Property Tax Auction Harris County

Our Hot Opportunities help you zero in on the best potential foreclosure deals in your area. Harris County Tax sales are held the first Tuesday of each month.

Harris County Texas Personal Property Tax Property Walls

Harris County Texas Personal Property Tax Property Walls

Harris County Appraisal District 13013 Northwest Freeway Houston Texas 77040-6305.

Property tax auction harris county. Harris County Delinquent Tax Sale Property Listing Sale Date. Sales must be held from 1000 am. Tax related county records Records Quick Links.

Harris County Appraisal District 13013 Northwest Freeway Houston Texas 77040-6305 Office Hours Hours. Each of the Constables conducts sales of properties in their precinct and the sales are most often held simultaneously. Generally the minimum bid at an Harris County Tax Deeds Hybrid sale is the amount of back taxes owed as well as any and all costs associated with selling the property.

Tax delinquent properties scheduled for a tax sale after a judgment of foreclosure has been taken. Public Auctions will be conducted at the courthouse of the county in which the property is located. This video is a live look at the Harris CountyHouston Texas Tax Auction April 2019.

The county will issue Sheriffs deed for the property to. Discover foreclosed house auctions for real estate in Harris County TX. Real Estate House Auctions.

Unpaid real estate taxes creates a. Property tax workshops holiday schedules and closings application deadlines and more. Who Conducts the Sale.

You CANNOT have delinquent taxes due on any property owned in Harris County and you must sign a statement attesting to that fact on your Bidder Registration application. WhenThe first Tuesday of every month beginning February 2 2016. Harris County Property Records and Maps.

The sale of certain listed properties may be canceled or removed at anytime prior to the Tax Sale. New Sale LocationBayou City Event Center 9401 Knight Road Houston TX 77045. However according to state law Tax Deeds Hybrid purchased at an Harris County Tax Deeds Hybrid sale have a redemption period attached to the Harris County Tax Deeds.

We select Hot Opportunities in each market based on the amount of equity for pre-foreclosures and auctions. You must register BEFORE the Tax Sale to be able to bid. 800 AM - 500 PM Monday - Friday Saturday Hearings.

An investor can win a bid by being highest bidder on delinquent tax property deed. Bring acceptable for of payment cash or cashiers check before bidding on properties. The sale of Georgia Tax Deeds Hybrid are final and winning bidders are conveyed either a Tax Deed or a Sheriffs Deed.

Harris County Texas relies on the revenue generated from real estate property taxes to fund daily services. Registration of bidders begins at 830 am. Then Sales may be conducted on the first Wednesday of the month.

You can register online prior to the sale or the morning of the sale starting at 830am. Help Center Buying a Foreclosure Buying a Bank Owned Home Blog Glossary. Information Phone Number 713 368-2727.

Resale In Texas Resale properties were struck off to the taxing entities and are scheduled for a resale usually at a lower opening bid. All Foreclosure Bank Owned Short Sales Event Calendar. The information provided on this website is updated daily from multiple sources and MAY NOT REPRESENT ALL of the properties available on the day of the Tax Sale.

Effective February 2 2016. Texas law authorizes the sale of tax deed properties at the Harris County tax deed sale auction on the first Tuesday of each month. Discover the hottest foreclosure opportunities in your area.

The Harris Sheriff Auction is part of the Houston Sheriff Auction which is one of the largest Sheriff auctions in Texas. Time1000 AM to 400 PM. Harris County Delinquent Tax Sale and Trustee Sale.

Harris County assumes no liability for damages incurred directly or indirectly as a result of errors omissions or discrepancies. Appraisal Records 1895-1997 Harris County Archives. Find and bid on Residential Real Estate in Harris County TX.

View property value and details images tax records loan details and nearby schools. Public Tax Sales may only be conducted on the first Tuesday of the month except when January 1 or July 4 occurs on the first Tuesday. Foreclosures Reflects postings accepted through 4152021 Images available from 1232013 to Present.

You can contact the Harris County Tax Assessor Collectors office at 7133682000 for more information. You must have a valid government issued photo ID. Houston is divided into eight primary counties with each county conducting its own SheriffTax Sale and each producing its own tax sale list.

Delinquent tax property deeds are sold to the highest bidder. Search our database of Harris County Property Auctions for free. Get a full look at pre registration process a look inside the event.

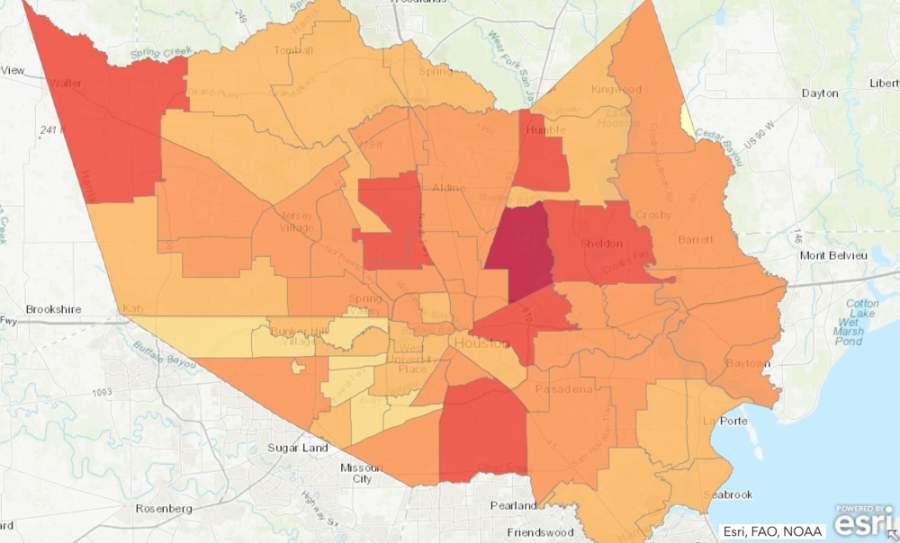

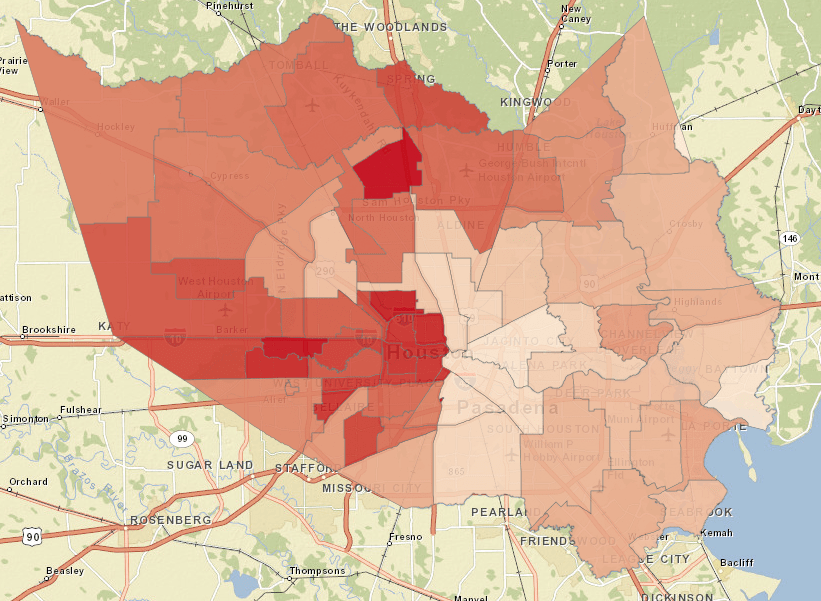

Houston Property Tax Altus Group

Houston Property Tax Altus Group

Texas Tax Foreclosure Auctions Houston Real Estate Lawyers

Texas Tax Foreclosure Auctions Houston Real Estate Lawyers

Houston Property Tax Altus Group

Houston Property Tax Altus Group

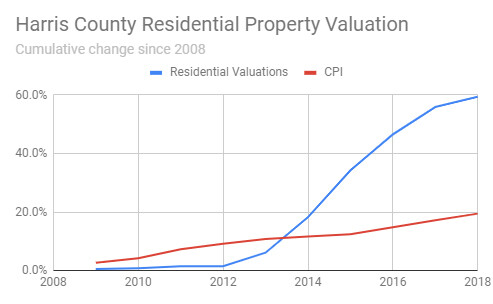

Harris County Home Values Rise By 6 On Average Coronavirus Disaster Will Not Trigger Tax Relief Community Impact Newspaper

Harris County Home Values Rise By 6 On Average Coronavirus Disaster Will Not Trigger Tax Relief Community Impact Newspaper

The Sale Of Distressed Properties And The Role Of Renew Indianapolis Renew Indianapolis

The Sale Of Distressed Properties And The Role Of Renew Indianapolis Renew Indianapolis

Form Mv 015 Download Fillable Pdf Or Fill Online Bill Of Sale To A Motor Vehicle Harris County Texas Templateroller

Form Mv 015 Download Fillable Pdf Or Fill Online Bill Of Sale To A Motor Vehicle Harris County Texas Templateroller

Https Www Hctax Net About Announcements Tax 20sale 20bidders 20auction 20guide Pdf

Free Tax List Foreclosure Information Listing Service Inc

Free Tax List Foreclosure Information Listing Service Inc

Free Tax List Foreclosure Information Listing Service Inc

Free Tax List Foreclosure Information Listing Service Inc

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

Free Tax List Foreclosure Information Listing Service Inc

Free Tax List Foreclosure Information Listing Service Inc

Https Www Alabar Org Assets 2014 08 The Alabama Lawyer 11 2012 Pdf

Free Harris County Texas Bill Of Sale Form Pdf Word Doc

Free Harris County Texas Bill Of Sale Form Pdf Word Doc

Houston Property Tax Altus Group

Houston Property Tax Altus Group

Casa Tax Auction Training Harris County Houston Texas Tax Deed Auction April 2019 Youtube

Casa Tax Auction Training Harris County Houston Texas Tax Deed Auction April 2019 Youtube

Recently Sold Homes In Harris County Ga 2 687 Transactions Zillow

Recently Sold Homes In Harris County Ga 2 687 Transactions Zillow

Harris County Appraisal District How To Protest Property Taxes

Harris County Appraisal District How To Protest Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home