How Do I File For Homestead Exemption In Cobb County Ga

Homestead exemptions applications must be received or US. 4700 Austell Rd 4400 Lower Roswell Rd.

Apply For Georgia Homestead Exemption Grant Park Atlanta Real Estate Grant Park Homes For Sale

In order to file for homestead exemption the homeowner must be the owner of record and occupy the property as the principal residence.

How do i file for homestead exemption in cobb county ga. Real Property Exemptions - Effective July 12008 may apply at anytime prior to April 1st of effective year. An application for homestead exemption can be filed anytime during the year however to be effective it must be filed before the Tax Commissioner of the County. These include basic homestead exemptions as well as homestead exemptions for seniors low income homeowners surviving spouses of public safety and.

Instructions for Filing Your Application. Homestead exemptions are a form of property tax relief for homeowners. However we are flexible in terms of the mode of submission and will accept applications by mail email or drop box.

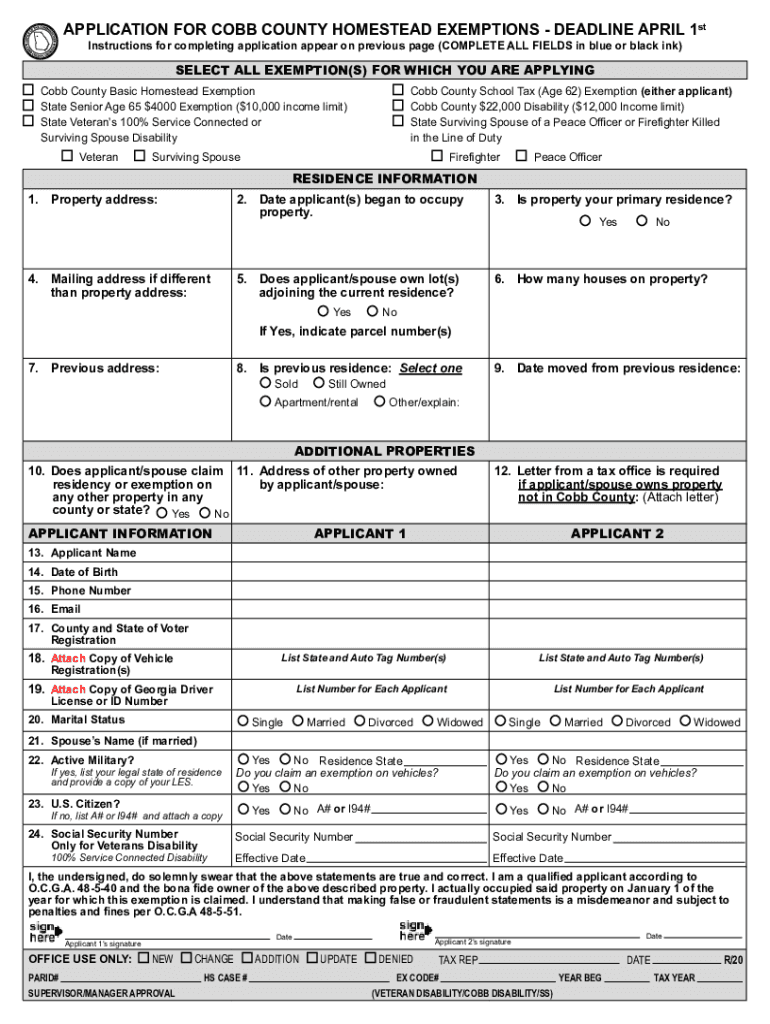

Faxed or emailed copy not accepted COBB COUNTY TAX COMMISSIONER. The homestead exemption can reduce the amount you have to pay on property taxes. Get GA Application for Cobb County Homestead Exemptions within your internet browser from any gadget.

If you are applying for a Homestead Exemption that is related to age or income you must come to the Tax Assessors Office at 2875 Browns Bridge Road and apply. You may apply for homestead exemptions if you own reside and claim the property as your primary residence on January 1. TOTAL SCHOOL TAX HOMESTEAD EXEMPTION Homeowners who are 65 years of age on or before January 1 are entitled to a full exemption in the school general and school bond tax categories.

To apply fill out the form provided by the Cobb County Tax Assessor Office by March 1 for the exemption. Homestead exemption on only one residence. You cannot apply online for exemptions where proof of age or income is required.

How you can complete GA Application for Cobb County Homestead Exemptions online. The homestead exemption is deducted from the assessed value 40 of the fair market value of the home. Then the mill rate is applied to arrive at the amount of ad valorem tax due.

You must furnish proof of age when you apply. South Govt Center East Office. Post marked by Wednesday April 1 to apply to the current 2020 tax year.

The local homestead increases the state exemption to 10000. Homestead exemptions are granted based on the qualifications of the applicant. In such cases you must apply in person.

To receive any Exemptions you must apply in person at the Tax Assessors Office located at 2782 Marietta Hwy Suite 200 Canton GA 30114. Applications and information are available on this website. Start by going to the Georgia Department of Revenue and filing an application for homestead exemption application.

The exemption will save you approximately 65 of the tax bill for unincorporated Cobb County. West Park Govt Center 736 Whitlock Ave Marietta GA 30064 South Govt Center 4700 Austell Rd Austell GA 30106 East Govt Center. All applicants names must appear on the deed to the property.

A married couple is allowed Homestead exemption on only one residence. Homestead school tax and disability exemptions may be filed all year long but to qualify for the current year exemption you must occupy the property by January 1 and apply by April 1. And for most the savings is hundreds of dollars.

Mail applications with all required documentation to. That is the absolute deadline for filingall forms filed after April 1 will be processed for the following year. Open the fillable PDF file with a click.

How do I qualify for Homestead Exemption. Faxed or emailed copy not accepted COBB COUNTY TAX COMMISSIONER PO BOX 100127 MARIETTA GA 30061 May apply in person at. Failure to properly and timely file the application.

You must apply for each exemption type for which you are eligible. Then complete the form and submit it to your county tax commissioner. MARIETTA GA 30061.

Please call 770-531-6720 if you have questions. This is a homestead exemption and only applies to the home you live in and you must be receiving or applying for regular homestead exemption to qualify. Start accomplishing the template field by field following the prompts of the sophisticated PDF editors interface.

PO BOX 100127. Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton County Tax Assessors office. Mail applications with all required documentation to.

You need to apply only once not yearly. Athens-Clarke County offers homestead exemptions that are more beneficial to the taxpayer than the exemptions offered by the state. We must conform to the April 1 deadline date as it is mandated by Georgia code.

Learning how to file homestead exemption in Georgia is easy. The applicants name must appear on the deed to the property and they must own occupy and claim the property as their legal residence on January 1 to be eligible for any exemption for that tax year.

Home Mortgage Information When And Why Should You File A Homestead Exemption

Home Mortgage Information When And Why Should You File A Homestead Exemption

Morehouse College Junior Justin Samples Was Recently Named Southern Intercollegiate Athletic Confere Tennis Players Fort Valley State University College Junior

Morehouse College Junior Justin Samples Was Recently Named Southern Intercollegiate Athletic Confere Tennis Players Fort Valley State University College Junior

Property Owners Have Month To File For Homestead Exemptions

Here S How To File For The Homestead Property Tax Exemption The Hank Miller Team Buying A New Home Outdoor Lighting Bohemian Wall Art

Here S How To File For The Homestead Property Tax Exemption The Hank Miller Team Buying A New Home Outdoor Lighting Bohemian Wall Art

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

How To Apply For Homestead Exemption In Georgia Growatlantahomes Com

How To Apply For Homestead Exemption In Georgia Growatlantahomes Com

Cobb Homestead Exemptions Due April 1 What You Need To Know Marietta Ga Patch

Cobb Homestead Exemptions Due April 1 What You Need To Know Marietta Ga Patch

The 2019 Southern Living Idea House Part 1 The Hank Miller Team Beach House Interior Design Southern Living Homes Riverside House

The 2019 Southern Living Idea House Part 1 The Hank Miller Team Beach House Interior Design Southern Living Homes Riverside House

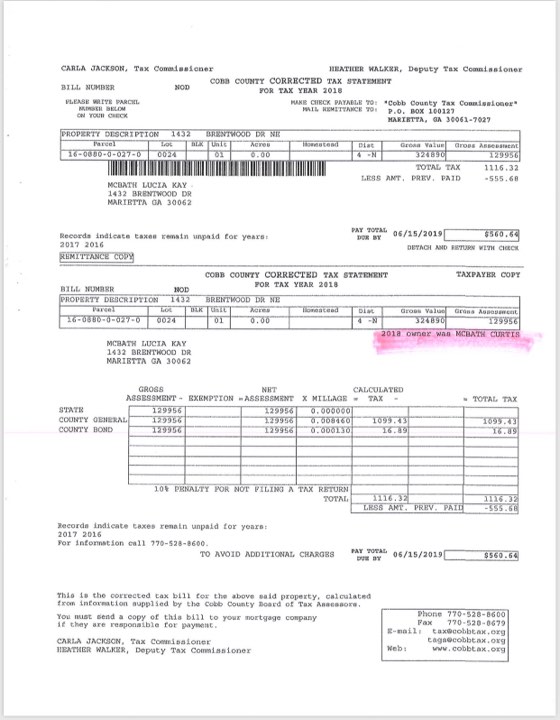

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Ga Application For Cobb County Homestead Exemptions 2020 2021 Fill Out Tax Template Online Us Legal Forms

Ga Application For Cobb County Homestead Exemptions 2020 2021 Fill Out Tax Template Online Us Legal Forms

You Re A Homeowner Take Advantage Of Homestead Exemption Atlanta Ben

Filing For A Homestead Exemption In Atlanta Home Sweet Home Atlanta

Https Www Lincolninst Edu Sites Default Files Gwipp Upload Sources Georgia 2017 Ga Property Tax Exemptions 20 20dor 2017 Pdf

Homestead Exemption Wadeworkscreative Com

Homestead Exemption Wadeworkscreative Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home