How To File For Homestead Exemption In Ohio

Please read the instructions on the back of this form before you complete it. If your eligibility is based on AGE.

Richland County Ohio Homestead Exemption Form Fill Online Printable Fillable Blank Pdffiller

Richland County Ohio Homestead Exemption Form Fill Online Printable Fillable Blank Pdffiller

The form is available on the Department of Taxations website and is.

How to file for homestead exemption in ohio. Visit the Ohio Department of Taxation website and download Form DTE 105A. Check the box that indicates. To apply for the Homestead Exemption please fill out the application and mail it to our office at 231 Main Street Suite 1A Chardon Ohio 44024.

To file a Homestead application please return completed forms to the Auditors Office or you can file electronically online. 2536 or send E-Mail or visit us personally at the County Administration Building 105 Main Street Painesville Ohio 44077. 105I-Homestead Exemption Application for.

Applications may be filed with the County Auditor on. Real Property and Manufactured Homes Applications are due by December 31st. DTE 105A 43669 KB.

In order to qualify for the homestead exemption an owners disability must be permanent and total and prevent the person from working at any substantial employment. Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses Real property. Please read the instructions on the back of this form before you complete it.

Find out your homes taxable value by subtracting the exemption from your homes assessed value. Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses Real property and manufactured or mobile homes. Disabled applicants must complete form DTE 105E.

Application Based on Age An application to receive the homestead exemption is filed with the property valuation administrator of the county in which the property is located. The Homestead Exemption allows low-income senior citizens and permanently and totally disabled Ohioans to reduce their property tax bills by shielding some of the market value of their homes from taxation. If you are claiming a mental disability you must have the certificate signed by a physician or psychologist licensed to practice in Ohio.

For Tax Year 2019 Calendar Year 2020 new applicants annual adjusted Ohio gross income OAGI must be less than 32800. Please read the instructions on the back of this form before you complete it. You can also download the Application or the Veterans Application and mail it to our office at.

Own and occupy your home as your principal residence place as of January 1 of the application year. Senior citizens age 65 and older and surviving spouse applications may be filled out and either submitted online or printed and mailed. Disabled applicants must complete form DTE 105E.

In Ohio any person who is 65 years old or. Applicants must complete the Homestead Exemption Application for Disabled Veterans and Surviving Spouses DTE105I to receive this exemption. Manufactured or mobile homes.

Homestead exemption application File with the county auditor on or before the December 31. File with the county auditor on or before December 31. Fill out application form DTE105Ayou can get the form at your county Auditors office at your county Auditors.

Verify that you are eligible for a homestead exemption. If you are interested in filing a homestead exemption application call our office at 216 443- 7050. File with the county auditor on or before the fi rst Monday in June.

Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses. Must complete and submit DTE Form 105H Addendum to the Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses. Must provide proof of age and current residency by submitting a photocopy of a valid Ohio drivers license or State of Ohio ID card.

Should you have any questions about Homestead Exemption my staff and I will be happy to assist you please do not hesitate to call 440 350-2536 or 1-800-899-LAKE Ext. File with the county auditor on or before December 31. To apply complete the application form DTE 105A Homestead Exemption Application Form for Senior Citizens Disabled Persons and Surviving Spouses then file it with your local county auditor.

105B-Continuing Homestead Exemption Application for Senior Citizens. 105E-Certificate of Disability for Homestead Exemption. 105A-Homestead Exemption Application for Senior CitizensDisabled Persons and Surviving Spouses.

File form DTE105A with your county Auditoryou must file the original form that has your ink signature not a copy. 105G-Addendum to the Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses. Real property and manufactured or mobile homes.

If you are under 65 and disabled you also have to download Form DTE 105E. File with the county auditor on or before Dec.

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Income Ohio Residency And Residency Credits Department Of Taxation

Income Ohio Residency And Residency Credits Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

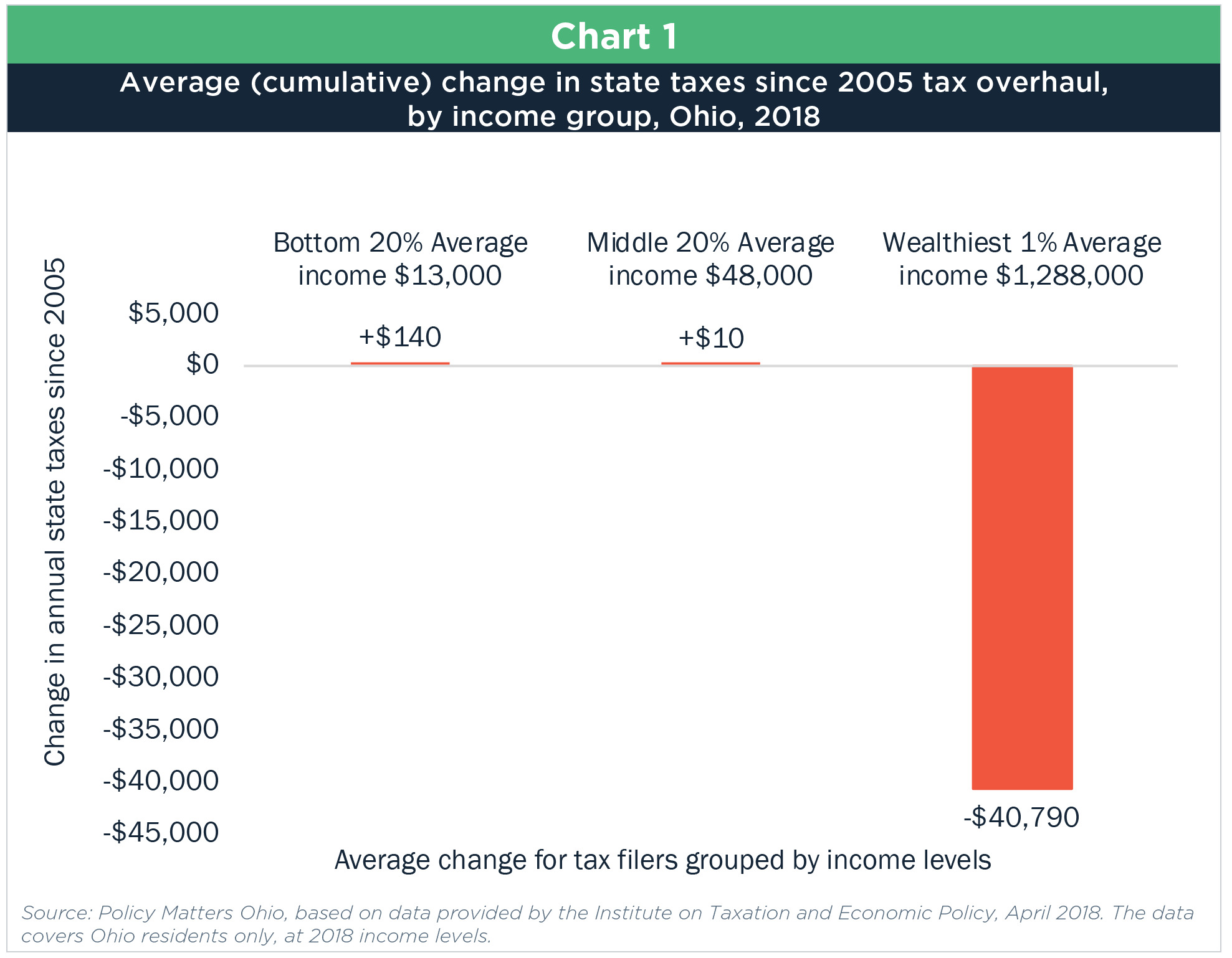

Overhaul A Plan To Rebalance Ohio S Income Tax

Overhaul A Plan To Rebalance Ohio S Income Tax

File Your Tx Homestead Exemption Exemption File Homestead Homesteading Homeowner Modern

File Your Tx Homestead Exemption Exemption File Homestead Homesteading Homeowner Modern

What Property Is Considered Exempt In An Ohio Bankruptcy Amourgis

What Property Is Considered Exempt In An Ohio Bankruptcy Amourgis

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home