Estimate Property Tax On Car

Shop Cars In Your Budget. For example if you trade in a car worth 3000 you would have a 3000 credit towards a new car.

Tax Return And Refund Tax Return Tax Tax Refund

Tax Return And Refund Tax Return Tax Tax Refund

Your county vehicle property tax due may be higher or lower depending on other factors.

Estimate property tax on car. Estimated tax title and fees are 0 Monthly payment is 384 Term Length is 72 months and APR is 7. Property Tax Rates in Arkansas. Select the correct assessment ratio from the Assessment Ratio drop down.

There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes. Motor Vehicle Fee is based upon the value weight and use of the vehicle and is adjusted as the vehicle ages. Please note that we can only estimate your property tax based on median property taxes in your area.

Highway use tax of 3 of vehicle value. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Estimated tax is the method used to pay tax on income when no taxor not enough taxis withheld.

Page Content Please input the value of the vehicle the number of months that you owned it during the tax year and click the Calculate button to compute the tax. After 1 is retained by the County Treasurer the distribution of funds collected for the Motor Vehicle Fee are. Use this calculator to compute your 2021 personal property tax bill for a qualified vehicle.

Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein. You may be required to make estimated tax payments to New York State if. A mill is equal to 11000 or one tenth of a percent.

Vehicle Property Tax Estimator. TAVT is a one-time tax that is paid at the time the vehicle is titled. 4 for a primary residence 6 for a non-primary residence or other real property or a motor vehicle 105 for personal property.

You receive certain types of taxable income and. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. New York only taxes vehicles based on the price the buyer pays out-of-pocket.

The calculator should not be used to determine your actual tax bill. The millage rates in Arkansas vary by county city and school district. This calculator is designed to estimate the county vehicle property tax for your vehicle.

Title Ad Valorem Tax TAVT became effective on March 1 2013. If you transfer the registration and plates from another vehicle you dont need to pay the plate fees or MCTD fee and you may be able to transfer the registration fees to your new vehicle. This means that you.

Estimate fees and taxes online. Motor Vehicle Trailer ATV and Watercraft Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred or a new resident registers the vehicle.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. These fees must be added to the estimated tax for the year to derive the total amount due. Tax rates in Arkansas are applied in terms of mills.

This website is a public resource of general information. Thats 20000 x 301000. Personal Vehicle Tax Estimator 2021 Enter the first 3 fields to calculate your estimated vehicle tax.

Please note that DMV and other vehicle fees are not included in the estimated tax amount. Contact your county tax department for more information. 52 rows Vehicle Property Tax based on value and locality.

Enter the Vehicles NC. So if your tax rate is 30 mills and your assessed value is 20000 your property tax bill would be 600. In our calculator we take your home value and multiply that by your countys.

50 to the County Treasurer of each county amounts in the same proportion as the most recent allocation received by each county from the Highway Allocation Fund. The online estimates DOES NOT include the sales tax.

Car Insurance Estimate Online Property For Rent Property And Casualty Homeowners Insurance

Car Insurance Estimate Online Property For Rent Property And Casualty Homeowners Insurance

A Primer On The Vehicle License Fee

A Primer On The Vehicle License Fee

The Best States To Retire For Taxes Smartasset Com Retirement Income Tax Brackets Inheritance Tax

The Best States To Retire For Taxes Smartasset Com Retirement Income Tax Brackets Inheritance Tax

Auto Loan Calculator Estimate Monthly Car Payments Online For Free

Auto Loan Calculator Estimate Monthly Car Payments Online For Free

Bi Weekly Payment Plan In Savannah Ga Car Loans Cheap Phone Plans Car Insurance

Bi Weekly Payment Plan In Savannah Ga Car Loans Cheap Phone Plans Car Insurance

Summit Financial Education Account Login Budget Planning Expenses Printable Financial Education

Summit Financial Education Account Login Budget Planning Expenses Printable Financial Education

Georges Excel Car Loan Calculator V2 0 Car Loan Calculator Loan Calculator Car Loans

Georges Excel Car Loan Calculator V2 0 Car Loan Calculator Loan Calculator Car Loans

Financial Car Loan Calculator Car Loan Calculator Loan Calculator Car Loans

Financial Car Loan Calculator Car Loan Calculator Loan Calculator Car Loans

Browse Our Example Of Automotive Repair Order Template Estimate Template Automotive Repair Auto Repair Estimates

Browse Our Example Of Automotive Repair Order Template Estimate Template Automotive Repair Auto Repair Estimates

In The United States Many People Receive Some Sort Of Car Tax Allowance Or A Car Allowance As It Is Usually Referred To By Most People Allowance Tax The Unit

In The United States Many People Receive Some Sort Of Car Tax Allowance Or A Car Allowance As It Is Usually Referred To By Most People Allowance Tax The Unit

Mortgage 101 Comparing Loan Estimates Can Help You Decide Estimate My Mortgage Payment See How Flood Insurance Mortgage Payment Mortgage Mortgage Brokers

Mortgage 101 Comparing Loan Estimates Can Help You Decide Estimate My Mortgage Payment See How Flood Insurance Mortgage Payment Mortgage Mortgage Brokers

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

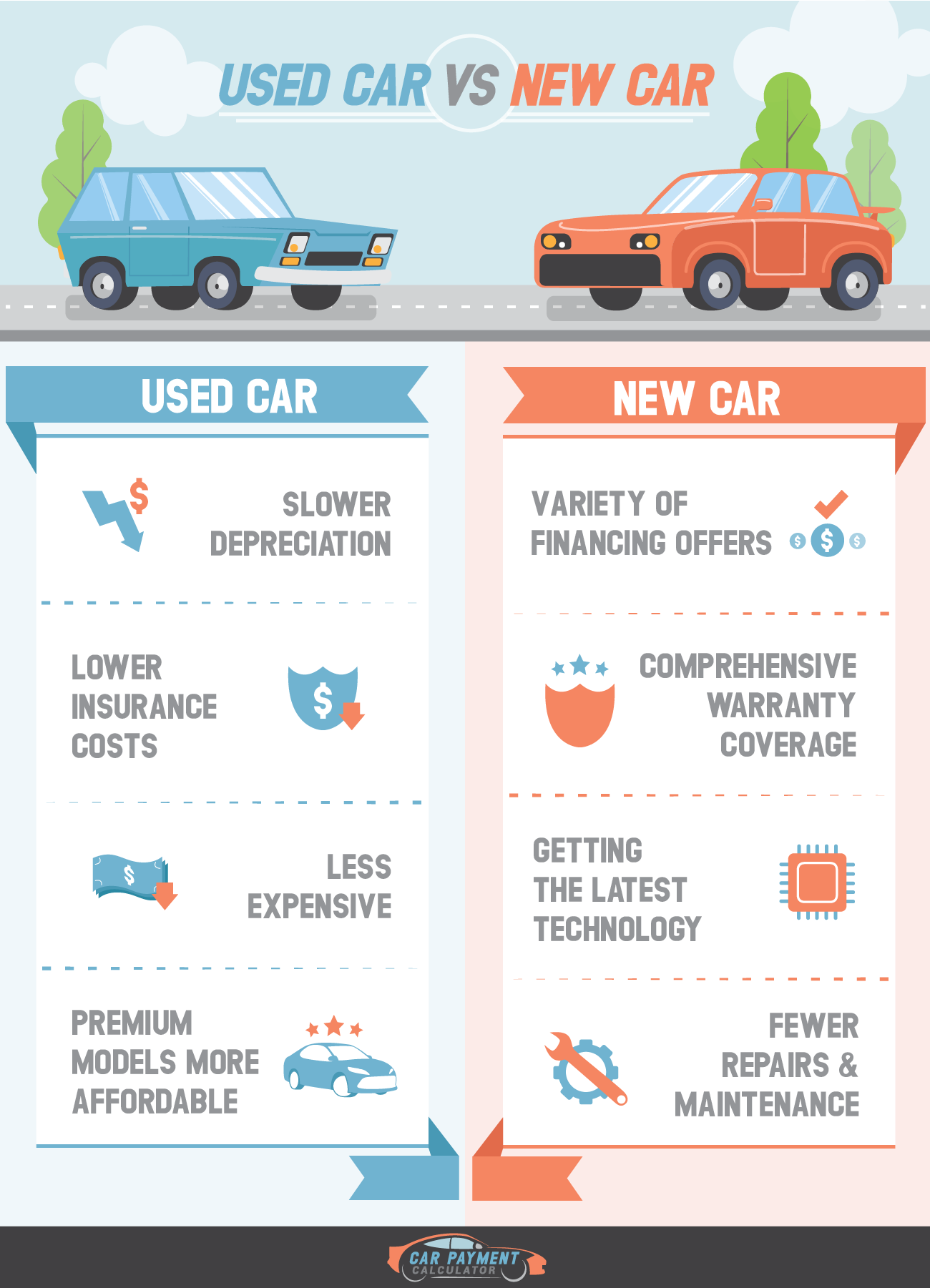

Pin On Buying Or Leasing A Vehicle

Pin On Buying Or Leasing A Vehicle

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Auto Repair Invoice For Wisconsin Automotive Repair Auto Repair Estimates Auto Repair

Auto Repair Invoice For Wisconsin Automotive Repair Auto Repair Estimates Auto Repair

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home