Property Tax In Jefferson County Ky

Our Jefferson County Attorneys Office Tax Team collected more than 13 million in 2019 bringing in money that is used for services including fire protection education and other essential government services. Yearly median tax in Jefferson County The median property tax in Jefferson County Kentucky is 1318 per year for a home worth the median value of 145900.

Buying A Kentucky Home No Money Down With A Conventional Loan From Kentucky Housing Down Payment Assistance Conventional Loan Kentucky Down Payment

Buying A Kentucky Home No Money Down With A Conventional Loan From Kentucky Housing Down Payment Assistance Conventional Loan Kentucky Down Payment

The median property tax on a 14590000 house is 153195 in the United States.

Property tax in jefferson county ky. The median property tax in Jefferson County Kentucky is 131800 All of the Jefferson County information on this page has been verified and checked for accuracy. The 2020 Jeffersontown real estate tax rate is 01401 per 100 of assessed value 100000 assessed value 14010 tax bill. This publication reports the 2019 ad valorem property tax rates of the state and local governmental units in Kentucky including county city school and special district levies.

The name and address on your property tax bill is provided to the Sheriffs Office by the Jefferson County Property Valuation Administrator prior to the current year tax bills being printed. This years publication date will be on June 19 2019. The median property tax on a 14590000 house is 131310 in Jefferson County.

Jefferson Street Louisville KY 40202In a few instances there is a possibility a search of parcel for tax claims conducted several months previously may be superseded. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. The median property tax on a 14590000 house is 105048 in Kentucky.

Clerks Main Office 527 W. Real estate property tax bills are based on a propertys assessed value as set by the Jefferson County property valuation administrator PVA and the real property tax rate levied by Jeffersontowns city government. Direction NNorth EEast SSouth WWest Jefferson.

It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. If any of the links or phone numbers provided no longer work please let us know and we will update this page. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

Complete information is available at the Professional License and Delinquent Tax Department in Room 100A of Metro Hall at 527 W. Clerks Main Office 527 W. You can search your Real Estate Taxes by Property ID Owner Name or Property Address and Personal Property Taxes by Business Tax Number or Business Name.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Jefferson County. Click here for more information on the proper address format required for this search. The Sheriffs Office collection of the 2020 Taxes starts on November 2 2020.

Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year. 600 W Jefferson St. Kentucky has a broadly-based classified property tax system.

As shown in the tables on the. Jefferson County collects on average 09 of a propertys assessed fair market value as property tax. The Jefferson County Clerks Office have received the official list of 2018 current year delinquent taxes from the Jefferson County Sheriffs Office on April 15 2019.

Payment shall be made to the motor vehicle owners County Clerk. Properties in Jefferson County are subject to an average effective property tax rate of 093. To determine your current DELINQUENT property tax please use the Jefferson County Clerks Taxmaster site.

If a property was sold there may have been insufficient time to update the owners name and address prior to. KRS 1322201aThe person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year. As in previous years there will be a list of 2018 bills advertised in the newspaper.

Property taxes in Jefferson County are slightly higher than Kentuckys state average effective rate of 083.

Kentucky Housing Mcc Khc Mortgage Credit Certificate Mortgage Easy Cash Refinance Mortgage

Kentucky Housing Mcc Khc Mortgage Credit Certificate Mortgage Easy Cash Refinance Mortgage

Available Properties Remax Associates Commercial Real Estate Lorianne Bonn In 2020 Real Estate License Commercial Real Estate Real Estate Services

Available Properties Remax Associates Commercial Real Estate Lorianne Bonn In 2020 Real Estate License Commercial Real Estate Real Estate Services

11003 Park Rd Anchorage Ky 40223 Looking For Peaceful Park Like Living Still Near All The Modern Conveniences Ranch Style Home Ranch Style Condos For Sale

11003 Park Rd Anchorage Ky 40223 Looking For Peaceful Park Like Living Still Near All The Modern Conveniences Ranch Style Home Ranch Style Condos For Sale

Kentucky Usda Rural Housing Loans Kentucky Rural Development Guidelines For Usda Refinance Streamline Mortgage Loans Usda Mortgage Assistance

Kentucky Usda Rural Housing Loans Kentucky Rural Development Guidelines For Usda Refinance Streamline Mortgage Loans Usda Mortgage Assistance

City Classifications In Jefferson County Ky

City Classifications In Jefferson County Ky

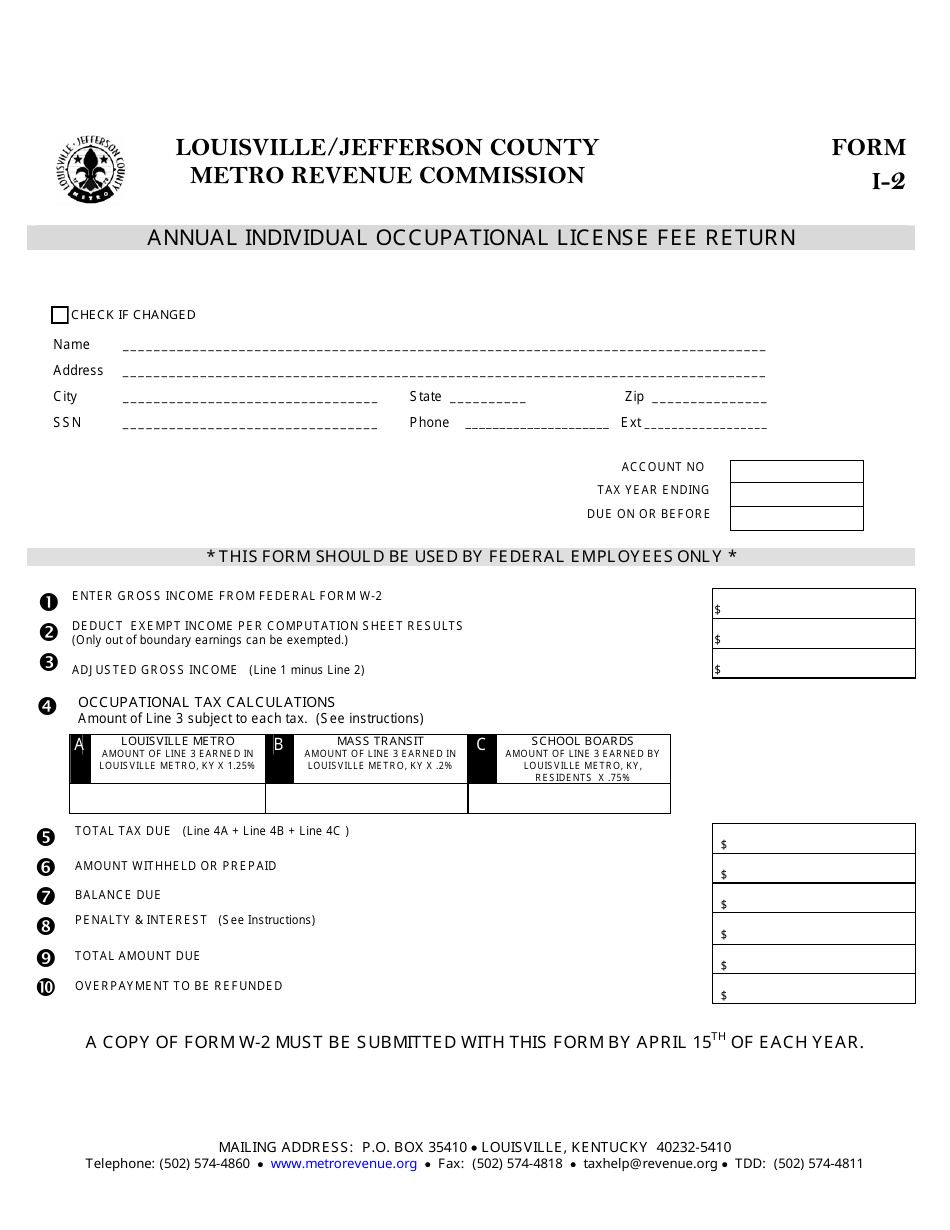

Form I 2 Download Fillable Pdf Or Fill Online Annual Individual Occupational License Fee Return Louisville Jefferson County Kentucky Templateroller

Form I 2 Download Fillable Pdf Or Fill Online Annual Individual Occupational License Fee Return Louisville Jefferson County Kentucky Templateroller

Jefferson County Sheriff S Office Property Tax Search Page

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Available Properties Remax Associates Commercial Real Estate Lorianne Bonn Real Estate License Real Estate Services Commercial Real Estate

Available Properties Remax Associates Commercial Real Estate Lorianne Bonn Real Estate License Real Estate Services Commercial Real Estate

Jefferson County Kentucky Property Tax Rate Property Walls

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

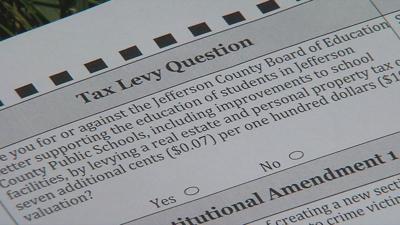

Jcps Property Tax Increase To Be Appealed News Wdrb Com

Jcps Property Tax Increase To Be Appealed News Wdrb Com

How Do You Calculate The Va Guaranty And Available Entitlement Va Mortgages Va Mortgage Loans Same Day Loans

How Do You Calculate The Va Guaranty And Available Entitlement Va Mortgages Va Mortgage Loans Same Day Loans

Available Properties Remax Associates Commercial Real Estate Lorianne Bonn Real Estate License Real Estate Services Commercial Real Estate

Available Properties Remax Associates Commercial Real Estate Lorianne Bonn Real Estate License Real Estate Services Commercial Real Estate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home