How To Calculate Tax Relief On Mortgage Interest

Mortgage Interest Relief is a tax relief on the interest you pay in a tax year on a qualifying mortgage loan. You filed an IRS form 1040 and itemized your deductions.

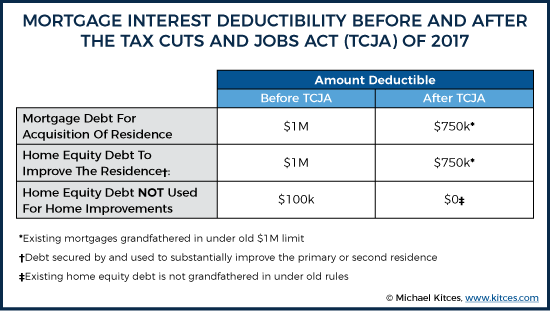

Tax Deductions For Home Mortgage Interest Under Tcja

Tax Deductions For Home Mortgage Interest Under Tcja

You can edit individual months by selecting a month from the dropdown or navigate to a specific month by clicking the left or right arrow buttons.

How to calculate tax relief on mortgage interest. In the 2017-18 tax year you could claim 75 of your mortgage tax relief. The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan principal. You can contact the TRS Helpline on 01 7383663 for further details on the above.

You can claim the relief. To work this out simply multiply the mortgage interest you pay by 20. If your income level places you in the highest tax bracket the tax rate at which you may deduct your mortgage interest will gradually decline.

Tax relief 100. The parent does not pay any of the mortgage. That means your interest alone is about 15000 a year.

This reduction will be accelerated by 3 annually from 2020 which means that in 2023 it will be 3693 percent. Maximum interest on which tax relief is payable to the end of 2020 is. By claiming it the old way you would get 40 or 6000 back.

The rate of relief paid on qualifying home loans is currently 15. Example of calculating finance costs relief using the new rules. Youll see in this example the new Tenant Tax rules have made no difference to this persons total tax liability.

This new system will potentially increase your tax bill in the following two ways. In the 2018-19 tax year you could claim 50 of your mortgage tax relief. The amount of mortgage interest charged you will subtract from the lease revenues would reduce by 25 over every budget year during the transition time whilst the proportion of interest costs eligible for the current payroll tax would then expand by 25.

You can claim Mortgage Interest Relief on interest paid by you on a loan used to purchase repair develop or improve the home. 1500 if a single person. Click Apply to all if your total expenses are the same every month.

Non-first time buyers. For the 2020-21 tax year you could deduct one quarter of your mortgage interest payments while three quarters of your mortgage interest payments received the tax credit. Relief was subject to upper limits or thresholds which depended on your personal situation and whether you were a first-time buyer.

All of the rental income you earn will be taxable and youll instead receive a 20 tax credit for your mortgage interest. Arrow or use drop down to change month. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Insert the total expense amount that you pay across all of your properties each month. Now with the new tax credit you only get 20 of it back or 3000. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017.

20-Tax credit amount Taxable Profit. The Tax Cuts and Jobs Act. Tax relief on mortgage interest on rented property example 2.

0 Taxable Mortgage interest. Landlord has rental income after other associated costs but before mortgage interest of 8000 per annum. But instead a tax credit equivalent to the basic rate of tax currently 20 will be set-off against total income.

3000 if married or in a civil partnership widowed or a surviving civil partner. Lets say you have a 300000 interest-only buy-to-let mortgage with 5 annual interest. Tax deductible costs-Mortgage interest Pre-tax Profit.

This means you can cut your final tax bill by 20 of your interest. These tax calculations are based on the tax year 202021. To qualify for tax relief on mortgage interest repayments you must have paid interest on money that you borrowed to purchase repair or improve your sole or main residence.

The mortgage is a secured debt on a. In 2021 the deductible mortgage interest rate is 43 percent down from 46 percent in 2020. The Finance Act 2016 says that the interest portion of mortgage repayments will be tax-free up to Sh25000 up from the previous limit of Sh12500.

If you increase your mortgage loan on your buy-to-let property you may be able to treat interest on the additional loan as a revenue expense or get relief against income tax as long as the. By 2020 none of the mortgage interest will be deductible from rental income as an expense. The big difference is that over 4 years the amount of mortgage interest you can deduct each year from rental income is reducing.

To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements.

Compare A 15 Year Mortgage To A 30 Year Mortgage With This Mortgage Comparison Calculator From Midwest Heritage Mortgage Comparison 30 Year Mortgage 30 Years

Compare A 15 Year Mortgage To A 30 Year Mortgage With This Mortgage Comparison Calculator From Midwest Heritage Mortgage Comparison 30 Year Mortgage 30 Years

Rental Property Tax Deductions Rental Property Management Real Estate Investing Rental Property Real Estate Rentals

Rental Property Tax Deductions Rental Property Management Real Estate Investing Rental Property Real Estate Rentals

Find Mortgage Rates Lenders Calculators And Help Hsh Com Mortgage Mortgage Approval Mortgage Rates

Find Mortgage Rates Lenders Calculators And Help Hsh Com Mortgage Mortgage Approval Mortgage Rates

Mortgage Interest Tax Deduction Skew To The More Affluent Mortgage Interest Tax Deductions Deduction

Mortgage Interest Tax Deduction Skew To The More Affluent Mortgage Interest Tax Deductions Deduction

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Mortgage Interest Tax Deduction Mortgage Interest Tax Deductions Mortgage Payoff

Mortgage Interest Tax Deduction Mortgage Interest Tax Deductions Mortgage Payoff

Mortgage Tax Deduction Calculator Freeandclear Mortgage Comparison Interest Only Mortgage Mortgage Amortization Calculator

Mortgage Tax Deduction Calculator Freeandclear Mortgage Comparison Interest Only Mortgage Mortgage Amortization Calculator

Mortgage Interest Deduction What You Need To Know About Mortgage Interest Deduction Summed Up In This Nice Mortgage Interest Real Estate Infographic Mortgage

Mortgage Interest Deduction What You Need To Know About Mortgage Interest Deduction Summed Up In This Nice Mortgage Interest Real Estate Infographic Mortgage

Calculating The Mortgage Interest Tax Deduction In 2020 Mortgage Interest Reverse Mortgage Mortgage

Calculating The Mortgage Interest Tax Deduction In 2020 Mortgage Interest Reverse Mortgage Mortgage

Calculate How Many Payments It Will Take To Pay Off Your Loan With This Amortizing Loan Calculator From Midwest Heritage A Hy V Loan Calculator Loan Investing

Calculate How Many Payments It Will Take To Pay Off Your Loan With This Amortizing Loan Calculator From Midwest Heritage A Hy V Loan Calculator Loan Investing

Free Mortgage Calculator Mn The Ultimate Selection Mortgage Interest Tax Deductions Mortgage Interest Rates

Free Mortgage Calculator Mn The Ultimate Selection Mortgage Interest Tax Deductions Mortgage Interest Rates

Mortgage Calculator With Extra Payments Mortgage Calculator Simple Mortgage Calculator Mortgage

Mortgage Calculator With Extra Payments Mortgage Calculator Simple Mortgage Calculator Mortgage

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

Missing These Tax Deductions Means Missing Out On Money Mortgage Interest Rates Pay Off Mortgage Early Mortgage Payoff

Missing These Tax Deductions Means Missing Out On Money Mortgage Interest Rates Pay Off Mortgage Early Mortgage Payoff

Can I Claim The Mortgage Interest Deduction Tax Deductions Tax Software Tax Refund Calculator

Can I Claim The Mortgage Interest Deduction Tax Deductions Tax Software Tax Refund Calculator

In Just 4 Simple Steps This Free Mortgage Calculator Will Show You Your Monthly Mortgage Payment Free Mortgage Calculator Mortgage Payment Mortgage Calculator

In Just 4 Simple Steps This Free Mortgage Calculator Will Show You Your Monthly Mortgage Payment Free Mortgage Calculator Mortgage Payment Mortgage Calculator

Home Buying Tax Deductions In 2020 Home Buying Tax Deductions Home Buying Process

Home Buying Tax Deductions In 2020 Home Buying Tax Deductions Home Buying Process

Labels: relief

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home