Property Tax Assessment Higher Than Purchase Price

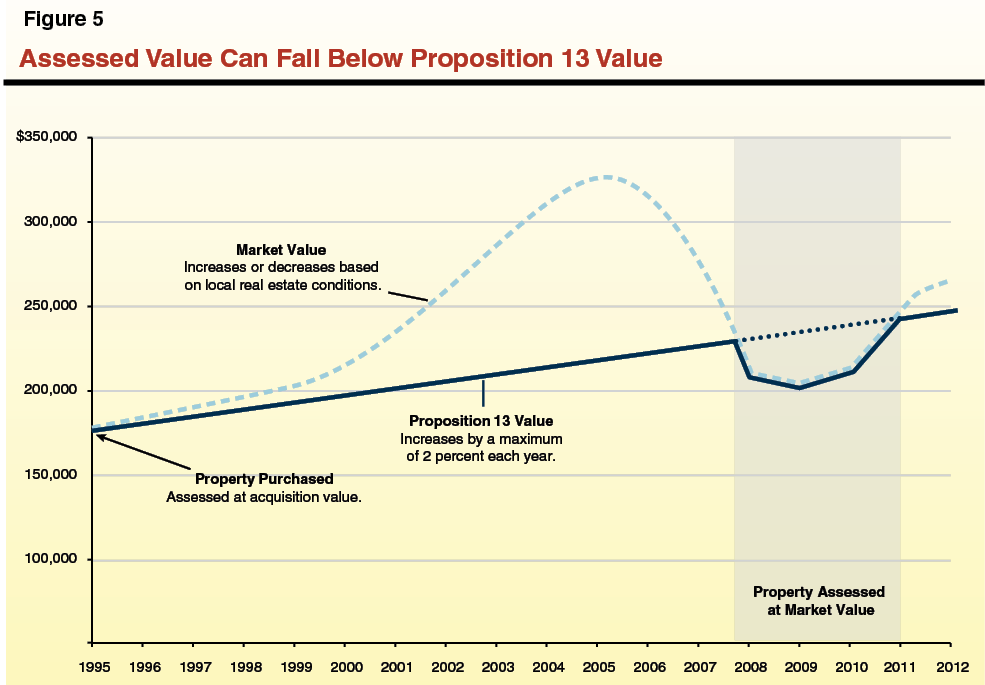

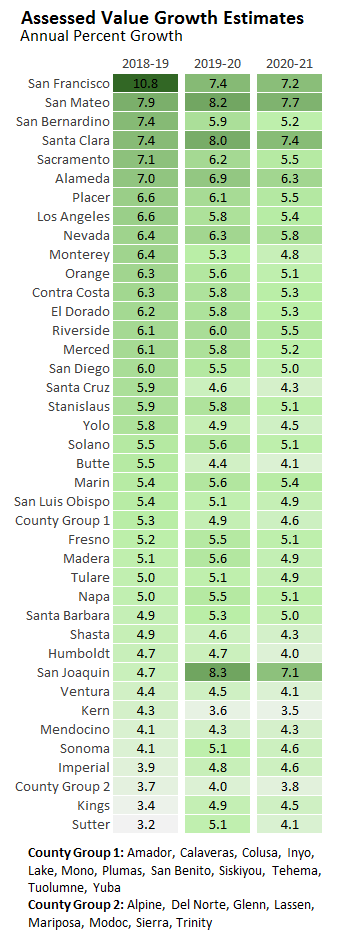

Taking the mill levy of 45 we calculated previously the tax due would be 1800 40000 x 45. After that the propertys assessed value can only increase by two percent or the allowed rate of inflation whichever is lower until the property sells.

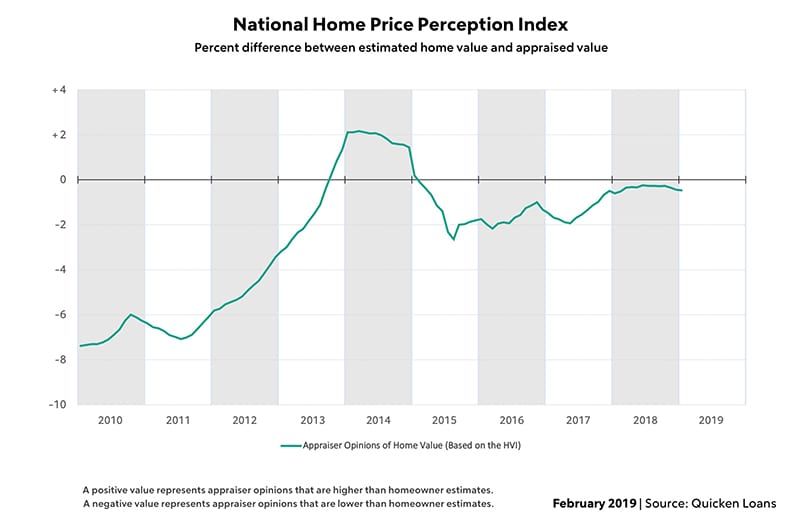

My Home Appraisal Came In Too Low Now What

My Home Appraisal Came In Too Low Now What

In Denver for instance assessed value is 29 percent of market value.

Property tax assessment higher than purchase price. The median annual property tax paid by homeowners in Summit County is 2540 the eighth-highest amount in the state. If you ever want to know what tyranny looks like this is it. If the appraised value is too high higher than what you could get for selling your home you can file an appeal to the county adjustment board.

If you feel that the assessed value of your home is higher than the market value of your home the city asks you to first consider whether your home would have sold for the amount in your assessment on July 1 of the previous year. The county assessment is not an appraisal. Once the assessor has the value they work in.

Because the rates are determined county by county youll find a pretty large variance in property tax rates across the country from averages as high as 189 New Jersey to averages as low as 018 Louisiana. Used our purchase price the mortgage lenders comps and comps of other properties sold in the neighborhood to successfully lobby for a lower value. For example a property could have an assessed tax value of 200000.

The higher the assessed value the more you will typically pay in. If this is in CA then because of Prop 13 properties of the same market value can have drastically different assessments. Its important to act quickly though as you have only 25 days to file an appeal.

The assessed value would be 40000. Property taxessometimes referred to as millage taxes are a tax levied on property most typically real estate property by county governments. You can easily buy a house where the prior owner only paid 500 a.

Every little bit helps. Such Property Taxes shall be based on the most recent assessment for the purpose of calculating the Purchase Price under Section 22 provided that the Seller shall indemnify Purchaser to the extent that Sellers actual pro rated assessed Property Taxes are greater than the estimate. Other states use an assessment rate that is a percentage of the market value.

If the Market Value is not similar to the purchase price then by law the Assessor must enroll the property at Market Value. A 270000 higher assessed property value leads to roughly 3000 more in property tax a year. The main effect of this relates to the amount of property tax levied on your home.

I am wondering if purchasing the home more than 37K above assessment would increase the tax assessment thus increasing the property tax. That is more than 200 higher than the state median which is 2324. Property taxes are state specific.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Government taxing bodies use the assessed value of real estate for property taxes. Some states use 100 of the market value to determine how much a homeowner will pay in property taxes.

You pay capital gains tax on the difference between your selling price in the property and your adjusted tax basis. Your adjusted tax basis in a property is the original cost you paid for the property plus any amount invested in renovations and improvements including labor costs on these projects that you have not previously deducted for taxes. However I got reset back to my original purchase price plus an extra 18 increase for the latest calendar year.

The assessment for 2016 is 81600. We also invited the assessor inside to look at our dated kitchen bathrooms etc. Property taxes in Florida are implemented in millage rates.

If your house is worth 100000 the value for property taxes is 29000. Prop 13 usually allows for only a 2 maximum property tax increase per year. The property taxes are calculated based on the county assessment of tax value.

Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. For example in a state with an assessment rate of 80 a home with a market value of 182000 would have an assessed value of 145600. In other areas such as California property-tax assessment values begin with your purchase price and typically increase about 2 percent annually regardless of the actual value of your home.

In order to come up with your tax bill your tax office multiplies the tax rate by the. A propertys market value is what that property might sell for regardless of what its assessed or appraised values are. It is important to keep in mind the county tax assessment of value is just that an assessment for the purpose of calculating taxes.

Property taxes are a function of government and are created by assessment not appraisal. 1000000 EMV 1300000 Sale Price or 77. Florida Property Tax Rates.

Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. Effective property tax rates in those counties range from 095 to 117. To illustrate if the sales of a specific class of property in a specific area in a given year have a median sale price 30 higher than the assessed value then the ratio would be 07692 ie.

Wound up below original assessment but higher than our purchase price. Your local tax collectors office sends you your property tax bill which is based on this assessment.

Understanding California S Property Taxes

Understanding California S Property Taxes

Real Estate Assessed Value Vs Fair Market Value

Real Estate Assessed Value Vs Fair Market Value

Understanding California S Property Taxes

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Understanding The Difference Between Market Value And Assessed Value Propertyshark Real Estate Blog

Understanding The Difference Between Market Value And Assessed Value Propertyshark Real Estate Blog

Real Estate Assessed Value Vs Fair Market Value

Real Estate Assessed Value Vs Fair Market Value

Understanding California S Property Taxes

Understanding California S Property Taxes

Mortgage Appraisals And Appraised Value The Truth About Mortgage

Mortgage Appraisals And Appraised Value The Truth About Mortgage

Structuring Business Assets Purchases With Taxes In Mind

Structuring Business Assets Purchases With Taxes In Mind

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

The Untold Truth Of Home Appraisals Real Estate Decoded

The Untold Truth Of Home Appraisals Real Estate Decoded

Assessed Value Vs Market Value Why Is There Such A Gap Duttons

Assessed Value Vs Market Value Why Is There Such A Gap Duttons

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Labels: assessment, higher, price, purchase

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home