Senior Exemption Property Tax Washington State

Income based property tax exemptions and deferrals may be available to seniors those retired due to disability and veterans compensated at the 80 service connected rate. Yet more than 26000 qualified seniors and disabled persons have yet to register for the exemption and only 1 in 100 of those eligible for deferrals are currently enrolled.

Wa State Property Tax Changes In 2018 Wsd

Of course there are qualifying rules for all these tax breaks and the first of these is your age.

Senior exemption property tax washington state. A Valid WA State IDDrivers license is REQUIRED please submit a copy with your application. Pierce County ATR 2401 S 35th St Rm 142 Tacoma WA 98409. Many more people in King County are now eligible for help with their property taxes.

The value of your Washington State residence is frozen for property tax purposes and you become exempt from all excess and special levies and possibly regular levies resulting in a reduction in your property taxes. Taxpayers who meet one of the following requirements as of December 31 of the year before the taxes are due. You can apply online here.

The exemption program reduces the amount of property taxes owing on your primary residence. Complete the Application included on the reverse of this paper and return to. Property tax exemption program for senior citizens and disabled persons.

Fill-In 64 0098e Proof of Disability Statement Fill-In 64 0095 Senior Citizens and Disabled Persons Declaration to Defer Fill-In 64 0011e Senior Citizens and Disabled Persons Exemption. SEATTLE -- New laws enacted in Washington will expand property tax relief programs to seniors and disabled citizens according to the Washington State Department of. Property Tax Exemption for Senior Citizens and People with Disabilities Washington state has two property tax relief programs for senior citizens and people with disabilities.

If you are a senior citizen andor disabled with your primary residence in Washington the Property Tax Exemption for Senior Citizens and Disabled Persons program may help you pay your property taxes. Income Checklist for Senior CitizenDisabled Persons Property Tax Relief Program. Property tax exemption program for senior citizens and people with disabilities.

It is the intent of the legislature that the property tax exemption for the owner occupied residences of low-income seniors disabled veterans and other people who are disabled applies to any additional local regular property taxes imposed by a city or county that has also approved such an action by identifying the tax exemption in the ballot measure placed before the voters. Combined service-connected evaluation rating of 80 or higher. For information about the property tax.

Retired from regular gainful employment due to. Only one spouse must typically be 65 or over if youre married and you own your property jointly. State law provides two tax benefit programs for senior citizens and the disabled.

At least 61 years of age or older. If you are a senior citizen or disabled person in need of property tax assistance you may be able to take advantage of the property tax exemption program. Property tax exemption program for senior citizens and people with disabilities.

Property tax exemptions and property tax deferrals. Senior CitizensDisabled Exemption. As noted these exemptions are generally reserved for those who are age 65 or older.

Senior Citizen Disabled Persons Exemption Program. Under the exemption program your residences assessed value is frozen and you will be exempt from excess and special levies resulting in a reduction in your property taxes. Contact your County Assessor for more information.

If you are a senior citizen or disabled person with your residence in Washington State you may qualify for a property tax reduction under the property tax exemption for senior citizens and disabled persons. Retired from regular gainful employment due to a disability. The person claiming the exemption must live in the home as their primary residence The minimum age requirement for senior property tax exemptions is generally between the ages of.

This program exempts all excess levies and may exempt a portion of regular levies on your primary residence and up to one acre of land. At least 61 years of age or older. There are four eligibility requirements you.

IMPORTANT CHANGES TO THE SENIOR EXEMPTION PROGRAM FOR TAXES DUE STARTING IN 2020 New legislation has passed changing the income threshold for Kitsap County to 48574 beginning in 2020 The Washington State Legislature has made major changes to the property tax exemption program beginning in 2020. PROPERTY TAX EXEMPTION APPLICATION FOR SENIOR CITIZENS OR PEOPLE WITH DISABILITIES. This brochure provides information for the property tax exemption program.

Property tax deferral program for senior citizens and disabled persons.

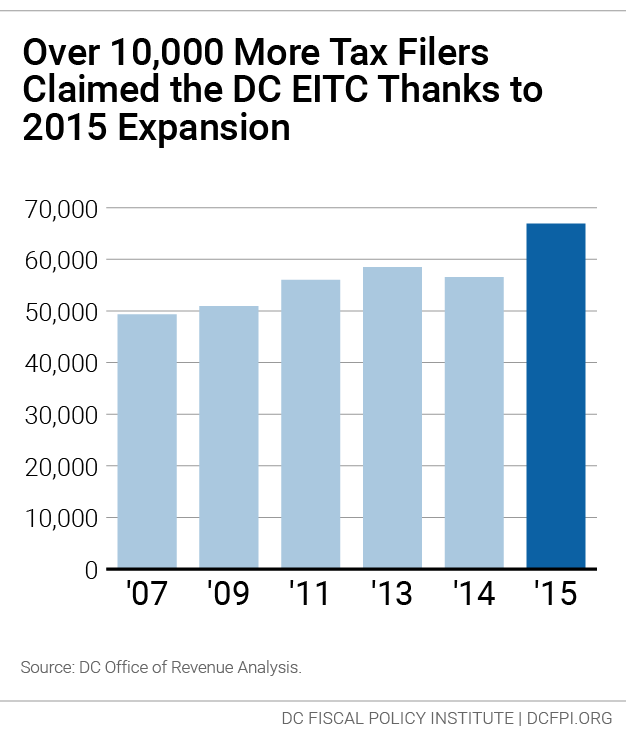

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Liable For Personal Property Taxes In Washington State Bader Martin

Liable For Personal Property Taxes In Washington State Bader Martin

Laws Rules Washington Department Of Revenue

Laws Rules Washington Department Of Revenue

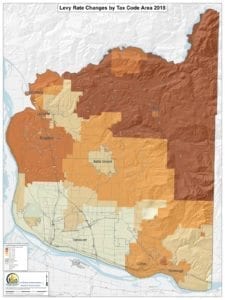

Property Taxes Increase Countywide Clarkcountytoday Com

Property Taxes Increase Countywide Clarkcountytoday Com

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Washington Retirement Tax Friendliness Smartasset

Washington Retirement Tax Friendliness Smartasset

Income Tax 2020 Bellflower Ca Income Tax Tax Refund Tax Time

Income Tax 2020 Bellflower Ca Income Tax Tax Refund Tax Time

Wa State Property Tax Changes In 2018 Wsd

Assessor S Department Senior Disabled Exemptions

Assessor S Department Senior Disabled Exemptions

Consider Taxes When Selling Your Home City Of Vancouver Washington

Consider Taxes When Selling Your Home City Of Vancouver Washington

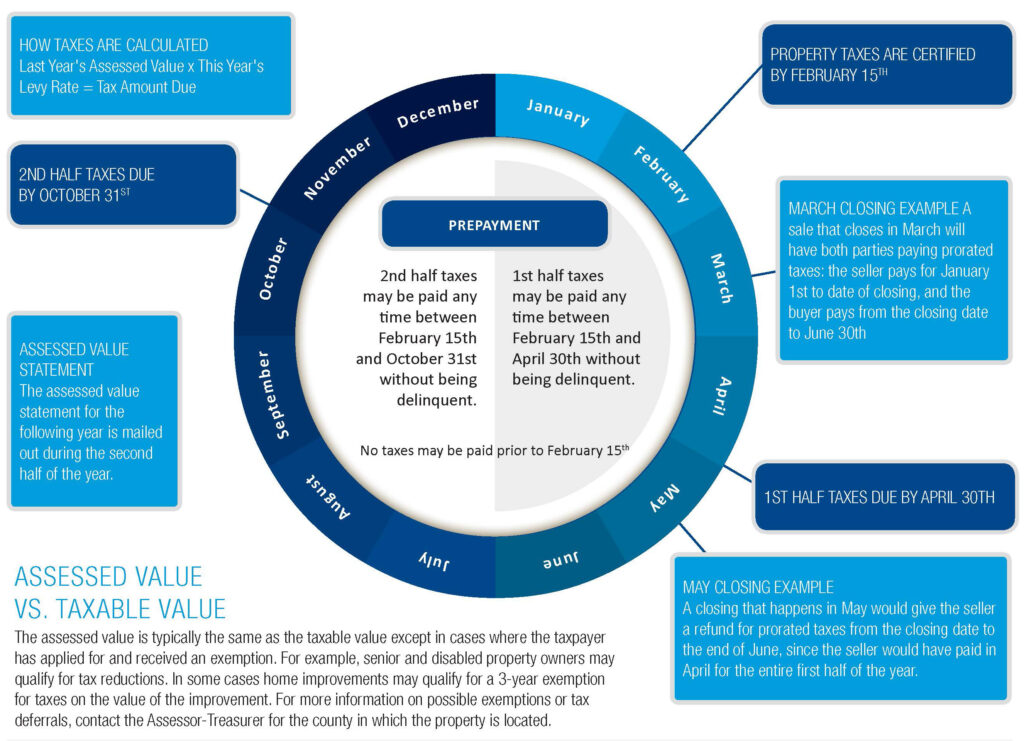

The Property Tax Annual Cycle In Washington State Myticor

The Property Tax Annual Cycle In Washington State Myticor

Https Www Washingtonlawhelp Org Resource Property Tax Exemptions For Senior Citizens A Download 39297c5a Ff4b A168 B180 9bb77825210e Pdf

The Property Tax Annual Cycle In Washington State Myticor

The Property Tax Annual Cycle In Washington State Myticor

Https Dor Wa Gov Sites Default Files Legacy Docs Forms Realestexcstx Realestextxaffidrtnblank Pdf

Washington Retirement Tax Friendliness Smartasset

Washington Retirement Tax Friendliness Smartasset

Labels: exemption, property, state, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home