Tax Break For Low Income Earners 2019

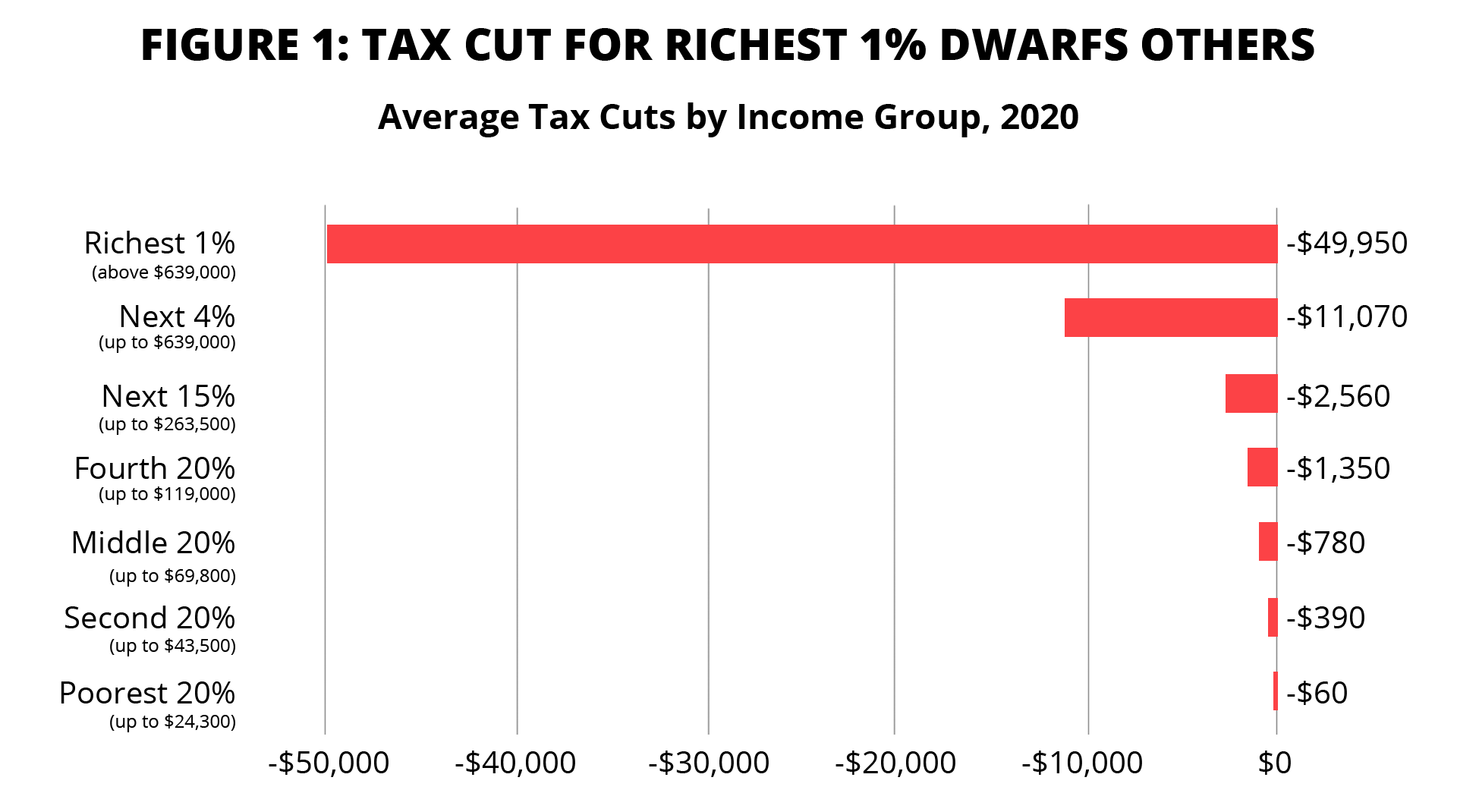

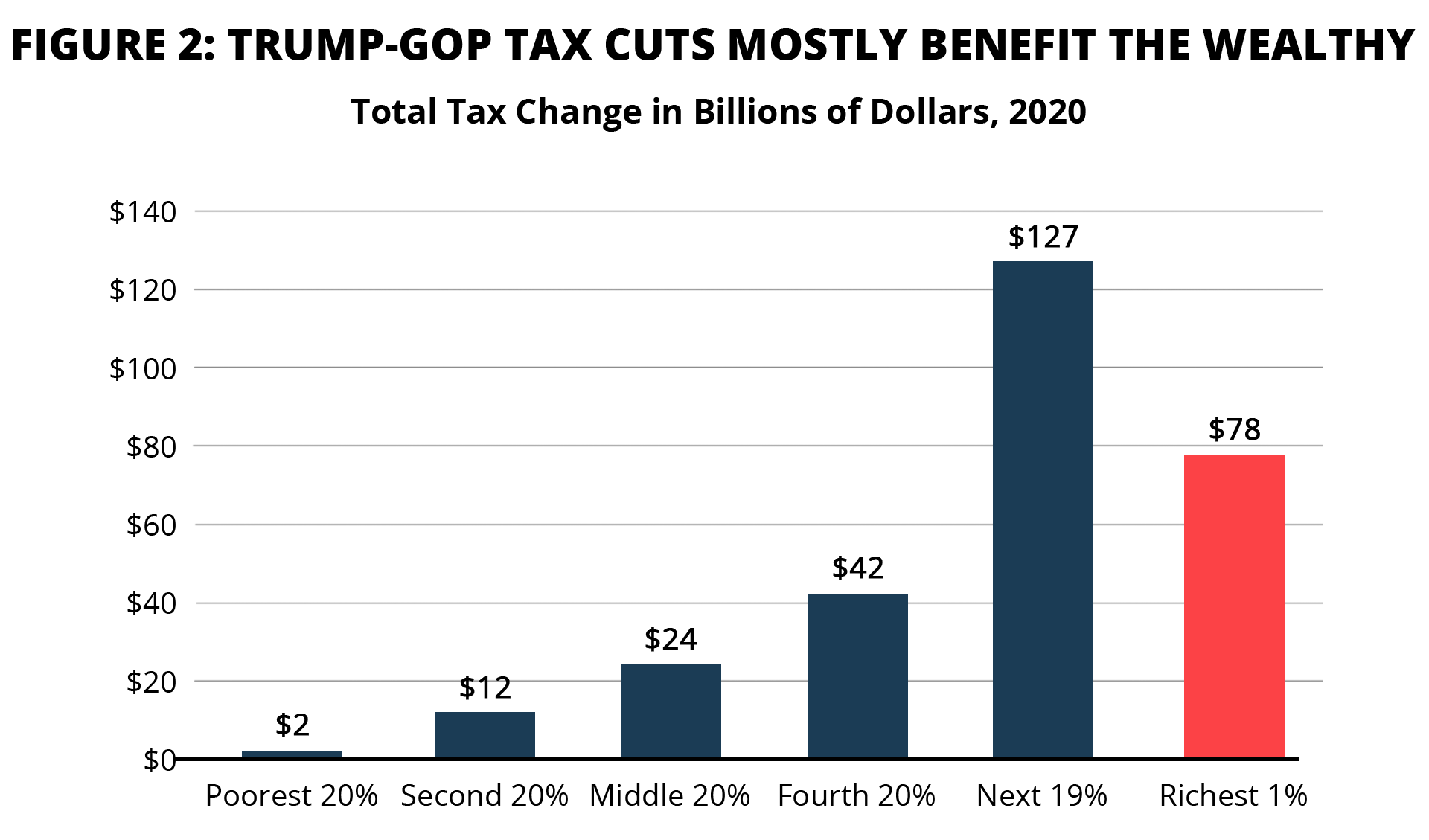

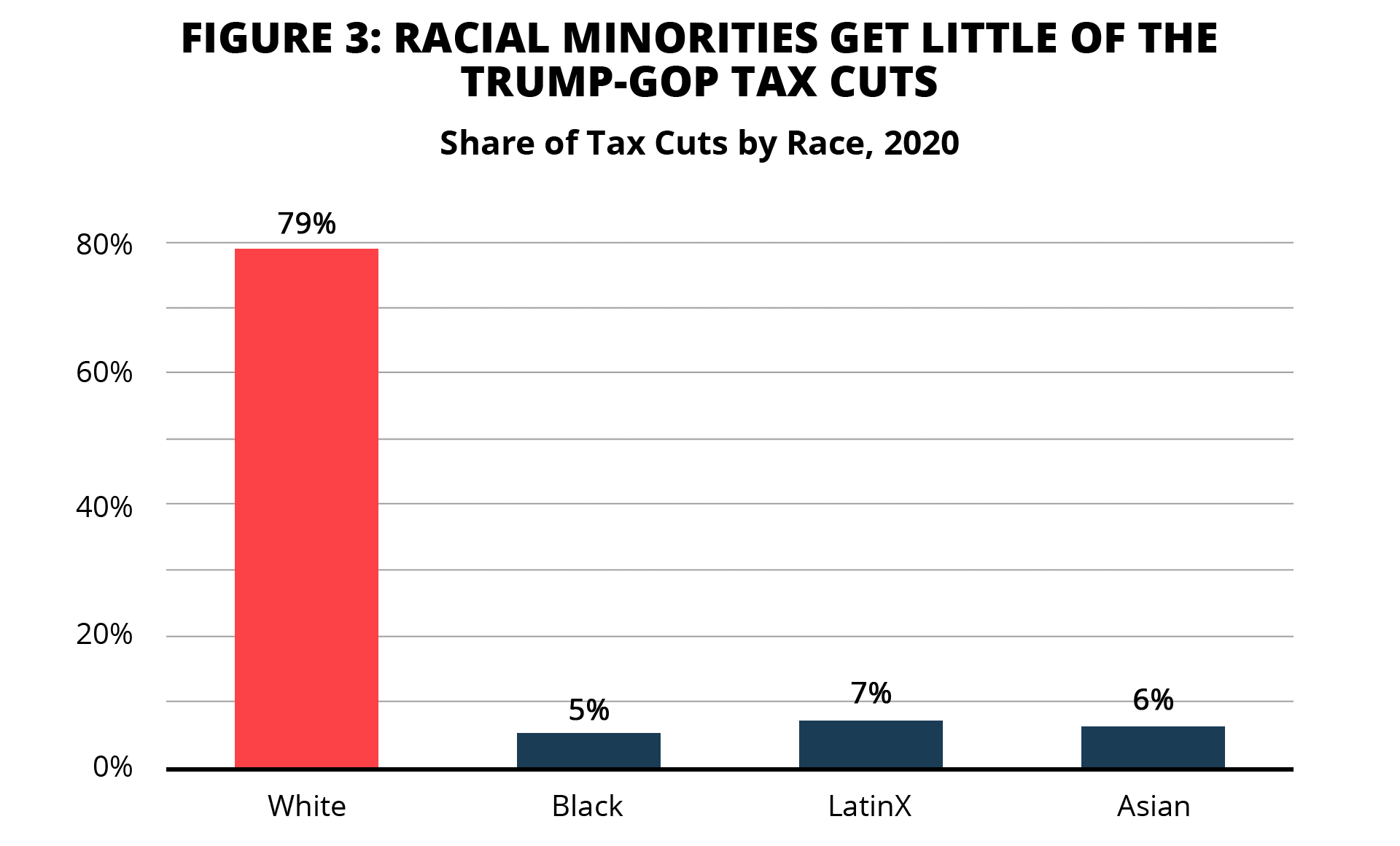

The amount of the credit steps down at various income levels depending on your filing status. The top 20 percent of earners received more than 60 percent of the total tax savings according to the Tax Policy Center.

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

The top 1 percent received nearly 17.

Tax break for low income earners 2019. Low- and middle-income earners will have their tax reduced by up to 1080 for single earners or up to 2160 for dual income families after lodging their tax returns as early as 1 July 2019. For a single filer an AGI exceeding 32500 in 2020 would make you ineligible to claim the credit. The EITC is a refundable credit.

A tax credit is a dollar-for-dollar reduction in your actual tax bill. The Earned Income Tax Credit EITC is money the federal government provides to low income working people to help them make ends meet. Its free money from the federal government.

The maximum credit for other adoptions equals the amount of qualified expenses up to 14440. Income groups above 100000 accounted for 45 percent of returns claiming the pass-through deduction but nearly 80 percent of the benefits. The Adoption Credit of 14440 applies to the adoption of a child with special needs.

Additionally the amount of your credit varies depending on your income. WASHINGTON AP Millions of Americans would lose a prized tax break under President Donald Trumps sweeping revamp of the tax code but corporations would get to keep it. Tyson is a beneficiary of new tax breaks signed into law by President Trump meant to help low-income communities.

Or phrases associated with the tax breaks in. The Low and Middle Income Tax Offset LMITO is available to Australian residents with annual taxable income not more than 126000 in the 201819 to 202021 financial years. To claim the WITB you must earn at least 3000 from a job or business.

As illustrated below in tax year 2019 income groups of 100000 and below accounted for 55 percent of the returns claiming the pass-through deduction but only 203 percent of the benefits. If you qualify you can claim this refundable credit on your return. 2019 Dec 15 2019 Updated Jan.

The new targeted offset will benefit over 10 million low- and middleincome earners. As of 2020 a single filer could get the maximum 50 percent credit if your adjusted gross income was 19500 or less. Earned income tax credit returns up to 6728 for married taxpayers filing jointly with three or more qualifying children.

A few credits are refundable which means if you owe 250 in taxes but qualify for a 1000 credit youll get a check for the. Phaseouts apply as income rises. This means you can collect it even if you dont owe any federal income tax.

The Working Income Tax Benefit WITB is designed to encourage low-income workers to stay in the work force. LMITO will operate in addition to the LITO and taxpayers may be entitled to receive both offsets up to and including the 202021 financial year.

What Is A Tax Credit How Tax Credits Work Centsai Tax Credits Tax Credits

What Is A Tax Credit How Tax Credits Work Centsai Tax Credits Tax Credits

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Expanding The Earned Income Tax Credit Could Provide Financial Security For Millions Of Workers Without Children Urban Institute

Expanding The Earned Income Tax Credit Could Provide Financial Security For Millions Of Workers Without Children Urban Institute

The Gop Tax Law Showers Benefits On The Wealthy And Large Corporations While Abandoning Middle Class Americans And Main Street Businesses House Budget Committee Democrats

The Gop Tax Law Showers Benefits On The Wealthy And Large Corporations While Abandoning Middle Class Americans And Main Street Businesses House Budget Committee Democrats

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How Tax Credits Work And Tax Credits To Consider Atkins E Corp Tax Credits Business Tax Deductions Business Tax

How Tax Credits Work And Tax Credits To Consider Atkins E Corp Tax Credits Business Tax Deductions Business Tax

Trump S Rumored Tax Cuts 2 0 Proposals Aren T Focused On The Middle Class Center For American Progress

Trump S Rumored Tax Cuts 2 0 Proposals Aren T Focused On The Middle Class Center For American Progress

Which Taxpayers Saved The Most From Tax Cuts Under Gov Scott Walker The Observatory

How Did The Tcja Change Taxes Of Families With Children Tax Policy Center

How Did The Tcja Change Taxes Of Families With Children Tax Policy Center

Tax Relief For Low Income And Minimum Wage Workers Ontario Ca

Tax Relief For Low Income And Minimum Wage Workers Ontario Ca

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

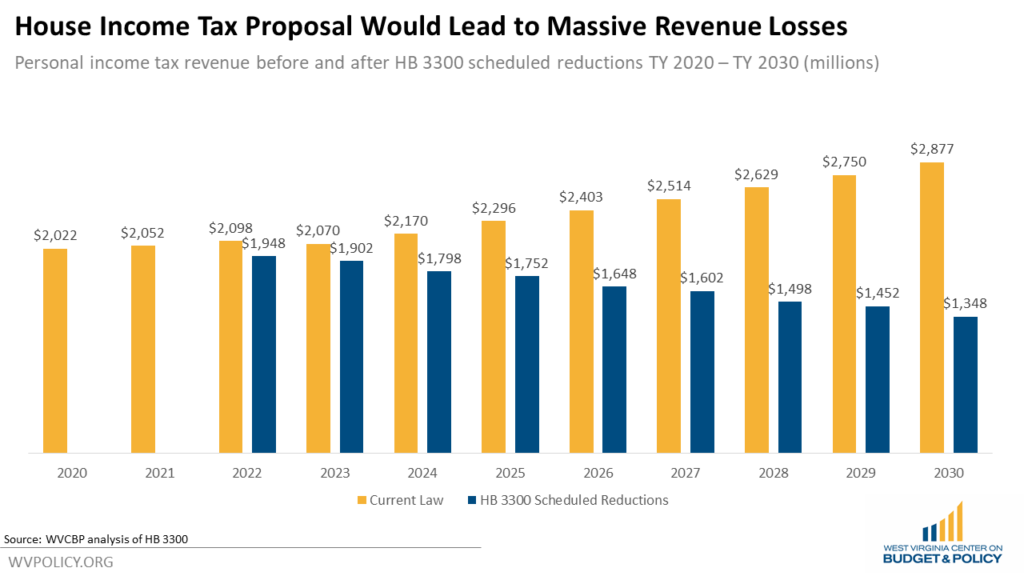

House Income Tax Cut Plan Would Devastate The State Budget West Virginia Center On Budget Policy

House Income Tax Cut Plan Would Devastate The State Budget West Virginia Center On Budget Policy

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Marginal Income Tax Rates Work And What If We Increased Them

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

How Does The Earned Income Tax Credit Affect Poor Families United Way Of Treasure Valley

How Does The Earned Income Tax Credit Affect Poor Families United Way Of Treasure Valley

Income Limits Before Tax Deductions Start Phasing Out

Income Limits Before Tax Deductions Start Phasing Out

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home