Should I Put My Property Taxes In Escrow

Your mortgage lender might pay your real estate taxes from an escrow account. These parts of your monthly payment will go into your escrow account and be held by your lender to pay property taxes and home insurance each year.

Should You Leave Your Tax And Insurance Payments In Escrow

Should You Leave Your Tax And Insurance Payments In Escrow

While you should not report the same.

Should i put my property taxes in escrow. Then the lender uses the money in that account to pay the taxes at the end of the. The additional payments are placed in escrow until the. Property tax escrow accounts help ensure borrowers wont default on property taxes and lose their homes to tax foreclosure.

Under certain conditions including specific equity percentages lenders. If so theyll send you Form 1098. They act as a savings account to hold.

If you pay your real property taxes by depositing money into an escrow account every month as part of your mortgage payment make sure you dont treat the entire payment as a property tax deduction. So at closing they will escrow or ask you to pay ten months worth of property taxes so that they have enough to pay a full twelve months when they are due. The most common reason for a bump in your escrow account payments is a property tax increase.

Yes your property taxes are still deductible if you pay them through via an escrow account. Your lender must work directly with the county tax collector to obtain the information on your. Form 1098 without any letter suffix is a mortgage interest statement.

You can deduct up to 10000 or 5000 if married filing separately of state and local taxes including property taxes. Mortgage lenders generally require borrowers to include taxes and insurance premiums in their monthly mortgage payments. Therefore from their standpoint they will only have two tax payments in their escrow account but they will be required to pay out twelve months to the municipality.

The actual dollar amount that goes into an escrow account is based on what insurance premiums and taxes average out to on a monthly basis. Your mortgage lender or servicer is allowed to collect the amount of your homeowners insurance and property tax payments plus a cushion month in and month out in escrow. It shows how much mortgage interest points and PMI you paid during the previous year.

If you plan to escrow you will need your down payment closing costs no such thing as a no closing cost mortgage 2-6 months worth of escrow need to put that reserve in there for the mortgage company to make sure they have enough to pay your taxes and home owners insurance any money that the previous home owner has paid on the tax bill for that property up to date. Beginning with the homebuyers first monthly principal and interest mortgage payment the lender will include 112th of the annual real estate taxes. The lender might require you to put your loan on an auto pay or impose a fee typically 025 percent of the loan amount to waive escrow.

Escrow accounts are used in conjunction with your mortgage loan. Also be sure to check your closing statement for any property taxes that were paid at closing. With an escrow account the lender collects a prorated amount toward the annual tax and insurance bills every month preventing borrowers from getting socked with a big lump sum tax bill that is harder to pay.

The escrowreserves deposit is calculated based on the number of months before the next tax bill is due against the number of months the lender will have collected through the mortgage payments from the date of closing. Homeowners pay money into the escrow account at closing and each month after that with their mortgage payment. The reason mortgage lenders want you to have an escrow account is so they dont have to worry about you falling behind on these important expenses.

These are the amounts to enter in TurboTax. Property taxes are collected by most counties twice per year. Generally only the amount that the bank or lender reports to the Internal Revenue Service IRS often noted on Form 1098 qualifies for the deduction.

Deducting Property Taxes for Real Estate Where to Look. Form 1098 from your mortgage company will include both Mortgage Interest and Property Taxes paid out of the escrow account. No the amount in escrow has not been used to pay deductible expenses yet.

Over time the balance grows and when property taxes and homeowners insurance are due the money is sent on to the tax collector or insurance company respectively. This form will report any real estate taxes you paid. Your homeowners insurance premium can go up too but probably with much less impact.

You may have to pay up to six months worth of property taxes and maybe even a years worth of insurance up front. The tax rate can go up and so can the assessed value of your property. How Are Property Taxes Paid Through an Escrow Account.

When your insurance or property tax billcomes due the lender uses the escrow. You will find the amount of property taxes paid through escrow on your Form 1098. Escrow accounts are set up to collect property tax and homeowners insurance payments each month.

When you pay your property tax the lender pays your monthly property tax payment into an escrow account. Property tax is paid to the local government and its usually collected yearly or twice a year.

How To Find Your Escrow Balance Or Shortage Santander Bank

Why You Shouldn T Impound Your Property Tax Insurance

Why You Shouldn T Impound Your Property Tax Insurance

Should You Escrow Property Taxes And Insurance Smartasset

Should You Escrow Property Taxes And Insurance Smartasset

Escrow Taxes And Insurance Or Pay Them Yourself

Escrow Taxes And Insurance Or Pay Them Yourself

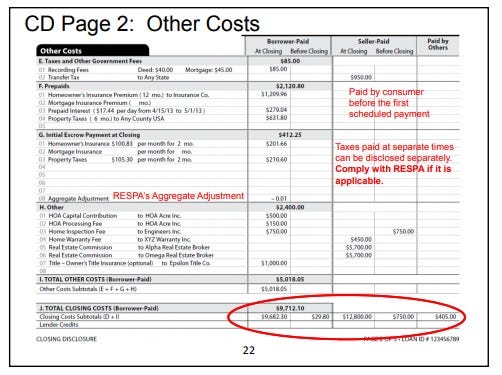

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

Mortgage Escrow What You Need To Know Forbes Advisor

Mortgage Escrow What You Need To Know Forbes Advisor

Should You Escrow Property Taxes And Insurance Smartasset

Should You Escrow Property Taxes And Insurance Smartasset

What Is An Escrow Account What You Need To Know Tms Tms Grow Happiness

What Is An Escrow Account What You Need To Know Tms Tms Grow Happiness

What Is An Escrow Account What You Need To Know Tms Tms Grow Happiness

What Is An Escrow Account What You Need To Know Tms Tms Grow Happiness

Mortgage Escrow Accounts Explained Pros And Cons Of Escrow Service

Mortgage Escrow Accounts Explained Pros And Cons Of Escrow Service

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

How To Calculate An Escrow Payment 10 Steps With Pictures

How To Calculate An Escrow Payment 10 Steps With Pictures

Mortgage Escrow Account How To Properly Set It Up

Mortgage Escrow Account How To Properly Set It Up

What Is An Escrow Account What You Need To Know Tms Tms Grow Happiness

What Is An Escrow Account What You Need To Know Tms Tms Grow Happiness

How To Calculate An Escrow Payment 10 Steps With Pictures

How To Calculate An Escrow Payment 10 Steps With Pictures

What Is An Escrow Account What You Need To Know Tms Tms Grow Happiness

What Is An Escrow Account What You Need To Know Tms Tms Grow Happiness

Can And Should You Pay Your Own Property Taxes Pt Money

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Mortgage Escrow Account How To Properly Set It Up

Mortgage Escrow Account How To Properly Set It Up

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home