Nj Property Tax Deduction Income Limit

2 days agoLawmakers from New Jersey and other high-tax states formed a new bipartisan congressional caucus Thursday to push for repeal of the 10000 limit on deducting state and local income and property. It places a 10000 cap on state local and property taxes collectively beginning in 2018.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

Homeowners and tenants who pay property taxes on a primary residence main home in New Jersey either directly or through rent may qualify for either a deduction or a refundable credit when filing an Income Tax return.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Nj property tax deduction income limit. For more information see the instructions for filing Form NJ-1040-HW. This ceiling applies to income taxes you pay at the state and possibly local level as well as property taxes. Annual Property Tax Deduction for Senior Citizens Disabled Persons.

Property Tax DeductionCredit Eligibility. Cap in New Jersey had income. Residents with gross income of 20000 or less 10000 if filing status is single or marriedCU partner filing separate return are eligible for a property tax credit only if they were 65 years or older or blind or disabled on the last day of the tax year.

Complete Schedules NJ-BUS-1 and NJ-BUS-2 to calculate the amount of the adjustment or loss carryforward. The deduction will reduce the taxable income used to calculate your tax. Second is New Jerseys longstanding 10000 cap on deducting real.

Annual deduction of up to 250 from property taxes for homeowners 65 or older or disabled who meet certain income and residency requirements. More information is available on the creditdeduction. Domicile is the place you consider your permanent home the place where you intend to return after a period of absence eg vacation business assignment educational leave.

You also may qualify if you are a surviving spouse or civil union partner. Property Tax DeductionCredit Eligibility. Own and occupy your home Dont exceed the income threshold Have been a legal resident of New Jersey for at least one year.

You must report the total amount of pension and annuity payments including IRA withdrawals which can be found on the Pensions Annuities and IRA Withdrawals line on your New Jersey Resident Income Tax Return Form NJ-1040. Homeowners may be able to deduct the lesser of all of your property tax or 15000. Certain senior or blinddisabled residents who are not required to file a tax return can use the Property Tax Credit Application Form NJ-1040-HW to apply for the credit.

NJ Income Tax Property Tax DeductionCredit for Homeowners and Tenants. This benefit is administered by the local municipality. You can deduct your property taxes paid or 15000.

The Democratic-controlled House passed a bill on Thursday that would do away with the 10000 limit on the itemized deduction for state and local taxes for. You may qualify for an annual 250 property tax deduction for senior citizens and people with disabilities if you. The TCJA limits the amount of property taxes you can claim.

If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. Property Tax DeductionCredit If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. Local Property Newsletter MayJune 1977 page 2.

See the tax return instructions for information on calculating your deductioncredit. All these taxes fall under the same umbrella. The first is the new 10000 limitation on deducting state and local taxes also called SALT on your federal income tax return.

The property tax deduction reduces your taxable income. You have only one domicile although you may have more than one place to live. Are considered income for purposes of establishing the 10000 income cutoff for the 250 Real Property Tax Deduction.

Eligibility Requirements and Income Guidelines. The deduction amount is determined based on your taxable income filing status and the amount of property tax paid. 12 hours agoA Bergen County homeowner making 150000 a year and owning a 600000 house can expect to pay as much as 12000 in property taxes and 5000 in state income taxes.

Legislation was introduced in Congress to eliminate the 10000 deduction on state and local taxes. Eliminated the 10000 limit for two. Renters can calculate 18 of the rent as property taxes paid.

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

When You Contribute To A Roth 401 K The Contribution Won T Lower Your Taxable Income Today But When You Even Roth Required Minimum Distribution Contribution

When You Contribute To A Roth 401 K The Contribution Won T Lower Your Taxable Income Today But When You Even Roth Required Minimum Distribution Contribution

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

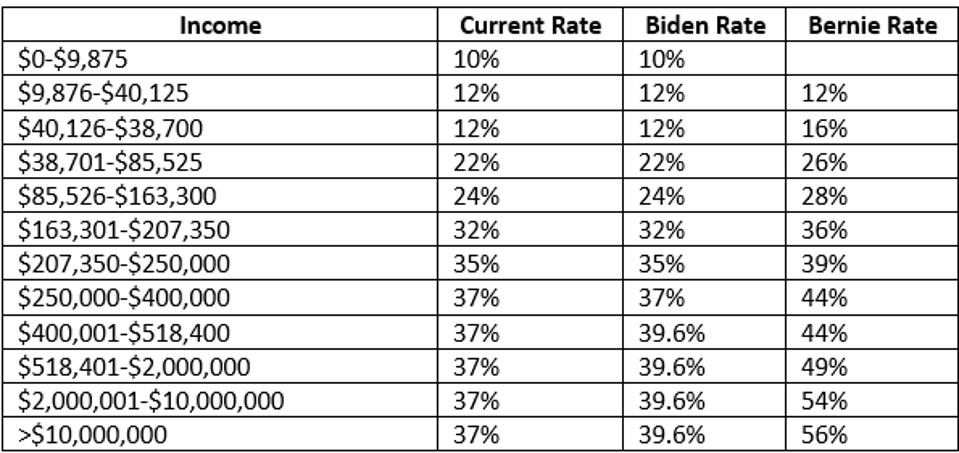

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Individual Income Tax Structures In Selected States The Civic Federation

Individual Income Tax Structures In Selected States The Civic Federation

India S Kolkata Municipal Corporation Is Undertaking Efforts To Make People Aware Of The New Property Taxation Municipal Corporation Property Tax New Property

India S Kolkata Municipal Corporation Is Undertaking Efforts To Make People Aware Of The New Property Taxation Municipal Corporation Property Tax New Property

Usa Median Household Income 2017 Family Income Centers For Disease Control And Prevention Credit Cards Debt

Usa Median Household Income 2017 Family Income Centers For Disease Control And Prevention Credit Cards Debt

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Housing Market Insights For 2018 Housing Market Insights For 2018 Summit New Providence Berkeley Heights Chatham M Housing Market Marketing Home Mortgage

Housing Market Insights For 2018 Housing Market Insights For 2018 Summit New Providence Berkeley Heights Chatham M Housing Market Marketing Home Mortgage

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png) The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Explained Vox

50 Failing Companies At Risk Of Going Out Of Business In 2019 Page 8 Of 51 Finance 101 Income Tax Federal Income Tax What Is Credit Score

50 Failing Companies At Risk Of Going Out Of Business In 2019 Page 8 Of 51 Finance 101 Income Tax Federal Income Tax What Is Credit Score

Www State Nj Us Treasury Taxation Pdf Ptr 15 Ptr1 Pdf Pdf Finance 15th

Www State Nj Us Treasury Taxation Pdf Ptr 15 Ptr1 Pdf Pdf Finance 15th

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home