is 97746 in Greenville County. The County accepts credit and debit card payments on our website online.

At the close of business Wednesday June 30 2021 the Moncks Corner SCDMV branch office at 108-B Highway 52 will permanently close. From now until further notice the County will waive the online service fee provided by.

Property Taxes Can Be Complicated Here S What Sc Homeowners And Buyers Need To Know Business Postandcourier Com

Property Taxes Can Be Complicated Here S What Sc Homeowners And Buyers Need To Know Business Postandcourier Com

Congratulations To Sccja Class 650 Tri County Fop Lodge 3 Class Congratulations

Congratulations To Sccja Class 650 Tri County Fop Lodge 3 Class Congratulations

Cities To Move To If You Re Just So Freaking Stressed Meditation Apps American Psychological Association Combat Stress

Cities To Move To If You Re Just So Freaking Stressed Meditation Apps American Psychological Association Combat Stress

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

Logistics Firm Expanding Sc Operations To Serve Volvo Cars Business Postandcourier Com

Logistics Firm Expanding Sc Operations To Serve Volvo Cars Business Postandcourier Com

Traveling For The Holidays Make Sure You Stay Safe On The Roads Autoautoinsurancecar Carinsurance Conn Winter Driving Tips Holiday Road Trip Winter Driving

Traveling For The Holidays Make Sure You Stay Safe On The Roads Autoautoinsurancecar Carinsurance Conn Winter Driving Tips Holiday Road Trip Winter Driving

49cc Mini Atv Quadracer Atv Atv Four Wheelers Mini

49cc Mini Atv Quadracer Atv Atv Four Wheelers Mini

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

Ellison On Broad Greenville S C Apartment Communities Apartment Finder Greenville Sc

Ellison On Broad Greenville S C Apartment Communities Apartment Finder Greenville Sc

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

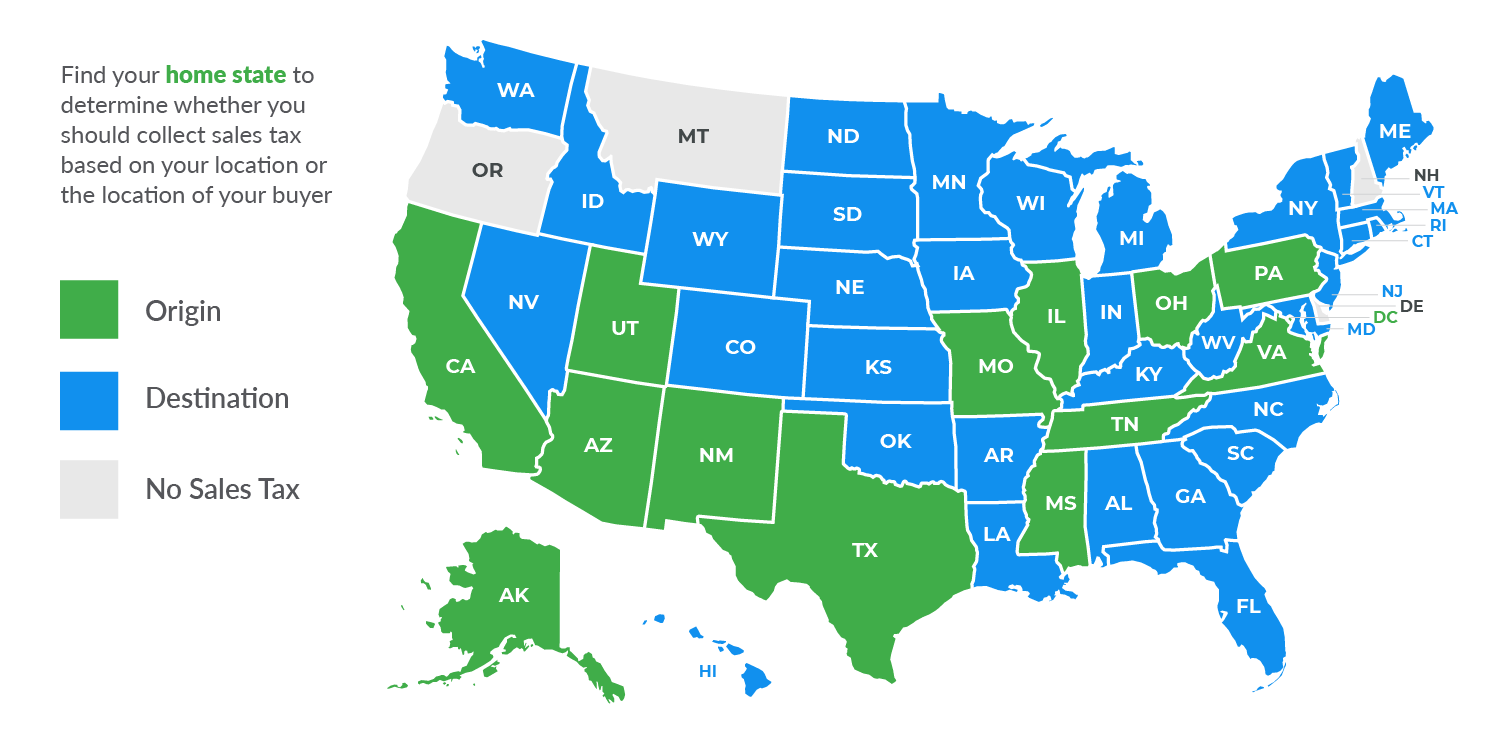

Origin Based And Destination Based Sales Tax Collection 101taxjar Blog

Origin Based And Destination Based Sales Tax Collection 101taxjar Blog

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

Liberty Sc Homes For Sale And Real Estate In Liberty Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Will Real Estate Prices Real Estate Estates

Liberty Sc Homes For Sale And Real Estate In Liberty Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Will Real Estate Prices Real Estate Estates

Residents Pay The Lowest Property Taxes In These States

Residents Pay The Lowest Property Taxes In These States

South Carolina S 20 Safest Cities Of 2021 Safewise

South Carolina S 20 Safest Cities Of 2021 Safewise

Labels: county, greenville, property, vehicle

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home