Property Tax Assessment Portland Oregon

If you qualify for the program the Oregon Department of Revenue will pay your county property taxes on November 15 of each year. Occupancy taxes for hotels BBs and vacation rentals.

6 Reasons To Buy A House Right Now Home Buying Real Estate Tips Waco

6 Reasons To Buy A House Right Now Home Buying Real Estate Tips Waco

If the 15th falls on a weekend or holiday due date is the next business day.

Property tax assessment portland oregon. The responsibilities of the Department of Assessment and Taxation include appraisal and assessment of property. A home tax assessed at 242000 a real market value of 390K with a mill-rate of 1640 would owe annual property taxes of 3968. Property taxes rely on county assessment and taxation offices to value the property calculate and collect the tax and distribute the money to taxing.

6 days ago. The mill-rate varies from one community to another. Oregon state law establishes the property tax payment deadlines and requires interest to be charged on properties with delinquent tax amounts.

Oregon law says the Assessor must value all property at 100 percent of its RMV. How property taxes work in Oregon. Small Tract Forestland Program ORS 321700-754.

Oregon Real Estate Transfer Taxes. See your tax bill for details. In the Portland Metro area mill-rates range from 1500 to 2030.

Government Researchers The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon. Special taxes such as. 503 823-4090 Fax.

2018 Harvest tax rates. How does the program work. Portland Tourism Improvement District.

Multnomah County does not have the authority to waive interest charges as a result of late property tax payments and the Oregon State Legislature has not at this time extended the property tax deadline. Portland Clean Energy Initiative. An In-Depth Guide For.

Property Tax Deferral for Disabled and Senior Citizens As a disabled or senior citizen you can borrow from the State of Oregon to pay your property taxes to the county. City of Portland PO Box 8834 Portland OR 97207. Two Enhanced Services Districts.

Property valuation of NE 20th Avenue Portland OR. Pay your taxes in full by November 15 or make partial payments with further installments due in February and May. Property tax payments are due May 17th.

To get a copy of your bill before 2018 contact Customer Service via phone email or chat. 825 150 825 200 825 200 825 202 825 206 825 210 825 220 825 225 825 225 825 230 tax assessments. RMV is typically the price your property would sell for in a transaction between a willing buyer and a willing seller on January 1 the assessment date for the tax year.

Personal property is either tangible or intangible. Si es posible QU É DESE EN CASA Y MANT É NGASE SEGURO. Oregons Multnomah County which encompasses most of the city of Portland has property taxes near the state average.

Forest Products Harvest Tax FPHT How forestland is taxed in Oregon. Intangible personal property is not taxable and tangible personal property may or may not be taxable. The tax rate or mill-rate is charged per 1000 of tax assessed value.

Personal property is taxable in the county where its located as of January 1 at 1 am. All personal property must be valued at 100 percent of its real market value unless otherwise exempt ORS 307020. 57 people watched 467600 For example if you want to purchase a home in the popular burgeoning city of Portland Oregon which falls within the boundaries of Washington County and pay the median selling price of 467600 the total transfer tax will come to 46760.

The countys average effective tax rate is 104. You can view copies of your bill back through 2018. Notification of operation permit 2020 harvest tax rates.

Collection of property taxes for all taxing entities. If you were to apply that rate to the countys 361300 median home value youd come up with an annual property tax bill of about 3768. Clean Safe District and Lloyd Improvement District.

Arts Education and Access Income Tax Business taxes for Portland and Multnomah County. Recording documents land plats issuing marriage licenses records retention and administration of Elections. Property tax statements are mailed before October 25 every year.

You can see property value and tax information back through 2008. 2 assessment on lodging establishments with 50 or more rooms.

North Portland Neighborhoods Mt Tabor North Northeast Northwest Industrial South Central Southe Portland Oregon Living Portland Travel Portland Neighborhoods

North Portland Neighborhoods Mt Tabor North Northeast Northwest Industrial South Central Southe Portland Oregon Living Portland Travel Portland Neighborhoods

Portland Neighborhood Map Portland Oregon Mappery Portland Map Portland Neighborhoods Portland Oregon Map

Portland Neighborhood Map Portland Oregon Mappery Portland Map Portland Neighborhoods Portland Oregon Map

Albina District Neighborhoods In Portland Oregon Download Scientific Diagram

Albina District Neighborhoods In Portland Oregon Download Scientific Diagram

Do Oklahomans Typically Have A Southern Or Midwestern Accent Tulsa Find A Job School Oklahoma City Ok Page West Linn School Fun Property Valuation

Do Oklahomans Typically Have A Southern Or Midwestern Accent Tulsa Find A Job School Oklahoma City Ok Page West Linn School Fun Property Valuation

Today Is Juneteenth Portland Real Estate How To Plan Freedom Day

Today Is Juneteenth Portland Real Estate How To Plan Freedom Day

Portland Oregon Homes For Sale Portland Real Estate Zillow Portland Real Estate Forest Park Country Roads

Portland Oregon Homes For Sale Portland Real Estate Zillow Portland Real Estate Forest Park Country Roads

Oregon Aerial Photography Including Portland Vancouver Beaverton Hillsboro Gresham Salem Mcminnville Etc Photographer Debbie Cruikshank

Oregon Aerial Photography Including Portland Vancouver Beaverton Hillsboro Gresham Salem Mcminnville Etc Photographer Debbie Cruikshank

Neighborhood Map Of Portland Oregon Portland Oregon And Its Neighborhoods Portland Oregon Portland Oregon Map Portland Travel Portland Neighborhoods

Neighborhood Map Of Portland Oregon Portland Oregon And Its Neighborhoods Portland Oregon Portland Oregon Map Portland Travel Portland Neighborhoods

Do You Need Assistance With Your Property Management Https Propertymanagement2016 Wordpress Com P 25 Preview True Rental Property Property Management Rent

Do You Need Assistance With Your Property Management Https Propertymanagement2016 Wordpress Com P 25 Preview True Rental Property Property Management Rent

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

Redeveloping With Pedestrians In Mind The Pearl District Portland Oregon Springerlink

Redeveloping With Pedestrians In Mind The Pearl District Portland Oregon Springerlink

City Of Portland Portland City Portland Skyline Portland Tattoo

City Of Portland Portland City Portland Skyline Portland Tattoo

What About Those Condo Assessments Portland Condos Portland Condos For Sale Complete Search Of Portland Condos In Portland Condo Condos For Sale Condominium

What About Those Condo Assessments Portland Condos Portland Condos For Sale Complete Search Of Portland Condos In Portland Condo Condos For Sale Condominium

Racist Restrictions Linger In Property Deeds And Portland Historians Want Help Finding Them Oregonlive Com

Racist Restrictions Linger In Property Deeds And Portland Historians Want Help Finding Them Oregonlive Com

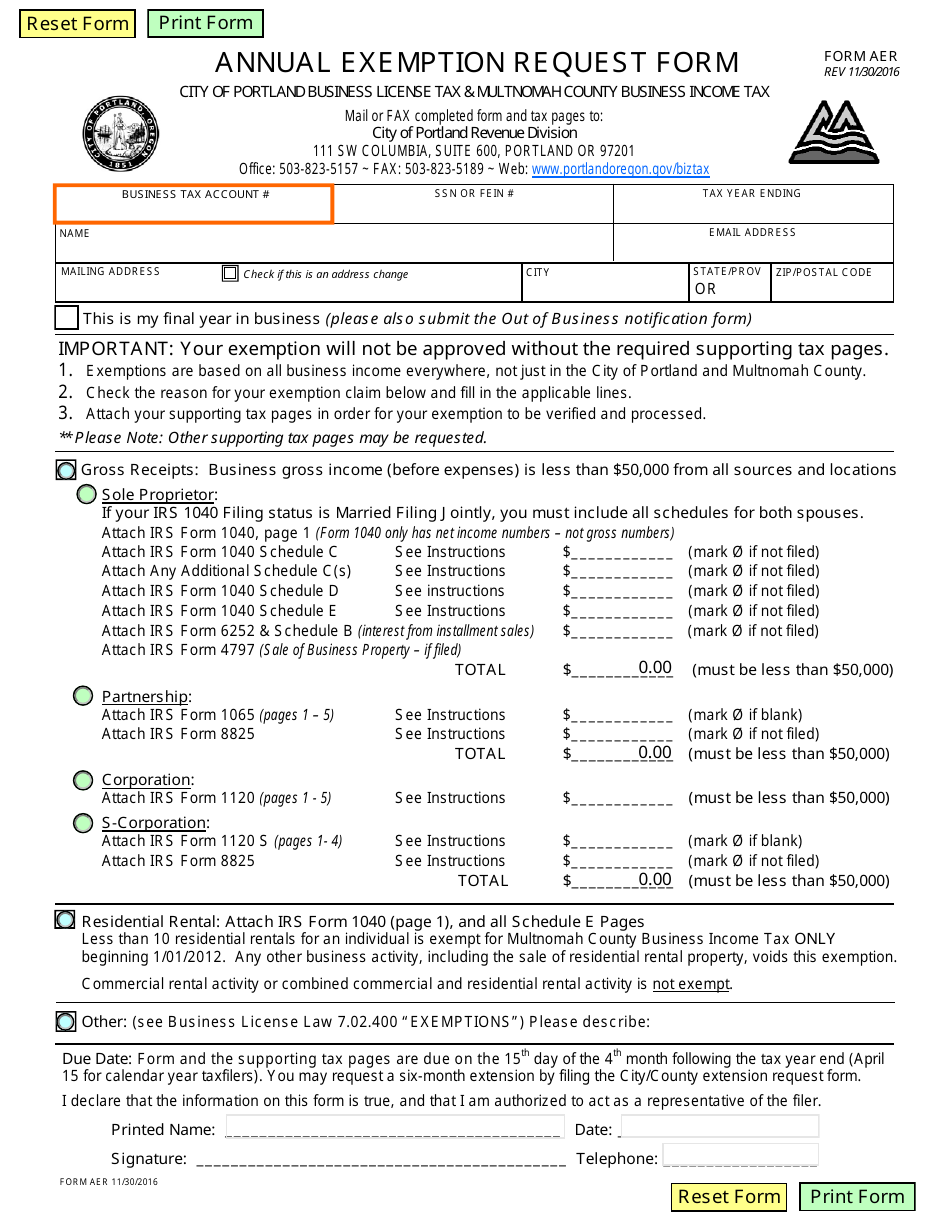

Form Aer Download Fillable Pdf Or Fill Online Annual Exemption Request Form City Of Portland Oregon Templateroller

Form Aer Download Fillable Pdf Or Fill Online Annual Exemption Request Form City Of Portland Oregon Templateroller

The Oregon Hop Commission Exists To Provide Research And To Maintain The Economic Stability Of Hop Production Through Assessments Paid B Oregon Growers Hopping

The Oregon Hop Commission Exists To Provide Research And To Maintain The Economic Stability Of Hop Production Through Assessments Paid B Oregon Growers Hopping

Explaining Oregon Property Taxes The Drew Coleman Team Portland Real Estate

Explaining Oregon Property Taxes The Drew Coleman Team Portland Real Estate

Portland Oregon Property Tax Rates Explained

Portland Oregon Property Tax Rates Explained

Property Tax Appeal Appraisal Portland Appraiser Residential Real Estate Appraiser Bernhardt Swisstrust Appraisal

Property Tax Appeal Appraisal Portland Appraiser Residential Real Estate Appraiser Bernhardt Swisstrust Appraisal

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home