Can A W2 Employee Deduct Home Office

The IRS allows you to deduct unreimbursed employee business expenses including use of a home office space if the expense is considered to be both ordinary and necessary. Only those who are self-employed filing with a 1099 or statutory employees can claim the deduction for business use of a home home office.

Blank W2 Form 2016 W 2 Laser 3 Up Horizontal Employee Sheet For 2018 Employee Tax Forms Irs Forms Tax Forms

Blank W2 Form 2016 W 2 Laser 3 Up Horizontal Employee Sheet For 2018 Employee Tax Forms Irs Forms Tax Forms

An independent contractor or self-employed youll be able to claim the home office deduction.

Can a w2 employee deduct home office. The short answer. An ordinary expenseis one that is common and accepted in your trade or profession. In other words you must use your home office only for your business.

The more space you devote exclusively to your business the more your home office deduction will be worth. That means if you are an employee who gets a. 102630 SAN DIEGO.

1 2018 and Dec. In practical terms this meant that the employer had to require the employee to work from home. That means if you work from home as an employee for someone else you cant take the home office deduction for tax years between Jan.

The short version is that if you are a W-2 employee you are no longer able to benefit from the home. But if youre self-employed a small-business owner freelancer or rideshare driver for example you may still be. The act now prevents full-time W-2 employees from deducting home office expenses on their 2020 taxes even when they worked from home.

Review the next question for details. The home office deduction is available to qualifying self-employed taxpayers independent contractors and those working in the gig economy. To report employee.

Employees who receive a paycheck or a W-2 exclusively from an employer are not eligible for the deduction even if they are currently working from home the IRS noted last month. Employees who receive a paycheck or a W-2 exclusively from an employer are not eligible for the deduction even if they are currently working from. The only people who can take the home office deduction are those who are self-employed according to Michael Corrente managing director of the tax group at CBIZ MHM an accounting and professional advisory firm.

Medical mortgage interest property taxes charitable giving ect to exceed your Standard Deduction. However the Tax Cuts and Jobs Act suspended the business use of home deduction from 2018 through 2025 for employees. Now however an employee that is a worker who receives a Form W-2 from an employer simply cannot claim a home office deduction for work done for the employer.

That includes sole proprietors and independent contractors. If you are a W-2 employee you probably cannot deduct your home office. This is because the Tax Cuts and Jobs Act eliminated the unreimbursed employee expenses deduction in 2018.

They are not. An employee who falls into one of the below employment categories. To deduct employee business expenses you must have enough itemized deductions ie.

A necessary expense is one that is helpful and appropriate for your business. This video file cannot be played. If you use part of your homesuch as a room or studioas your business office but you also use that space for.

Sadly this valuable tax break was severely limited in the TCJA aka the Trump tax plan. You can take an unreimbursed employee expense deduction. Employees who receive a paycheck or a W-2 exclusively from an employer are not eligible for the deduction even if they are currently working from home according to the IRS.

If youre an employee at a regular job but you also have your own side hustle you can claim deductions for business expenses and the home office deduction for. Skip ahead to question 4. You cant take the home office deduction unless you use part of your home exclusively for your business.

So you may not gain a tax benefit from the deduction. In 2017 the Tax Cuts and Jobs Act suspended tax write-offs for home office deductions through 2025. Work from home is an employee business expense.

If you itemize your deduction is limited to the extent that it exceeds 2 of your Adjusted Gross Income. Employees who receive a paycheck or a W-2 exclusively from an employer are not eligible for the deduction even if they are currently working from home the IRS noted last month. But the ability to write off home office expenses went away in 2018 for most W2 employees.

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Employee Tax Forms Irs Forms

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Employee Tax Forms Irs Forms

Home Office Ideas Working From Home With Your Style 0 002 Regelung Bei Ho Minimalist Office Design Office Interior Design Home Office Design

Home Office Ideas Working From Home With Your Style 0 002 Regelung Bei Ho Minimalist Office Design Office Interior Design Home Office Design

How To File Taxes The Easy And Organized Way Filing Taxes Tax Checklist Tax Prep Checklist

How To File Taxes The Easy And Organized Way Filing Taxes Tax Checklist Tax Prep Checklist

Home Office Deductions Everything You Need To Know Who S Eligible And How To Calculate Them

Home Office Deductions Everything You Need To Know Who S Eligible And How To Calculate Them

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Money Template Statement Template

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Money Template Statement Template

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

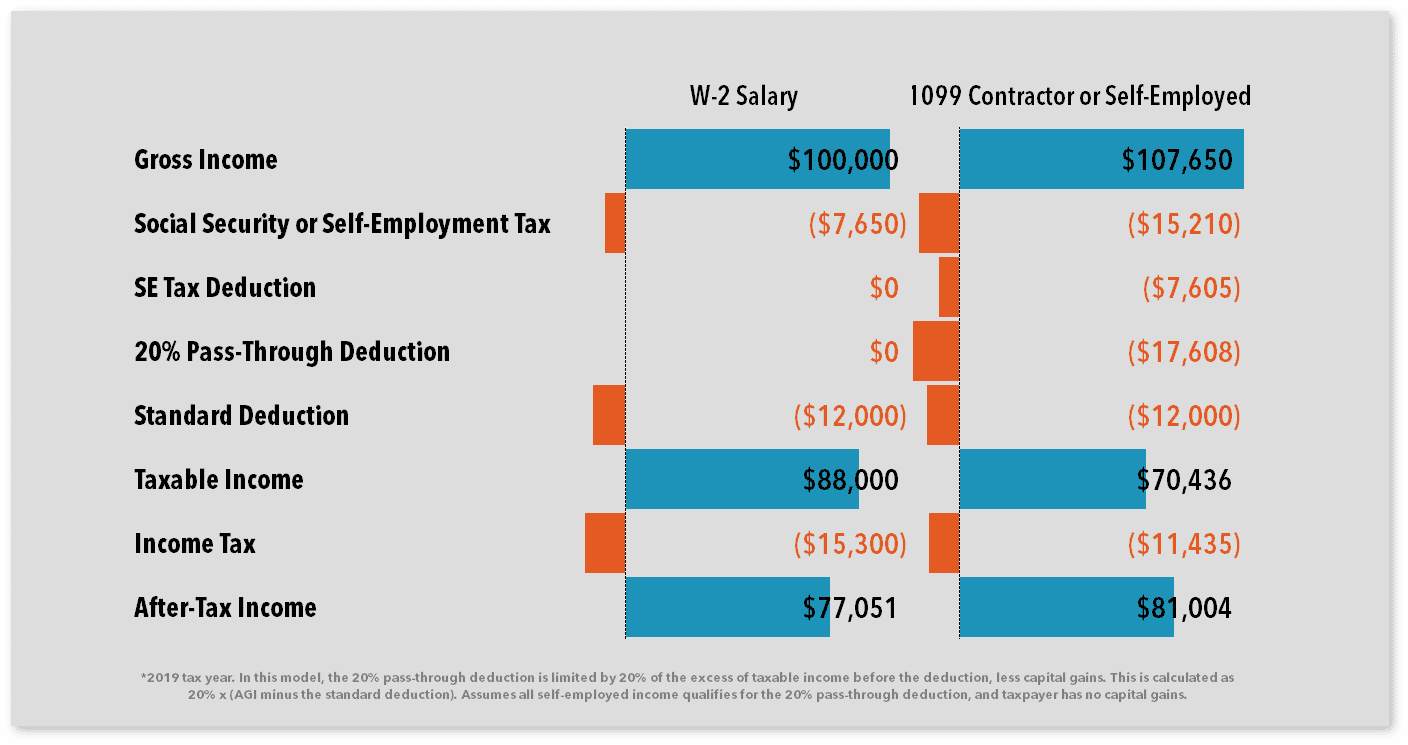

1099 Vs W2 Difference Between Independent Contractors Employees

1099 Vs W2 Difference Between Independent Contractors Employees

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Life Insurance Calculator

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Life Insurance Calculator

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

Tax Prep For Bloggers Tax Prep Blog Taxes Business Tax

Tax Prep For Bloggers Tax Prep Blog Taxes Business Tax

The Sad Truth About Home Office Tax Deductions

Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

Being An Independent Contractor Means You Will Get Full Pay With No Deductions That Also Means Work From Home Moms Independent Contractor Business Articles

Being An Independent Contractor Means You Will Get Full Pay With No Deductions That Also Means Work From Home Moms Independent Contractor Business Articles

Access Denied Tax Forms 1099 Tax Form This Or That Questions

Access Denied Tax Forms 1099 Tax Form This Or That Questions

How To Deduct Donations Which Ones Qualify H R Block Business Tax Tax Write Offs Irs Taxes

How To Deduct Donations Which Ones Qualify H R Block Business Tax Tax Write Offs Irs Taxes

Office Workspace Mid Century Office Design With Black Leather Swivel Chair On Grey Sleek Projeto De Home Office Escritorios De Casa Modernos Mesa Home Office

Office Workspace Mid Century Office Design With Black Leather Swivel Chair On Grey Sleek Projeto De Home Office Escritorios De Casa Modernos Mesa Home Office

Tax Deductions For Self Employed Tax Deductions Tax Time Deduction

Tax Deductions For Self Employed Tax Deductions Tax Time Deduction

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home